Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. There are several kinds of life insurance, including term and permanent plans. Thesection will discuss the different types of life insurance payouts and how they work.

When a policyholder passes away, it is up to the beneficiary to contact the insurance company and start the claims process. The beneficiary will need to provide a death certificate and any other necessary documentation to initiate the payout. The way the death benefit is distributed depends on how the policy was set up. The policyholder designates one or more beneficiaries, who will then receive the payout. The death benefit is typically paid out as a lump sum, though some policies may offer other options like installment payments or an annuity.

Lump-sum payments are the most common type of life insurance payout. The beneficiary receives the entire death benefit in one single payment, which is usually tax-free. This option provides the beneficiary with immediate access to the full amount, which can be crucial for covering significant expenses or debts. However, receiving such a large amount of money at once can be overwhelming, and the beneficiary is responsible for making it last.

Another option is installment payments, where the beneficiary receives the death benefit in installments over a fixed period or for their lifetime. This option provides a steady income stream, making financial planning easier. However, any interest earned on these payments may be taxable.

A third type of life insurance payout is a retained asset account, where the insurer holds the death benefit in an interest-bearing account and provides the beneficiary with a checkbook to draw funds as needed. This option offers flexibility and easy access to the funds, but the interest earned may be subject to taxes.

Overall, the type of life insurance payout that is best for an individual will depend on their unique circumstances and financial needs. It is important to understand the different options available to make an informed decision.

| Characteristics | Values |

|---|---|

| Types of life insurance payouts | Lump-sum payment, Installment payments, Retained asset account (RAA), Interest-only payout, Lifetime annuity, Fixed-period annuity |

| Life insurance payout process | Contact the insurance company, Submit a certified copy of the death certificate, Complete additional paperwork, Submit the claim |

| Life insurance payout time | 30 to 60 days |

| Life insurance payout delays | Policy purchase date, Suspected foul play, Fraud, Policyholder killed during illegal activity |

| Life insurance payout uses | Paying off a mortgage, Saving for college tuition, Paying down consumer debt, Saving for retirement, Creating an emergency fund |

| Life insurance payout taxes | Interest income, Goodman triangle, Estate tax |

What You'll Learn

- Lump-sum payments are the most common type of life insurance payout, where beneficiaries receive the entire death benefit at once

- Installment payments are also an option, where beneficiaries receive the death benefit in regular payments over a fixed period or for their lifetime

- Retained asset accounts allow beneficiaries to leave the payout with the insurance company in an interest-bearing account and access it using a checkbook

- Lifetime annuities provide guaranteed payments to the beneficiary for the rest of their life

- Fixed-period annuities pay out the death benefit over a specified period, such as 10 or 20 years

Lump-sum payments are the most common type of life insurance payout, where beneficiaries receive the entire death benefit at once

With a lump-sum payment, the beneficiary has immediate access to the full amount, which can be crucial in times of financial hardship. It is also usually tax-free, so beneficiaries receive the full amount without deductions. This is in contrast to other payout options, such as installment payments or annuities, where the interest earned may be subject to taxation.

Lump-sum payments are the default payout option for most policies. However, beneficiaries may have some flexibility in choosing how they receive the proceeds. For example, they could opt for a combination of options, such as receiving the interest on the death benefit until retirement and then taking the remainder as an annuity.

It's important to note that life insurance companies won't automatically know when a policyholder has passed away. It's the responsibility of the beneficiary to contact the insurer and initiate the claims process by providing a death certificate and any other necessary documentation. The insurer will then review the claim and process the payout if everything is in order.

Life Insurance and Tax Returns: What's the Connection?

You may want to see also

Installment payments are also an option, where beneficiaries receive the death benefit in regular payments over a fixed period or for their lifetime

When a loved one passes away, the last thing you want to do is stress over money. This is why your loved one had life insurance. But trying to collect on their policy can be confusing. It's important to understand how life insurance payouts work so that you can get the money you need to take care of yourself and your family during this difficult time.

There are several ways a beneficiary may receive a life insurance payout, including lump-sum payments, installment payments, annuities, and retained asset accounts.

Installment Payments

Installment payments are a good option if you want to guarantee that the proceeds will last for a necessary number of years. With an installment plan, the life insurance company pays you a certain amount of money on a regular schedule (usually monthly, quarterly, or yearly). And that money gets paid out over a certain period of time. For example, if Paul had a $750,000 life insurance policy, his wife Jody could ask the insurance company to pay her $75,000 a year for 10 years.

