Term life insurance is a type of insurance that provides coverage for a specific period of time, such as 10, 20, or 30 years. It is often an affordable way to protect your family financially in the event of your death. When purchasing term life insurance, you need to decide on the length of coverage and the amount of insurance. Ideally, the policy should last until your last significant obligation is met. Therefore, the duration of your financial commitments will determine how long your term life insurance policy should be.

Term life insurance policies are typically sold in lengths of 5, 10, 15, 20, 25, or 30 years. The longer the policy, the higher the premium. This is because you are locking in your rate for a more extended period, and health problems become more common as you age.

When selecting a term length, consider your financial responsibilities, such as your mortgage or children's education. Additionally, think about the length of your mortgage, how long your children will depend on you financially, and your retirement plans.

Term life insurance is a popular choice for those seeking affordable coverage for a specific period. It is essential to choose a reputable company with strong financial stability and a history of positive customer experiences.

| Characteristics | Values |

|---|---|

| Term life insurance policy length | 5, 10, 15, 20, 25, 30, 40 years |

| Annual renewable term life insurance | Premiums increase each year |

| Whole life insurance policy length | Until a set age, e.g. 95, 100, 120 |

| Whole life insurance cash value | Accumulates at a guaranteed rate |

| Average annual rates for term life vs. whole life | $2,532, $4,682, $9,270 for a $500,000, 20-year term life policy for a healthy, non-smoking 40-year-old man |

| Average annual rates for term life vs. whole life | $1,154, $2,194, $3,988 for a $500,000, 20-year term life policy for a healthy, non-smoking 40-year-old woman |

What You'll Learn

Term life insurance: what it is and how long it lasts

Term life insurance is a type of insurance that provides coverage for a specific period, such as 10, 20 or 30 years. It is often an affordable way to ensure your family is financially protected in the event of your death. When purchasing term life insurance, you need to decide on the amount of coverage and how long it should last.

The duration of your term life insurance should be based on your financial commitments and obligations. For example, if you have a mortgage, you may want a policy that lasts until it is paid off. Other factors to consider include how long you will have children or other dependents, and how long until your retirement.

Term lengths

Term life insurance policies are typically sold in lengths of 5, 10, 15, 20, 25 or 30 years. Some companies also offer 40-year term life insurance. The longer the policy, the higher the premium is likely to be, as you are locking in your rate for a longer period, and health problems become more common as you age.

Annual renewable term life insurance

Another option is annual renewable term life insurance, which allows you to renew coverage each year for a set period. However, the premiums usually increase with each renewal, so a standard level term life insurance policy may be more cost-effective in the long run.

Choosing the right term length

The most common term lengths include:

- Annual renewable term life insurance is suitable for those with short-term financial obligations or those who need coverage until they get a new group life insurance policy through their next job.

- 5-year term life insurance is ideal for those with short-term financial commitments, such as small loans or college fees.

- 10-year term life insurance may benefit parents with older children who still rely on their income or those approaching retirement.

- 20-year term life insurance is the most popular option and can help cover the income of new parents or newlyweds as their family grows.

- 30-year term life insurance can cover large, long-term financial obligations, such as a mortgage or college debt, and is also suitable for young applicants who want coverage for most of their earning years.

If your longest financial commitment falls between the available term periods, it is generally recommended to round up. For example, if your mortgage will be paid off in 17 years, opt for a 20-year term.

Factors to consider when choosing the term length

When deciding on the length of your term life insurance, consider the following:

- The length of your mortgage: This is often a significant expense and a common reason for purchasing life insurance. Ensure your policy covers the entire duration of your mortgage payments.

- How long your children will be dependent on you: Consider how long until your children can financially support themselves, especially if you plan to pay for their college education.

- The number of years until retirement: If you are buying term life insurance to replace your income, you may not need it after retirement, once you have sufficient savings.

When a term life insurance policy expires, your coverage ends, and you are no longer required to make premium payments. You may have the option to extend the policy on an annual renewable basis, purchase a new term policy, or convert it to permanent life insurance. However, premiums usually increase with these options, and some insurers may require a new medical exam.

