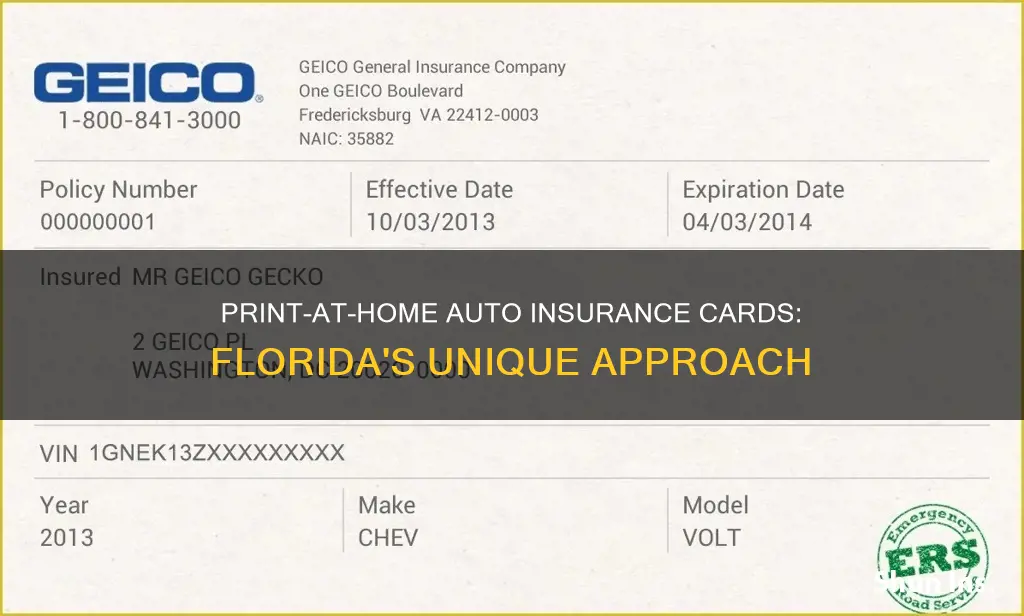

Florida is one of 30 states that allow drivers to show proof of auto insurance through electronic means. In 2013, Governor Rick Scott and the Florida Cabinet approved a measure that allows drivers to show their insurance information via their cell phone, laptop, tablet, or other devices. However, the electronic display must resemble the insurance card. This change in law provides convenience and flexibility for drivers, eliminating the need to carry a physical copy of their insurance card at all times.

| Characteristics | Values |

|---|---|

| Is a printed insurance card required? | No, Florida allows drivers to show proof of insurance electronically. |

| Is an electronic insurance card valid? | Yes, as long as it looks like the insurance card. |

What You'll Learn

Florida's acceptance of digital insurance cards

Florida is one of the many states in the US that allow drivers to provide proof of auto insurance coverage through their phones or other electronic devices. This is known as an electronic insurance card or an e-card.

In 2013, Florida passed a law that allowed drivers to show their proof of insurance electronically. However, an administrative rule still required drivers to carry and display a printed insurance card. It was only in December of that year that Gov. Rick Scott and the Florida Cabinet signed off on an administrative rule change to address this.

According to Trooper Steve Montiero, a traffic safety expert, Florida law requires drivers to have their vehicle registration and insurance in the car. While insurance cards can be displayed electronically, vehicle registration must be shown in physical form.

Auto-Owners Insurance: Exploring Discounts for Non-Alcoholic Drinkers

You may want to see also

The legality of physical insurance cards

In the US, insurance cards are typically physical documents sent by auto insurance companies to prove that drivers meet their state's minimum car insurance requirements. However, the legality of physical insurance cards varies across states. While some states require drivers to carry physical proof of insurance, others have adopted e-card laws that allow electronic verification of insurance coverage.

Florida is among the states that allow electronic proof of auto insurance. In 2013, Florida enacted a law permitting drivers to display their insurance information via their cell phones, laptops, tablets, or other electronic devices. This change provides convenience and flexibility for drivers, eliminating the need to carry a physical insurance card.

However, it is important to note that not all states accept electronic proof of insurance. As of 2022, New Mexico and Georgia are the only states that do not accept electronic proof, with Georgia requiring insurance information to be electronically transferred to a state database for verification.

