AAA Life Insurance, a well-known provider of insurance products, offers various life insurance options, including term and permanent life insurance. One of the key considerations when applying for life insurance is whether a medical exam is required. In this paragraph, we will explore the question of whether AAA Life Insurance mandates a medical examination for its policyholders. Understanding the process and requirements can help individuals make informed decisions about their insurance coverage and ensure they receive the appropriate protection for their needs.

| Characteristics | Values |

|---|---|

| Medical Exam Requirement | AAA Life Insurance may require a medical exam for certain policy amounts and coverage types. The exam is typically used to assess the insured's health and determine eligibility. |

| Exam Process | The medical exam involves a physical examination and may include blood tests, urine analysis, and other health assessments. It is conducted by a licensed healthcare professional. |

| Exam Frequency | The frequency of medical exams can vary. Some policies may require an exam at the time of application, while others may have periodic reviews or exams based on policy changes. |

| Exam Cost | The cost of the medical exam is usually borne by the insurance company. However, in some cases, applicants may be responsible for a portion of the expenses. |

| Exam Location | Exams can be conducted at a medical facility or a designated AAA office, depending on the company's preferences and the applicant's location. |

| Exam Results | The results of the medical exam are used to determine the insured's risk profile and may influence the policy terms, premiums, and coverage amount. |

| Policy Types | Medical exams are often required for term life insurance, whole life insurance, and universal life insurance policies with higher coverage amounts. |

| Exemption Options | In some cases, applicants may be exempt from a medical exam if they meet specific health criteria or have a pre-existing relationship with the insurance company. |

What You'll Learn

- Medical Exam Requirements: AAA Life Insurance may require a medical exam for policy approval

- Health Questionnaires: Applicants often need to complete health questionnaires as an alternative to exams

- Age and Gender: Age and gender can influence the need for a medical exam

- Policy Type: Term life, whole life, and permanent life policies may have different exam requirements

- Underwriting Process: AAA's underwriting process determines if and when a medical exam is needed

Medical Exam Requirements: AAA Life Insurance may require a medical exam for policy approval

AAA Life Insurance, a well-known insurance provider, may require a medical examination as part of the application process for certain life insurance policies. This is a standard procedure for many insurance companies to assess the risk associated with insuring an individual. The medical exam is an essential step to ensure that the insurance company can accurately evaluate the health and longevity of the applicant, which directly impacts the premium rates and policy terms.

The specific requirements for a medical exam can vary depending on the type of policy and the applicant's health status. For instance, term life insurance policies might have less stringent medical exam requirements compared to permanent life insurance or whole life insurance. Additionally, individuals with pre-existing health conditions or those seeking higher coverage amounts may be subject to more comprehensive medical assessments.

During the medical exam, an authorized healthcare professional will conduct a series of tests and ask about your medical history. These tests often include measuring blood pressure, checking heart rate, and taking a blood sample for various tests. The exam may also involve a physical examination to assess overall health. The information gathered is used to determine the insurability risk and to tailor the policy accordingly.

If you are applying for AAA Life Insurance, it is crucial to be prepared for the medical exam. Here are some key points to consider: Firstly, maintain your regular health check-ups and keep your medical records up to date. This ensures that you can provide accurate and relevant information during the application process. Secondly, be transparent and honest when disclosing your medical history. Any false information could lead to policy rejection or future complications. Lastly, understand the different levels of medical exams and their implications. Some policies may require a standard medical exam, while others might need a more extensive evaluation, including a full-body MRI or a comprehensive blood panel.

In summary, AAA Life Insurance may mandate a medical exam as a crucial step in the policy approval process. This exam provides valuable insights into an individual's health, allowing the insurance company to make informed decisions. By being prepared and understanding the requirements, applicants can navigate the process smoothly and increase their chances of securing the desired life insurance coverage. Remember, a thorough medical examination is a standard practice in the insurance industry to ensure fair and accurate policy offerings.

Chen Medical's Insurance Coverage: A Comprehensive Guide

You may want to see also

Health Questionnaires: Applicants often need to complete health questionnaires as an alternative to exams

Health questionnaires are an essential part of the life insurance application process, especially for companies like AAA Life Insurance, which often use them as a screening tool instead of requiring a medical examination. These questionnaires are designed to gather detailed information about an applicant's health, lifestyle, and medical history, providing a comprehensive overview of their well-being. By completing these forms, applicants can help insurance providers assess their risk and determine the terms and premiums for their life insurance policy.

