Term life insurance is the simplest form of life insurance. It provides a death benefit that's paid to your beneficiary or beneficiaries if you pass away during the policy term. It's called term insurance because it only covers you for a set period of time, typically between 10 and 30 years. If you die during that time, your beneficiaries will receive a payout, but if you outlive the policy, it expires, and your beneficiaries won't receive anything. Term life insurance is generally the most affordable type of life insurance, but it doesn't offer any cash value or investment opportunities.

| Characteristics | Values |

|---|---|

| Length of protection | Term life insurance provides temporary protection that lasts for a set period of time (the term). Whole life insurance, on the other hand, is designed to provide long-term, often lifelong coverage as long as premiums are paid. |

| Benefits | Term life insurance offers short-term death benefit protection, and beneficiaries receive a lump-sum death benefit if the policyholder passes away during this time. Whole life insurance offers long-term death benefit protection and the opportunity to build cash value, which can be used to pay for unexpected emergencies or milestone events. |

| Cost | Term life insurance is cheaper and more cost-effective than whole life insurance, which tends to be more expensive due to its lifelong coverage and cash value component. |

| Policy length | Term life insurance policies typically have a set time period such as 10, 20, or 30 years. Whole life insurance usually covers until a specific age, such as 90, 100, or 120 years old. |

| Cash value | Term life insurance has no cash value and cannot be borrowed against or cashed out. Whole life insurance has a cash value component that accumulates at a guaranteed rate, allowing policyholders to borrow against or withdraw from it. |

| Premium stability | Term life insurance offers level premiums that remain the same throughout the policy term. Whole life insurance premiums also remain level and do not change throughout the policyholder's life. |

| Dividends | Term life insurance does not offer dividend payments. Whole life insurance policies may offer dividends based on the company's financial performance, which policyholders can use to boost their cash value or reduce premiums. |

| Death benefit | Term life insurance offers a guaranteed death benefit that remains level throughout the policy term. Whole life insurance also offers a guaranteed death benefit, but it may be reduced if the policyholder withdraws money from the accumulated cash value. |

What You'll Learn

Term life insurance is the simplest form of life insurance

Here's how it works: you pay a premium for a specific term, typically between 10 and 30 years. If you die during that time, a death benefit is paid to your family or anyone else you name as your beneficiary. The death benefit is usually income tax-free.

Term life insurance is a good option if you only need coverage for a specific period, such as while you have minor children or other dependents. It is also a good choice if you are on a budget, as the premiums are much lower than for other types of life insurance.

However, term life insurance does not offer lifelong protection. If you outlive the term of the policy, your beneficiaries will not receive any money. Additionally, term life insurance does not accumulate any cash value, so it cannot be used as a wealth-building or tax-planning strategy.

In contrast, whole life insurance is a form of permanent life insurance that lasts as long as you live, provided you pay the premiums. It also includes a cash value account that grows tax-free over time and can be withdrawn or borrowed against while you are alive. Whole life insurance is more complex and significantly more expensive than term life insurance, but it offers lifelong protection and the opportunity to build cash value.

When deciding between term and whole life insurance, it's important to consider your financial goals, budget, and the duration of coverage needed. Term life insurance is typically sufficient for most people, while whole life insurance may be preferable for those who want lifelong coverage, have complex financial needs, or want to use life insurance as a tax-efficient savings vehicle.

Annuities and Taxes: What You Need to Know

You may want to see also

Term life insurance is more cost-effective than whole life insurance

Term life insurance is often considered more cost-effective than whole life insurance because it offers basic coverage for a finite duration, making it the cheapest type of life insurance. Here are some reasons why term life insurance is more cost-effective:

Lower Costs and Premiums

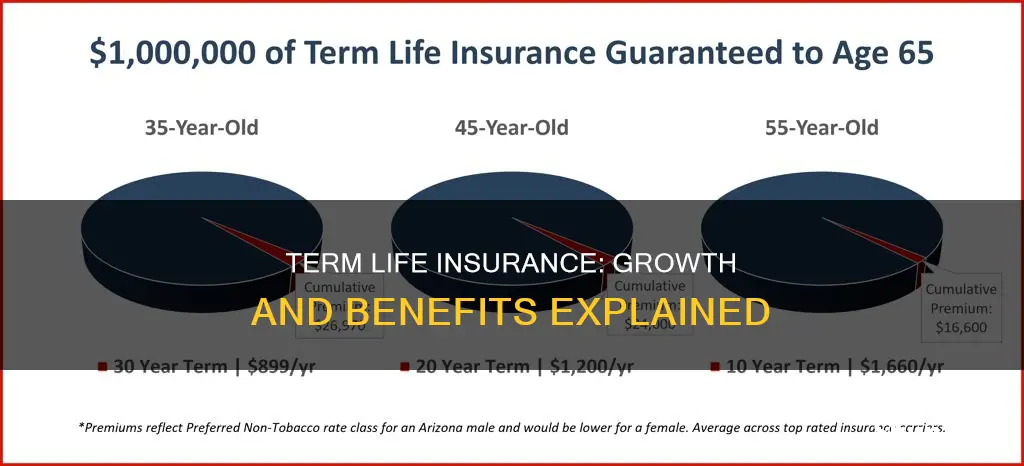

Term life insurance provides coverage for a specific period, such as 10, 15, 20, or 30 years. During this term, the premiums remain level and locked-in, ensuring that the policyholder pays the same amount throughout the coverage period. Term life insurance is significantly more affordable than whole life insurance, sometimes up to 17 times less expensive for the same death benefit. This affordability makes it an attractive option for those on a budget or seeking short-term coverage.

Simplicity and Straightforwardness

Term life insurance is often referred to as the simplest and purest form of life insurance. It is easy to understand as it is straightforward insurance without a savings or investment component. There is no cash value accumulation, making it a straightforward transaction where the policyholder pays premiums for a specified term, and their beneficiaries receive a death benefit if the insured passes away during that term.

Flexibility

Term life insurance offers flexibility in terms of coverage length and premiums. Policyholders can choose a term length that suits their needs, typically ranging from 10 to 30 years. Additionally, term life insurance allows for the option of converting the policy to whole life insurance later on without requiring an additional medical exam. This flexibility provides policyholders with the ability to adjust their coverage as their circumstances change.

Peace of Mind

While term life insurance may not offer lifelong coverage, it provides peace of mind during critical periods, such as when raising children or paying off a mortgage. It ensures that your loved ones will receive financial support if something happens to you during the specified term.

Suitability for Different Life Stages

Term life insurance is particularly beneficial for individuals who are just starting out or on a budget. It offers affordable coverage during the early stages of life when budgets may be tighter. As your financial situation improves and your family becomes more financially independent, you may not need as much coverage, making term life insurance a cost-effective choice.

In summary, term life insurance is more cost-effective than whole life insurance due to its lower premiums, simplicity, flexibility, and ability to provide peace of mind during critical life stages. It is an excellent option for those seeking affordable coverage for a specified term without the complexities of cash value accumulation.

Understanding Life Insurance Dividends and Their Tax Implications

You may want to see also

Term life insurance does not offer cash value

Term life insurance is a simple and inexpensive form of life insurance. It offers fixed monthly premiums for a set period of time, typically between 10 and 30 years, and predictable coverage in case of death. However, term life insurance does not offer cash value. Unlike permanent life insurance policies, which accumulate cash value over time, term life insurance does not accrue any cash value and does not provide a payout after the term expires. This means that if the policyholder outlives the policy, they will not receive any payout.

Term life insurance policies have no cash value because they lack investment or savings components. The premiums are lower compared to permanent life insurance policies, but there are no opportunities to build cash value within the policy. Permanent life insurance policies, such as whole life, variable, and universal life insurance, on the other hand, operate like investment accounts and can accumulate cash value over time. Policyholders can borrow money against these policies to pay for expenses such as mortgage payments.