While the trend towards digital insurance verification is growing, with 30 states adopting e-card laws as of 2014, it is always a good idea to keep a physical copy of your insurance card in your vehicle, such as in the glove box compartment. This ensures that you have a backup in case of technological failures or situations where electronic proof is not accepted.

Additionally, it is worth noting that while electronic proof of insurance is convenient, there may be specific instances where a physical insurance card is preferred or required. For example, in emergency medical situations, having a physical card can expedite the verification process and reduce potential delays in receiving care.

Pennsylvania Auto Insurance: What You Need to Know

You may want to see also

Florida's insurance requirements

Florida is one of 30 states that allow drivers to show proof of insurance electronically, such as on a cell phone or laptop. However, the electronic display must resemble the insurance card. Alternatively, drivers can keep a physical copy of their insurance card in their vehicle.

Vehicle owners in Florida must maintain continuous insurance coverage throughout the registration period, regardless of the vehicle's location. The only exception to this rule is for military members. If a Florida driver moves out of state, they must surrender their license plates and registration before cancelling their insurance policy.

Failure to maintain the required insurance coverage in Florida can result in the suspension of driving privileges and license plates for up to three years, as well as a reinstatement fee of up to $500.

Auto Insurance and Rodent Damage: Are You Covered?

You may want to see also

Displaying insurance on a mobile device

Florida is one of the 30 states that allow drivers to display their proof of auto insurance on their mobile devices. This means that drivers in Florida can now show their insurance information via their cell phones, laptops, tablets, or other devices. This change was implemented by Gov. Rick Scott and the Florida Cabinet in December 2013, removing the previous requirement for drivers to carry and display a printed insurance card.

The new rule is a natural progression that acknowledges the changing technology and customer behaviour. Many insured drivers use insurance company apps on their mobile devices and tablets to access their insurance information. This rule provides added convenience to drivers and helps prevent avoidable ticketing.

It is important to note that the responsibility for the device remains with the driver. If the device is dropped or damaged while in an officer's possession, it will not be considered the officer's fault. Additionally, while Florida law allows for electronic proof of auto insurance, drivers are still required to carry a physical copy of their vehicle registration.

The ability to display insurance on a mobile device improves convenience and ensures that drivers can easily provide proof of insurance during traffic stops. This change aligns with the trend across the United States, where almost every state now accepts electronic proof of insurance, with New Mexico being the only exception as of October 2022.

California's Digital Auto Insurance Card Law: Everything You Need to Know

You may want to see also

The benefits of digital insurance cards

Florida is one of 30 US states that allow drivers to show law enforcement officers proof of automobile insurance through their cell phones and other electronic devices. This means that Florida drivers can display their insurance information via their cell phones, laptops, tablets, or other devices.

The use of digital insurance cards offers several advantages over traditional physical cards. Firstly, it eliminates the need for printing and shipping costs, saving insurance providers money and reducing environmental waste. Secondly, digital cards can be delivered to customers much faster, allowing them to receive their insurance ID cards immediately upon signing up for a new policy. Thirdly, digital cards can be easily updated automatically as insurance premiums change, policies are updated, or customers change or cancel their insurance. These updates ensure that customers always have the most accurate and up-to-date information.

Additionally, digital insurance cards provide a more interactive experience for customers. Insurance companies can add personalized policy information, such as policy numbers, customer names, effective dates, expiration dates, payment status, and policy usage. They can also include clickable links to websites, phone numbers, email addresses, or map locations, making it more convenient for customers to access relevant information and services. Furthermore, digital insurance cards are easily accessible offline, providing customers with peace of mind and eliminating the worry of not having a physical card on hand.

The convenience, speed, and accessibility of digital insurance cards make them a preferred choice for customers, and the environmental benefits and cost savings make them advantageous for insurance providers.

Admiral Insurance: Understanding Auto-Renewal

You may want to see also

Frequently asked questions

Yes, Florida allows drivers to show proof of auto insurance either electronically or by showing a printed paper insurance card.

Yes, Florida law requires drivers to carry proof of insurance with them whenever they drive, and it must be current.

Yes, Florida is one of the 30 states that allow drivers to show law enforcement officers their proof of automobile insurance through their cell phone or other electronic means.

Yes, your electronic display must look like the insurance card.