The process is straightforward and typically involves a series of questions covering various aspects of an individual's health. These may include inquiries about pre-existing conditions, such as diabetes, heart disease, or cancer, as well as questions related to lifestyle choices like smoking, alcohol consumption, and exercise habits. Applicants might also be asked about their family medical history, previous surgeries, or any ongoing medical treatments. The more comprehensive and honest the responses, the better the insurance company can evaluate the applicant's overall health and potential risks.

One of the advantages of health questionnaires is their non-invasive nature. Unlike medical exams, which often require physical examinations and lab tests, questionnaires allow applicants to provide information from the comfort of their homes. This approach is particularly beneficial for individuals with busy schedules or those who may feel uncomfortable with medical procedures. It also enables insurance companies to quickly gather a large amount of data, facilitating a faster decision-making process.

However, it is crucial for applicants to provide accurate and honest information. Insurance companies rely on the data provided to assess risk and set premiums. Misrepresenting or omitting health-related details can lead to significant issues down the line, such as denied claims or legal complications. Therefore, applicants should carefully review the questionnaire, ensuring they provide a complete and truthful account of their health status.

In summary, health questionnaires play a vital role in the life insurance application process, offering a convenient and efficient way for applicants to provide essential health information. By completing these forms, individuals can contribute to a fair and accurate assessment of their health, which is crucial for obtaining suitable life insurance coverage. AAA Life Insurance, like other insurance providers, utilizes these questionnaires as a primary tool to evaluate applicants, making it an essential step in securing life insurance without the need for a medical exam.

Village Medical at Walgreens: Unlocking Insurance Coverage

You may want to see also

Age and Gender: Age and gender can influence the need for a medical exam

Age and gender play a significant role in determining whether a medical examination is required for AAA life insurance. Generally, older individuals and men are more likely to be subject to medical exams as part of the underwriting process. This is primarily due to the statistical data and risk assessment associated with these demographics. As people age, the likelihood of developing health issues increases, and this is especially true for men, who tend to have higher rates of certain chronic conditions. For instance, older applicants might be asked to undergo a medical exam to assess their overall health, including checking blood pressure, cholesterol levels, and other vital signs, as these factors can impact the insurance company's decision.

For men, certain health conditions are more prevalent and may require a medical examination. These include heart disease, cancer, and diabetes, which are often associated with older age. Insurance companies use these factors to evaluate the risk of insuring an individual, as older men may have a higher risk profile compared to younger individuals of the same gender.

On the other hand, younger individuals, especially those in their 20s and 30s, may be exempt from medical exams. This is because younger people are generally considered lower-risk candidates for life insurance. Their age and the fact that they have a longer life expectancy can make them more attractive to insurance providers. However, it's important to note that this doesn't mean younger individuals are not required to provide any health information. They may still need to answer health-related questions and provide medical history details.

Gender also comes into play, as women generally have a lower risk profile for certain health conditions compared to men. This is particularly true for conditions like heart disease and cancer, which are often associated with older age and men. As a result, women may be more likely to be approved for life insurance without a medical exam, especially if they are younger. However, it's worth mentioning that this doesn't apply to all women, and individual health factors still play a crucial role in the underwriting process.

In summary, age and gender are essential considerations when determining the need for a medical exam for AAA life insurance. Older individuals and men are more likely to be subject to medical examinations due to increased health risks, while younger individuals, especially women, may have a lower risk profile and potentially avoid a medical exam. Understanding these factors can help individuals navigate the insurance application process more effectively.

Employer Flexibility in Medical Insurance Contributions: Exploring Options

You may want to see also

Policy Type: Term life, whole life, and permanent life policies may have different exam requirements

When considering AAA Life Insurance, it's important to understand the different types of policies and their respective medical exam requirements. The three primary types of life insurance policies are term life, whole life, and permanent life, each with its own unique characteristics and exam processes.

Term life insurance is a straightforward policy that provides coverage for a specified period, typically 10, 20, or 30 years. This type of policy is often chosen for its simplicity and affordability. In most cases, term life insurance does not require a medical exam for coverage up to a certain amount. The insurer may request basic health information and a simple health questionnaire to assess the applicant's risk profile. However, for higher coverage amounts, especially for those with pre-existing health conditions or a family history of certain diseases, a medical exam might be necessary. This exam typically involves a physical examination, blood tests, and sometimes a urine sample to evaluate the applicant's overall health and determine the risk associated with the policy.

Whole life insurance, on the other hand, is a permanent policy that provides coverage for the entire lifetime of the insured individual. This type of policy offers a guaranteed death benefit and a fixed premium that does not change over time. Whole life insurance often requires a medical exam, which can be more extensive compared to term life. The exam may include a physical examination, blood tests, and sometimes a full-body MRI or CT scan to assess the applicant's health comprehensively. This thorough evaluation is necessary to ensure the insurer's risk assessment is accurate, especially for older applicants or those with significant health concerns.

