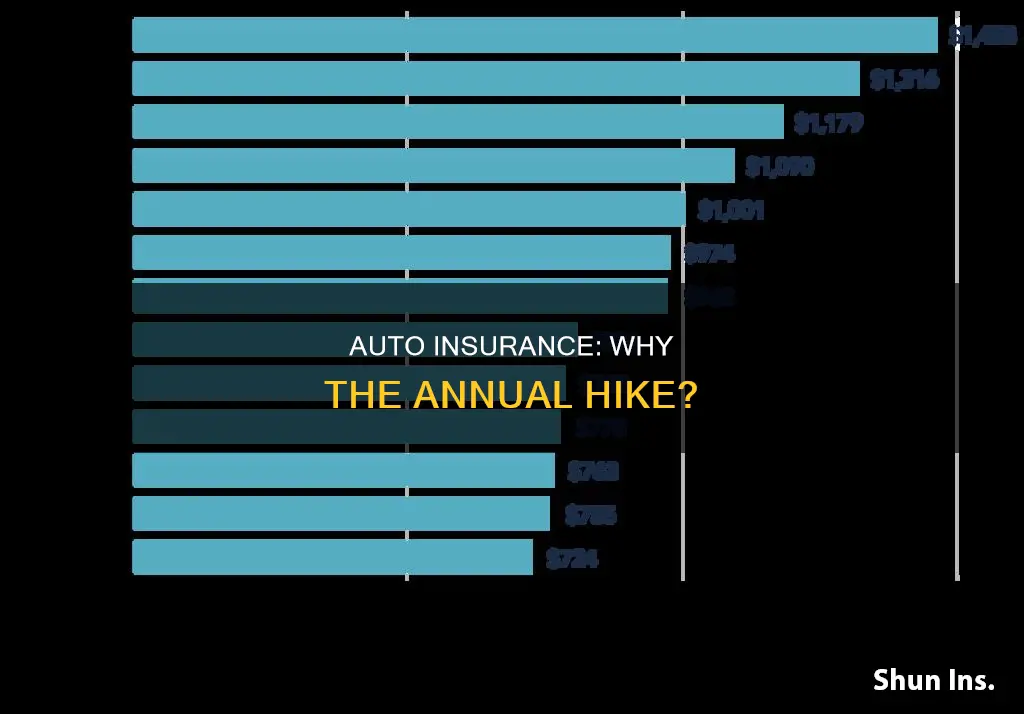

Car insurance premiums have a habit of increasing annually, even if you haven't filed any claims or had any traffic violations. This is because insurers need to collect enough premiums to cover the claims they pay out. If their claim payouts exceed their premium revenue, they will pass on the costs to customers the following year. Increases in repair and medical costs, as well as economic factors like inflation, can also contribute to rising premiums.

| Characteristics | Values |

|---|---|

| Car insurance rates increase | Every year or every six months |

| Reasons | Car accidents, traffic violations, change of address, adding a new vehicle or driver, increases to claims in your ZIP code, increases to car repair/replacement cost, inflation, higher expenses, adding vehicles, drivers and coverage, driving record, points and accidents, substantial claims loss, widespread insurance fraud, rise in claims and cost of claims, medical costs, location, age, claims history, driving record, car make and model, credit score, etc. |

What You'll Learn

Adding a new driver to your policy

Firstly, you should typically include licensed drivers who live in your household or regularly drive your vehicle on your car insurance policy. This is because, if an accident occurs, your insurance company will cover any accidents or claims involving the additional driver.

There are several common scenarios in which you might add a driver to your car insurance policy:

- Your teenage child gets their learner's permit and will use your household's car(s) to practice their driving skills.

- You get married and want to add your spouse.

- You move in with your partner and will share a car.

- Your adult child moves back home and will use your household car(s).

- Your parent or another relative moves in with you and will use your household car(s).

- You and your roommate share a car.

You can usually add a driver to your insurance policy at any time, but you may need to wait until your child gets their full license to include them. Most insurance companies allow you to add another driver to your policy, and some may require you to do so if the person drives the insured cars regularly or shares the same permanent residence.

To add a driver, you can either call your insurance company or log in to your account online. The insurance company will typically need the driver's name, date of birth, driving history, license information, and their vehicle identification number (VIN) if you plan to share one policy that covers both of your vehicles.

