Dealing with auto insurance after the death of a policyholder can be a complicated and tricky process. The steps involved will depend on your relationship to the deceased and the details of the policy. If you are a spouse, you can transfer the policy to your name, but if you are a relative, you will need to be the executor of the deceased's estate to cancel the policy. In most cases, the policy will remain in force while the vehicle is being used by the executor for estate-related affairs. It is important to notify the insurance company of the policyholder's death as soon as possible and provide documentation such as a death certificate.

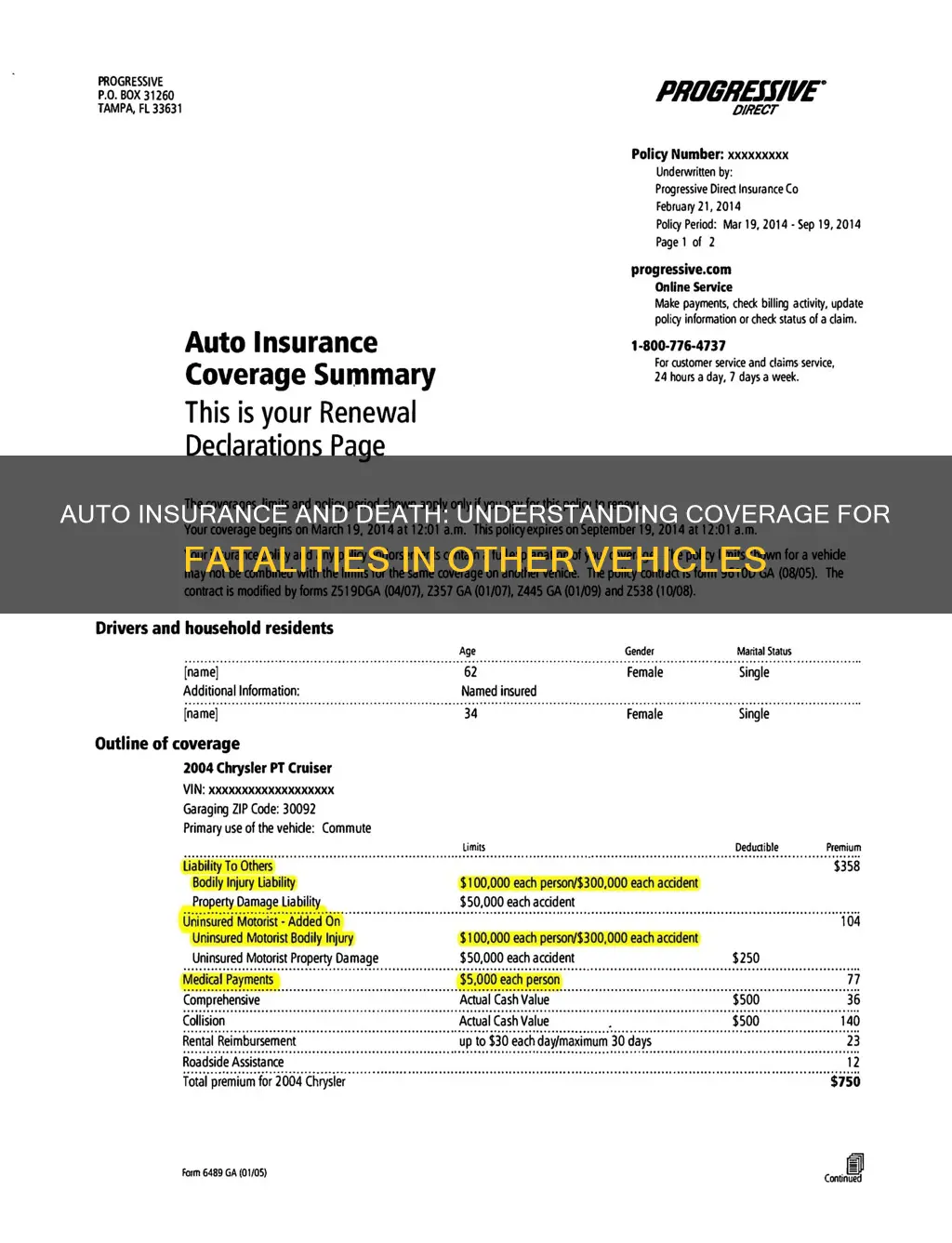

| Characteristics | Values |

|---|---|

| What happens to the auto insurance policy when the policyholder dies? | The policy will remain in force until its expiration date or until it is canceled by the executor of the deceased's estate. |

