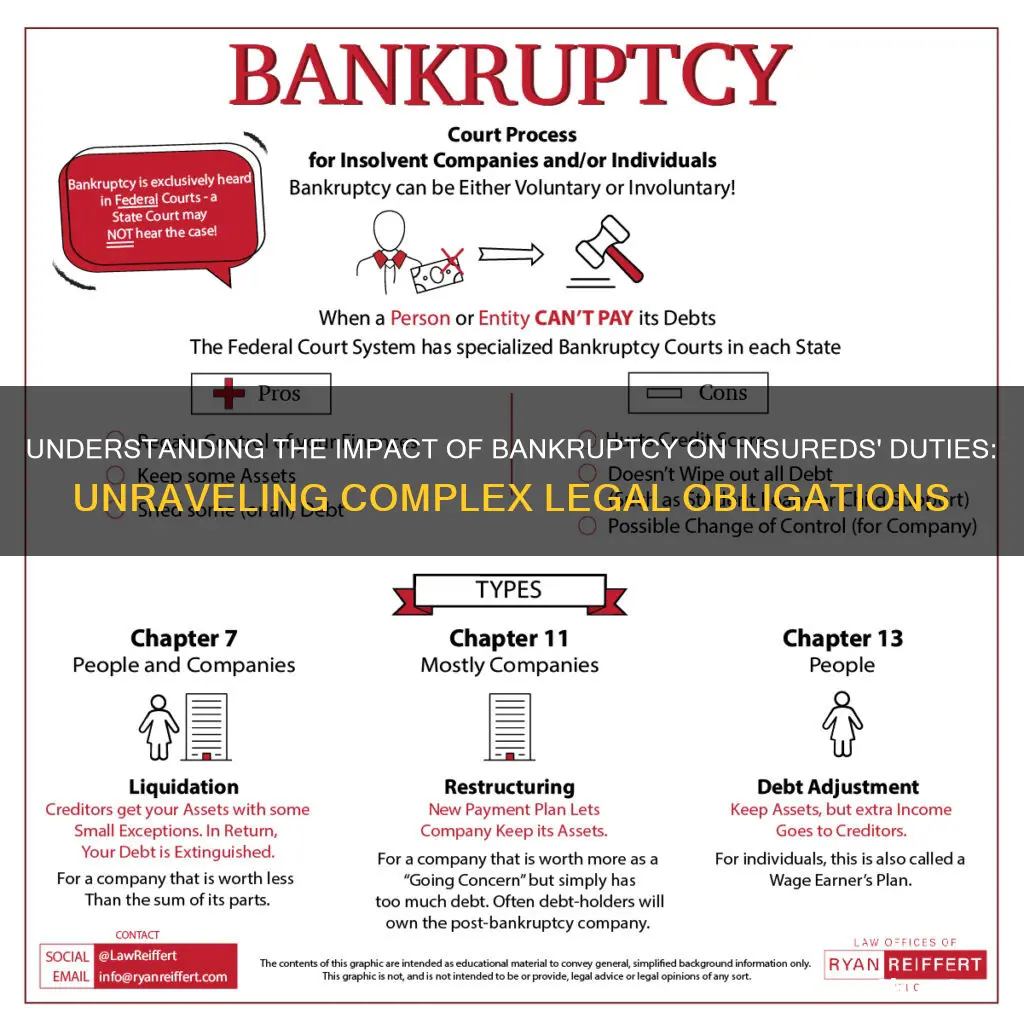

The duties of an insured person can change depending on the type of bankruptcy they are filing for. For example, under Chapter 11 bankruptcy, a company can continue to operate under court protection while financially reorganizing. This may result in cost-cutting measures such as layoffs or benefit reductions, which could impact the insured's duties and coverage. On the other hand, Chapter 7 bankruptcy results in the complete shutdown of a company and liquidation of its assets, leading to a loss of all employer-based group insurance coverage. It's important for individuals to understand the implications of bankruptcy on their insurance coverage and take necessary steps to protect their interests.

| Characteristics | Values |

|---|---|

| Whether bankruptcy changes insureds duties | Depends on the type of bankruptcy |

| What happens to employer-based insurance coverage | Depends on the type of bankruptcy |

| Chapter 11 bankruptcy | Company continues in business under court protection as it financially reorganizes itself |

| Chapter 7 bankruptcy | Company shuts down completely and liquidates its assets to satisfy creditors' financial claims |

| Accident insurance proceeds | Can be kept if the accident occurs after Chapter 7 filing |

| Life insurance proceeds | Likely property of bankruptcy estate if received within six months of filing Chapter 7 |

| State exemption laws | Allow exemption of specific assets, vary by state |

| Federal exemption laws | Allow exemption of up to $13,400 of life insurance policy's cash value |

What You'll Learn

Directors' duties in insolvency

Directors have extensive legal and regulatory responsibilities, which also carry the risk of personal liability. When a company is trading normally, directors must act in the best interests of the company and promote its success for its shareholders. However, when a company becomes insolvent, directors' duties change.

