Life insurance policies typically include a suicide clause, which prevents the insurer from paying out to beneficiaries if the insured's death was due to suicide within a certain period, usually two years, from the start of the policy. This clause is meant to prevent someone from purchasing a policy and then taking their own life so that their loved ones can receive financial benefits. After this exclusion period, most life insurance policies do cover suicide, and beneficiaries are entitled to receive the full death benefit. However, there are some variations in how different types of life insurance policies address suicide coverage.

| Characteristics | Values |

|---|---|

| Do dependents get life insurance money in suicide cases? | Yes, after a certain period from the start of the policy. |

| What is this period called? | Suicide clause, exclusion period, or contestability period. |

| How long is this period? | 1-3 years, typically 2 years. |

| What happens if the insured dies by suicide within this period? | The insurer may deny the death benefit or only return the premiums paid. |

| What happens if the insured dies by suicide after this period? | The beneficiaries would be entitled to receive the full death benefit. |

| What happens if there is no suicide clause in the policy? | The insurer is required to pay the full death benefit. |

| Can changing a policy restart the suicide exclusion period? | Yes. |

| Are there any exceptions to the suicide clause? | Group life insurance and military life insurance typically don't include a suicide clause. |

What You'll Learn

Military and group life insurance policies

Military life insurance policies, such as those offered by Veterans' Group Life Insurance (VGLI) and Servicemembers' Group Life Insurance (SGLI), are unique in that they typically pay out the death benefit to the insured's beneficiaries regardless of the cause of death. This means that even if the insured dies from an act of war or by suicide, their beneficiaries will still receive the death benefit.

Group life insurance policies, on the other hand, often provided as part of an employee benefits package, usually include a suicide clause similar to those found in individual life insurance policies. If the insured dies by suicide during the exclusion period, typically within the first two years of the policy, the death benefit may not be paid out. However, after this exclusion period, group life insurance generally covers suicide.

It is important to note that supplemental life insurance purchased through an employer usually has a standard suicide clause and contestability period. The benefits administrator should be able to provide accurate information about a specific plan.

In the case of military life insurance, the death benefit is typically paid out to the insured's beneficiaries, providing financial support to the dependents in the event of suicide.

Life Insurance: Multiple Beneficiaries, Single Payout

You may want to see also

Suicide clauses

It is important to note that changing a policy, such as adding coverage or converting a term policy into a whole life policy, can reset the exclusion period.

Group life insurance policies, often provided by employers, may not include a suicide clause. In these cases, the policy can pay out for suicidal death. However, supplemental life insurance purchased through an employer usually has a standard suicide clause.

Life Insurance Expiry: What You Need to Know

You may want to see also

Contestability clauses

The life insurance contestability period is a short window, typically two years from the policy's start date, during which the insurance company can investigate and deny a death claim if they find that the policyholder misrepresented or omitted important information on their application. This period is designed to protect the insurance company from fraud and ensure that the policyholder is getting the best plan for their health and lifestyle.

During the contestability period, the insurance company can be exempt from paying out the death benefit if it finds intentional misrepresentations in the policyholder's application. For example, if the policyholder concealed a depression diagnosis, the company could deny or reduce the amount the beneficiary receives. The misrepresentations do not have to be related to the cause of death. For instance, if the policyholder failed to disclose a history of alcohol abuse and then died in a car accident, the insurance company could deny the death claim.

The contestability period allows the insurance company to review the policyholder's application for intentional errors after a death claim. It is separate from the suicide clause, although there may be some overlap. The suicide clause gives the insurance company the ability to reject a beneficiary's claim if the cause of death was self-harm and the policyholder died within the first two to three years after the policy became active.

If the policyholder dies by suicide after the suicide clause has expired, the insurer will pay the death benefit. As with the contestability period, the suicide clause period restarts if a new policy is purchased.

To prevent insurers from investigating claims made after the contestability period, some policies include an incontestability clause. This clause prevents insurers from voiding coverage due to a misstatement by the insured after a specific amount of time, usually two or three years. The incontestability clause is one of the strongest protections for a policyholder or beneficiary, as it guarantees that their coverage cannot be easily contested after the initial period.