| Who should notify the insurance company of the policyholder's death? | The executor of the deceased's estate or a family member. |

| What documents should be provided to the insurance company? | Death certificate, executor's appointment letter, copy of the will, proof of executorship, recent statement or copy of the policy. |

| What happens to open claims after the death of the vehicle owner? | The claim can still be processed through a settlement even though the policy will be canceled. |

| How to cancel car insurance when the policyholder dies? | Call the insurance company, provide documentation, wait for confirmation. |

| What happens if you drive a deceased person's car? | Driving a deceased person's vehicle can be complicated, especially if the car is still registered in the deceased owner's name. In many places, it's illegal to operate a vehicle registered to someone who has passed away unless you are a named driver on the deceased's policy. |

| What is accidental death and dismemberment (AD&D) insurance? | AD&D insurance provides a payout to your family if your death or loss of limb was due to an accident. |

What You'll Learn

Cancelling a policy after the death of a spouse

Dealing with the death of a spouse is difficult, and handling their auto insurance policy can be tricky. Here are some steps to guide you through the process of cancelling a policy after the death of a spouse:

Notify the Insurance Company

It is important to inform the insurance company about the policyholder's death as soon as possible. Contact the insurance company's customer service department and let them know about your spouse's passing. You will likely need to provide documentation, such as a death certificate or probate form/executor of the estate documents.

Understand the Policy Details

Before making any decisions, it is crucial to understand the specifics of the policy. Review the policy documents to determine if there are any other drivers registered on the same policy. In some cases, the surviving spouse may be covered under the existing policy, at least temporarily, until a new arrangement is made.

Decide on Cancellation or Transfer

If you wish to cancel your spouse's policy, inform the insurance company, and they will guide you through their specific process. You may be offered the option to become the primary policyholder if you were previously listed on your spouse's policy. If you choose to cancel, the insurance company will likely request proof of death, such as a death certificate.

On the other hand, if you intend to keep the vehicle, you can choose to transfer the policy to your name. This process may vary depending on the insurance company and your location. Contact the insurance company to understand their requirements and initiate the transfer process.

Handle Open Claims

If there are any open insurance claims on your spouse's policy, you can still proceed with cancelling the policy. The insurance company will typically process the claim through a settlement, and any amount owed will be paid through the estate, while the insurance deductible can be taken from the claim payout.

Update Vehicle Registration

If you decide to keep the vehicle, ensure that you update the car registration to your name. Contact your local Department of Motor Vehicles (DMV) to understand the specific requirements and procedures for transferring the vehicle title.

Explore Alternative Options

If you are unhappy with the insurance rates or prefer to explore other options, you can shop around for alternative insurance providers. Compare rates and coverage options to find the best fit for your needs.

Remember, each insurance company and policy may have unique requirements and processes, so always refer to their specific guidelines.

Auto Insurance: Confirming Marital Status to the DMV

You may want to see also

Cancelling a policy after the death of a non-spouse

Cancelling a car insurance policy after the death of a non-spouse can be a complicated process. The steps involved will depend on your relationship to the deceased and the details of the policy. Here are the steps you can take:

Contact the Insurance Company

First, call the insurance company or your agent and inform them of the policyholder's death. You will likely need to provide certain information, such as the policyholder's name, policy number, date of death, and Social Security number. Be prepared to explain your relationship to the deceased and why you are authorised to cancel the policy.

