Many people are curious about the impact of driving for Lyft on their insurance rates. The question arises because driving for a ride-sharing company like Lyft involves unique risks and responsibilities compared to traditional employment. This paragraph will explore the relationship between being a Lyft driver and insurance premiums, examining how factors such as driving frequency, vehicle usage, and personal insurance coverage can influence the financial implications for drivers. It will also discuss potential strategies for managing insurance costs while providing a ride-sharing service.

What You'll Learn

- Income Impact: Lyft driving income affects insurance rates, requiring adjustments to coverage

- Vehicle Usage: Frequency of driving for Lyft influences insurance premiums and coverage needs

- Risk Assessment: Insurance companies evaluate Lyft drivers' risk based on driving patterns and experience

- Liability Coverage: Lyft drivers need comprehensive liability insurance to cover potential accidents and legal fees

- Discounts and Incentives: Lyft offers insurance discounts, but drivers must meet specific criteria to qualify

Income Impact: Lyft driving income affects insurance rates, requiring adjustments to coverage

The income generated from driving for Lyft can significantly impact your insurance rates, and it's essential to understand how this works to ensure you have adequate coverage. When you drive for Lyft, you are considered self-employed, and your income from this activity needs to be reported to insurance companies to accurately assess your risk profile. Insurance rates are often calculated based on an individual's income, as higher earnings can indicate a greater potential for accidents or other claims. This is because individuals with higher incomes may be perceived as more likely to be involved in costly incidents, and insurance providers need to account for this potential risk.

As a Lyft driver, your income may be considered a form of additional income or a side business. Insurance companies often have specific guidelines for classifying and rating this type of income. They might categorize it as a professional service, a business venture, or even a hobby, depending on the frequency and nature of your driving. The more you drive, the more income you generate, and this increased income can lead to higher insurance premiums. For instance, if you drive full-time for Lyft, your insurance rates might need to be adjusted to reflect the higher risk associated with a more active and potentially more dangerous occupation.

The impact of Lyft driving income on insurance rates is a result of the insurance company's risk assessment model. They consider various factors, including your overall income, the consistency of your Lyft earnings, and the potential for accidents or claims. If your Lyft driving income is substantial and consistent, it may be treated as a significant part of your financial portfolio, leading to a reevaluation of your insurance coverage. This could mean an increase in your premium to account for the perceived higher risk.

To manage this impact, it's crucial to maintain open communication with your insurance provider. Inform them about your Lyft driving activities and the associated income. They might offer solutions such as adjusting your coverage limits, adding specific endorsements to your policy, or providing discounts for safe driving practices. Some insurance companies even offer specialized policies tailored to drivers with multiple income streams, ensuring that your coverage is appropriate and cost-effective.

In summary, being a Lyft driver can indeed increase your insurance rates due to the income generated from this activity. It is essential to be proactive and inform your insurance provider about your Lyft driving to ensure that your coverage is adequately adjusted. By understanding the relationship between your Lyft driving income and insurance rates, you can make informed decisions to protect your financial well-being and ensure you have the right level of coverage.

Auto-Owners Insurance: Is It Legally Binding?

You may want to see also

Vehicle Usage: Frequency of driving for Lyft influences insurance premiums and coverage needs

The frequency of your vehicle usage for Lyft ridesharing can significantly impact your insurance premiums and coverage requirements. As a Lyft driver, your driving patterns and habits are crucial factors in determining the cost and extent of your insurance policy. Here's a detailed breakdown of how the frequency of your driving for Lyft influences your insurance:

