Guaranteed Asset Protection (GAP) insurance covers the difference between the settlement amount you receive from your motor insurer and the original retail price you paid for the car, or the amount you require to pay your early settlement amount. It is especially helpful if you would like any vehicle depreciation to be covered or if you would need to settle any outstanding finance that may be more than the motor insurer’s settlement amount at the time of loss.

You can buy GAP insurance from car insurance companies, banks and credit unions. You might also be offered GAP insurance when you buy a car from a dealership, but check with your insurance agent to see if your company has a better deal.

| Characteristics | Values |

|---|---|

| --- | --- |

| What is gap insurance? | A type of insurance that covers the difference between the amount you paid for your car and the amount an insurance company would give you if it was written off or stolen. |

| Should I get gap insurance? | It depends on whether you want a brand new replacement car or you owe money to a car finance company. |

| The cheapest way to buy gap insurance | Buy a policy via a broker, which is typically cheaper than buying from a car dealership. |

| Top gap brokers | ALA Gap Insurance, MoneySupermarket, Go Gap Insurance |

What You'll Learn

What is gap insurance?

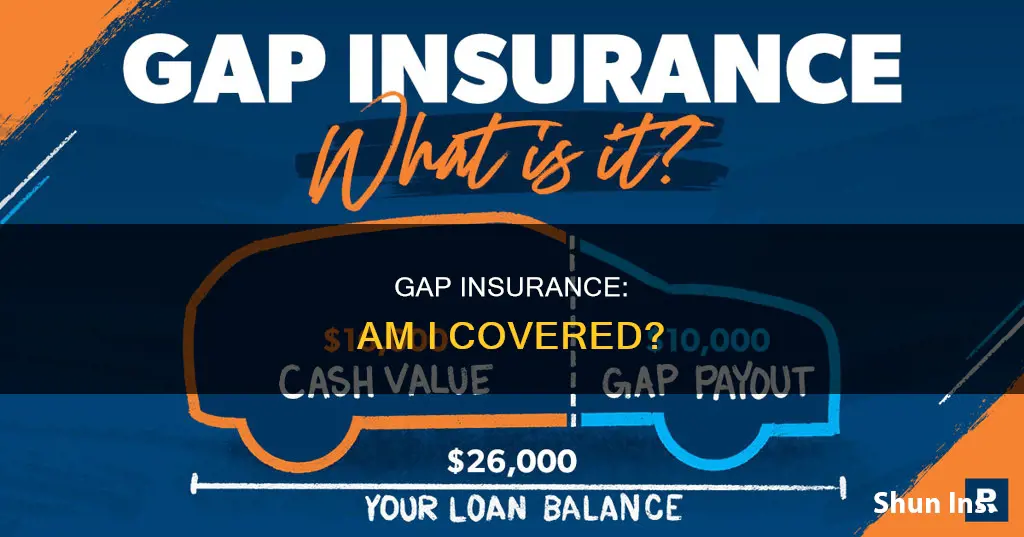

Gap insurance, which stands for Guaranteed Asset Protection insurance, is an optional add-on coverage that can help drivers cover the difference between the financed amount owed on their car and the car's actual cash value (ACV) in the event of a covered incident where their car is declared a total loss.

When you buy or lease a new car, the vehicle starts to depreciate in value the moment it leaves the car lot. Most cars lose 20% of their value within a year. Standard auto insurance policies cover the depreciated value of a car, meaning that a standard policy pays the current market value of the vehicle at the time of a claim. This can leave a "gap" between the amount you owe on your loan and the amount that your insurance company pays out. Gap insurance covers this difference.

For example, imagine your car is three years old and its actual cash value is $20,000, but you still owe $25,000 in payments. If your car is totaled, gap insurance will pay off the remaining $5,000 that you owe (minus your deductible). Gap insurance also applies if your car is stolen and not recovered.

In general, gap insurance is only available for brand-new vehicles or for models that are less than three years old. It is typically more expensive to purchase gap insurance from a dealership than from an insurer. Some lenders and leasing companies may require you to purchase gap insurance.

Vehicle Registration: Proof of Insurance?

You may want to see also

Do I need gap insurance?

Gap insurance is an optional, additional coverage that can help certain drivers cover the difference between the financed amount owed on their car and the car's actual cash value (ACV) in the event of a covered incident where their car is declared a total loss.

Gap insurance is a good option for drivers who:

- Owe more on their car loan than the car is worth.

- Have a car loan that requires gap insurance.