Provide Documentation

The insurance company will require documentation to verify the policyholder's death and your authority to cancel the policy. This may include a death certificate, executor of estate form, or other legal documents. If you are not a spouse or listed on the policy, the insurance company may require additional information to confirm your relationship to the deceased.

Wait for Confirmation

The insurance company will need to verify the provided information and documentation. This process may take some time, especially if you are not a spouse or immediate family member of the deceased. Once the cancellation process is complete, you should receive a cancellation confirmation from the insurance company.

Reimbursements and Refunds

If the policy was paid for in advance (monthly, semi-annually, or annually), you may be eligible for a reimbursement or refund of the unused portion. Any reimbursements will typically be transferred to the estate or beneficiary of the deceased policyholder.

Transfer of Vehicle Ownership

If you or another family member plan to take possession of the vehicle, the title must be changed at the local DMV, and a new insurance policy must be purchased. Be sure to contact the insurance company as soon as possible to avoid any lapse in coverage.

Open Claims

If there are any open insurance claims on the policy, these can still be processed through a settlement even after the policy is cancelled. Any amount owed will be paid through the estate, and the insurance deductible can be taken from the claim payout.

It is important to note that the above process may vary depending on your location and the specific insurance company. Always refer to the insurance company's guidelines and seek clarification from their customer service department when in doubt.

Life Events: Auto Insurance Impact

You may want to see also

Driving a deceased person's car

Dealing with a deceased person's car insurance can be a complicated process, and there are a few important things to keep in mind. Firstly, it is recommended not to drive the deceased person's vehicle until the insurance policy has been transferred to your name. Driving a car that is still registered and insured under the deceased person's name can be illegal in many places, leaving you uninsured and liable in case of an accident.

If you are the spouse of the deceased person, you can easily cancel their policy or transfer it to yourself. This process usually requires submitting documentation, such as a death certificate, probate form, or executor of the estate documents. It is best to contact the insurance company directly to inquire about the necessary steps and requirements. If you are not the spouse but a relative or the executor of the estate, you may still be able to cancel the policy, but the process may be more complicated and lengthier. You will need to provide documentation proving your relationship to the deceased and your authority to cancel the policy.

In most cases, the policy will remain in force while matters of the estate are being handled. However, if you plan on keeping and driving the car, you will need to register and insure the vehicle in your name. It is important to contact your insurance company and the local Department of Motor Vehicles (DMV) for specific instructions and requirements.

It is crucial to address the issue of insurance and ensure proper coverage before driving the deceased person's car to avoid any liability risks. Additionally, keep in mind that car tax can no longer be transferred to another person and must be cancelled and reset under the new registered keeper's name.

Georgia Drivers: Avoid Underinsurance

You may want to see also

Open claims after the death of a vehicle owner

Dealing with open claims after the death of a vehicle owner can be a challenging and complicated process. Here are some steps to guide you through the process:

Notify the Insurance Company

It is important to inform the insurance company about the policyholder's death as soon as possible. Contact the insurance company's customer service department and let them know about the death. If you are a spouse or a driver insured on the policy, you may become the primary policyholder.

Provide Necessary Documentation

The insurance company will likely request documentation to verify the policyholder's death and your authority to act on their behalf. This may include a death certificate, executor of estate form, probate form, or other relevant legal documents.

Continue with Claim and Policy Cancellation

Even if the policy is cancelled, open claims can still be processed through a settlement. The deductible will be taken from the claim payout, and if there is an amount owed, it will be paid through the deceased's estate.

Transfer of Policy or Vehicle Ownership

If you are the surviving spouse, you may be able to transfer the policy to your name. In some states, community property rules automatically transfer the vehicle ownership to the surviving spouse. Otherwise, the transfer of ownership may need to go through probate court, which can take several months.

Address Outstanding Loans or Debts

Any outstanding auto loans or debts will still be in effect and will need to be addressed. Typically, car loans have a death clause outlining the repayment process. The surviving co-signer or the borrower's estate may be responsible for the remaining balance.