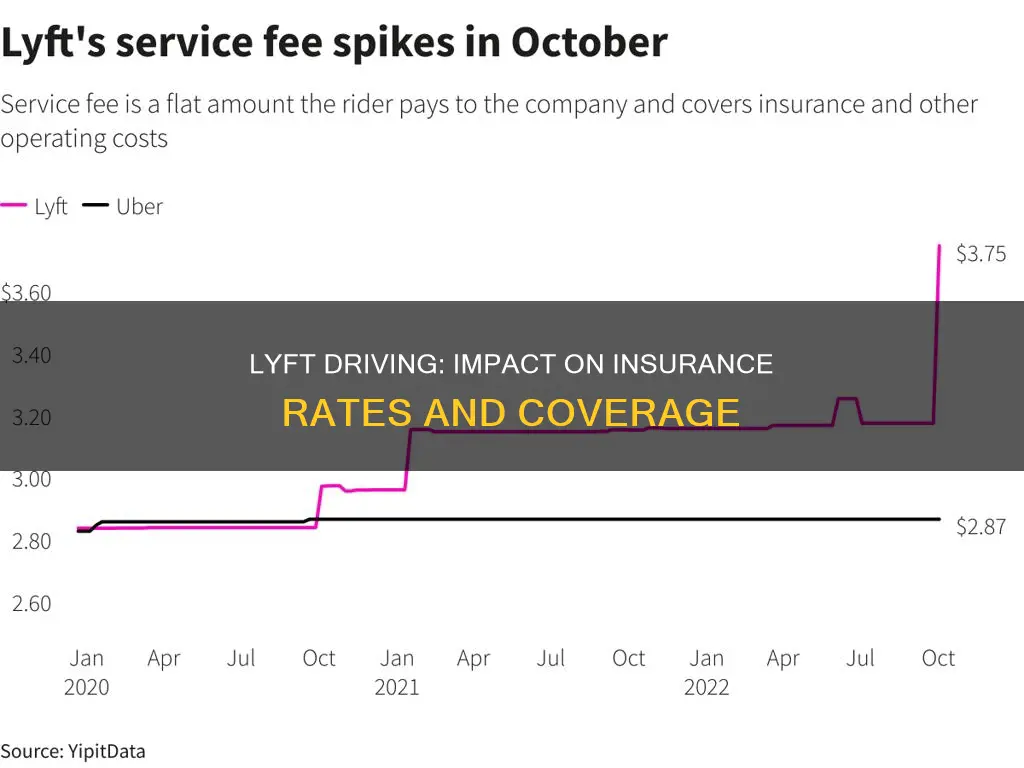

Increased Mileage and Wear: Regularly driving for Lyft means more miles on the odometer, which directly correlates to higher insurance premiums. Insurers consider the mileage of your vehicle when calculating rates. Higher mileage often indicates a higher risk of wear and tear, potential mechanical issues, and increased chances of accidents. As a result, insurance companies may charge more to cover the potential costs associated with a frequently driven vehicle.

Risk Assessment: Insurance providers assess the risk associated with your driving behavior. If you drive for Lyft multiple times a week or every day, it suggests a higher level of engagement in the ridesharing service. This increased activity can be perceived as a higher risk factor, especially if you tend to drive during peak hours or in busy areas. Insurers may adjust your premiums to account for this perceived risk, ensuring they can cover potential liabilities.

Coverage Adjustments: The frequency of your Lyft driving may also impact the type and level of coverage you need. For instance, if you drive for Lyft daily, you might be more exposed to various driving conditions and potential accidents. This could lead to a higher likelihood of comprehensive and collision coverage being necessary. Additionally, considering the nature of ridesharing, liability coverage is essential, as it protects you in case of accidents involving passengers or other vehicles.

Policy Customization: Insurance companies often offer customizable policies, allowing drivers to tailor their coverage based on their specific needs. If you frequently drive for Lyft, you might want to consider adding endorsements or riders to your policy. These could include ridesharing coverage, which provides additional protection while you are actively driving for the company. Customizing your policy ensures that you have the appropriate coverage for your unique driving situation.

Understanding the relationship between your Lyft driving frequency and insurance is essential for managing costs and staying protected. By being aware of these factors, you can make informed decisions about your insurance coverage, ensuring you have the right protection for your vehicle and driving activities.

State Farm Auto Insurance: Understanding Your Policy

You may want to see also

Risk Assessment: Insurance companies evaluate Lyft drivers' risk based on driving patterns and experience

When it comes to assessing the risk of insuring Lyft drivers, insurance companies take a comprehensive approach, considering various factors that influence the likelihood of accidents and claims. One of the primary methods they employ is evaluating driving patterns and experience. This assessment is crucial as it helps insurers understand the potential risks associated with insuring Lyft drivers, especially those who are new to the platform or have a history of driving-related incidents.

Driving patterns play a significant role in risk evaluation. Insurance companies analyze data such as driving frequency, distance traveled, and the time of day or week when the driver operates. For instance, a driver who frequently travels during peak hours or in areas with high traffic congestion may be considered riskier due to increased chances of accidents. Additionally, the duration of a driver's experience with Lyft is a critical factor. Newer drivers might face higher insurance premiums as they are considered less experienced and may have a higher accident probability.

Insurance adjusters also consider the driver's overall driving record and history. This includes previous traffic violations, accidents, or claims made. A driver with a clean record and no history of at-fault accidents is likely to be deemed lower-risk. Conversely, a driver with multiple violations or accidents may face higher insurance rates as they are statistically more prone to causing incidents. The type of vehicle driven by the Lyft driver is another consideration. Different vehicles have varying levels of safety features and maintenance requirements, which can impact the risk assessment.

Furthermore, insurance companies might also review the driver's performance on the Lyft platform. This could involve analyzing trip data, customer ratings, and any feedback provided by passengers. A driver with consistently high customer ratings and positive feedback may be perceived as more responsible and less likely to engage in risky behavior. In contrast, frequent complaints or low ratings could indicate potential risks associated with the driver's conduct.

By considering these factors, insurance companies can make informed decisions about setting premiums and providing coverage for Lyft drivers. This risk assessment process ensures that insurers can accurately evaluate the potential liabilities associated with insuring drivers on the platform, allowing them to offer suitable coverage options while managing their risk exposure. It also encourages Lyft drivers to maintain a safe driving record, which can lead to better insurance rates over time.

Auto Insurance and Physical Therapy: What's Covered?

You may want to see also

Liability Coverage: Lyft drivers need comprehensive liability insurance to cover potential accidents and legal fees

When you become a Lyft driver, one of the most critical aspects of your insurance coverage to consider is liability insurance. This type of insurance is essential for covering potential accidents and the associated legal fees that can arise during your time as a driver. As a Lyft driver, you are required to have a certain level of liability coverage, which is typically set by the company and may vary depending on your location and the specific requirements of your area.

