Life insurance rates are determined by the risk an individual poses to the insurer. Factors such as age, health, lifestyle choices, and medical history are considered when determining the premium costs. One factor that may be surprising to some is gender, which does lead to notable differences in male and female life insurance rates. Women generally pay less for life insurance than men, and this is primarily due to their longer life expectancy. According to data from 2020, the life expectancy for women in the US is around 80 years, while for men, it's approximately 74.5 years. Since women are expected to live longer, they are considered lower risk and thus pay lower premiums.

| Characteristics | Values |

|---|---|

| Average life expectancy | 79.9 years for women, 74.2 years for men |

| Life insurance rates | Women pay less than men |

| Life insurance ownership | 49% of women own a policy, compared to 55% of men |

| Household tasks | Women complete more than their male counterparts |

| Income | Women's income is lower than men's |

What You'll Learn

- Life insurance rates are generally higher for men than women

- Women live longer than men, so they pay less for life insurance

- Women pay nearly twice as much of their income on health insurance

- Men are more prone to certain health conditions that increase mortality risk

- Men are more likely to work in high-risk fields

Life insurance rates are generally higher for men than women

Life insurance rates are generally higher for men than for women. This is because insurance companies base their premiums on risk factors, and men are considered to have a shorter life expectancy than women. Women live longer than men for reasons largely related to genetics and hormones. Other factors that influence life insurance rates include age, health history, and lifestyle choices.

Life Expectancy

Statistically, women live longer than men. According to data from 2020, the life expectancy for women in the United States is approximately 80 years, while for men, it's around 74.5 years. Since women are expected to live longer, insurers consider them a lower risk and usually offer them lower premiums.

Health Factors

Men and women face distinct health risks throughout their lives. Men are generally more susceptible to certain health conditions that increase mortality risk, such as heart disease and hypertension.

Occupational Hazards

Men and women tend to work in different industries, which can have varying levels of risk. Men are more likely to pursue careers in high-risk fields, such as construction, mining, or logging, which increases the likelihood of accidents and fatalities.

Lifestyle Choices

Men and women often exhibit different lifestyle habits that can impact their health and life expectancy. Men are more prone to risky behaviours, such as smoking, heavy alcohol consumption, drug use, and high-risk hobbies like extreme sports, all of which increase their chances of premature death.

Other Factors

While gender plays a significant role in life insurance rates, it's important to remember that other factors are also considered. These include age, family medical history, pre-existing health conditions, lifestyle risks like smoking, policy benefits, and risky activities or hobbies.

How to Get Life Insurance for Your Boyfriend

You may want to see also

Women live longer than men, so they pay less for life insurance

Life insurance rates are calculated based on how risky the insurer thinks it is to insure you, i.e., how likely you are to die while your coverage is active. Women live longer than men due to genetic and hormonal factors, so they are usually offered lower life insurance rates and pay less for life insurance than men. On average, women pay 24% less for life insurance than men.

Actuarial tables, which determine an individual's chances of dying based on historical data, show that men usually die earlier than women. According to 2020 data, the life expectancy for women in the U.S. is about 80 years, while for men, it's around 74.5 years. The Social Security Administration (SSA) actuarial life tables also show that a woman who was 40 in 2019 was expected to live about four years longer than a man who was 40.

In addition to genetics and hormones, there are other factors that contribute to women's longer life expectancy. Women are generally less prone to certain health conditions that can increase mortality risk, such as heart disease and hypertension. They also tend to engage in fewer risky behaviors, such as smoking, heavy alcohol consumption, and extreme sports.

Occupational hazards are another factor to consider. Men are more likely to work in high-risk fields, such as construction, mining, or logging, which increases the likelihood of accidents and fatalities.

It's important to note that while gender is a significant factor in life insurance rates, it is not the only one. Individual health history, lifestyle choices, and other factors can also impact the cost of life insurance for both men and women.

Founders Federal Credit Union: Life Insurance Options?

You may want to see also

Women pay nearly twice as much of their income on health insurance

Women generally pay lower premiums for life insurance than men. However, this is not the case for health insurance, where women spend nearly twice as much of their income as men. This discrepancy is due to a combination of higher costs and the gender pay gap.