Unfortunately, there’s no more money after the 10 years end. That’s why some insurance companies offer installments that last “for the rest of your life”. But there are some huge flaws with lifetime installment plans. For starters, the life insurance company is just guessing how much money to give you based on how long they think you’ll live. So if your loved one passes away when you’re 25, you might get a couple of hundred dollars a month. That isn’t even enough to cover rent. And regardless of your age, the reality is that life is just too short. If you pass away before you get the entire payout, the insurance company will keep the leftover money, so you can’t even leave it to anyone else.

Some people try to get around this by choosing a period-certain installment, which means the insurance company will keep distributing the payout for a set amount of time—say, 20 years. If you pass away in that time, it’ll go to the secondary beneficiary listed on the original policy. If they’re still alive, the insurance company keeps the money.

Pros and Cons of Installment Payments

The pros of choosing an installment plan are that you get a steady income stream, making financial planning easier. The cons are that you have less flexibility than you would with a lump-sum payment, and any interest earned on these payments may be taxable.

Midland Life Insurance: Accelerated Benefits and Their Availability

You may want to see also

Retained asset accounts allow beneficiaries to leave the payout with the insurance company in an interest-bearing account and access it using a checkbook

When a policyholder passes away, the insurance company pays out a death benefit to the person or persons named as beneficiaries of the policy. There are several ways a beneficiary may receive a life insurance payout, including lump-sum payments, installment payments, annuities, and retained asset accounts.

With a retained asset account, the insurance company sets up an interest-bearing account in the beneficiary's name. The beneficiary is then provided with a checkbook to draw funds as needed. The principal and a minimum rate of interest are guaranteed by the insurer, and additional interest is credited to the account at a rate declared by the insurer. This rate is comparable to that paid in similar accounts offered by banks and money-market mutual funds. Beneficiaries receive free checks and periodic reports on the status of their account.

While retained asset accounts offer some benefits, there are also some drawbacks. The interest rates on these accounts may be lower than those offered by banks or other investment vehicles. Additionally, there may be restrictions on accessing the funds, and the accounts do not provide the same protections as bank accounts. In the event of an insurer going out of business, retained asset accounts may not be fully protected.

It is important to note that beneficiaries have the right to choose how they want to receive the life insurance payout. They are not required to accept the option provided by the insurance company. By staying informed and understanding their rights, beneficiaries can make the best decision for their financial needs and goals.

Expunged Records: Life Insurance Disclosure Requirements

You may want to see also

Lifetime annuities provide guaranteed payments to the beneficiary for the rest of their life

Lifetime annuities are a type of financial product that provides guaranteed payments to the beneficiary for the rest of their life. This means that the beneficiary will receive regular income, typically in the form of monthly, quarterly, or annual payments, until they die. The amount they receive is determined by the death benefit and their age—the older they are when they start receiving payments, the higher the payments will be as their life expectancy is shorter.

Lifetime annuities are sold by insurance companies and are sometimes called guaranteed lifetime income annuities. They are a type of contract that promises to pay income for the rest of the buyer's life in return for a lump sum or a series of premiums. The buyer can choose to start receiving income immediately or defer it to a future date. The main selling point of lifetime annuities is that the buyer will never have to worry about running out of money as they age, which is a concern for many retirees.

There are two main types of lifetime annuities: single-life annuities and joint and survivor annuities. A single-life annuity stops paying income when the owner dies, while a joint and survivor annuity continues to pay income to another person, usually a surviving spouse, after the owner's death. Joint and survivor annuities typically pay less each month because they have a longer payout phase.

Lifetime annuities can be an appropriate choice for people who want a regular source of income to supplement their Social Security benefits, pensions, or other investments. However, they can be expensive, with sales commissions and ongoing fees, and it is often costly or impossible to withdraw money early. Additionally, the owner's heirs may get nothing from the annuity after the owner dies unless a death benefit rider is added.

It's important to note that lifetime annuity income is fully taxable unless the annuity was funded with after-tax dollars. During the accumulation phase, the money in the annuity grows tax-deferred.

Military Life Insurance: Who Qualifies and How to Apply

You may want to see also

Fixed-period annuities pay out the death benefit over a specified period, such as 10 or 20 years

Fixed-period annuities are a type of life insurance payout option that guarantees a steady income stream for a predetermined number of years, typically ranging from 10 to 20 years. This type of annuity is also known as a "period-certain" annuity, and it offers beneficiaries a sense of financial security and peace of mind during the specified period.