Typically, term life insurance does not build cash value, so you cannot cash out the policy. However, the difference in cost between term and permanent life insurance could be invested or saved over time.

Most term life insurance policies last for 10 to 30 years. Some policies allow for annual renewals or renewal until a certain age, such as 80 or 90, but premiums tend to increase with age.

The ideal length for your term life insurance policy should cover your major financial obligations, such as the length of your mortgage or until your children are financially independent.

Term life insurance provides temporary coverage for a specific period, such as 10, 20 or 30 years. If you pass away during the term, your insurer will pay a sum of money to your beneficiaries. Unlike whole life insurance, term life insurance typically does not build cash value, and coverage expires at the end of the term.

Term life insurance is sufficient for most people and is particularly useful if others depend on you financially, your death would be a financial burden to others, you have debt that will be paid off in a few years, or you are a stay-at-home parent whose family would need to pay for household services in your absence.

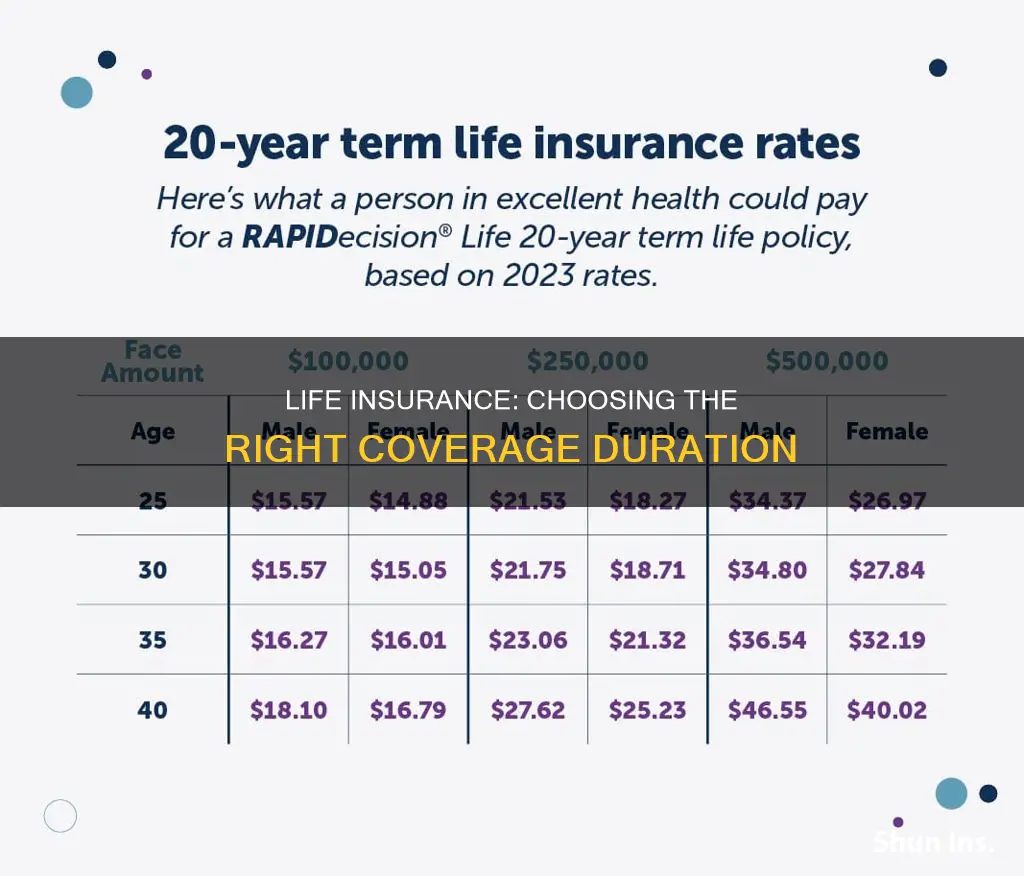

Term life insurance is generally the most affordable type of life insurance, with costs depending on factors such as age, health, and gender. Younger, healthier individuals tend to qualify for lower premiums.

