Auto insurance policies typically last for six or 12 months. While six-month policies are more common, some insurers offer 12-month policies that allow you to lock in your rate for a year, avoiding billing surprises. However, not all insurers offer this option, and there are pros and cons to both choices.

What You'll Learn

Pros and cons of 6-month and 12-month policies

When choosing between a six-month and a 12-month auto insurance policy, you should consider the pros and cons of each option.

Pros of a 6-month auto policy

- Policy flexibility: If you are unhappy with your insurance carrier or have found a better option elsewhere, a six-month policy means you would not have to wait as long for your renewal period.

- Driving activity is re-evaluated more frequently: High-risk drivers might find a six-month policy attractive. When tickets or accidents drop off your driving record, there may no longer be a surcharge on your policy. Each time your policy renews, your insurance company may remove any surcharges that no longer apply.

- Paying in full may be more accessible: Some insurance carriers offer discounts for customers who choose to pay their policy in full upfront instead of paying the premium in monthly instalments. Choosing a six-month policy could make paying in full more accessible and allow you to qualify for the discount.

Cons of a 6-month auto policy

- More frequent premium recalculations: With a six-month policy that renews twice a year, you could see your premium fluctuate more frequently.

- Potential to forget renewal dates: When you have a six-month policy, you might be more likely to forget your renewal dates since they occur twice a year and could potentially miss a payment, causing a lapse in insurance coverage.

- Possible missed discounts: If you are benefiting from a discount that you will no longer qualify for when your policy term ends, a six-month policy could mean losing those savings sooner than if you were locked in for a full year.

Pros of a 12-month auto policy

- Less frequent premium fluctuations: You will have more time between renewals, so if you cause an accident during your policy term that will lead your carrier to add a surcharge to your policy, you could have more time surcharge-free on a 12-month policy.

- May be easier to remember renewal dates: Since a 12-month auto policy has half as many renewal dates as a six-month policy, you may be more inclined to remember your policy renewal date.

- May not need to requalify for discounts as often: Since renewals happen less frequently with a 12-month policy, you may be able to cut down on how often you send paperwork to your carrier.

Cons of a 12-month auto policy

- Less policy flexibility: Some companies charge an early cancellation fee if you terminate your policy in the middle of your term. If you want to cancel but also want to avoid this fee, you’ll have to wait until your renewal date, which could be further away on a 12-month auto policy.

- Driving activity isn’t re-evaluated as frequently: Because a 12-month policy doesn’t renew as frequently as a six-month policy, surcharges for accidents and tickets are not removed as often.

- Harder to pay in full: It could be harder to pay a 12-month policy in full since you will be paying for the entire year’s worth of insurance upfront.

Auto Insurance and Healthcare: Unraveling the Maryland Licensing Conundrum

You may want to see also

Policy flexibility

Auto insurance policies can be as short as six months or as long as a year. While a 12-month policy locks in your rate for a year, a six-month policy offers more flexibility.

Six-Month Policies

A six-month policy is a good option if you're looking for flexibility. This type of policy is ideal if you're unhappy with your current insurance provider or if you've found a better option elsewhere. With a six-month policy, you won't have to wait long for your renewal period, and you'll have the flexibility to change providers.

Six-month policies are also beneficial if you're a high-risk driver. Your policy will be re-evaluated more frequently, and any surcharges for accidents or tickets will be removed sooner. Additionally, if you're paying for your policy upfront, a six-month policy may be more affordable than a 12-month policy.

12-Month Policies

While a 12-month policy offers less flexibility, it provides the benefit of locked-in rates for a year. This means you won't have to worry about rate increases during the policy period. It also simplifies budgeting, as you'll know exactly how much you'll be paying each month.

However, if you add or remove a driver or vehicle from your 12-month policy, your rates will change. Additionally, if you have a speeding ticket or accident on your record, you'll be paying an elevated rate for the entire year.

Usage-Based Policies

In addition to the traditional six-month and 12-month policies, some providers offer usage-based policies, where customers are charged based on how much they drive their car. These policies are ideal for people who rarely use their cars, as they provide more flexibility and can result in significant cost savings.

For example, MY Smart Car Insurance by Chubb offers three plans based on mileage tiers of 5,000 km, 7,000 km, and 10,000 km. These types of flexible plans often allow you to enhance your coverage with add-ons, such as multiple driver coverage, protection from special perils, and windscreen coverage.

Choosing the Right Policy

When deciding between a six-month and a 12-month policy, consider your priorities. If flexibility is important to you, a six-month policy may be the best option. On the other hand, if you prefer locked-in rates and the convenience of fewer renewals, a 12-month policy might be a better fit.

Additionally, keep in mind that not all insurers offer 12-month policies, so you may need to shop around to find one that meets your needs. Comparing quotes from multiple providers will help you find the best rate and policy for your situation.

Traffic Ticket Troubles: To Tell or Not Tell Your Auto Insurer?