Contact Relevant Departments

In addition to the insurance company, you may need to contact the Department of Motor Vehicles (DMV) for various processes, such as transferring vehicle ownership or cancelling the deceased's driver's license. Obtaining an official death certificate is also crucial for these processes and can take several weeks, depending on the state.

Police Cars: Insured?

You may want to see also

Reimbursement for funeral and burial expenses

Dealing with the death of a loved one is never easy, and the last thing you want to worry about is money. However, funeral and burial costs can be high, and auto insurance may be able to provide some financial relief during this difficult time. Here is some information on reimbursement for funeral and burial expenses:

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of coverage that includes medical expenses and, in some cases, lost wages, damages, and death benefits. If you have purchased a plan above the minimum coverage, your insurance policy will cover ordinary funeral and burial expenses for any persons who died as a result of an accident. These benefits are "protected", meaning they must be paid out even if other benefits, such as medical expenses, have already been paid in full. However, most PIP policies have a time limit for filing a claim and receiving payments. When applying for these benefits, you will need to provide proper documentation, especially for claims relating to lost wages and other death benefits beyond funeral and burial costs.

No-Fault Coverage

If you live in a no-fault state, your insurance company is required to cover the cost of your injuries as long as your plan meets the state's minimum requirements. In these states, if you have purchased a PIP policy, it will automatically cover a minimum amount that you or your passengers can claim in the event of an injury, regardless of who is at fault. This includes certain death benefits like funeral and burial fees.

Accidental Death Coverage

Accidental Death Coverage, also known as Automobile Death Indemnity, provides coverage for funeral expenses if the driver of your vehicle is at fault for a motor vehicle-related death. This type of coverage usually offers $5,000 to $15,000 in benefits and is a relatively inexpensive add-on to your policy. Death benefits are typically paid out to any persons named in the declaration page of the deceased, including a spouse, child, or parents of a minor. Alternatively, payments can go directly to the estate of the insured. It is important to note that Accidental Death Coverage does not always pay for your own injuries or damages to your car or property, and each policy will have certain exclusions.

Burial Insurance

Burial insurance, also known as funeral or final expense insurance, is a type of whole life insurance policy specifically designed to cover funeral, burial, and other end-of-life expenses. This type of insurance can help alleviate the financial burden on your loved ones after your passing. Burial insurance policies typically do not require a medical exam and are available to individuals between the ages of 50 and 85. The beneficiary will need to contact the insurance company as soon as possible following the death of the insured and may be required to provide identification, a claims form, and a certified copy of the death certificate. While there are no restrictions on how the payout is used, the lower coverage amount may not leave much, if anything, after funeral and burial expenses have been paid.

Reimbursement Process

It is important to notify the insurance company of the policyholder's death as soon as possible and provide any necessary documentation, such as a death certificate and proof of executorship. If there is an open claim, it can still be processed through a settlement, even if the policy has been cancelled. Any amount owed will be paid through the estate, and the insurance deductible can be taken from the claim payout. If the policy was paid for in advance, the insurance company may issue a refund for the unused portion.

Remember that each insurance policy is unique, and it is always best to contact the insurance company directly to understand your specific coverage and reimbursement options.

Safe Auto Insurance: Good or Bad?

You may want to see also

Frequently asked questions

The car insurance policy remains active until its expiration date or until it is cancelled by the executor of the deceased's estate.

The insurance company will continue the claim process through to settlement even if the policy is no longer active. The policyholder's estate will be responsible for paying any amount owed.

In most cases, the family or beneficiaries cannot continue using the policy in the name of the deceased. The policyholder's estate will handle any remaining insurance needs or claims until a new arrangement is made.

The executor of the deceased's estate or a family member. They will need to provide the policyholder's name, policy number, and the date of death.

Driving a deceased person's car can be complicated, especially if the car is still registered in their name. In many places, it's illegal to operate a vehicle registered to someone who has passed away unless you are a named driver on the policy.