When applying for a driver's license, many individuals wonder if they need to provide proof of insurance during the exam process. This question is particularly relevant for those who are new to driving or are renewing their license. The requirement for insurance varies depending on the region and local regulations. In some areas, having valid insurance coverage is mandatory for all drivers, and this information is often requested during the licensing exam to ensure that applicants meet the necessary safety and financial responsibility standards. Understanding the specific insurance requirements in your area is essential to avoid any delays or complications when obtaining your driver's license.

What You'll Learn

- Insurance Awareness: Candidates must understand the importance of insurance during driving exams

- Policy Requirements: Knowledge of insurance policy details is crucial for passing the exam

- Coverage Basics: Exam covers basic insurance coverage types and their significance

- Financial Responsibility: Understanding financial liability and insurance's role in accident coverage

- Exam Procedures: The exam process includes insurance verification and documentation

Insurance Awareness: Candidates must understand the importance of insurance during driving exams

When it comes to obtaining a driver's license, many candidates often overlook the significance of insurance, which is an essential aspect of responsible driving. During the driving exam process, it is crucial to understand the role of insurance and its implications. Insurance is not merely a formality but a vital component of road safety and legal compliance.

The primary purpose of insurance is to provide financial protection and peace of mind to drivers. In the event of an accident, insurance coverage ensures that individuals are not burdened with excessive financial liabilities. It covers medical expenses, vehicle repairs, and other associated costs, reducing the financial impact on both the driver and the insurance company. This aspect becomes particularly important during driving exams, as it demonstrates a candidate's awareness of the potential risks and their commitment to responsible driving.

During the exam, candidates should be prepared to answer questions regarding insurance coverage and its relevance. Exam instructors may inquire about the types of insurance required for driving, such as liability coverage, which protects against bodily injury and property damage to others. Understanding the different insurance options and their benefits is essential to passing the exam and becoming a responsible driver. Moreover, it showcases a candidate's ability to make informed decisions and consider the well-being of others on the road.

In some regions, insurance companies and driving schools collaborate to educate candidates about insurance requirements and benefits. This partnership ensures that aspiring drivers are well-informed about their insurance options and the importance of maintaining valid coverage. By providing this information, candidates can make the necessary arrangements before their exam, ensuring a smooth and stress-free process.

In summary, insurance awareness is a critical aspect of the driving exam process. Candidates must recognize that insurance is not just a requirement but a vital tool for financial protection and road safety. Understanding the different insurance options and their significance empowers individuals to make responsible choices, ensuring a safer driving experience for themselves and others. Being prepared and knowledgeable about insurance during the exam demonstrates a candidate's commitment to being a responsible and aware driver.

Safeco's Gap Insurance: What You Need to Know

You may want to see also

Policy Requirements: Knowledge of insurance policy details is crucial for passing the exam

Understanding the intricacies of insurance policies is an essential aspect of becoming a responsible driver, and this knowledge becomes even more critical when preparing for a driver's exam. The exam often includes questions related to insurance coverage, requirements, and the legal obligations of drivers. Here's why a comprehensive understanding of insurance policy details is crucial for success:

The driver's exam typically covers various topics, and insurance is a significant part of the curriculum. It is essential to know the different types of insurance coverage available, such as liability, collision, comprehensive, and personal injury protection. Each policy type has specific provisions and limitations, and candidates must be able to explain these to demonstrate their understanding. For instance, liability insurance covers damages and injuries caused to others, while collision insurance is for vehicle repairs after accidents.

During the exam, you might be asked to identify the appropriate insurance coverage for a given scenario. This requires a deep understanding of policy terms and conditions. For example, a question could present a hypothetical situation where a driver is involved in an accident and needs to know the extent of their coverage, including any limitations or exclusions. Being able to analyze and interpret insurance policies is a key skill that will help you navigate real-life driving situations.

Furthermore, the exam may assess your knowledge of insurance regulations and legal requirements. Drivers must be aware of the mandatory insurance coverage laws in their region. This includes understanding the minimum liability coverage required by law and the consequences of driving without insurance. Exam questions might test your ability to explain these regulations and their implications, ensuring that you are well-prepared for the practical aspects of driving.

In summary, a solid grasp of insurance policy details is vital for passing the driver's exam. It equips you with the knowledge to make informed decisions regarding insurance coverage, understand your legal obligations, and provide accurate answers to exam questions. This preparation ensures that you are not only a safer driver but also a more confident and knowledgeable individual when it comes to insurance matters.

Vehicle Insurance: Extended Validity or Not?

You may want to see also

Coverage Basics: Exam covers basic insurance coverage types and their significance

The 'Coverage Basics' exam is an essential component of the driver's license process, as it ensures that new drivers understand the fundamental concepts of insurance and their importance on the road. This exam covers a range of topics, providing a solid foundation for drivers to navigate the complex world of insurance. Here's an overview of what you can expect:

Liability Insurance: This is often the first type of coverage that comes to mind when discussing driver's exams. Liability insurance is a legal requirement in most places and covers the driver's financial responsibility in the event of an accident. It typically includes bodily injury liability, which pays for injuries sustained by other drivers or passengers, and property damage liability, which covers damage to other people's vehicles or property. Understanding liability insurance is crucial, as it ensures that drivers can financially protect themselves and others in the event of a collision.

Collision and Comprehensive Coverage: While not always mandatory, these two types of insurance are essential for protecting your vehicle. Collision coverage pays for repairs or replacement of your car if it's damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-collision-related incidents like theft, vandalism, fire, or natural disasters. Exam takers should grasp the significance of these policies, especially for those who drive in areas prone to accidents or extreme weather conditions.

