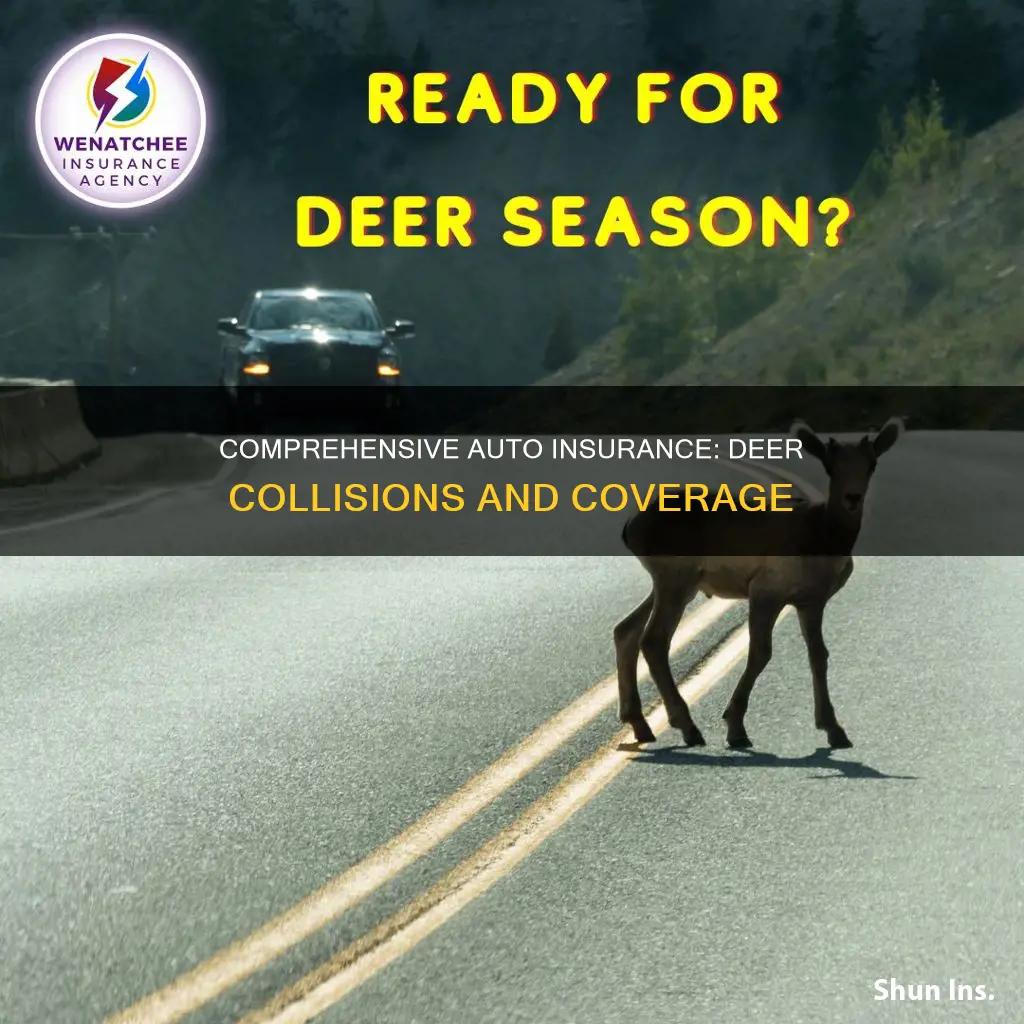

If you hit a deer with your car, the damage to your vehicle will be covered by your auto insurance policy if you have comprehensive coverage. Comprehensive coverage is optional and covers damage caused by events out of your control, such as hitting an animal. Comprehensive coverage may also cover the cash value of your car if it is totaled. However, it is important to note that comprehensive insurance will not cover any injuries sustained from hitting a deer, and these would need to be claimed under medical payments coverage or personal injury protection (PIP) coverage.

