Life insurance is a financial safety net for your loved ones after you pass away. It's a contract between the policyholder and the insurance company, which pays out a death benefit to the beneficiaries. The primary reason to have life insurance is to provide financial security for your beneficiaries, helping them maintain their standard of living, pay off debts, or cover future expenses. When it comes to receiving the insurance benefit, beneficiaries usually have a few options, including a lump-sum payout, annuity, or installment payments. Most insurance companies offer direct deposit/EFT for claim payments, ensuring the money goes directly into the beneficiary's bank account.

| Characteristics | Values |

|---|---|

| How to receive direct deposit | Set up direct deposit and receive benefits payments directly into your bank account |

| Who can receive direct deposit | Beneficiaries of the policy |

| Time taken to receive direct deposit | 30-60 days of the date of the claim |

What You'll Learn

Direct deposit is an option for receiving life insurance benefits

Direct deposit is one way to receive a lump-sum payout. With this option, the insurance company deposits the proceeds directly into the beneficiary's bank account. This can be a convenient way to receive the money, as it eliminates the need to wait for a check in the mail and then deposit the funds. Direct deposit can also provide faster access to the funds, which can be important for beneficiaries who need the money to pay bills or cover other immediate expenses.

Some insurance companies also offer the option of receiving the death benefit through an annuity. With this option, the insurance company pays the beneficiary a regular income stream over a set period, typically for the beneficiary's lifetime. This can be a good choice for beneficiaries who want the security of a reliable monthly income. However, the downside is that the income may not be enough to cover all expenses, and it may stop if the beneficiary dies.

Another option is to keep the death benefit with the insurance company and receive installment payments. The insurance company holds the money in an interest-bearing account and sends checks to the beneficiary based on an agreed-upon schedule. This option provides flexibility, as the beneficiary can increase or decrease the income stream as needed. However, unlike an annuity, installment payments will stop when the principal account balance is used up.

Ultimately, the best option depends on the beneficiary's financial situation and goals. Direct deposit can be a convenient and fast way to receive a lump-sum payout, while annuities and installment payments can provide a steady income stream. Beneficiaries should carefully consider their needs and preferences when choosing how to receive life insurance benefits.

SSDI and Life Insurance: Can You Have Both?

You may want to see also

Life insurance benefits can be paid in a lump sum

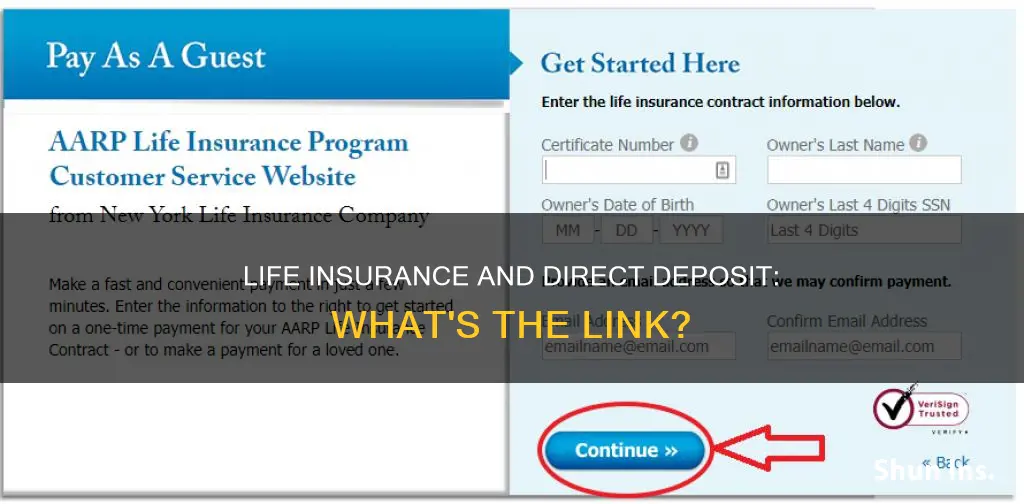

To set up direct deposit for life insurance benefits, you can usually download and fill out a form from your insurance company's website. This allows you to receive your benefits directly into your bank account.