Liability insurance is designed to protect you and your passengers in the event of an accident. It covers the costs associated with injuries sustained by others and damage to their property. For instance, if you were to be involved in a minor collision while driving for Lyft, the liability coverage would help pay for the repairs of the other vehicle or any medical expenses incurred by the passengers. This is crucial, as accidents can happen even to the most cautious drivers, and having adequate insurance ensures that you are financially protected.

The legal fees that can arise from accidents are often substantial and can quickly add up. Even if you are not at fault in an accident, the legal process can be complex and costly. Comprehensive liability insurance provides a safety net, covering these legal expenses, which can include court costs, attorney fees, and other related expenses. This is particularly important for Lyft drivers, as the company may also require you to cover these costs until the legal proceedings are resolved.

It is recommended that Lyft drivers consider purchasing additional insurance coverage beyond the minimum requirements. This could include collision coverage, which pays for repairs to your own vehicle, and comprehensive coverage, which provides protection against non-collision incidents like theft or natural disasters. By having a well-rounded insurance policy, you can ensure that you are fully protected and prepared for any eventuality while driving for Lyft.

In summary, liability coverage is a vital component of insurance for Lyft drivers, as it safeguards against potential accidents and the associated financial burdens. Understanding the requirements and exploring additional coverage options can help drivers make informed decisions to ensure they are adequately protected while providing safe transportation for their passengers.

Understanding Comp OTC: Auto Insurance Simplified

You may want to see also

Discounts and Incentives: Lyft offers insurance discounts, but drivers must meet specific criteria to qualify

Lyft, the popular ride-sharing company, offers various benefits and incentives to its drivers, including insurance discounts. These discounts are designed to reward drivers who meet certain criteria and can significantly reduce their insurance costs. However, it's important to understand the specific requirements and how they impact insurance premiums.

One of the primary ways Lyft provides insurance discounts is through its partnership with insurance companies. When you sign up to drive for Lyft, you are typically required to provide proof of insurance. If you already have a valid auto insurance policy, you may be eligible for a discount. This discount is often based on the type of coverage you have and the insurance company's assessment of your driving record and vehicle. For instance, having a comprehensive policy with a higher deductible might qualify you for a lower premium rate.

To qualify for these discounts, drivers must meet specific criteria set by both Lyft and their insurance providers. These criteria often include maintaining a clean driving record, which means no major violations or accidents. Lyft may also consider your overall driving behavior, such as the number of trips completed and the time spent driving. Additionally, having a reliable and properly maintained vehicle can also increase your chances of qualifying for these discounts.

It's worth noting that the specific requirements and discount amounts can vary. Some insurance companies may offer discounts for completing online safety courses or for having a good credit score. Lyft itself might also provide incentives, such as reduced fees or bonus payments, for drivers who meet certain milestones or maintain a high-quality service rating.

In summary, being a Lyft driver can indeed impact your insurance, but in a positive way through potential discounts. By meeting the specified criteria, drivers can enjoy reduced insurance premiums, making the profession more financially viable. It is essential to review the terms and conditions of both Lyft and your insurance provider to understand the exact requirements and benefits you can expect.

Switching Auto Insurance: A Smooth Transition

You may want to see also

Frequently asked questions

Yes, driving for Lyft can impact your insurance rates. When you drive for Lyft, you are considered self-employed, and this status can affect your insurance coverage and premiums. Insurance companies often view drivers who work for ride-sharing platforms as high-risk due to the increased likelihood of accidents and the potential for more frequent driving. As a result, your insurance provider may adjust your rates accordingly.

As a Lyft driver, your personal insurance policy might not fully cover your ridesharing activities. Lyft provides its own insurance coverage for drivers, but it's essential to understand the terms and conditions. During peak hours or when you're waiting for a ride, Lyft's insurance might not be in effect, leaving you vulnerable. It's recommended to review your policy and consider adding an endorsement or rider to ensure comprehensive coverage.

While you can use your personal insurance, it's crucial to notify your insurer about your new role as a Lyft driver. Failing to do so could result in a denial of claims or increased premiums. Lyft also offers insurance products specifically designed for drivers, which can provide additional coverage and peace of mind. It's best to assess your needs and choose the insurance plan that suits your requirements as a Lyft driver.

Yes, many insurance companies offer discounts to Lyft drivers. These discounts can vary and may include safe driving records, multiple policy discounts, or loyalty rewards. It's worth checking with your current insurer and comparing quotes from different providers to find the best rates. Additionally, Lyft itself may offer insurance-related benefits and discounts to its drivers, so staying informed about their programs is beneficial.

Managing insurance costs as a Lyft driver involves several strategies. Firstly, maintain a clean driving record to avoid rate increases. Consider taking defensive driving courses to improve your skills and potentially qualify for discounts. Review your insurance policy regularly and adjust coverage as needed. Additionally, explore different insurance providers and compare quotes to find the most competitive rates for your specific circumstances as a Lyft driver.