| Characteristics | Values |

|---|---|

| Type of insurance that covers hitting a deer | Comprehensive coverage |

| What comprehensive coverage includes | Damage caused by falling objects like tree branches, thunderstorms, hail, hurricanes, and animals |

| What comprehensive coverage doesn't include | Injuries caused by hitting a deer |

| Average cost of an animal-strike claim | $2,730 from 2004 to 2014 |

| Average annual premium for comprehensive coverage | Depends on the value of the vehicle |

| Average increase in insurance premium after hitting a deer | $8 per month |

What You'll Learn

- Comprehensive coverage insures damage to your car from hitting a deer

- Comprehensive coverage also covers damage caused by other animals

- Comprehensive insurance does not cover injuries sustained from hitting a deer

- Liability insurance does not cover damage to your car from hitting a deer

- Comprehensive coverage is more expensive for more valuable vehicles

Comprehensive coverage insures damage to your car from hitting a deer

If you want to insure your car against deer-related damage, you need comprehensive coverage. Comprehensive coverage is an optional coverage that most drivers add to their auto policy. It covers damage to your car caused by events that are out of your control, such as hitting a deer or other animals. Comprehensive coverage may also cover damage caused by falling objects, thunderstorms, hail, and hurricanes. It is important to note that comprehensive coverage only applies if your car comes into direct contact with the animal. If you swerve to avoid hitting a deer and collide with another object or vehicle, you would need collision coverage for the damage to be covered.

When purchasing comprehensive coverage, you can choose a deductible amount, typically ranging from $500 to $2,000. This is the amount you will need to pay out of pocket before your insurance company covers the remaining cost of repairs. If your car is totaled, your comprehensive coverage will pay out the actual cash value of your car, minus the deductible.

It is worth noting that comprehensive coverage does not cover any injuries sustained from hitting a deer. Medical bills and injuries would be covered by medical payments coverage or personal injury protection (PIP) coverage. Additionally, your health insurance can help cover any injury-related expenses.

In summary, comprehensive coverage is essential if you want protection against deer-related damage to your vehicle. It covers damage caused by hitting a deer or other animals, but it is important to understand its limitations and how it differs from collision coverage.

Vehicle Insurance Certificate: What You Need to Know

You may want to see also

Comprehensive coverage also covers damage caused by other animals

If you have comprehensive coverage, you can claim for damage to your car caused by hitting a deer or other animals. Comprehensive coverage is an optional extra that most drivers add to their auto policy. It covers damage caused by events outside of your control, such as collisions with animals. This includes damage caused by animals running into your car, animals burrowing into your car, or your car colliding with an animal on the road.

Comprehensive coverage also covers damage caused by animals other than deer. For example, if a raccoon tears into your seat cushions or a rodent chews the wires under your hood, comprehensive coverage may apply. It is important to note that the animal must come into contact with your car for comprehensive coverage to apply. If you swerve to avoid an animal and hit another object, you would need collision coverage to cover the damage to your vehicle.

Comprehensive coverage also covers damage caused by events other than animal collisions. This includes falling objects, such as tree branches, and weather events like thunderstorms, hail, and hurricanes.

Before your car insurance will cover animal damage, you will need to pay your policy's deductible. Deductibles typically range from $500 to $1,000, and you will need to pay this amount out of pocket before your insurance company covers the rest. If the damage to your car is less than your deductible, you may want to pay for repairs yourself.

Understanding Vehicle Insurance Surcharges

You may want to see also

Comprehensive insurance does not cover injuries sustained from hitting a deer

Comprehensive insurance is designed to cover things other than collisions that are out of the driver's control. This includes damage to your car caused by hitting a deer or other animals. However, it is important to note that comprehensive insurance does not cover injuries sustained from hitting a deer.

Comprehensive insurance policies typically require that your car comes into direct contact with the animal. So, if a deer runs into the road and collides with your car, you should be covered for any damage to your vehicle. However, if you swerve to avoid a deer and hit another car or object, comprehensive insurance will not cover the resulting damage. In such cases, you would need collision coverage.

