Navigating the complexities of health insurance coverage can be challenging, especially when it comes to specialized treatments like weight loss medication. In this context, many individuals are curious about the extent of their insurance coverage, particularly regarding medications that may not be traditionally covered by standard health plans. One such area of interest is the coverage of weight loss medications by insurance providers. This paragraph aims to shed light on the specific question of whether quartz insurance, a type of health insurance, typically covers weight loss medication. By exploring this topic, we can better understand the financial implications and accessibility of these treatments for individuals seeking to manage their weight effectively.

| Characteristics | Values |

|---|---|

| Coverage Type | May vary depending on the specific policy and provider |

| Policy Exclusions | Often excludes weight loss medications that are not considered medically necessary or are deemed experimental |

| Pre-existing Conditions | May impact coverage; some policies may require a waiting period or additional premiums |

| Network Providers | In-network providers may offer more favorable coverage terms |

| Prescription Requirements | Some policies may require a valid prescription from a licensed healthcare professional |

| Coverage Limits | May have annual or lifetime coverage limits for weight loss medications |

| Deductibles and Copays | Out-of-pocket costs may apply before coverage kicks in |

| Policy Renewability | Coverage may be renewed annually, and terms can change over time |

| Customer Support | Contact customer service for specific policy details and coverage information |

What You'll Learn

**Coverage for Weight Loss Medication**

When considering health insurance coverage for weight loss medication, it's important to understand the various factors that can influence your policy. Many insurance providers, including those under the Quartz Insurance umbrella, offer coverage for such medications, but the specifics can vary widely. Here's a breakdown of what you need to know:

Understanding Insurance Coverage:

Insurance coverage for weight loss medications typically falls under the category of prescription drugs. These medications are often prescribed to individuals who are obese or have certain medical conditions that require weight management. The coverage can vary depending on the insurance plan and the specific medication in question. It's crucial to review your policy documents or contact your insurance provider directly to obtain accurate information.

Factors Influencing Coverage:

- Policy Type: Different insurance plans, such as HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization), may have distinct coverage policies. HMOs often require referrals from primary care physicians, while PPOs offer more flexibility in choosing healthcare providers.

- Medicine Classification: Some weight loss medications are classified as brand-name drugs, while others are generics. Insurance coverage might differ between these categories. Brand-name drugs often have higher co-pays or require prior authorization, whereas generics may be more affordable and covered under most plans.

- Medical Necessity: Insurance companies often require a medical professional to determine the necessity of the medication. This assessment ensures that the treatment is appropriate and not merely a personal choice. A letter from your doctor explaining the medical need for the medication can significantly impact coverage.

- Network of Providers: Insurance plans often have a network of preferred healthcare providers. Using in-network pharmacies and doctors can result in better coverage and lower out-of-pocket costs. Out-of-network services may require higher co-pays or additional fees.

Steps to Ensure Coverage:

- Review Your Policy: Carefully read through your insurance policy to locate the section related to prescription drug coverage. Understand the terms, conditions, and any specific requirements for coverage.

- Contact Customer Support: If you have any doubts or need clarification, reach out to your insurance provider's customer support team. They can provide detailed information about your coverage, including any limitations or exclusions.

- Consult Your Healthcare Provider: Discuss the weight loss medication with your doctor and obtain a prescription. Ensure that your healthcare provider is aware of any insurance coverage requirements, such as prior authorization or specific forms that need to be completed.

- Explore Prescription Drug Discounts: Some insurance companies offer prescription drug discounts or assistance programs for individuals who may not have adequate coverage. These programs can help reduce out-of-pocket costs for necessary medications.

Remember, insurance coverage is a complex matter, and it's essential to be proactive in understanding your benefits. By reviewing your policy, seeking clarification from your insurance provider, and working closely with your healthcare team, you can ensure that you receive the necessary coverage for weight loss medication.

Insurance Coverage for Compounded Medications: What You Need to Know

You may want to see also

**Policy Exclusions and Limitations**

Policy Exclusions and Limitations

When considering insurance coverage for weight loss medication, it's crucial to understand the specific policy exclusions and limitations that may apply. Insurance companies often have certain criteria and restrictions in place to manage the costs and risks associated with such treatments. Here are some key points to be aware of:

- Pre-existing Conditions: Insurance policies may exclude coverage for weight loss medications if the treatment is primarily intended for a pre-existing medical condition. For example, if an individual's obesity is a result of an underlying health issue, the insurance might not cover the medication as a standalone weight loss treatment. It is essential to review the policy's definition of pre-existing conditions and consult with the insurance provider to determine eligibility.