How to Exchange Life Insurance for an Annuity

You may want to see also

Denied claims

If your life insurance claim is denied, it's important to understand the insurer's reasoning and know what steps you can take to challenge their decision. Here are some key points to consider:

- Timing of Death: Most policies include a "suicide clause" that prevents the insurer from paying out if the insured's death was due to suicide within a certain period, typically one to two years, from the start of the policy. This period is known as the exclusion or contestability period. If the death occurs during this time, the claim will likely be denied.

- Misrepresentation: If the insured person misrepresented themselves on their application, the claim may be denied. For example, if a smoker claimed to be a non-smoker to get cheaper premiums, the insurer may deny the claim.

- Non-Disclosure: If relevant medical information was withheld or inaccurate, such as mental health conditions not disclosed during the underwriting process, the insurer may deny the claim.

- Policy Changes: Changing a policy, such as adding coverage or converting a term policy to a whole life policy, can restart the suicide exclusion period. If the insured person dies by suicide after these changes, the claim may be denied.

- Fraud or Misrepresentation: Some insurers may deny a claim outside of the contestability period if they suspect fraud or misrepresentation on the original application, including the omission of serious mental health conditions or medical information.

- Investigation Results: If the insurer conducts an investigation and concludes that the death was a suicide, but you disagree with their findings, you can contest their decision. This may involve reviewing evidence such as testimony from family and friends, suicide notes, and weapons purchases.

If your life insurance claim is denied, you can take the following steps:

- Wait for the insurance company's decision and review their denial letter.

- Carefully review the insurance policy and application for any discrepancies or misrepresentations.

- Check if your state has specific protections for beneficiaries against insurance companies to ensure the denial aligns with state rules.

- Gather relevant information, including the insurance application, policy, proof of premium payments, death certificate, and any other supporting documents.

- Contact the insurance company to appeal their decision and provide any necessary documentation.

- If the insurance company does not reconsider, you can file a complaint with your state's department of insurance, hire a life insurance attorney, or pursue mediation or arbitration.

Dave Ramsey's Life Insurance Philosophy Explained

You may want to see also

Mental health and life insurance

Mental illness should not prevent you from obtaining life insurance, but it may make the process more challenging and costly. The best option for those with mental health issues is to work with a licensed insurance agent or broker who can help them find an insurer that is more likely to provide them with a policy despite their diagnosis.

Types of Life Insurance

Term Life Insurance

Term life insurance offers coverage for a set period, typically between 10 and 30 years. This type of insurance is usually cheaper than other types, especially for younger and generally healthy individuals.

Permanent Life Insurance

Permanent life insurance, such as whole life insurance, lasts your entire life as long as you pay the premiums. It is often more expensive than term life insurance. Permanent life insurance includes a cash value component, which can be used as an investment vehicle.

Guaranteed Issue Life Insurance

If you have been denied coverage in the past, guaranteed issue life insurance may be a good option. This type of insurance does not require a medical exam or health questionnaire, and approval is guaranteed if you meet the age requirements (typically 50 to 80 years old). However, the death benefits are usually capped at a lower amount, and there is often a two-year waiting period before beneficiaries can receive the full death benefit.

Group Life Insurance

Group life insurance is often offered by employers and is generally inexpensive and easy to obtain, with no medical underwriting required. However, the policy is only active while you are employed by the company.

Factors Affecting Life Insurance with Mental Health Conditions

Diagnosis and Treatment

The type of mental health diagnosis and treatment history can impact the cost of life insurance. More severe diagnoses, inconsistent treatment records, and recent hospitalizations may result in higher premiums or even application denial.

Suicide Attempts

A history of suicide attempts can make obtaining life insurance more challenging. Insurers evaluate the risk based on medical and personal history, and table ratings or flat extras may be applied, resulting in higher premiums.

Medication and Treatment Plan

The number of medications and consistency of the treatment plan can also affect the cost of life insurance. Insurers may offer better rates to those on fewer medications or with a stable treatment plan.

Employment History

A consistent employment history, along with stable mental health and treatment, can positively influence the insurer's decision and result in lower premiums.

Tips for Applying for Life Insurance with Mental Health Conditions

- Be transparent and honest about your mental health issues on the application. Lying or hiding medical information can be considered fraud and lead to serious consequences.

- Work with an independent broker who can help you compare quotes from different insurers to find the most affordable policy for your situation.

- Consider guaranteed issue life insurance or group life insurance if you have been denied traditional term or permanent policies.

