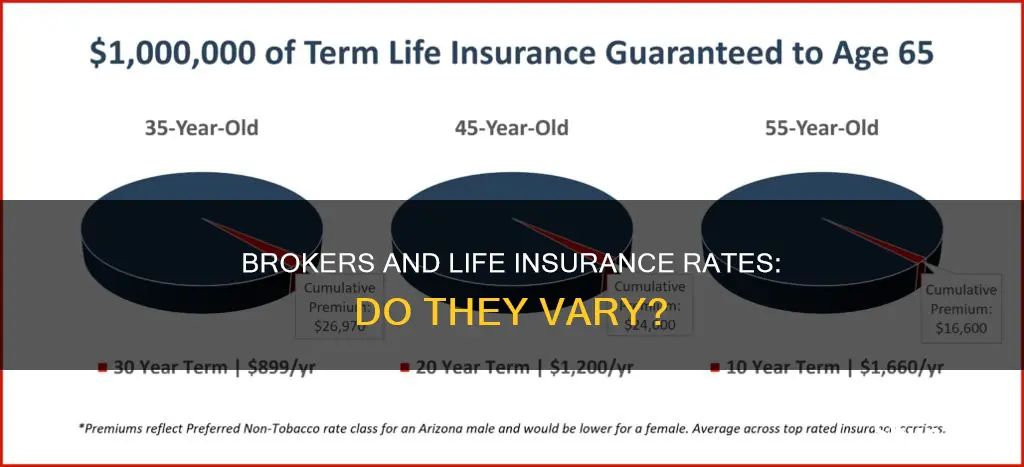

Life insurance brokers are independent insurance salespeople who offer policies from multiple life insurance companies. They are not tied to any single insurer and can offer policies from various companies. They help clients navigate a wider range of options and are required to follow industry guidelines set by provincial insurance counsels.

Brokers earn commissions from the life insurance carriers for each policy they sell, which may add somewhat to the cost of a policy. The customer doesn't pay the broker directly; instead, the provider does, once the policy has been medically and financially underwritten and the policyholder pays their first premium.

The commission brokers earn varies from product to product. For life and living benefit products, the first-year commission usually ranges from 40% to 60% of the annual premium, depending on the type of product. In general, a whole-life policy pays the broker much more than a term policy.

While brokers can be a valuable resource, it's worth noting that some charge a fee in addition to their commission. As with all industries, knowledge and experience among brokers vary greatly, so finding a broker you trust may be time-consuming.

| Characteristics | Values |

|---|---|

| What is a life insurance broker? | An independent insurance salesperson who offers policies from multiple life insurance companies. |

| How does a life insurance broker get paid? | Brokers earn commissions from the life insurance carriers for each policy they sell. |

| How does a life insurance broker determine the products they offer? | Brokers use analytical tools such as "fact finders" and "needs analysis" to match you with a policy. |

| Are brokers in the insurance company's pocket? | No. Brokers can sell the products of insurance providers they have contracts with, and the compensation is usually very similar for similar products across companies. |

| How much do life insurance brokers make? | It depends on the product they are selling. For life and living benefit products, the first-year commission is usually 40-60% of the annual premium. |

| Who pays the broker? | The customer doesn't pay the broker directly. The insurance provider pays the broker once the policy has been underwritten and the policyholder pays their first premium. |

| How to spot a good broker? | Ask yourself, "Does this life insurance product address my needs and wants?" If the answer is yes, then the broker has done their job. |

What You'll Learn

Brokers vs. agents: what's the difference?

When it comes to life insurance, brokers and agents fulfil different roles and responsibilities. Here's a detailed overview:

Life Insurance Brokers

A life insurance broker is an independent insurance salesperson who offers policies from multiple insurance companies. They are not tied to any single insurer and can provide clients with a wide range of options. Brokers work for their clients, helping them navigate and choose from policy offerings from a range of insurers. They do this by assessing their client's insurance needs and comparing life insurance quotes to find the best deal based on price, coverage type, customer satisfaction, and other metrics.