You may want to see also

Premium recalculations

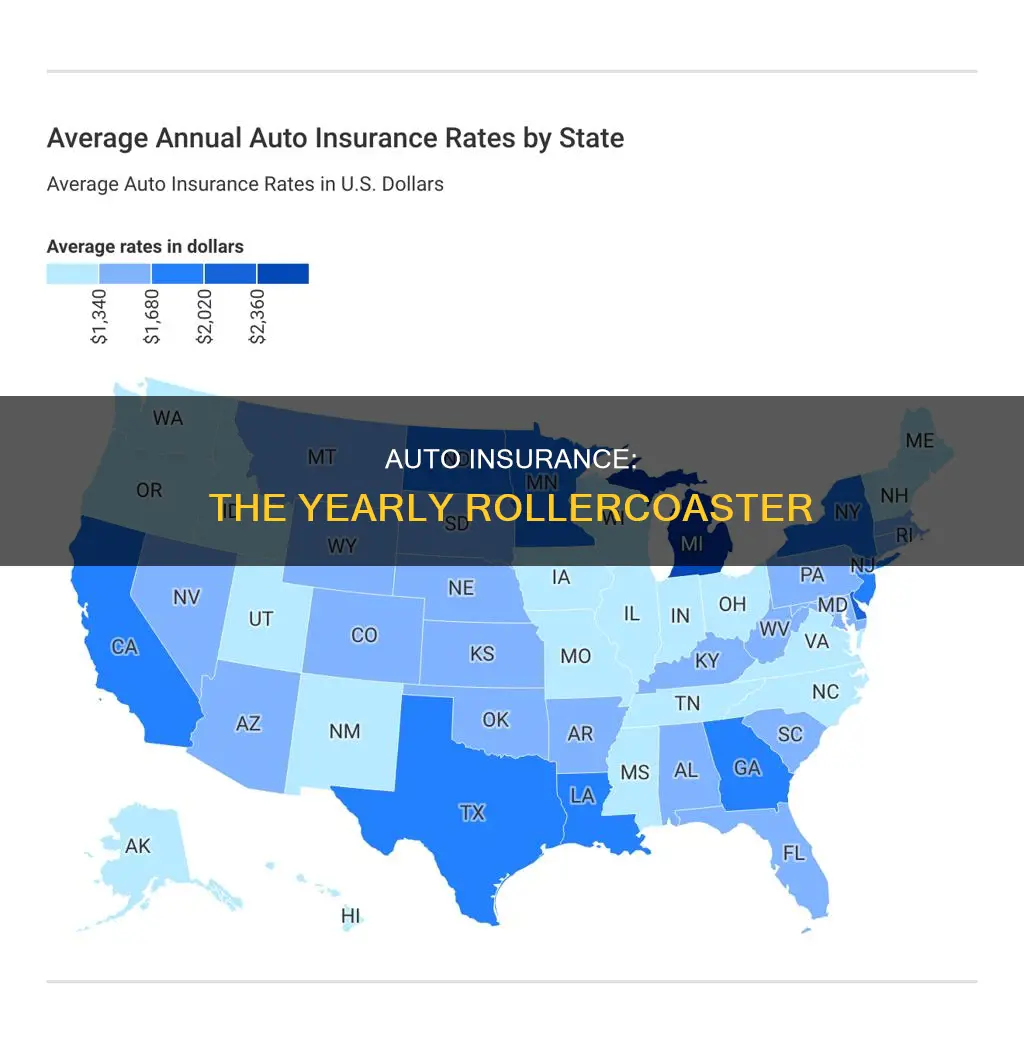

Car insurance premiums are calculated differently by each insurer, and there is no standard way to calculate them. However, there are some common factors that insurers take into account when setting rates. These include the type and value of the vehicle, the driver's age and gender, their driving record and habits, location, credit score, and marital status.

The premium for a car insurance policy can change over time, and it is usually recalculated at the end of the policy term, which is typically six or twelve months. The review process will evaluate the policyholder's claims history, driving record, and other factors that may impact the insurance premium for the next term.

Policyholders can also make changes to their current policy, such as adjusting coverage limits or adding or removing vehicles or drivers, which may result in a change in the premium. Switching insurance companies can also lead to a different premium, as each company uses its formula for setting costs.

Insurers may offer discounts for customers who choose to pay their policy in full upfront instead of paying monthly instalments. Additionally, paying for a 12-month policy in full may result in a discount, locking in the rate for the year. On the other hand, paying for a six-month policy in full may be more accessible for those who cannot afford to pay for a full year upfront.

Policyholders can also take advantage of usage-based discounts, where insurers offer reduced rates for safe driving when tracked through a telematics app. Increasing the voluntary deductible, or the amount contributed towards repairs when filing a claim, can also lead to a reduced premium.

It is important to note that not making any claims during a policy year can result in a No Claim Bonus, which can help lower the premium for the following year. Policyholders should also be mindful of any cancellation fees that may apply if they choose to switch insurers or cancel their policy before the term expires.

Minors: Their Own Auto Insurance?

You may want to see also

Renewal dates

- Automatic Renewal: Many auto insurance companies offer automatic renewal options, where the policy renews automatically at the end of the term without any action required from the policyholder. This provides convenience and ensures continuous coverage. However, it's important to review the new terms and rates, as premiums may change.