Life Insurance Agents: A US Overview and Insights

You may want to see also

Frequently asked questions

It depends on the policy and how long it has been active. Many life insurance policies include a "suicide clause" that prevents the insurer from paying out if the insured's death was due to suicide within a certain period, typically two years. After this exclusion period, most life insurance policies do cover suicide, and dependents would be entitled to receive the full death benefit.

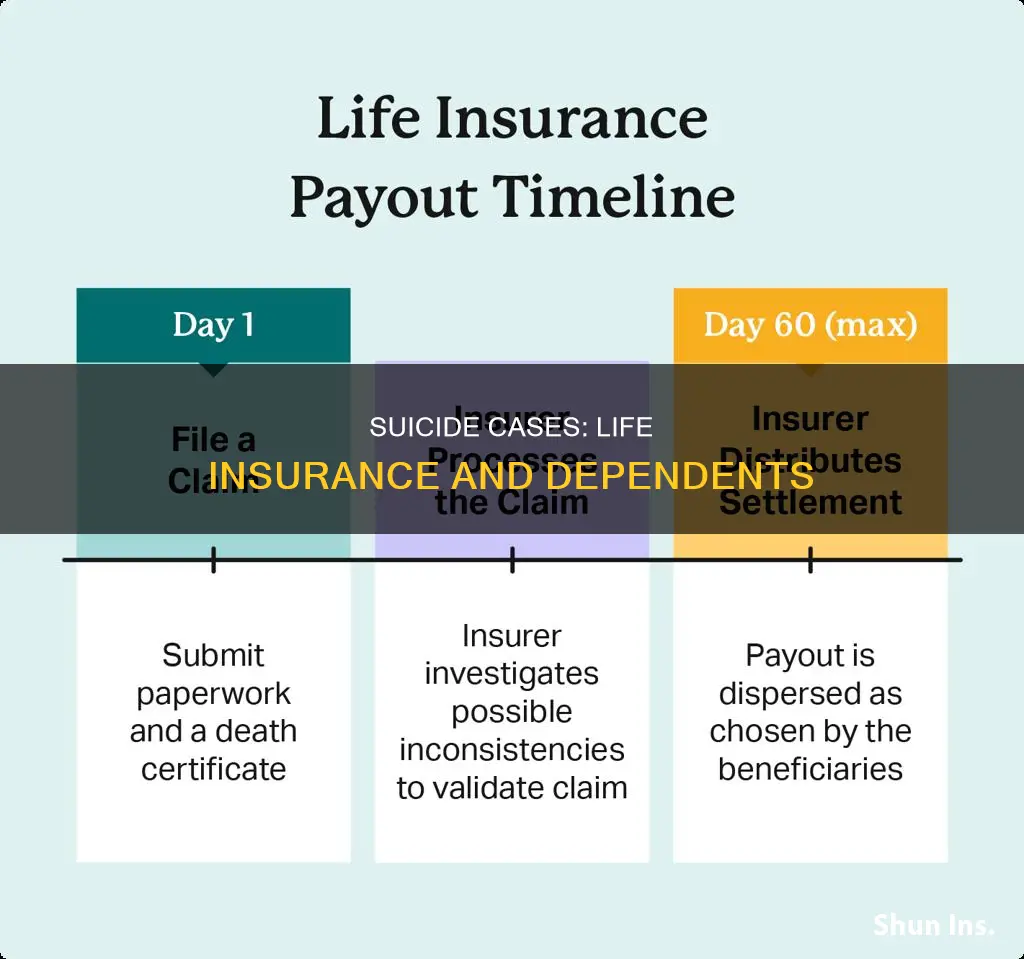

When a policyholder dies, the insurance company will request a death certificate, which will describe the cause of death. If the death certificate is inconclusive, the insurance company may request additional documentation, such as an autopsy report, a medical examiner report, or the person's medical records.

A life insurance suicide clause denies benefits if the death occurs within a certain period of time from the start of the policy, typically two years. This clause is intended to prevent people from taking out a policy with the intention of ending their life shortly afterward.

If your life insurance claim is denied, you have the right to question and appeal the insurer's decision. First, wait for the insurance company's decision and review the policy and application. Then, see if your state has any protections for beneficiaries against insurance companies. Finally, contact the insurance company with your appeal, providing any relevant information to support your claim.