Term life insurance is sufficient for most families, offering temporary coverage for a specific period. On the other hand, whole life insurance is more expensive and offers lifelong coverage, building cash value over time. Whole life insurance may be a better option if you can comfortably afford the higher premiums, want coverage for your entire life, or have lifelong dependents, such as children with special needs.

Life Insurance: Debt Relief and Financial Security

You may want to see also

How to calculate how much life insurance you need

When you're buying term life insurance, you have two main decisions to make: how much life insurance to buy and how long the coverage should last. You want the policy to continue until your last major obligation is taken care of. So, the duration of your financial commitments will generally determine how long your term life insurance policy should be.

Add up your financial obligations

To calculate how much life insurance you need, think about your financial obligations now and in the future. Then, aim to take out a policy to match them.

Add up any long-term debts like a mortgage or college fees.

Multiply your annual income by the number of years you want your beneficiaries to be covered after you die.

Subtract your assets

From that total, subtract liquid assets, such as savings, as well as existing college funds and current life insurance policies. The number you’re left with is the amount of life insurance you need.

Consider additional riders

With most companies, you can customize your term policy with life insurance riders for a fee. These provide additional coverage you wouldn’t get otherwise. For example, an accelerated death benefit rider allows you to tap into your policy’s payout if you get sick, and a waiver of premium rider pauses your premiums if you become disabled or unemployed and can’t earn an income for a period of time.

Get prices from a handful of companies

The cost of coverage varies among companies, so aim to compare life insurance quotes from multiple insurers. Ideally, you want to choose a company with a strong financial strength rating – this indicates its ability to pay claims far into the future. You can check the financial strength rating of each term life insurance company you’re considering through a rating firm such as AM Best. NerdWallet typically recommends considering insurers with ratings of A- or higher. All of the largest life insurance companies have solid financial strength ratings.

Think about term length

When calculating coverage, think about how long you want your term policy to last. For example, if you need life insurance to cover your income until your kids go to college, you may need a 20-year policy. Alternatively, if you want to cover your mortgage, you may need a 30-year term policy.

Whole Life Insurance: A Child's Smart Investment Strategy?

You may want to see also

The pros and cons of term life insurance vs. whole life insurance

When deciding how long your term life insurance should last, it's important to consider your financial commitments and obligations. The duration of your term life insurance should generally match the length of your financial responsibilities, such as your mortgage or children's education. Here are some factors to help you determine how long your term life insurance should last:

- The length of your mortgage: Your mortgage is a significant financial commitment, and it's often a primary reason for purchasing life insurance. Consider how many years you have left on your mortgage payments.

- Dependent children: If you have children who depend on your financial support, you may want a term life insurance policy that lasts until they become financially independent. This could be longer than just their childhood years, especially if you plan to support their college education.

- Retirement plans: If you're buying term life insurance to replace your income, you may not need it after retirement. Consider when you plan to retire and whether you'll have sufficient savings to support yourself.

Now, let's explore the pros and cons of term life insurance versus whole life insurance:

Term Life Insurance Pros:

- Affordability: Term life insurance is typically much cheaper than whole life insurance because it's temporary and doesn't build cash value.

- Customizable: You can choose the term length that suits your unique situation, which can help reduce costs in the long run.

- Simplicity: Term life insurance is straightforward without the added complexity of investment components.

Term Life Insurance Cons:

- Limited duration: Term life insurance only covers you for a set number of years. If you outlive the term, your coverage ends, and you won't receive any benefits.

- No cash value: Term life insurance doesn't accumulate cash value like an investment account, so it can't be used for wealth-building or tax planning strategies.

Whole Life Insurance Pros:

- Lifetime coverage: Whole life insurance provides coverage for your entire life, as long as you keep up with premium payments.

- Guaranteed premiums: The premiums for whole life insurance remain the same throughout the policy, giving you predictability.

- Cash value growth: Whole life insurance has a cash value component that grows at a guaranteed rate, allowing you to borrow against it or withdraw funds.