While term life insurance does not have a cash surrender value, there are still options for generating cash from the policy. Policyholders can sell their term life insurance policy for cash or a combination of cash and coverage with no future premiums. The value of the policy on the secondary market will depend on factors such as the specific terms of the policy, the age and health of the insured, and the willingness of the provider to invest in the policy.

In summary, term life insurance is a straightforward insurance product that provides coverage for a fixed period without accruing any cash value. It is important for policyholders to understand the limitations of term life insurance and explore their options if they are seeking to generate cash value from their insurance policy.

Life Insurance Proceeds: Form 3520 Requirements

You may want to see also

Term life insurance is a good option for those who need short-term coverage

One of the main advantages of term life insurance is its affordability. Since it only offers coverage for a set period, it is significantly cheaper than whole life insurance. This makes it a good option for those on a budget or those who cannot afford the high premiums of whole life insurance. Term life insurance is also straightforward and easy to understand, as it only provides insurance without any savings or investment components.

Term life insurance can be particularly beneficial for young people with children. It enables them to obtain substantial coverage at a low cost, ensuring their family is taken care of in the event of their untimely death. Additionally, term life insurance offers flexibility, allowing individuals to choose the duration of coverage that suits their needs. It can also be renewed at the end of the term, although the premiums will increase.

However, it is important to note that term life insurance does not offer any cash value or savings component. It solely provides a death benefit, and if the insured outlives the policy term, there is no payout. Term life insurance is suitable for those seeking short-term coverage but may not be ideal for those looking for long-term financial protection or wealth accumulation.

Life Insurance Expiry: What You Need to Know

You may want to see also

Whole life insurance offers lifelong coverage

Whole life insurance policies are one of several types of permanent life insurance, with universal life, indexed universal life, and variable universal life being the others. Whole life insurance is similar to term life insurance in that both types of policies offer a payout upon the death of the insured. However, whole life insurance offers a guaranteed death benefit for the entire lifetime of the insured, whereas a term policy only pays out if the insured dies within a certain time frame, usually 10, 20, or 30 years.

Whole life insurance has several advantages, including lifelong coverage, a cash value that can be used for loans or withdrawals, a guaranteed death benefit amount, and predictable premium payments. However, there are also some disadvantages, such as higher costs compared to term life insurance, slower cash value growth than other policies, and limited ability to adjust the death benefit.

The cost of whole life insurance varies depending on factors such as age, occupation, and health history. Older applicants typically have higher rates, and people with a history of health issues normally receive higher rates than those in good health. The face amount of coverage also determines the premium, with higher coverage resulting in a higher premium.

Life Insurance Wealth: Maximizing Payouts, Securing Your Future

You may want to see also

Frequently asked questions

Term life insurance is a simple form of life insurance where you pay a premium for a specific period, typically between 10 and 30 years. If you pass away during that time, a death benefit is paid to your beneficiaries. It is more cost-effective than permanent whole life insurance but does not offer lifelong coverage or accumulate cash value.

Term life insurance provides coverage for a set period, while whole life insurance offers lifelong protection as long as premiums are paid. Whole life insurance also includes a cash value component that grows over time, which can be borrowed against or withdrawn. However, whole life insurance premiums are typically much higher than term life insurance.

Term life insurance is more affordable and offers flexible coverage options, such as choosing the length of the term. It also provides the option to convert to a whole life policy later on. Additionally, there is no penalty for cancellation, and you can choose the coverage amount and period to fit your budget.

Term life insurance only provides coverage for a limited period, and there is no accumulation of cash value. The coverage term may not be sufficient for lifelong dependents or end-of-life planning. Renewing the policy after the term ends can also result in higher premiums.

Term life insurance is suitable when you need coverage for a specific period, such as when you have young children or want more affordable coverage. It is also a good option if you are not concerned about accumulating cash value and prefer the flexibility of choosing different coverage periods.