In 2020, women spent an average of 6.8% of their annual pretax income on health insurance, compared to 3.9% for men. This equates to women paying $510 more than men. The gap widens with age, with women over 65 spending 11.7% of their income on health insurance, compared to 8.4% for men.

The gender pay gap is a significant factor in this disparity. Women's earnings are lower than men's, yet they face higher healthcare costs. For example, women in their prime earning years (ages 35-44) spend almost 3% of their income on health insurance, while men's top-earning years are a decade later, and they only spend 2.7% of their income on health insurance.

Additionally, women are considered a higher insurance risk due to factors such as pregnancy and longer life expectancy. As a result, they tend to visit the doctor more frequently and have more complex medical issues, increasing their insurance costs.

The impact of these factors is evident across income levels. Lower-income women are disproportionately affected, with those earning less than $15,000 per year paying 20.7% of their income towards health insurance, compared to 15.7% for men in the same income bracket.

The discrepancy in health insurance costs between genders is not limited to the United States. A 2004 study found that per capita lifetime healthcare expenditures for women were a third higher than for men globally.

While the Affordable Care Act (ACA) has helped mitigate gender-based insurance rates, many women are still subject to them, especially those with private insurance or working for large companies.

Globe Life Insurance: Understanding the Waiting Periods

You may want to see also

Men are more prone to certain health conditions that increase mortality risk

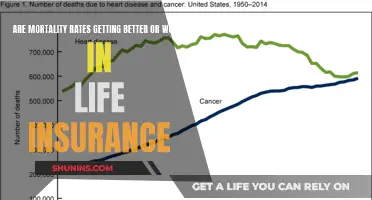

Men are more prone to certain health conditions that increase their mortality risk. According to the US Centers for Disease Control and Prevention (CDC), men have shorter life expectancies than women. In 2019, 357,761 American men died of heart disease, representing one in every four male deaths. Heart disease is the leading cause of death in men each year, and men usually develop it 10 to 15 years earlier than women, making them more likely to die from it.

In addition to heart disease, the leading causes of cancer death in men are lung cancer, prostate cancer, and colorectal cancer. In 2021, 69,410 men were projected to die of lung cancer. Testicular cancer is also more common in younger men, aged 20 to 54.

Men are also more likely to die from unintentional injuries, which include accidents such as falls, fires, and impaired driving. In 2019, 173,030 people died from unintentional injuries in the US, with 37,595 deaths due to motor vehicle crashes and 10,497 due to alcohol-impaired driving crashes. Male drivers involved in fatal crashes are almost twice as likely as female drivers to be intoxicated.

Furthermore, men are more prone to chronic obstructive pulmonary disease (COPD), which includes chronic bronchitis and emphysema. Smoking is the leading cause of COPD, and men who smoke are nearly 12 times more likely to die from it than men who have never smoked.

Depression and suicide are also significant health concerns for men. Men are more likely than women to commit suicide, as they are more likely to use deadlier means, such as firearms. Depression is often undiagnosed in men, as they are less likely to seek help and may not exhibit standard symptoms such as sadness.

These health conditions contribute to the higher mortality risk among men and are important factors considered by life insurance companies when determining premiums.

Bank-Sold Credit Life Insurance: What's the Deal?

You may want to see also

Men are more likely to work in high-risk fields

The gendered segregation of occupations and the gendered division of labour within specific occupations can place men at greater risk. Men are overrepresented in these high-risk industries, and they may experience different types of occupational injuries and reasons for illness absences. Men may be exposed to greater workplace hazards and traumatic injuries, while women may experience more chronic musculoskeletal conditions, anxiety, and depression.

Men in high-risk occupations may also experience increased exposure to physical risks, violence and psychological hazards, and normative expectations relating to masculinity, or "hypermasculinity". These expectations may demand that men be physically tough and fearless in the face of risk or danger.

Additionally, men are more likely to engage in risky behaviours, such as smoking, heavy alcohol consumption, drug use, and high-risk hobbies, which can increase their likelihood of passing away.

Sildenafil: Impact on Life Insurance Coverage and Costs

You may want to see also