- Off-Label Use: Medications approved for specific conditions may have limitations when used for weight loss. Insurance companies might not cover treatments used "off-label," meaning for purposes other than those approved by the relevant health authorities. This exclusion ensures that insurance funds are utilized for treatments with established medical benefits.

- Experimental or Unapproved Treatments: Insurance policies typically exclude coverage for experimental or unapproved medications. These are treatments that have not yet undergone rigorous clinical trials and do not have a proven track record of safety and efficacy. Weight loss medications that fall into this category may not be covered, as insurance providers prioritize approved and established treatments.

- Patient's Responsibility: In some cases, insurance policies may have a provision that limits coverage to a specific number of treatments or a maximum benefit amount. This means that after reaching the policy's limits, the patient might be responsible for the full cost of subsequent treatments. Additionally, copayments, coinsurance, or deductibles may apply, increasing the patient's financial responsibility.

- Regional and Country-Specific Variations: Insurance coverage can vary significantly between different regions and countries. Policies may have unique exclusions and inclusions based on local healthcare regulations and medical practices. It is essential to check the insurance provider's website or contact their customer support to understand the specific coverage available in your area.

Understanding these policy exclusions and limitations is vital for individuals seeking insurance coverage for weight loss medication. It ensures that patients are aware of their rights and responsibilities and can make informed decisions regarding their healthcare options.

Wisdom Teeth Extraction: Navigating Insurance Coverage for Dental and Medical Expenses

You may want to see also

**Pre-Authorization and Priorities**

When considering insurance coverage for weight loss medication, it's important to understand the process of pre-authorization and how it can impact your access to these treatments. Pre-authorization, also known as prior authorization, is a step in the insurance claims process that involves a review by the insurance company to determine if a specific treatment or medication is medically necessary and covered under your policy. This process is crucial, especially for specialized medications like those used for weight loss, as it can help manage costs and ensure that the treatment is appropriate for the patient's condition.

The pre-authorization process typically begins when a patient's healthcare provider submits a request to the insurance company, detailing the patient's medical history, current condition, and the proposed treatment plan. This request may include specific criteria such as the patient's body mass index (BMI), the severity of their obesity, and any previous attempts at weight loss. The insurance company then reviews this information to assess whether the medication is a suitable and cost-effective option for the patient. This review can take several days to a week, depending on the insurance provider and the complexity of the case.

During this pre-authorization period, it is essential for patients to provide all necessary documentation and medical records to support their need for the weight loss medication. This may include lab results, physician notes, and any relevant medical history. The insurance company may also require additional information or consultations with medical experts to make an informed decision. If the medication is approved, the insurance company will provide a determination, indicating whether the treatment is covered and, if so, under what conditions.

Priorities in the pre-authorization process can vary depending on the insurance company and the specific medication in question. Some insurers may prioritize treatments that are considered standard of care, while others might focus on cost-effectiveness and long-term outcomes. For instance, a medication that has a strong track record of success and is widely recognized by medical professionals may be approved more quickly. Additionally, the severity of the patient's condition and the potential risks associated with obesity can also influence the authorization process.

Understanding the pre-authorization process and its priorities is essential for patients and healthcare providers alike. It ensures that patients receive the necessary treatments while also managing insurance costs. Patients should be prepared to provide comprehensive medical information and may need to follow up with their insurance company to expedite the process. Healthcare providers can assist patients by ensuring all relevant details are included in the pre-authorization request, which can help streamline the approval process and improve access to essential weight loss medications.

Employer Flexibility in Medical Insurance Contributions: Exploring Options

You may want to see also

**Alternative Treatment Options**

Alternative Treatment Options

When considering weight loss, it's important to explore various treatment options that can help individuals achieve their goals safely and effectively. While medication can be a part of a comprehensive approach, it's not the only solution. Here are some alternative treatment options to consider:

- Nutrition and Dietary Changes: Adopting a healthy and balanced diet is fundamental to weight loss. This involves focusing on whole, unprocessed foods, lean proteins, complex carbohydrates, and plenty of fruits and vegetables. Reducing the intake of sugary drinks, refined sugars, and highly processed snacks can significantly impact weight management. Creating a calorie deficit by eating fewer calories than you burn is essential, but it should be done in a sustainable and nutritious way. Consulting with a registered dietitian can provide personalized guidance on creating a meal plan that suits individual preferences and dietary needs.

- Physical Activity and Exercise: Regular exercise is a cornerstone of weight loss and overall health. Incorporating both cardiovascular exercise and strength training can help burn calories, build muscle, and improve overall fitness. Activities like brisk walking, jogging, swimming, cycling, or even high-intensity interval training (HIIT) can be effective. Strength training, such as weightlifting or bodyweight exercises, helps increase muscle mass, which further boosts metabolism. Aim for a minimum of 150 minutes of moderate-intensity exercise or 75 minutes of vigorous-intensity exercise per week, as recommended by most health organizations.

