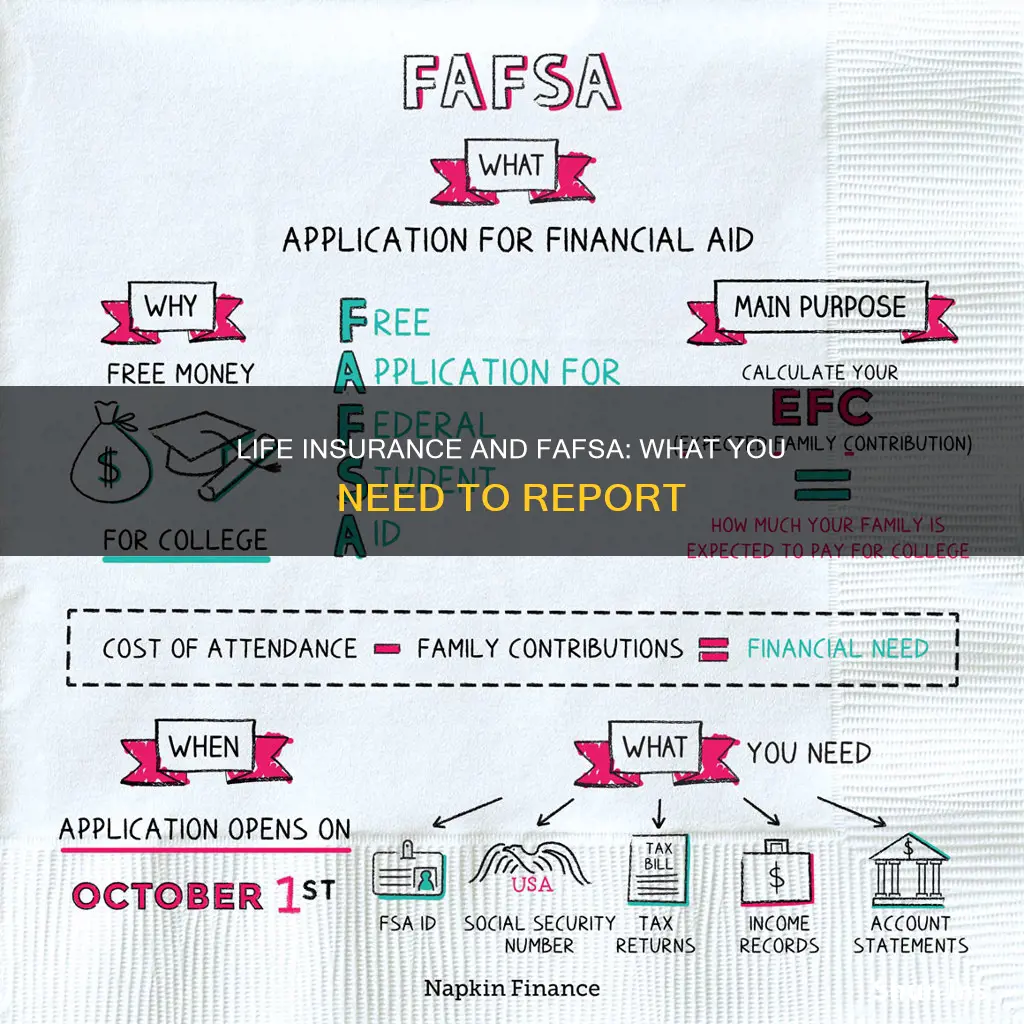

The Free Application for Federal Student Aid (FAFSA) is an extensive form that can be intimidating for many families with college-bound children. It is, however, a crucial document that can unlock billions of dollars in federal financial, state, and institutional aid. One of the most common mistakes made by families is not filling out the FAFSA at all, often due to the misconception that their income level disqualifies them from receiving aid. This is not always the case, and it is recommended that all families with college-bound children complete the FAFSA. While the FAFSA does require information on assets, there are certain assets that are non-reportable, such as qualified retirement plans and the family home. One type of asset that families may wonder about is life insurance. The FAFSA does not consider cash value life insurance as an asset, and settlements from a life insurance policy will count as income.