Whole Life Insurance Cons:

- Higher cost: Whole life insurance is significantly more expensive than term life insurance due to its lifelong coverage and cash value component.

- Complexity: Whole life insurance is more complex than term life, with additional features like cash value accumulation and dividends.

- Limited flexibility: Whole life insurance doesn't offer the flexibility to choose the length of the policy.

Whole Life Insurance Dividends: Annual or Monthly Payouts?

You may want to see also

How to choose the right term length

When choosing the right term length for your life insurance, there are a few key factors to consider:

The length of your mortgage

Your mortgage is likely one of your biggest financial commitments, so you'll want to ensure that your life insurance coverage lasts as long as you have mortgage payments. Consider how many years you have left on your mortgage and choose a term length that will cover this period.

How long until your children are financially independent

If you have children, you'll want to ensure they are provided for financially until they can support themselves. Consider how many years it will be until your children finish their education and are able to earn an income. Choose a term length that will cover this period.

Your retirement plans

If you are planning to retire in the future, you may not need life insurance coverage after this point as you will no longer have the same financial commitments or dependents. Consider your planned retirement age and choose a term length that covers you until this point.

Any other long-term financial commitments

In addition to your mortgage, you may have other long-term financial commitments, such as college fees or business loans. Make sure your term length covers the duration of these commitments.

Your health and lifestyle

Your health and lifestyle can impact the cost of your life insurance premiums. If you are in good health and don't have any dangerous hobbies, you may be able to get a better rate on your premiums. Consider your current health and lifestyle when choosing a term length, as your circumstances may change over time.

Remember, it's better to round up your term length than to have your coverage end before your financial commitments are met. You can also consider buying multiple life insurance policies with different term lengths to cover specific financial obligations.

Sun Life Insurance: Cataract Surgery Coverage Explained

You may want to see also

How to choose between term and permanent life insurance

Term life insurance and permanent life insurance are two types of life insurance policies that offer financial protection for your loved ones in case you pass away. The main differences between the two are the length of coverage, the features and benefits offered, and the structure of the premiums (your payments).

Term Life Insurance

Term life insurance provides temporary protection for a set period, such as 10, 20, or 30 years. It is typically the most affordable option and is ideal for those who:

- Only want coverage for a specific period.

- Are looking for the most affordable coverage, especially if they are young and healthy.

- May want permanent life insurance in the future but cannot afford it at the moment.

- Do not want to use life insurance to accumulate cash value and would rather invest their money elsewhere.

Term life insurance is often sufficient for those who have others depending on them financially for a known period, such as new parents or those with a mortgage.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides long-term or lifelong coverage. As long as you continue to pay the premiums, your coverage will remain in place. Permanent life insurance is generally more expensive than term life insurance due to its longer coverage period and the ability to build cash value. This type of insurance may be suitable for those who:

- Need long-term financial protection.

- Want to create an inheritance for their heirs.

- Are looking for a tax-advantaged way to save for future expenses.

- Prefer stable premiums, which are available with whole life insurance.

When deciding between term and permanent life insurance, it is important to consider your unique needs and circumstances. Term life insurance is ideal for short-term financial obligations, while permanent life insurance offers lifelong coverage and additional benefits such as the ability to build cash value.

Life Insurance: Is AARP Coverage Worth the Cost?

You may want to see also

Frequently asked questions

Term life insurance policies often last for 10, 20 or 30 years, but some insurers offer policies in one- and five-year increments.

Term life insurance is cheaper and covers you for a set period of time, while whole life insurance usually costs more but can last your entire life. Whole life insurance can also build cash value that you can borrow against, which makes it a more complex and expensive product.

Most term life insurance policies are temporary, which means your coverage expires once your term is up. If you still need life insurance, you can purchase a new policy, though you can expect to pay higher rates.

No, term life insurance doesn’t have a cash value. If you want a policy that builds value over time, look into permanent life insurance.

In general, you should add up your long-term financial obligations, such as mortgage payments or college fees, and then subtract your assets. The remainder is the gap that life insurance will have to fill.