- Behavioral Therapy and Support: Addressing the psychological aspects of weight loss is crucial for long-term success. Cognitive-behavioral therapy (CBT) can help individuals identify and change negative thought patterns and behaviors related to food and exercise. It teaches skills to manage stress, overcome emotional eating, and develop a positive relationship with food. Support groups or online communities can also provide a sense of accountability and encouragement. These groups offer a safe space to share experiences, learn from others, and receive motivation, which can be especially beneficial during challenging times.

- Lifestyle Modifications: Sustainable weight loss often involves making long-term lifestyle changes. This includes improving sleep quality, as adequate rest is essential for regulating hormones that control appetite. Managing stress levels through relaxation techniques like meditation, yoga, or deep breathing exercises can also help reduce cravings and promote healthier eating habits. Additionally, staying hydrated by drinking plenty of water throughout the day can support metabolism and overall well-being.

- Natural Supplements and Herbal Remedies: Some natural supplements and herbal remedies have been traditionally used to support weight loss. For example, green tea extract, conjugated linoleic acid (CLA), and glucomannan are popular choices. However, it's important to note that the effectiveness of these supplements varies, and they should not be relied upon as a sole treatment. Always consult with a healthcare professional before taking any supplements to ensure safety and avoid potential interactions with other medications.

Navigating Medical Record Release: Insurance, Privacy, and Your Rights

You may want to see also

**Patient Responsibility and Costs**

When considering the financial implications of weight loss medication, it's important to understand the patient's responsibilities and potential costs. While insurance coverage can vary, patients should be aware of their out-of-pocket expenses and the factors that may influence their financial burden.

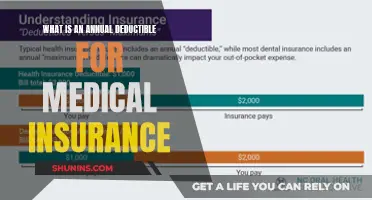

Copayments and Deductibles: Patients often have to pay copayments for each prescribed medication. These copays can vary depending on the insurance plan and the specific medication. Additionally, individuals with high-deductible health plans might need to meet a certain deductible before insurance coverage kicks in, which can be a significant expense. For instance, if the deductible is $1,000 and the medication costs $500, the patient would have to pay the full amount before insurance assistance.

Prescription Drug Benefits: Different insurance providers offer varying levels of coverage for prescription drugs. Some plans may fully cover the medication, while others might require a copay or have a specific tier system that affects the cost. It is the patient's responsibility to review their insurance policy and understand the coverage for weight loss medications. This includes checking if there are any restrictions or requirements, such as prior authorization or a specific formulary that the medication must be on.

Patient Assistance Programs: Many pharmaceutical companies offer patient assistance programs to help cover the costs of medications for those who qualify. These programs can provide financial assistance or even free medication to eligible patients. Patients should inquire about such programs and the application process to ensure they are aware of all available resources.

Alternative Treatment Options: In some cases, patients might explore alternative treatment methods for weight loss, which could potentially reduce costs. This could include lifestyle changes, such as diet and exercise programs, or seeking medical advice for non-pharmacological interventions. While these options may not be suitable for everyone, they can help manage expenses and provide a more holistic approach to weight management.

Understanding the patient's financial responsibilities is crucial when considering weight loss medication. Patients should actively engage with their insurance providers, review their policies, and explore all available resources to minimize costs. Being informed about copayments, deductibles, and prescription drug benefits can significantly impact an individual's ability to access necessary medications while managing their healthcare expenses.

Unraveling the Mystery: Insurance Coverage for Immigration Medical Exams

You may want to see also

Frequently asked questions

Coverage for weight loss medication can vary depending on the specific insurance plan and the medication in question. It's essential to review your policy or contact your insurance provider to understand the details of your coverage. Some plans may cover prescription medications for weight management, especially if they are deemed medically necessary by a healthcare professional.

Insurance companies often require a medical necessity determination for weight loss medications. This means that the medication must be prescribed by a licensed healthcare provider and deemed appropriate for your specific health condition. The severity of the medical issue and the potential benefits of the medication compared to other treatment options are typically considered.

Typically, insurance plans do not cover over-the-counter weight loss supplements as they are considered alternative or complementary treatments. These products are generally not subject to the same rigorous testing and regulation as prescription medications. However, it's always best to check with your insurance provider to confirm their specific policies regarding over-the-counter supplements.