What You'll Learn

- Life insurance policy payouts are counted as income

- Whole life and cash value life insurance policies are sheltered as retirement plans

- Life insurance settlements are counted as income

- Life insurance payouts may be considered an asset

- Life insurance agents may suggest cash value life insurance to hide parents' assets

Life insurance policy payouts are counted as income

The Free Application for Federal Student Aid (FAFSA) is a form that must be filled out by students seeking financial aid through government programs. The FAFSA does not consider cash value life insurance as an asset. However, life insurance policy payouts are counted as income. This means that if you are a beneficiary of a life insurance policy and receive a payout, that payout is considered income and could decrease your financial aid eligibility.

The FAFSA does not ask about the family's primary home or assets in a small business that the family owns and controls, as long as the small business has fewer than 100 full-time employees and the family owns more than 50% of the business. The FAFSA also does not consider assets in a farm if it is the family's primary residence and the student or parents are actively involved in the farming operation.

While life insurance policy payouts are counted as income, borrowing from a life insurance policy is treated differently. If you borrow from a life insurance policy after filing the FAFSA, it is not reported as an asset. However, the interest on the loan is not deductible, and unpaid interest may eventually count as taxable income.

It is important to note that the treatment of life insurance policies and payouts may vary between the FAFSA and other financial aid applications, such as the CSS Profile used by some private colleges and universities. The CSS Profile does inquire about home equity and business assets, and its treatment of these assets may vary by institution. Therefore, it is essential to carefully review the requirements and guidelines of the specific financial aid application you are completing.

Additionally, if you have unique circumstances, such as the recent death of a parent, you may need to provide additional documentation and information when filling out the FAFSA. In such cases, it is recommended to contact the financial aid office of your school to understand their specific procedures and requirements.

Universal Life Insurance: What's the Real Deal?

You may want to see also

Whole life and cash value life insurance policies are sheltered as retirement plans

Whole Life and Cash Value Life Insurance Policies as Retirement Plans

Whole life and cash-value life insurance policies are considered sheltered retirement plans on the FAFSA. However, they are generally regarded as poor investment options due to their low return on investment, high surrender charges, and high sales commissions.

Whole life insurance is a permanent life insurance policy that offers several unique benefits. Firstly, it provides a permanent life insurance benefit, whereas term life insurance policies only last for a specific period. Secondly, the premium for whole life insurance remains fixed throughout the policy, unlike term life insurance, which must be renewed at higher rates. Thirdly, whole life insurance allows you to build guaranteed cash value over time, as a portion of each premium payment is set aside and invested. Finally, whole life insurance may offer dividends if the policy is purchased from a mutual company, providing the policyholder with ownership rights.

Cash value life insurance, including whole life, universal, and variable life insurance policies, can serve as a source of funds during retirement. The cash value component of these policies grows over time as policyholders make premium payments. This cash value can be withdrawn or borrowed against to supplement retirement income, providing a valuable option, especially during market downturns.

However, it is important to note that accessing the cash value of a life insurance policy has certain implications. Withdrawing or borrowing from the cash value reduces the remaining cash value and the death benefit. It also increases the likelihood of the policy lapsing and may result in tax consequences if the policy terminates before the insured's death.

While life insurance can provide a valuable supplement to retirement income, it should not be the primary source of retirement funding. It is recommended to use life insurance as an accompaniment to dedicated retirement accounts and investments, such as IRAs or 401(k) plans, which are typically more efficient ways to save for retirement.

Life Insurance for US Veterans: Who Qualifies?

You may want to see also

Life insurance settlements are counted as income

The Free Application for Federal Student Aid (FAFSA) is used by students seeking financial aid through government programs. The FAFSA does not consider cash value life insurance as an asset. However, life insurance settlements are counted as income. This means that if you are a beneficiary of a life insurance policy and receive a payout, that payout is considered income and could decrease your financial aid eligibility.

The FAFSA does not require you to report the financial information of deceased parents. If both your parents have passed away, you are considered an independent student, and only your financial information is evaluated. While any death benefit you receive from a parent's life insurance may not be considered income by some colleges, it is still considered an asset if it remains unspent. This could disqualify you from certain need-based aid.