A company is deemed insolvent when it is unable to pay its debts as and when they fall due. This includes being unable to pay sums set out in a statutory demand or judgment debt. There are also two tests that can be used to determine insolvency:

- The balance sheet test: This looks at whether the company's liabilities exceed its assets. If they do, the company is considered insolvent.

- The cash flow test: This states that if a company is unable to pay its debts when they are due, even if it has substantial capital tied up in assets, it is insolvent.

When a company becomes insolvent, directors' duties shift from promoting the interests of the company and its shareholders to acting in the best interests of the company's creditors as a whole. Directors must take steps to minimise creditor losses and demonstrate this through clear records of emails, conversations, and accurate books. Failure to uphold these responsibilities can result in personal liability for company debts and disqualification from acting as a company director.

- Preserve and safeguard the company's assets: Directors need to take steps to secure property, machinery, stock, and collect debts owed to the business.

- Hold a meeting with shareholders: If the decision is made to end trading, a shareholders' meeting can be held, and a vote taken to wind up the company voluntarily.

- Engage an insolvency practitioner and cooperate throughout: Appointing a licensed insolvency practitioner is crucial. They will take control of the business, realise the company's assets, and arrange for proceeds to be distributed to creditors.

- Provide creditors with a report: Directors and the liquidator must put together a report and statement of affairs for creditors, including details of the financial situation, business history, and any unusual activities.

- Attend necessary meetings and cooperate with the insolvency practitioner: This includes answering questions, providing information, and notifying all interested parties such as creditors, shareholders, employees, and regulatory authorities.

- Repay overdrawn directors' loan accounts: Directors with overdrawn accounts must repay these. If unable to do so, legal advice should be sought.

- Observe the creditor duty: Directors must act in the best interests of creditors.

Wrongful and fraudulent trading

Directors must be cautious not to engage in wrongful or fraudulent trading practices. Wrongful trading occurs when directors continue trading after knowing or having reason to know that there was no reasonable prospect of avoiding insolvent liquidation or administration. This can result in personal liability for losses sustained by the company.

Fraudulent trading is a criminal offence and occurs when directors use the company's business to defraud creditors. This can result in a prison sentence and personal liability for company debts.

Who is considered a director?

It is important to note that even if an individual is not a registered director, they may still be considered a director by the court if they actively participate in controlling the direction of company affairs or give instructions to directors ("shadow directing"). These individuals are legally responsible for ensuring the company takes the necessary steps to repay outstanding debts.

Navigating the Medical Billing Maze: Correcting Misdirected Hospital Invoices

You may want to see also

Life insurance and bankruptcy

Life insurance is probably not the first thing that comes to mind when you think about bankruptcy. However, it can affect your bankruptcy case. Every life insurance policy has an owner, an insured, and a beneficiary. The owner controls the policy and can make changes or cancel it. The insured is the person whose death triggers the benefit payments. The beneficiary is the person who receives the insurance proceeds.

There are two primary ways that life insurance might come into play in bankruptcy:

- If you own a life insurance policy that has a cash value

- If you’re the beneficiary under a life insurance policy and the insured dies within a certain time before or after you file for bankruptcy

Unmatured vs. Matured Life Insurance Policies

People in the insurance industry sometimes use terms like "matured" and "unmatured" when referring to insurance policies. An "unmatured" policy is active and in force. It hasn't paid a death benefit, expired, or been cashed out, and coverage remains available. A policy "matures" after paying a death benefit, expiring, or being redeemed for its cash value. Coverage is no longer available.

Bankruptcy Exemptions

When you file for Chapter 7 bankruptcy, everything you own is potentially property of your bankruptcy estate. That doesn't mean you'll lose everything, though. Each state has exemption laws that allow you to protect specific assets. Some states let you choose between state exemptions and federal exemptions, depending on which set works best for you. Many people can exempt all of their property in Chapter 7 bankruptcy, but not always. The Chapter 7 trustee can sell or liquidate non-exempt assets to pay creditors.

Life Insurance Proceeds

Life insurance proceeds are likely property of your bankruptcy estate if you're entitled to them as the result of a death that occurred:

- Before you filed for Chapter 7

- Within six months after you filed for Chapter 7

State law will determine the amount of the life insurance proceeds exemption you can claim, or if you can use the federal exemptions. A wildcard exemption might be available to protect these proceeds as well.

Life Insurance and Premium Rates

Bankruptcy can significantly affect your life insurance eligibility and premium rates. A bankruptcy filing will lower your credit score, making it harder to qualify for life insurance and increasing the cost of premiums. Insurers consider your credit score when determining eligibility and calculating premiums.