Brokers can be traditional or online. Traditional brokers offer personalised advice and are a good choice for those who want guidance. Online brokers are more suitable for those who know what type of policy they want and just need a way to easily compare rates.

Brokers earn commissions from insurance carriers for each policy they sell, which may add to the cost of the policy. They may also charge a consultation fee.

Life Insurance Agents

Life insurance agents represent insurance companies and sell policies that meet their client's needs. There are two types of agents: captive agents and independent agents.

Captive agents typically work for and sell policies from one insurer. They may offer a policy from another company only if their primary insurer doesn't sell that type of coverage.

Independent agents can sell policies from multiple companies but only those with which they have an agreement.

Agents generally don't charge consultation fees. They typically earn a base salary plus a commission or work solely on commission.

Choosing Between a Broker and an Agent

Whether you choose to work with a life insurance broker or agent depends on your specific needs and preferences.

A life insurance agent may be a good fit if:

- You know the kind of policy and insurer you want.

- You are healthy and want a straightforward process.

- You don't want to pay extra fees since agents typically earn commissions.

On the other hand, a life insurance broker may be preferable if:

- You want help shopping for insurance and comparing quotes from various companies.

- You have a complex health or financial situation and need additional insight.

- You don't mind paying a consultation fee for personalised recommendations.

Both brokers and agents are licensed experts who can provide valuable assistance when shopping for life insurance. It's important to understand their differences to make an informed decision about which professional to work with.

Bipolar Disorder: Life Insurance Options and Availability

You may want to see also

How brokers get paid

Life insurance brokers are professionals who sell insurance but do not work for insurance providers. They represent the consumer in the insurance-buying process. Their primary duty is to their client, and they are paid a broker fee by the insurance provider the client selects. This fee is usually a commission based on a percentage of the insurance policy, typically 2% to 8% of the premiums.

The customer does not pay the broker directly. The provider pays the broker once the policy has been medically and financially underwritten and the policyholder pays their first premium. The broker will also receive a commission every time the client renews their coverage, giving them an incentive to keep their clients happy.

In addition to the commission, brokers can also make money by providing consultative and advisory services to clients for a fee. They can charge transactional fees for things like initiating changes and helping to file claims. However, these fees are governed by the state and must be reasonable and agreed upon by the client and broker.

Some brokers may also receive bonuses or increased commissions from insurance companies as incentives for good performance. However, this is controversial as it could create a conflict of interest.

Overall, life insurance brokers are paid through a combination of commissions, fees, and, occasionally, bonuses from insurance companies.

Life Insurance Policies: Can You Cancel Yours?

You may want to see also

Pros and cons of using a broker

Pros of using a broker

- Brokers can help you compare coverage offerings and rates from multiple companies.

- They can help you negotiate to secure coverage if you have a pre-existing condition.

- They can help you understand the finer points of different life insurance policies.

- They can help you modify your policy to meet your family's changing financial needs.

- They can help you with the application process, ensuring that all necessary paperwork is completed accurately and efficiently.

- They can continue to offer support even after the policy is in effect, helping you with any policy changes, claims, or inquiries that may arise.

Cons of using a broker

- Some brokers may charge a fee in addition to their commission.

- Knowledge and experience among brokers will vary.

- Finding a broker you trust may be time-consuming.

Life Insurance Cash Value: Taxable or Tax-Free?

You may want to see also

Finding the right broker

Finding the right life insurance broker is crucial to ensure you get the best coverage for your needs. Here are some tips to help you find a reputable and reliable broker:

- Referrals and Recommendations: Ask friends, family, or colleagues for referrals. People you trust can provide first-hand accounts of their experiences with specific brokers. This can give you valuable insights into the broker's professionalism, responsiveness, and level of personal attention.

- Online Reviews: Check online review sites like Trustpilot or Yelp. While taking reviews with a grain of salt, look for consistent patterns in the feedback. Do they respond promptly? Are they knowledgeable? Do they provide personalised recommendations?