- Notification: Insurers are typically required to notify policyholders in advance of the upcoming renewal. Most states mandate a 30-day to 45-day notice period before the term expires. This gives policyholders time to review their coverage, compare rates, and make necessary changes.

- Policy Changes: Renewal dates are an opportunity to reassess your insurance needs and make changes to your policy. You can adjust coverage limits, add or remove drivers or vehicles, or switch insurance providers entirely. It's a good time to shop around and compare quotes to ensure you're getting the best rates and coverage.

- Premium Adjustments: Renewal dates are when insurance companies may adjust your premiums based on various factors, including driving history, age, claims filed, and market trends. Premiums can increase or decrease, so it's important to review the new rates and understand the reasons for any changes.

- Policy Expiration: If you choose not to renew your policy or switch to a different insurer, it's crucial to ensure your new policy starts before the old one expires. A lapse in coverage can lead to legal and financial penalties, including fines and license suspension.

- Grace Period: Some insurance companies offer a grace period for expired policies, allowing you to renew after the expiration date. However, this may result in penalties or higher premiums.

Vehicle Insurance: Name Fraud

You may want to see also

Discounts

Auto insurance policies are typically valid for six or 12 months. While the rates remain the same during this period, you can avail of several discounts that can lower your premium. Here are some of the most common discounts offered by auto insurance companies:

Multi-Policy Discount

Also known as "multi-line discount" or "bundling", this discount is often applicable when you buy multiple policies from the same company. This could include bundling car insurance with home insurance, renters' insurance, motorcycle insurance, boat insurance, RV insurance, or life insurance. The discount offered usually ranges from 5% to 25%.

Multi-Car Insurance Discount

If you insure more than one car with the same insurance company, you can usually get a discount of up to 8% to 25%.

Vehicle Safety Discounts

Cars equipped with safety features like anti-lock brakes, airbags, and daytime running lights may qualify for a discount. Airbag discounts can be as high as 40% on medical payments or personal injury protection coverage. Cars less than three years old may also qualify for a new car discount, ranging from 10% to 15%.

Anti-Theft Device Discounts

Cars with anti-theft features may be eligible for a discount of up to 5% to 25% on comprehensive coverage. This includes both factory-installed and after-market-installed devices. Examples of anti-theft devices include GPS-based systems, stolen vehicle recovery systems, and VIN etching.

Good Driver Discounts

Insurance companies often reward drivers with incident-free records. For example, Geico offers up to 26% in potential savings if you haven't had any accidents in five years. Good driver discounts typically range from 10% to 40%.

Defensive Driver Discounts

Some insurance companies offer discounts if you take an approved defensive driving course. This discount may be restricted to drivers above a certain age, typically 50 or older. The discount usually ranges from 5% to 10%.

Good Student Discount

If you or your student driver is enrolled full-time in high school or college with good academic standing, you may qualify for a discount. The student is usually required to maintain at least a B average and be aged 16 to 25. Good student discounts can range from 8% to 25%.

Student Away at School Discount

If your student is away at school without a car, you may be eligible for a discount. The student is typically required to be under 25 years old and more than 100 miles from home, only accessing your car during school vacations and holidays.

Pay-in-Full Discount

Paying your full policy term upfront can often get you a discount of 6% to 14%. Additionally, you save on monthly finance or service fees charged by some companies for instalment payments.

Electronic Funds Transfer (EFT) Discount

If you pay in instalments through automatic withdrawals, you may be eligible for a small discount, typically ranging from 3% to 6%.

Paperless Discount

Though less common now, some insurance companies offer a small discount, usually around 3%, if you opt for paperless billing and receive policy documents and billing electronically.

Online Quote Discount

Some companies offer a discount, ranging from 4% to 12%, if you get an online quote and sign up for a policy.

Advance Quote Discount

Shopping for insurance and buying a policy in advance of your current policy's expiration can get you a discount. This discount typically ranges from 2% to 15%, with the sweet spot for purchasing being around seven to 14 days in advance.

Occupational Discounts

Your occupation may qualify you for discounts with certain insurance companies. For example, Liberty Mutual offers special policy features for educators, while Geico offers up to 15% off for military personnel.

Usage-Based Insurance Program Discount

Some insurance companies offer usage-based insurance (UBI), which adjusts rates based on your driving behaviour and frequency. Enrolling in a UBI program can get you an initial discount of 5% to 10%, with an additional discount based on your driving habits, which could be anywhere from 5% to 40%.

Insuring Your Vehicle in Alberta

You may want to see also

Frequently asked questions

A 12-month auto insurance policy locks in your rate for a year, preventing billing surprises. It also makes budgeting simpler as you know what to expect from month to month.

A 6-month auto insurance policy offers more flexibility than a 12-month policy. It also allows for more frequent rate revisions, which can save you money depending on your driving record.

The length of the policy does not typically impact your overall car insurance rate. However, a 6-month policy may be cheaper in certain situations, such as when you have a clean driving record and no recent claims or violations.