Here's how it works: when you choose a fixed-period annuity, you select a defined period, such as 10, 15, or 20 years, during which you will receive regular payments from your annuity. These payments are guaranteed for the entire chosen period, providing a stable source of income. If the annuitant (the person who owns the annuity) dies before the fixed period ends, the insurance company will continue to make payments to the designated beneficiary for the remaining years. This ensures that the beneficiary still receives the financial benefits intended for them.

For example, let's say you choose a 20-year fixed-period annuity. If you pass away within the first 10 years, the insurance company is obligated to continue making payments to your beneficiary for the remaining 10 years. This feature provides assurance that your loved ones will be financially supported even after your death.

It's important to note that with fixed-period annuities, the payments may stop once the fixed period ends or the account balance reaches zero, whichever comes first. If you outlive the fixed period or exhaust the account balance before your death, there may be no further payments unless the plan includes a provision for the continuation of benefits.

Fixed-period annuities offer a guaranteed income stream for a set duration, making them a reliable option for those seeking financial security over a specific period. However, it's always advisable to carefully review the terms and conditions of any annuity contract before making a decision, as the specific provisions and benefits may vary depending on the insurance company and the chosen plan.

Life Insurance Exam: How Many Questions for North Carolina?

You may want to see also

Frequently asked questions

Contact the insurance company to find out their procedure for filing a claim. You will likely have to submit a certified copy of the death certificate and complete additional paperwork, such as a claim form.

The most common payout option is a lump-sum payment, where the beneficiary receives the entire death benefit in one go. Other options include instalment payments, annuities, and retained asset accounts.

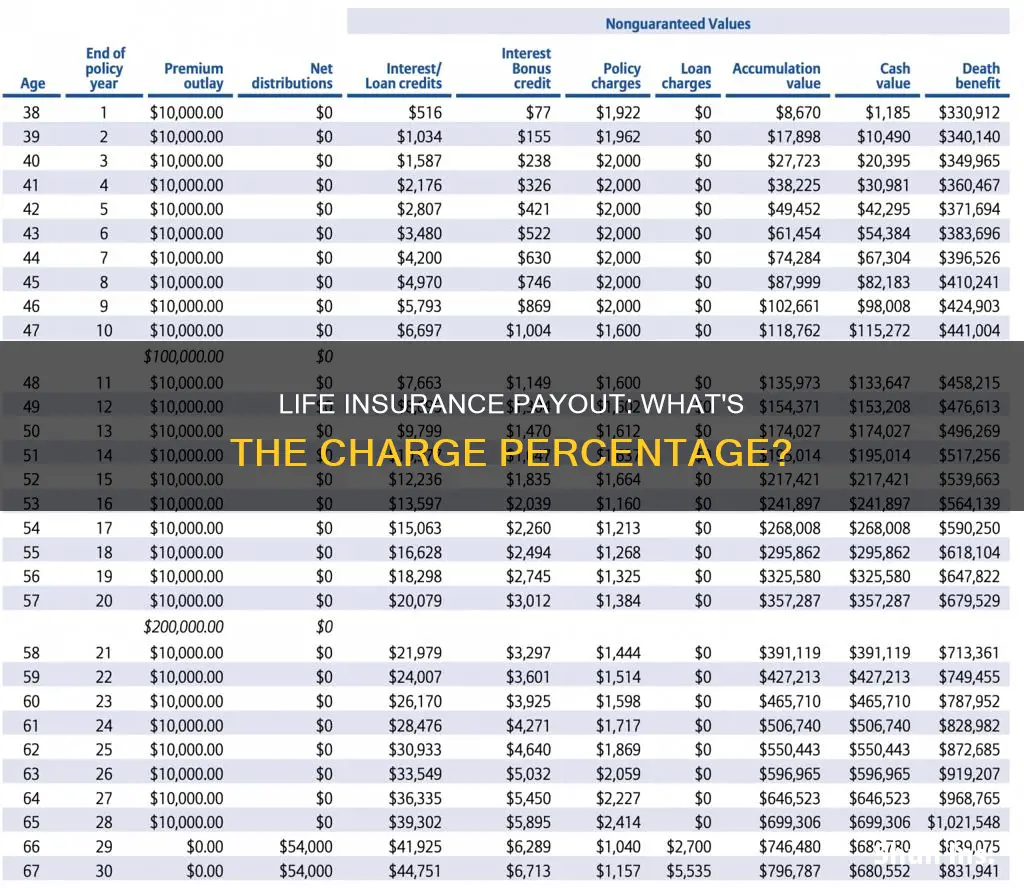

Yes, there are several charges associated with life insurance policies, including premium allocation charges, surrender or discontinuance charges, policy administration charges, fund management charges, and mortality charges.