The cost of adding a driver to your insurance policy varies based on factors like the driver's age and their motor vehicle record. For example, adding a teenage or newly licensed driver can result in increased insurance premiums because they are high-risk motorists. On the other hand, adding a more experienced driver with a clean driving record may reduce your premiums as they are a low risk to the insurer.

Stolen Vehicle: Insurance Contact?

You may want to see also

Moving to a new address

Location and Risk Factors

Insurers consider location and driving information to set rates. Your new ZIP code can affect your insurance premiums due to various risk factors such as traffic, crime rates, weather conditions, and natural disasters. Moving from a rural area to an urban area with higher population density, more traffic, and a higher rate of accidents and theft can increase your premiums. On the other hand, moving to a less populated area with lower crime rates and better weather conditions may lead to lower insurance rates.

State Regulations and Coverage Requirements

Each state has its own unique coverage requirements and regulations. If you're moving to a different state, your insurer must cancel your old policy and create a new one that complies with the new state's regulations. Some states have higher coverage requirements, which can result in higher premiums. Additionally, some states follow a no-fault system, where each driver must carry personal injury protection, which can also increase insurance rates.

Commute Distance

The distance and duration of your commute can also impact your insurance rates. A longer commute means spending more time on the road, increasing the likelihood of accidents. Therefore, a longer commute may result in higher insurance rates, even if you move to an area with better driving conditions.

Cost of Living

The local cost of living can influence insurance rates. Areas with a higher cost of living may have higher car repair and medical care costs after accidents. Insurers may pass these higher costs on to policyholders, leading to increased premiums.

Credit Score and Age

While not directly related to moving, it's important to note that your credit score and age can also impact your insurance rates. Most states allow insurance carriers to consider your credit score when determining premiums. Younger drivers, especially those under 25, often have higher insurance rates due to their lack of driving experience and higher likelihood of accidents.

Steps to Take When Moving

When moving to a new address, it's essential to update your auto insurance policy and notify your insurer of your new address. If you're moving to a different state, you may need to switch insurance providers if your current insurer doesn't operate in that state. Compare quotes from multiple insurers to find the best rates and coverage for your new location. Remember to cancel your old policy after the new one takes effect to avoid double coverage.

Full Coverage Auto Insurance in Texas: Costs Explained

You may want to see also

Upgrading your insurance coverage

Health Insurance Upgrades

Upgrading your health insurance plan can be beneficial if you feel your current plan is insufficient or lacks the type of cover you need. Here are some advantages of upgrading your health insurance:

- Higher Cover: The primary reason for upgrading is often to obtain a higher level of cover. This is particularly important if you feel there are increased health risks to you or your family. It is recommended to review your cover periodically to ensure it meets your needs.

- More Flexibility: Upgrading can give you greater flexibility and customisation options. You can adjust sub-limits, choose deductible components, and design a plan that suits your specific requirements.

- Add-Ons: Upgrading can allow you to add optional riders or add-on covers to your basic health insurance policy, providing additional benefits such as a room rent waiver, maternity cover, or critical illness cover.

- Family Changes: A policy upgrade is often necessary when there are changes to your family structure, such as the addition of a new baby or the removal of a deceased family member from the plan.

- Cashless Hospitalization: Upgrading can provide access to cashless hospitalization, where the insurer settles bills directly, eliminating the need for out-of-pocket payments and reimbursement claims.

- Adjust Deductibles: Upgrading allows you to adjust deductibles to suit your budget. Typically, a lower deductible results in a higher premium, so finding the right balance is essential.

- Lifetime Renewability: Upgrading to a policy with lifetime renewability ensures your health insurance coverage continues without interruption as you age, avoiding the higher costs and inconvenience of obtaining a new policy later in life.

Car Insurance Upgrades

Upgrading your car insurance can provide additional protection and peace of mind. Here are some reasons why you might consider upgrading:

- Increased Coverage: Upgrading can provide more comprehensive coverage, including incidents such as car theft, vandalism, accidents (both at-fault and not-at-fault), and damage due to weather or natural disasters.

- Additional Vehicles and Drivers: If you acquire a new vehicle or add a new driver to your policy, an upgrade may be necessary to ensure adequate coverage.

