Minnesota residents who meet the state's minimum filing requirement must file Form M1, Individual Income Tax. If your gross income is less than the requirement, you should file a Minnesota return to claim a refund if any of the following apply: you had Minnesota tax withheld, you made estimated tax payments to Minnesota, or you qualify for refundable credits. Even if you do not file a federal or state income tax return, you may still file Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. Household income, which includes both taxable and nontaxable income, affects your eligibility and refund amount for the Property Tax Refund. So, do distributions from life insurance affect MN M1PR?

| Characteristics | Values |

|---|---|

| What is M1PR? | Minnesota Property Tax Credit |

| Who can claim the M1PR? | Homeowners and renters |

| Who must file Form M1? | Minnesota residents who meet the state's minimum filing requirement |

| Who must file Form M1PR? | Minnesota residents who don't file a federal or state income tax return |

| What is included in household income? | Federal adjusted gross income and certain nontaxable income |

| What is not included in household income? | Settlement payments from car insurance used to pay medical bills, child support payments, child care assistance, Minnesota property tax refunds, and dependent's income (including Social Security) |

What You'll Learn

Life insurance distributions are taxable income

Life insurance proceeds are generally not taxable income for beneficiaries. However, there are exceptions to this rule.

If the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. There are some exceptions to this rule. Generally, the beneficiary must report the taxable amount based on the type of income document received, such as a Form 1099-INT or Form 1099-R.

Interest received by the beneficiary is taxable and should be reported. This includes interest calculated from the date of the insured's death to the date the insurance company sends the death benefit check to the beneficiary.

If the beneficiary chooses to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments could be taxed. That extra money from interest is considered taxable income, even though the original death benefit is not.

If the policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary, the estate's total value may trigger estate taxes, reducing what the beneficiaries ultimately receive.

Policyholders can generally borrow or withdraw money from the policy's cash value, and as long as they don't take out more than they've paid in, those withdrawals are usually tax-free. However, if there are unpaid loans against the policy, they will be deducted from the death benefit, meaning beneficiaries receive less.

If the policy is a modified endowment contract (MEC), taxes are different. For tax purposes, withdrawals are on a last-in, first-out (LIFO) basis. This means that all withdrawals are treated as taxable income until they cumulatively equal all interest earnings in the contract.

Life Insurance and Paramotoring: What's Covered?

You may want to see also

Minnesota taxes all resident income

You are considered a Minnesota resident for tax purposes if you meet the following two conditions:

- You spend at least 183 days in Minnesota during the year (any part of a day counts as a full day)

- You or your spouse rent, own, maintain, or occupy a residence in Minnesota suitable for year-round use and equipped with its own cooking and bathing facilities

If you are a full-year resident of Minnesota, you must file Form M1, Individual Income Tax. If you are a part-year resident or nonresident, you must file Form M1 and Schedule M1NR, Nonresidents/Part-Year Residents.

If your Minnesota gross income is below the minimum filing requirement ($13,825 for 2023), you do not need to pay Minnesota income tax.

Portable Life Insurance: Rates Rising, What to Know

You may want to see also

Non-residents are taxed on Minnesota-sourced income

In Minnesota, you are considered a non-resident if you are a permanent resident of another state or country and you spent less than 183 days in Minnesota. If you are a non-resident, you must file a Minnesota return if your Minnesota gross income meets the minimum filing requirement. In 2023, this was $13,825.

If you are a non-resident, Minnesota taxes your income earned in Minnesota. This includes wages or salaries you earn while physically in the state. However, if you are working in another state for a business located in Minnesota, that income is not taxable in Minnesota.

If you are a non-resident employed in the transportation, airline, or shipping industries, special rules may apply to work-related income earned in Minnesota. For example, if you work for an interstate rail or motor carrier company and regularly work in more than one state, you can only be taxed by your state of residence. In this case, as a non-resident, you do not need to file or pay Minnesota income tax on your work-related income earned in Minnesota.

Additionally, if you are a non-resident employee, your wages are subject to Minnesota withholding if you earned them while a Minnesota resident but received them while a non-resident. This includes all income for services performed in Minnesota, such as severance pay, equity-based awards, and other non-statutory deferred compensation. However, payments from the sale of stock purchased through statutory stock options and qualified deferred compensation plans, such as regular defined benefit pensions, 401(k) accounts, IRAs, and 457 plans, are not subject to Minnesota withholding.