Life Insurance and Blood Tests: What's Required?

You may want to see also

Annuity is another option for receiving life insurance benefits

Annuities are a type of insurance contract that turns your money into future income payments. You can buy an annuity with a lump sum or through multiple payments. You can set up an annuity with a growth period to build your savings. The return on your investment depends on the type of annuity you choose. For example, a fixed annuity pays a guaranteed interest rate, while a variable annuity lets you invest your savings in mutual funds.

When you're ready, you can start receiving income payments from the annuity. You can set these up over a fixed period or for the rest of your life. Annuities can be a form of insurance against outliving your savings.

You can set up a death benefit on an annuity contract, which will pay out your heir based on the contract terms and your balance. For example, if you bought an annuity for $500,000 and received $300,000 of income payments, the annuity death benefit might pay out the remaining $200,000 to your beneficiaries.

Life insurance is primarily used to pay your beneficiaries when you pass away. However, some life insurance policies let you build savings while you're alive, and you can receive these savings as an annuity. While most life insurance policies pay out the death benefit in a lump sum, some insurers offer beneficiaries the option to receive their payout as an annuity, or in payments over time.

Life insurance annuities, or installments, allow the unpaid death benefit to earn interest until it's fully paid out, providing a steady stream of income for the beneficiary. A longer timeframe for a life insurance annuity can result in more earned interest and a higher overall payout. However, beneficiaries should consult a tax professional, as the interest earned during the annuity period might be subject to income tax.

How to Get Life Insurance for Your Husband

You may want to see also

Installment payments are a third option

When a loved one passes away, the grieving process can lead you to make emotional rather than rational decisions. This is where the option of receiving life insurance payouts in installments can help.

With this option, the insurance company holds the money for you in an interest-bearing account and can send you cheques based on an instalment schedule that you decide. For example, you may request $5,000 a month. The insurance company will continue to send you instalment payments until the account runs out. This differs from an annuity, as an insurance company can guarantee annuity income for life, whereas instalment payments will stop when the principal account balance is used up.

The advantage of instalment payments is that you can increase or decrease the income stream depending on your needs. With an annuity, you are usually locked into a fixed payment. Instalment payments are a good option for those who are undecided about how to take a death benefit and need time to evaluate their options. The payments can help cover some of the immediate bills while you decide how to best use the larger amount of money.

A financial adviser can help you evaluate whether the interest rate on the interest-bearing account is competitive or whether a different strategy may produce more income.

Life Insurance After Divorce: What You Need to Know

You may want to see also

Life insurance benefits are usually paid within 30-60 days

Life insurance benefits are usually paid out within 30 to 60 days of the date of the claim. This is because insurance companies are motivated to pay as soon as possible after receiving proof of death, to avoid steep interest charges for delaying payment.

There is no set deadline for filing a life insurance claim, but it is recommended that beneficiaries file as soon as possible to initiate the payout process and avoid unnecessary delays. The sooner a claim is filed, the sooner the payout process can begin.

To file a claim, beneficiaries must submit the relevant documents, including the policy number, information about the deceased, a death certificate, and the original contract. They may also need to provide an obituary or other public notice of death. The insurance company will then review the claim and verify the cause of death and that all policy conditions have been met.

Most insurance companies now offer direct deposit/EFT for claim payments. This allows beneficiaries to receive their benefits directly into their bank account.

There are several factors that can delay the processing of life insurance claims and extend the time it takes to receive benefits. These include incomplete or inaccurate paperwork, the cause of death, and the contestability clause. If the insured dies within the first two years of the policy, the insurance company may contest the claim and review the medical records to ensure no misrepresentations were made on the application.

Probate Court and Life Insurance: What's the Connection?

You may want to see also