- Risk Factors: Even if you haven't made any claims or had any traffic violations, small changes in individual risk factors can result in higher premiums. Upgrading your coverage can help mitigate these increases.

Remember, when considering an upgrade, it is important to compare different insurance plans and providers to find the best fit for your needs.

GST on Motor Vehicle Insurance: Calculation Method

You may want to see also

Adding a vehicle

When adding a vehicle to your policy, you will also need to decide on the amount of coverage you want. While your new vehicle must meet the minimum insurance requirements in your state, you may want to consider additional coverages such as comprehensive and collision insurance.

- Contact your insurance provider: Get in touch with your insurance company by phone, through their website or mobile app, or by visiting their office.

- Provide vehicle information: Have the following information about your vehicle ready: make, model, year, VIN, and license plate number.

- Provide policy information: You will also need to provide your current policy number and information about the coverage you want for the additional vehicle.

- Consider multi-vehicle discounts: Ask your insurance provider about any multi-vehicle discounts they offer, as this can help reduce your overall insurance costs.

- Review your coverage options: Work with your insurance provider to ensure you have the appropriate level of coverage for the additional vehicle, including any optional coverages you may want.

- Add any necessary drivers: If someone else will be driving the added vehicle, you will need to add them to your policy as a covered driver. Provide their name, date of birth, and driver's license number.

- Review your insurance documents: Once the vehicle has been added to your policy, review the updated insurance documents to ensure the information is accurate and that you understand the coverage and any applicable discounts.

Remember that adding a vehicle to your insurance policy may increase your premiums, but it is generally a more convenient and cost-effective option than maintaining separate policies for each vehicle.

Primary vs. Secondary: Vehicle Insurance Explained

You may want to see also

Your age

Age is one of the most important factors in determining your car insurance rate. While there are good drivers in every age group, younger drivers are generally more likely to have accidents or take risks on the road. As a result, they are considered high-risk by auto insurance providers.

Car insurance is most expensive for teen drivers, with rates decreasing as they get older. The cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s, with a significant reduction in premiums around the age of 25. This is because drivers are seen as less risky once they gain more experience behind the wheel.

From ages 16 to 25, car insurance rates will steadily decrease each year, provided the driver keeps their record clean. Rates then level off for a few decades, starting around age 35, before increasing again after age 65 or 70. This is because, as people age, factors such as vision or hearing loss and slowed response time might make them more likely to get into accidents.

The cheapest car insurance for teenagers is typically offered by GEICO, American Family, and USAA. These companies provide the lowest rates on average, although this can vary depending on location and individual driver profiles. For 25-year-olds, the cheapest carriers are usually Nationwide, GEICO, and Progressive.

It's worth noting that some states, such as California, Hawaii, and Massachusetts, have started equalizing car insurance rates by prohibiting gender and age from being used as rating factors.

Gap Insurance: Monthly Payment or One-Time Fee?

You may want to see also

Frequently asked questions

Yes, auto insurance premiums tend to increase every year, even if you haven't filed any claims or had any traffic violations. This is due to a variety of factors, including:

- Inflation and rising expenses, such as healthcare, salaries, and the cost of living.

- Increased claims and claim severity in your area.

- Rising costs of vehicle repairs and replacements.

There are several factors that can cause your auto insurance rate to go up, including:

- Accidents, whether you are at fault or not.

- Traffic violations, such as speeding tickets or driving while intoxicated.

- Adding new vehicles or drivers to your policy, especially teenage drivers.

- Changing your address or moving to a different ZIP code.

- Increasing the amount of your coverage or making changes to your policy.

Yes, there are factors outside of your control that can impact your auto insurance rate. These include:

- Increased accidents, distracted driving, and uninsured or underinsured drivers in your area.

- Natural disasters, supply chain issues, and labour shortages that drive up repair and replacement costs.

- Widespread insurance fraud, which leads to higher rates for all insured individuals.

- Statistical and demographic factors, such as your age, location, vehicle, and credit score.

There are several ways to reduce your auto insurance costs:

- Maintain a clean driving record and drive safely to avoid accidents and violations.

- Shop around and compare rates from different insurance companies.

- Take advantage of discounts offered by insurance companies, such as good student discounts or safe driver programs.

- Reduce the number of vehicles or drivers on your policy if possible.

- Consider increasing your deductible or reducing your coverage limits.