Life insurance is designed to pay out a death benefit to the person or persons you name as beneficiaries when you pass away. In exchange for this coverage, you pay a premium to the life insurance company. There are different types of life insurance policies available, such as term life insurance and permanent life insurance, and the premium rates vary depending on the type of policy chosen. Term life insurance is a straightforward and affordable option for many people, with premiums that remain level throughout the policy term. However, when the term ends and the policy is up for renewal, the premiums can increase due to factors such as age and health status changes. On the other hand, permanent life insurance policies often have premiums that increase annually as the insured person ages. Understanding the different types of life insurance policies and their associated costs is crucial for individuals seeking to provide financial protection for their loved ones.

| Characteristics | Values |

|---|---|

| Type of insurance | Term life insurance |

| Premium changes during the term | No |

| Premium changes after the term | Yes |

| Premium changes due to age | Yes |

| Premium changes due to health status | Yes |

| Premium changes due to lifestyle factors | Yes |

| Premium changes due to inflation | No, but inflation can affect future premiums |

| Premium changes due to occupation | Yes |

What You'll Learn

- Age: The older you get, the higher the risk for the insurance company

- Health: The likelihood of premiums increasing is significant if your health deteriorates over time

- Lifestyle: Lifestyle changes, such as taking up smoking, can impact your premiums

- Policy type: Term life insurance policies have level premiums, while permanent life insurance policies may have premiums that rise annually

- Coverage amount: The more coverage you need, the more you'll likely have to pay

Age: The older you get, the higher the risk for the insurance company

Age is one of the most important factors that determine life insurance premium rates. The older you get, the higher the risk for the insurance company, and this heightened risk translates into higher premium rates. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of the policyholder dying while the policy is in force. The older you are, the more likely you are to become ill or die while under coverage, and so the insurance company incurs a higher risk.

The premium amount increases, on average, about 8% to 10% for every year of age; it can be as low as 5% annually if you're in your 40s, and as high as 12% annually if you're over 50. For example, a 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

The older you are when you purchase a policy, the more expensive the premiums will be. This is why it's more cost-effective to buy a policy when you are younger. For example, if you take out a policy at 30, your premiums will be lower than those who start their policy at 50. The increased age signifies a higher risk for the insurer, which is why premiums rise with age.

The annual premium, or "rate," for a term life insurance policy is determined at the time of purchase and set for the duration of the policy. Once the term of your current policy expires, you could face very steep rates based on your age. If the insured outlives the initial term, the insurance carrier must adjust the premium to reflect their new age.

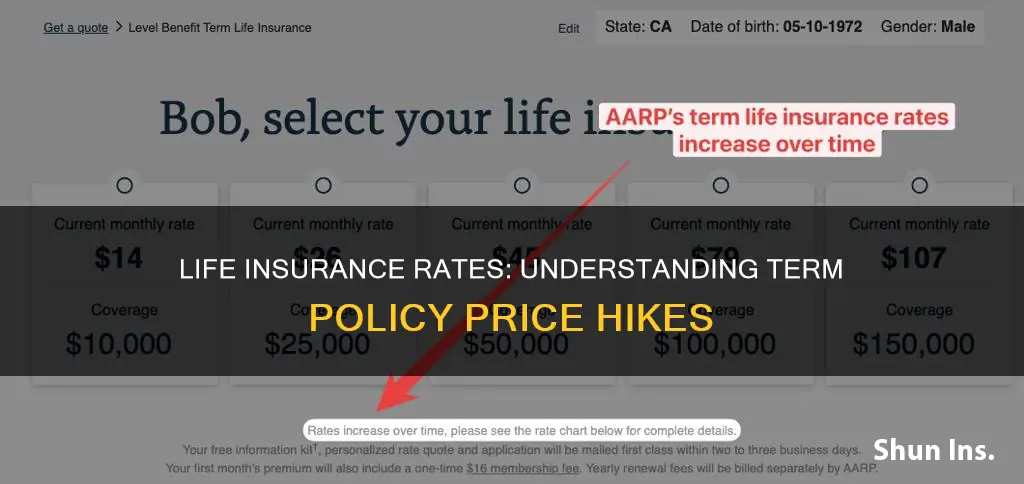

Term life insurance policies typically offer lower premium rates compared to permanent life insurance. With term life insurance, your premium is established when you buy a policy and remains the same every year. With some permanent life insurance policies, the premium rises annually.

Age also affects whether a person will qualify for life insurance coverage at all, with qualifying medical exams getting increasingly stringent. Most carriers only offer 20-year term policies to those ages 18 to 70. After that, you cannot get a term that lengthy.

Life Insurance: Don't Be Dave, Be Smart!

You may want to see also

Health: The likelihood of premiums increasing is significant if your health deteriorates over time

Health is a significant factor in determining life insurance premiums. When you apply for life insurance, you will be placed in a health class that will influence your monthly premium and financial obligation. The health class is determined by your health history, including any pre-existing conditions, and your family's health history. The healthier you are, the lower your premiums will be.

If your health deteriorates over time, the likelihood of your premiums increasing is significant. This is because insurance companies view individuals with deteriorating health as a higher risk. Pre-existing conditions, such as diabetes, heart disease, or obesity, may result in higher rates as individuals with these conditions may not live as long as healthy individuals. Additionally, insurance companies use rating tiers to determine health risks, and those with moderate to severe medical issues will fall into higher-risk categories, resulting in higher premiums.

It is important to note that being transparent when applying for life insurance is crucial. Lying on a life insurance application or omitting relevant information can result in the denial of an application or non-payment of death benefits to beneficiaries. Therefore, it is always best to be honest about your health status and any lifestyle choices that may impact your health.