While comprehensive insurance can provide financial protection for vehicle repairs or replacement, it does not cover medical bills or injuries resulting from a deer collision. Claims for medical expenses after hitting a deer would typically be covered by separate medical payments coverage or personal injury protection (PIP) coverage. It is advisable to provide your health insurance information to healthcare providers in case your auto insurance coverage is insufficient for your total medical bills.

Additionally, it's important to understand that comprehensive insurance does not cover injuries sustained by the deer or other animals in the event of a collision. The focus is solely on the damage caused to the vehicle and the subsequent financial protection offered to the policyholder.

Finally, it's worth noting that, while comprehensive insurance can provide coverage for deer-related incidents, it does not absolve the driver from potential fault or liability in certain situations. For instance, if a driver swerves to avoid a deer and causes an accident involving another vehicle or property, they may still be deemed negligent and held responsible for the resulting damage.

Insurance Rates: Zip Code Discrimination

You may want to see also

Liability insurance does not cover damage to your car from hitting a deer

If you have liability insurance and you hit a deer, your policy will not cover the cost to repair your vehicle. Liability insurance only covers damage to other people's property and any injuries they sustain. It does not cover damage to your own vehicle.

If you want to be covered for damage to your car from hitting a deer, you will need to add comprehensive coverage to your auto policy. Comprehensive coverage is optional, but most drivers choose to add it. It covers damage to your car caused by events outside of your control, such as hitting an animal. If you lease or finance your car, you will likely be required to have comprehensive coverage.

Comprehensive coverage will also cover damage to your car if an animal runs into you or burrows into your car. However, it is important to note that if you swerve to avoid hitting a deer and then collide with another vehicle or object, comprehensive coverage will not apply. In this case, you would need collision coverage.

When purchasing comprehensive coverage, you will need to consider your deductible amount. A higher deductible typically results in a lower premium. However, make sure you can afford to pay the deductible amount out of pocket if you need to file a claim.

In addition to comprehensive coverage, medical payments coverage or personal injury protection (PIP) coverage can help cover medical bills if you or your passengers are injured in a deer-related accident.

State Farm: Down Payment Needed for Auto Insurance?

You may want to see also

Comprehensive coverage is more expensive for more valuable vehicles

Comprehensive coverage is an optional insurance coverage that protects your vehicle from damage caused by non-collision events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. While comprehensive coverage is not required by law in any state, it is usually required by lenders if you are leasing or financing your vehicle.

The cost of comprehensive coverage depends on various factors, such as the state you live in, the value of your vehicle, your driving record, and your coverage amounts. The higher the vehicle's cash value, the more expensive a comprehensive insurance policy will be. Additionally, if you choose a higher deductible, your premium tends to be lower. For example, if you have a $500 comprehensive deductible and the deer causes $2,000 worth of damage to your car, your insurance company will pay out $1,500 if the claim is approved.

Comprehensive coverage is particularly important if you live in an area with a high deer population, as deer behavior can be unpredictable, and collisions with vehicles can occur even if drivers are paying attention. Comprehensive coverage will protect you financially in the event of an accident with a deer, covering the cost of repairs to your vehicle.

In summary, comprehensive coverage is more expensive for more valuable vehicles due to the higher cash value of the vehicle and the potential for higher repair costs in the event of an accident. However, it is important to consider the value of your vehicle, your personal preferences, and your financial circumstances when deciding whether to opt for comprehensive coverage.

Accident Forgiveness: Standard Practice or Rare Privilege?

You may want to see also

Frequently asked questions

Yes, comprehensive coverage will cover damage caused by hitting a deer. This is the only type of car insurance coverage that covers damage caused by hitting a deer.

Liability insurance only covers damage you cause to another person or their property. It will not cover the cost to repair your own vehicle.

If you swerve to avoid hitting a deer and hit another car, you may be deemed at fault for the collision and liable for any damage caused. Collision coverage may apply in this situation if you have full coverage insurance.

Your insurance rates will likely increase after filing a claim for an accident involving a deer. While a comprehensive claim usually doesn't increase insurance rates as much as a collision claim, you can still expect to see an increase in your premium at your next renewal.