Buying Life Insurance After Bankruptcy

Your eligibility for life insurance depends on a number of factors, including your financial history. Life insurance companies see past or current bankruptcies as a risk because they suggest that you may struggle to pay your policy premiums. A personal bankruptcy won’t keep you from getting life insurance permanently, but your rates may be slightly higher.

You’ll also have to wait until your bankruptcy has been discharged before applying for most policies. You’ll need to show proof of financial stability, including regular income, a repayment plan, and improved credit history.

Walgreens Flu Shot Services: Understanding Insurance Coverage and Billing

You may want to see also

Accident insurance proceeds

The ability to keep accident insurance proceeds in a Chapter 7 bankruptcy depends on a number of factors, including when the accident occurred and whether a bankruptcy exemption covers the proceeds. If the accident occurs after a Chapter 7 filing, the insured will be able to keep the insurance proceeds resulting from the post-bankruptcy accident. However, if the accident occurs before the Chapter 7 filing, any insurance proceeds payable are likely property of the bankruptcy estate, and the insured will need to determine if they are exempt.

In general, insurance proceeds are tax-free, but there are certain exceptions. For example, in the US, the IRS taxes insurance proceeds received for pain and suffering, litigation, and lost wages. However, compensation for medical expenses and vehicle repairs is usually not considered taxable.

Understanding Bill Insurance: Protecting Your Finances from Unforeseen Costs

You may want to see also

Life insurance proceeds

State law will determine the amount of the life insurance proceeds exemption you can claim, or if you can use the federal exemptions. A wildcard exemption might also be available to protect these proceeds.

If you receive life insurance proceeds within 180 days of filing for bankruptcy, you must report them. If you receive them more than 180 days after filing, they are not considered part of your bankruptcy estate.

Under federal exemption laws, life insurance payments you receive as a beneficiary are fully exempt if the insured person could claim you as a dependent on the day they died, and the insurance payments are reasonably necessary to support you and your dependents.

Understanding Face Value: Unraveling the True Meaning in Insurance Terms

You may want to see also

Insurance company insolvency

Insurance company insolvencies are rare, but they do happen. When an insurance company goes out of business, policyholders are protected by the state. All 50 US states, the District of Columbia, and Puerto Rico have insurance guaranty associations that step in when an insurance company becomes insolvent. Guaranty associations are funded by a portion of insurers' profits, and membership in a guaranty association is mandatory for insurance companies.

When an insurance company runs into financial trouble, the guaranty system in the state where the insurance company is headquartered will come to the rescue. The state insurance department tries to rehabilitate the company to improve its financial situation. If rehabilitation is unsuccessful, the state insurance department can declare the company insolvent and sell off its assets.

If an insurance company is declared insolvent, the state guaranty association and guaranty fund will transfer the insurer's policies to another insurance company or continue providing coverage itself for policyholders. It's important for policyholders to continue paying premiums if their insurer is taken over by the state.

There are caps on the amount of claims that will be paid out by the guaranty association. Most states limit benefit payouts to the following amounts:

- $300,000 in life insurance death benefits

- $100,000 in cash surrender or withdrawal values for life insurance

- $250,000 in present value annuity benefits

- $500,000 in major medical or hospital benefits

- $100,000 in other health insurance benefits

- $300,000 in long-term care insurance benefits

- $300,000 in disability insurance benefits

- $300,000 for property and casualty claims

There are no caps on workers' compensation claims.

To avoid having to rely on a state guaranty association, you can check up on insurance companies' financial strength before purchasing a policy. Insurance companies are rated by independent agencies such as AM Best, Fitch, Kroll Bond Rating Agency, Moody's, and Standard & Poor's.

Navigating Insurance Status Changes: Does Separation Affect Your Coverage?

You may want to see also

Frequently asked questions

Chapter 7 bankruptcy will result in the loss of all employer-based group insurance coverage as the company ceases to exist. Any outstanding insurance claims must be filed for reimbursement before the company closes.

It depends on the type of bankruptcy. In Chapter 11 bankruptcy, employees may be able to retain coverage if the company maintains its group plans. However, in Chapter 7 bankruptcy, all group insurance coverage will be lost.

Life insurance proceeds are considered part of your bankruptcy estate if the insured's death occurs before or within six months after filing for Chapter 7. These proceeds may be kept if they are exempt, depending on state laws.

Accident insurance proceeds received due to a personal injury after filing for Chapter 7 can be kept and are not part of the bankruptcy estate. However, proceeds from an accident that occurred before filing for Chapter 7 are likely part of the bankruptcy estate and may need to be exempted.

If your insurance company becomes insolvent, the state guaranty association will transfer your policy to another insurer or provide coverage through the guaranty fund. It is important to continue paying your premiums to maintain coverage.