Furthermore, as you age, the likelihood of developing health issues increases, which can also contribute to higher premiums. Age is a significant factor in determining life insurance rates, as older individuals are closer to their life expectancy and pose a higher risk to insurance companies. Thus, if your health deteriorates as you age, you may experience a significant increase in your premiums.

To mitigate the impact of health deterioration on your life insurance premiums, it is advisable to purchase life insurance while you are young and healthy. This way, you can lock in lower rates for the duration of your policy. Additionally, improving your health through lifestyle changes, such as quitting smoking or losing weight, can help lower your insurance risk classification and, consequently, your premiums.

Life Insurance: Does Your Weight Matter?

You may want to see also

Lifestyle: Lifestyle changes, such as taking up smoking, can impact your premiums

Lifestyle choices can have a significant impact on life insurance premiums. When applying for life insurance, you will be asked about your lifestyle, including any risky behaviours such as smoking. Smoking is a good example of a lifestyle choice that can affect your premiums. If you are a smoker, you will likely be placed in a higher risk class, which will result in higher premiums. This is because smoking is associated with an increased risk of various health issues, including cancer, heart disease, and respiratory problems.

Other lifestyle factors that can influence your premiums include your occupation and hobbies. Certain occupations, such as construction work, are considered more dangerous and may result in higher premiums. Similarly, participating in high-risk activities such as skydiving, rock climbing, or racing can also increase your premiums. These activities are seen as increasing the likelihood of an insurance claim, and so insurers will charge more to offset this risk.

It is important to be transparent when applying for life insurance and disclose any relevant lifestyle information. Failing to do so may result in your application being denied or your beneficiaries not receiving the full death benefits.

Additionally, making positive lifestyle changes can help lower your premiums. For example, quitting smoking, losing weight, or switching to a less dangerous hobby can improve your insurance risk classification and result in lower premiums. Insurers may also offer lower rates to individuals who maintain a healthy weight, eat a nutritious diet, and engage in regular exercise.

Overall, lifestyle choices can have a significant impact on your life insurance premiums. It is essential to carefully consider your lifestyle and make any necessary changes to ensure you are getting the best possible rates.

Life Insurance and Experimental Vaccines: What's Covered?

You may want to see also

Policy type: Term life insurance policies have level premiums, while permanent life insurance policies may have premiums that rise annually

Term life insurance and permanent life insurance are the two basic types of life insurance policies. Term life insurance is the simplest form of life insurance. It pays out only if death occurs during the term of the policy, which is usually from one to 30 years. Permanent life insurance, on the other hand, provides lifetime protection as long as the policy remains active.

Term life insurance policies are often level term policies, meaning the premium remains the same throughout the policy term. However, when the term ends and the policyholder decides to renew or take out a new policy, the premiums can increase due to factors such as age and health status changes. The level term premium is determined by factors such as age, health, term length, and coverage amount. While the premium remains level, the death benefit also remains the same.

Permanent life insurance policies, such as whole life insurance, universal life insurance, and variable universal life insurance, often have premiums that do not increase over time as long as the required premiums are paid on schedule. However, permanent life insurance policies generally accrue cash value that can be accessed by the policyholder, and this cash value component is absent in term life insurance policies.

The main differences between term and permanent life insurance policies are the duration of the policy, the accumulation of cash value, and the cost. Term life insurance policies are ideal for people who want substantial coverage at a low cost, while permanent life insurance policies offer lifelong coverage at a higher premium.

Understanding Tax Implications of Group Term Life Insurance Proceeds

You may want to see also

Coverage amount: The more coverage you need, the more you'll likely have to pay

When it comes to term life insurance, the amount of coverage you need plays a significant role in determining the cost you will incur. The simple principle here is that the more coverage you require, the more you will likely have to pay for your insurance policy.

The amount of coverage you opt for is influenced by various factors, including your age, income, debts, and future plans. For instance, if you have a 30-year fixed mortgage, you might consider a 30-year term life insurance policy to match. Similarly, if you are 10 years away from retirement, a 10-year term policy might be a more suitable option. By aligning the term length with your financial responsibilities, you can ensure that your loved ones are protected during these critical periods.

The impact of coverage amount on cost is particularly evident when comparing term life insurance with permanent life insurance. Permanent life insurance policies, such as whole life insurance, offer lifelong coverage and often include a cash accumulation feature. However, due to the extended coverage duration and additional benefits, permanent policies are generally significantly more expensive than term life policies. As a result, term life insurance is often seen as a more affordable option for those seeking coverage for longer periods.

When deciding on the coverage amount, it is essential to consider not only your current income but also any unpaid labour you contribute to the household. For example, if you provide childcare or other caretaking responsibilities, you should ensure that you have sufficient coverage to compensate for these essential tasks in the event of your absence. This comprehensive view of your contributions will help ensure that your loved ones receive the financial protection they need.

Additionally, it is worth noting that while term life insurance premiums generally remain level throughout the policy term, they can increase upon renewal or when taking out a new policy due to factors such as age and health status changes. Therefore, it is beneficial to purchase the right amount of coverage when initially obtaining life insurance to secure a lower rate while you are young and healthy.

Term Rider: Life Insurance's Essential Add-On

You may want to see also

Frequently asked questions

Yes, term life insurance rates increase with age. The older you are when you purchase a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force.

Yes, your health status is another crucial factor that insurance companies consider. If your health deteriorates over time, the likelihood of your premiums increasing is significant.

Yes, lifestyle changes, such as taking up smoking, can also impact your premiums. If you start smoking after purchasing your policy, the insurance company might re-evaluate and increase your premiums to reflect the added risk.

No, term life insurance rates do not increase every year. With term life insurance, your premium is established when you buy a policy and remains the same every year.

Yes, when the term ends and you decide to renew your policy, the premiums can increase due to factors such as age and health status changes.