- Licensing and Expertise: Ensure your broker is properly licensed and experienced in the type of life insurance you seek. Check their affiliations with insurance companies and reputable associations like the National Association of Insurance Commissioners (NAIC), Chartered Life Underwriter (CLU), or Certified Financial Planner (CFP).

- Reputation and Experience: Consider brokers with extensive industry experience. This indicates their level of knowledge and understanding of the complex nature of life insurance. Also, consider brokers with specialised knowledge in areas like estate planning, retirement planning, tax planning, or investing.

- Communication and Customer Service: Opt for a broker who communicates effectively, explains different insurance types, answers your questions, and provides tailored advice based on your financial situation.

- Understanding Your Needs: Choose a broker who takes the time to understand your unique circumstances, financial goals, risk tolerance, family dynamics, and future plans. This ensures they can advise on the most suitable coverage for your specific needs.

- Broker Credentials: Inquire about additional broker credentials, certifications, and training. This demonstrates their commitment to ongoing professional development and staying current with industry trends and regulations.

- Broker Availability: Consider whether you prefer a traditional broker who meets with you in person or a virtual broker who works remotely. Both options are available, and your choice depends on your personal preference and level of comfort.

Remember, the right broker will be knowledgeable, experienced, responsive, and dedicated to helping you find the best life insurance policy for your specific circumstances.

Life Insurance After 60: Affordable Options Exist

You may want to see also

Brokers' obligations to clients

Life insurance brokers have a fiduciary duty to act in the best interests of their clients. They must exercise reasonable care and skill in obtaining the cover requested by their clients, making reasonable enquiries to fully understand the risks and arranging effective and appropriate cover. Brokers are not employed to give specialist legal advice, but they do have a responsibility to offer advice to their clients. However, if they give advice on legal matters and it turns out to be wrong, they may be in breach of duty.

- Contain and reduce costs – Brokers must obtain the best cover at the best terms possible. They must assess the risk that can be insured and then source the most suitable and affordable insurance for their client's needs.

- Protect future earnings – Brokers must act with integrity and have a detailed knowledge of the products offered by different insurers, including policy wordings, industry specialisations, and attitudes towards claims. They should be able to explain the cover provided by the contract, its limitations, and any exclusions.

- Ensure governance and compliance – Brokers must comply with relevant laws and regulations, such as the duty of utmost good faith towards insurers under the Insurance Contracts Act. They must also ensure that their clients meet their obligations, such as disclosing all facts relating to the proposed risks.

- Act as the client's agent – Brokers work for their clients, not insurance companies. They should always act in the client's best interests and seek to obtain insurance that meets the client's needs.

- Provide risk management services – In addition to insurance broking, brokers may offer risk management services such as risk identification, risk profiling, and risk mitigation strategies.

- Disclose any affiliations – Brokers should be transparent about any relationships they have with insurers and disclose any potential conflicts of interest.

- Charge reasonable fees – Brokers can charge a broker fee on top of their commission, but this must be reasonable and disclosed to the client upfront.

It is important to note that the specific obligations of life insurance brokers may vary depending on the jurisdiction and relevant laws.

Understanding Life Insurance: Death Benefits Explained

You may want to see also

Frequently asked questions

Life insurance brokers earn a commission from the insurance carrier for each policy they sell. The commission is usually a percentage of the premium amount, which can be up to 40-60% in the first year and then drops to 1-10% in subsequent years.

Life insurance brokers work for their clients and not for any specific insurance company. They are independent and can offer policies from multiple insurance providers.

Look for a licensed broker with extensive experience and deep knowledge about different insurance products. Ask for referrals from friends and family, check online reviews, and research the broker's credentials and associations.

A life insurance agent typically works for a specific insurance company and can only offer policies from that company. In contrast, a life insurance broker is independent and can offer policies from multiple insurance companies.

You can buy life insurance directly from an insurance company, but a broker can help you navigate the options and find the best policy for your specific needs. They can also assist with the application process and provide ongoing support.