It is important to note that whole life and cash value life insurance policies are sheltered as retirement plans, but they may not be the best investment options due to their high surrender charges and sales commissions. Additionally, distributions from these policies are counted as untaxed income on the FAFSA.

To maximize your eligibility for financial aid and avoid common errors, it is recommended to seek guidance from experts or utilize resources such as the Edvisors Network's guide, "Filing the FAFSA." This guide provides valuable insights on completing the FAFSA accurately and efficiently.

Mortgage Protection Life Insurance: What You Need to Know

You may want to see also

Life insurance payouts may be considered an asset

Life insurance policy payouts may be considered an asset when filing the Free Application for Federal Student Aid (FAFSA). If you are a beneficiary of a life insurance policy and receive a payout, that payout typically counts as income for the beneficiary. This could reduce the amount of financial aid you are eligible for. However, the payout may still be considered an asset if it hasn't been spent, which could disqualify you from some need-based aid.

The FAFSA does not consider cash value life insurance as an asset. Because of this, some insurance agents promote cash value life insurance as a way to hide parents' assets. However, experts advise against this strategy due to the high sales commissions, high premiums, low return on investment, and other problems associated with these policies.

If you are a student who has lost one or both parents, you are considered an independent student on the FAFSA. You are only required to submit your financial information, not that of your deceased parents. However, any death benefit you receive from your parents' life insurance may affect your financial aid.

It is important to note that the treatment of life insurance payouts may vary depending on the specific circumstances and the policies of the college or university. It is always best to speak with a financial aid office or a qualified expert for advice on your specific situation.

Life Insurance and Humira: What You Need to Know

You may want to see also

Life insurance agents may suggest cash value life insurance to hide parents' assets

When filling out the Free Application for Federal Student Aid (FAFSA), it is important to understand which assets need to be reported and which do not. The FAFSA doesn't consider cash value life insurance as an asset. This means that settlements from a life insurance policy will count as income, but the policy itself does not need to be reported as an asset.

Life insurance agents may suggest cash value life insurance as a way for parents to hide their assets when applying for financial aid. While this may be seen as a strategic move, there are several reasons why this suggestion should be approached with caution.

Firstly, it is important to understand the nature of cash value life insurance. This type of insurance includes a savings component, allowing policyholders to accumulate cash value over time. While this can provide benefits such as tax advantages and the ability to borrow against the policy, it also comes with drawbacks. Cash value life insurance tends to be more expensive than term life insurance, with high sales commissions, high premiums, and low returns on investment. The process of accumulating cash value can also be slow, taking decades to build up a substantial amount.

Secondly, the suggestion to use cash value life insurance to hide assets may be unnecessary and costly. Assets owned by parents are already given favourable treatment in financial aid formulas. Certain assets, such as retirement accounts and home equity, are not counted at all by the FAFSA. Parents are also allowed to exempt a portion of their assets based on their age, with older parents being able to shield a larger amount.

Therefore, before considering cash value life insurance as a way to hide assets, it is advisable to use tools such as the "expected family contribution calculator" to assess the impact of the assets on financial aid eligibility. In most cases, there are better ways to make college more affordable than trying to hide assets. Additionally, boosting financial aid eligibility may result in receiving more loans that need to be repaid, rather than scholarships or grants.

In conclusion, while cash value life insurance may be suggested by agents as a way to hide parents' assets on the FAFSA, it is important to carefully weigh the benefits against the potential drawbacks and expenses. There are often more effective strategies for maximizing financial aid eligibility, and the costs of cash value life insurance may outweigh the benefits for many families.

How Canadians Can Get a US Life Insurance License

You may want to see also

Frequently asked questions

No, the FAFSA doesn't consider cash value life insurance as an asset. However, settlements from a life insurance policy will count as income.

FAFSA stands for Free Application for Federal Student Aid. It is an extensive form that asks questions about your family's financial situation.

Some common mistakes to avoid when filling out the FAFSA are not filling out the application at all, waiting until the last minute, inputting incorrect information, and not using the IRS data retrieval tool.