Permanent life insurance, also known as whole life or universal life, offers lifelong coverage and a cash value component that grows over time. Similar to whole life, permanent life insurance often requires a medical exam, which can vary in complexity depending on the insurer's guidelines. The exam may include a physical examination, blood tests, and a review of the applicant's medical history. The insurer will use this information to determine the premium and coverage amount, ensuring that the policy aligns with the applicant's health and financial goals.

In summary, AAA Life Insurance's exam requirements vary depending on the policy type. Term life insurance may have less stringent exams for standard coverage, while whole life and permanent life policies often require more comprehensive medical evaluations. Understanding these differences is crucial for individuals seeking life insurance coverage to ensure they choose the right policy that meets their needs and budget.

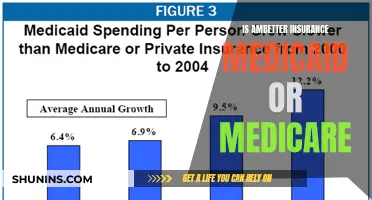

Medicaid Coverage: Navigating Deductibles from Primary Insurance

You may want to see also

Underwriting Process: AAA's underwriting process determines if and when a medical exam is needed

The underwriting process for AAA life insurance is a comprehensive evaluation that determines the terms and conditions of your policy. One crucial aspect of this process is the decision on whether a medical exam is required, which can significantly impact the application's outcome. Underwriters at AAA carefully assess various factors to make this determination, ensuring the policy's fairness and accuracy.

When you apply for AAA life insurance, the underwriting team will review your application, including personal and medical history, lifestyle choices, and any existing health conditions. They will consider factors such as age, gender, smoking status, alcohol consumption, and overall health. For instance, a 30-year-old non-smoker with a healthy lifestyle may be considered a lower-risk candidate, potentially reducing the need for a medical exam. In contrast, a 60-year-old with a history of smoking and diabetes might require a more thorough assessment, which could include a medical exam.

The underwriting guidelines for AAA life insurance are designed to be fair and consistent. They take into account the severity and impact of health conditions on an individual's life expectancy and potential risk to the insurer. For example, a minor health issue, such as high blood pressure, might not necessitate a medical exam if it is well-managed and does not significantly affect overall health. However, a chronic condition like heart disease or cancer would likely require a medical examination to assess the candidate's health status accurately.

Underwriters may also consider the type of life insurance policy being applied for. Term life insurance, which provides coverage for a specified period, may have different underwriting criteria compared to permanent life insurance. The latter often requires a more detailed evaluation, including a medical exam, to ensure the policy's long-term viability. The underwriting process is a critical step in ensuring that AAA can provide the best possible coverage while managing risk effectively.

In summary, AAA's underwriting process is a meticulous evaluation that determines the necessity of a medical exam based on various factors. This process ensures that the insurance company can accurately assess the risk associated with each applicant, allowing them to offer suitable coverage. Understanding these underwriting practices can help individuals navigate the application process more effectively and make informed decisions about their life insurance needs.

Unraveling Quartz Insurance's Coverage: Weight Loss Medication and Your Policy

You may want to see also

Frequently asked questions

AAA Life Insurance may require a medical exam, but it depends on the type of policy and your individual circumstances. For standard coverage, a medical exam is often a standard part of the underwriting process to assess your health and determine the risk associated with insuring you. This typically involves a physical examination, blood tests, and sometimes a review of your medical history.

Yes, there are certain situations where a medical exam might be waived or simplified. For instance, if you're purchasing a smaller policy amount or a term life insurance, the insurer may not require a full medical exam. Additionally, individuals with pre-existing health conditions or those who are considered healthy may also be exempt from a medical exam, but this varies by insurer and policy type.

If a medical exam is required, it's beneficial to prepare in advance. Ensure you provide accurate and complete medical information during the application process. Get your blood pressure and cholesterol levels checked, and if you have any recent medical records, share them with the insurer. Being transparent and up-to-date with your health information can help streamline the process and provide more accurate results.

Failing to provide the necessary medical information or lying on your application can have serious consequences. It may result in a denial of coverage or a claim being contested if you make a claim in the future. It's essential to be honest and accurate when disclosing health-related details to ensure a fair assessment of your insurance application.

While it may be challenging, it's not impossible to obtain AAA Life Insurance with a pre-existing condition. Some insurers offer specialized policies for individuals with health concerns, but these may come with higher premiums and specific terms. It's best to consult with an insurance advisor who can help you explore your options and find a suitable policy that meets your needs.