Life Insurance: Cremation Coverage and Your Options

You may want to see also

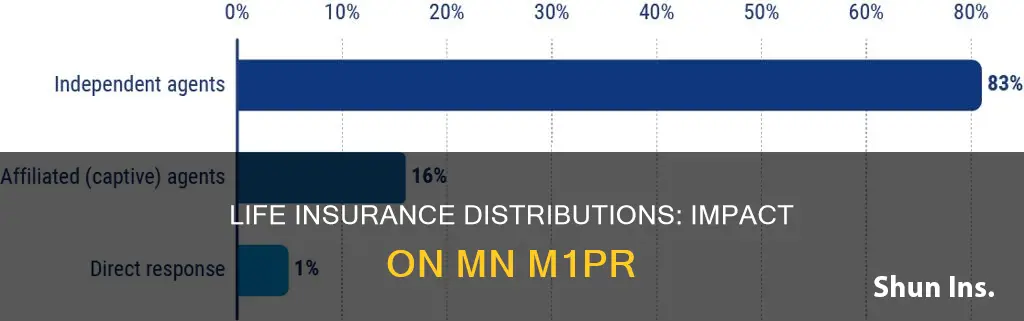

Life insurance distributions may affect M1PR eligibility

Your household income determines your eligibility and refund amount for the Property Tax Refund. This includes your federal adjusted gross income and certain non-taxable income.

Life insurance distributions may be considered non-taxable income and, therefore, may impact your household income calculation for the M1PR. It is important to note that not all life insurance distributions are treated the same for tax purposes, and the specific rules and regulations can vary depending on the type of life insurance and the circumstances of the distribution.

Additionally, there are other factors that can affect your M1PR eligibility and refund amount, such as your filing status, dependents, age, and disability status. It is recommended to refer to the instructions for Form M1PR and consult with a tax professional to understand how life insurance distributions may specifically impact your situation.

Life Insurance and COVID-19 Vaccines: Any Impact?

You may want to see also

M1PR is calculated based on household income

The M1PR is calculated based on household income. Household income includes adjusted gross income and certain non-taxable income received during the year.

To calculate household income, including subtractions that may help you qualify, refer to the line instructions for Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund.

The following is a list of items that are included in household income:

- Adjusted gross income

- Most types of non-taxable income

- Qualified retirement plan contributions

- Dependent, elderly, or disabled subtractions

- Form 1099-A income

- Acquisition or abandonment of property gain not included in federal income

- Subsidy payments and employer-paid expenses for adoption assistance

- 1099-C income for cancellation of debt (not included on the federal return)

- Community Access for Disability Inclusion Waivers

- Deferred compensation plan contributions (e.g. 401(k), 403(b), 457 deferred compensation, or SIMPLE/SEP plan)

- Dependent care account contributions and/or medical expense accounts

- Distributions from a Roth or traditional IRA not included in Federal Adjusted Gross Income (including distributions made to charity)

- Employer-paid education expenses

- Foreign earned income excluded on the federal return

- Foster care payments

- Gain on the sale of your home (not included on the federal return)

- GI Bill funding and scholarships

- Medicaid waiver payments

- Medicare Part B premiums

- Public Safety Officer medical insurance exclusion

- Worker's Compensation Benefits

It is important to note that this list is not exhaustive, and there may be other items that need to be included or excluded from household income. For a comprehensive understanding, refer to the instructions for non-taxable income that must be reported.

Term Life Insurance Extension: Is It Possible?

You may want to see also

Frequently asked questions

M1PR stands for Minnesota Property Tax Credit.

Renters, homeowners, and nursing home residents may apply for a refund of property taxes paid on their principal residence in Minnesota.

To qualify for the refund, you must meet the following requirements:

- You were a Minnesota resident for all or part of the year.

- You could not be claimed as a dependent on someone else’s federal income tax return.

- The property was assessed property taxes or payments were made in lieu of property taxes.

- If you are a homeowner, additional criteria must be met, including having a valid Social Security Number and occupying the property on January 2 of the year following the year of assessment.

Household income includes both taxable and nontaxable income. It is calculated based on the sum of your adjusted gross income, most types of nontaxable income, your qualified retirement plan contribution, and dependent, elderly, or disabled subtraction.

Examples of nontaxable income that must be added to the return include Form 1099-A income, cancellation of debt income (1099-C), foster care payments, gain on the sale of your home, and Medicare Part B premiums.