Medical Payments or Personal Injury Protection (PIP): This coverage is designed to pay for medical expenses incurred by the driver and their passengers after an accident, regardless of who is at fault. PIP ensures that medical bills and related costs are covered, providing financial relief during a challenging time. Understanding this aspect of insurance is vital, as it highlights the importance of having adequate coverage to manage potential healthcare costs.

The exam likely emphasizes the importance of these basic insurance types, ensuring that new drivers are aware of their responsibilities and the potential consequences of driving without proper coverage. It serves as a reminder that insurance is not just about protecting others but also about safeguarding oneself and one's assets. By covering these fundamental concepts, the exam equips drivers with the knowledge to make informed decisions regarding their insurance needs and to drive with a sense of security and responsibility.

Do You Have Auto Insurance? How to Verify Your Coverage

You may want to see also

Financial Responsibility: Understanding financial liability and insurance's role in accident coverage

When it comes to obtaining a driver's license, financial responsibility is a crucial aspect that often goes unnoticed until it's too late. Understanding your financial liability and the role of insurance in accident coverage is essential for all drivers, especially those who are new to the road. This knowledge can help prevent financial disasters and ensure that you are prepared for any unforeseen circumstances while driving.

During the driver's exam process, it is common for authorities to assess your understanding of financial responsibility. This is done to ensure that you are aware of the potential consequences of driving without proper coverage. Insurance is not just a legal requirement but also a vital tool to protect yourself and others on the road. When you purchase insurance, you are essentially creating a safety net that covers potential damages and liabilities in the event of an accident. This coverage can include property damage, bodily injury, and even legal fees, providing a comprehensive shield against financial ruin.

The exam may involve questions about the different types of insurance coverage available. For instance, you might be asked to differentiate between collision, comprehensive, and liability insurance. Collision coverage pays for damages to your vehicle in case of a collision, while comprehensive insurance covers non-collision-related incidents like theft, vandalism, or natural disasters. Liability insurance, on the other hand, is mandatory and covers the costs of injuries or damages you cause to others. Understanding these coverage types is key to making informed decisions when selecting insurance policies.

Additionally, the exam could test your knowledge of financial liability. This includes recognizing the importance of having sufficient coverage to meet your state's minimum requirements. In the event of an accident, your insurance company will step in to cover the damages up to the policy's limits. However, if your coverage is insufficient, you may be held financially responsible for any remaining costs, which can be devastating. Therefore, it is crucial to assess your financial situation and choose insurance plans that provide adequate protection.

In summary, financial responsibility is an integral part of the driver's exam process, and it should not be overlooked. By understanding your financial liability and the various insurance coverage options, you can make informed choices to protect yourself and your assets. Remember, insurance is not just a legal obligation but a powerful tool to ensure financial security while on the road. Being prepared and knowledgeable about these aspects will contribute to a safer and more responsible driving experience.

Understanding Medical Qualification Criteria for Auto Insurance

You may want to see also

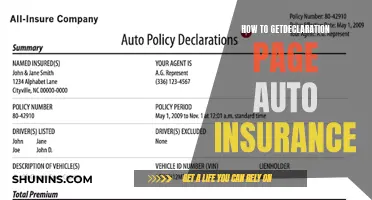

Exam Procedures: The exam process includes insurance verification and documentation

The process of obtaining a driver's license involves several steps, and one crucial aspect is the verification of insurance coverage. This is an essential requirement to ensure that all drivers are adequately protected and meet the legal standards set by the relevant authorities. During the exam, examiners will carefully review the candidate's insurance documentation to confirm its validity and compliance with the necessary criteria.

When you arrive at the testing center, you will be required to provide proof of insurance. This typically involves presenting a valid insurance card or a document that clearly states your insurance coverage. The insurance information should include the name of the insurance company, your policy number, and the types of coverage you have. It is important to ensure that your insurance is up-to-date and covers the vehicle you will be driving during the exam.

The insurance verification process is a standard procedure to assess the candidate's responsibility and awareness of the legal requirements. By checking your insurance, the examiners can confirm that you have the necessary coverage to operate a vehicle legally. This includes liability insurance, which protects you and others in case of accidents, and may also involve additional coverage such as collision or comprehensive insurance, depending on your preferences and the vehicle being tested.

In some regions, the insurance verification process might vary slightly, but the overall goal remains the same. The examiners will ensure that your insurance meets the minimum requirements and is valid for the duration of the exam. It is essential to be prepared and have all the necessary documents readily available to avoid any delays or issues during the testing process.

Additionally, candidates should be aware that the insurance verification is not just a formality but also a safety measure. It ensures that drivers are financially responsible and can provide compensation in case of any accidents or damages. Therefore, having valid and adequate insurance coverage is a critical aspect of the driver's licensing process.

Auto Insurance: Colorado vs Montana, Who's Cheaper?

You may want to see also

Frequently asked questions

No, you typically do not need to provide proof of insurance at the time of your driver's exam. The exam focuses on assessing your driving skills, knowledge of road rules, and understanding of traffic signs. Insurance is usually a requirement after you've obtained your driver's license and started driving on the road.

Insurance coverage is not mandatory before the driving test. The primary purpose of the exam is to evaluate your driving abilities and readiness to operate a vehicle. Insurance companies often require proof of coverage after you've passed the test and started driving.

Not having insurance after passing the exam is generally not an issue during the testing process. However, it is essential to obtain insurance coverage as soon as possible after obtaining your license. Driving without insurance can lead to legal consequences and financial liabilities in case of accidents or damages.