- Have a lease that requires gap insurance.

- Have a long finance period.

- Have purchased a vehicle that depreciates quickly.

You may not need gap insurance if:

- You own your car outright.

- You owe less on your car than its current actual cash value.

- You made a down payment of at least 20% on the car when you bought it.

- You’re paying off the car loan in less than five years.

- Your vehicle is a make and model that historically holds its value better than average.

Gap insurance is typically purchased from car insurance companies, banks, and credit unions. It can also be purchased from lenders and dealerships, but it will likely be more expensive.

The cost of gap insurance varies depending on factors such as the current actual cash value of your car, the state you live in, and your previous car insurance claims. It usually costs around $20-$60 per year when added to an existing car insurance policy, but it can be purchased independently for an average rate of $200-$300 per year.

In summary, gap insurance is worth considering if you owe more on your car than it is worth, or if you expect your car to depreciate quickly. It can provide valuable peace of mind and financial protection in the event of a total loss. However, if you have positive equity in your vehicle and are confident in your ability to absorb any potential losses, gap insurance may not be necessary.

Tracking System Insurance: Vehicle Protection

You may want to see also

When do I need gap insurance?

Gap insurance is an optional auto insurance coverage that helps pay your car loan if your car is lost or stolen and you owe more than the vehicle is worth. It is a good option for drivers who owe more on their car loan than the car is worth. It is also a good option for drivers whose car loan requires gap insurance, and for those whose lease requires gap insurance.

Gap insurance is worth it in a few situations. You should consider gap insurance coverage if:

- You made a small down payment

- You have a long finance period

- You purchased a vehicle that depreciates quickly

If your vehicle is not financed, there is no reason to purchase gap coverage. If you do finance your vehicle, gap coverage can be a good idea, but it depends on how much you drive and how quickly your car depreciates.

Gap insurance covers the difference between the compensation you receive after a total loss of your vehicle and the amount you still owe on a car loan. It is also known as guaranteed asset protection insurance.

Safeco's Insurance Policy for Rebuilt Cars

You may want to see also

How much does gap insurance cost?

The cost of GAP insurance depends on where you purchase it. Dealerships and lenders charge higher prices for GAP insurance than car insurance companies. Dealerships and lenders sell GAP insurance for a flat rate, typically between $500 and $700, which are the highest rates for this type of policy. Insurance companies, on the other hand, charge an average of $20 to $40 per year for GAP insurance when bundled with an existing insurance policy. If you want to buy a standalone GAP insurance policy, you can expect to pay between $200 and $300.

Gap Insurance Calculation: What's the Formula?

You may want to see also

How do I get a gap insurance refund?

To get a refund on your GAP insurance, you must have paid your insurance bill in advance and be cancelling the policy before the period expires. You will not be eligible for a refund if you have filed a claim against the policy.

There are typically three situations in which you can cancel your GAP insurance and get a refund:

- Paying off your loan: If you pay off your car loan early, you may be eligible for a partial refund for the GAP coverage that you haven’t used yet.

- Switching insurance companies: If you cancel your policy within 30 days of its start date, you can usually get a full refund (including GAP insurance costs). If you cancel after 30 days, your refund will be prorated.

- Selling or trading your car: If you sell or trade in your car, you can get a refund on the amount of GAP coverage you didn't use. Make sure you wait to cancel your insurance until after the car is no longer yours.

To get a refund, contact your insurance provider and tell them you want to cancel your GAP insurance and get a refund for the remaining coverage. You will then need to submit the appropriate paperwork, such as proof of sale or an auto payoff letter. You may also need to provide an odometer verification showing the mileage on your car.

Vehicle Total Loss: Payout Expectations

You may want to see also

Frequently asked questions

Gap insurance covers the difference between the amount you paid for your car and what your insurance company will pay out if it's written off or stolen.

Gap insurance is not essential as your car insurance should pay out for a replacement car of the same age and condition. However, you might want to consider it if you want a brand new replacement car or if you have a finance deal and would owe more to the finance company than you'd get from the insurer.

You can typically buy gap insurance from car insurance companies, banks and credit unions.

Gap insurance costs an average of $61 a year, but it's much cheaper to buy it from a car insurance company than a car dealership.

Cancel the policy when you owe less than your vehicle is worth. This usually takes about two years.

You can cancel gap insurance by contacting your car insurance company. There may be a cancellation fee, and you should expect a pro-rated refund based on how long you’ve had the gap insurance.