Florida Power and Light Corporation (FPL) does not carry storm damage insurance. FPL is not responsible for food loss, power outages, voltage fluctuations, or property damage caused by hurricanes, weather-related conditions, or other acts of nature. Instead, the company urges its customers to prepare for storms and hurricanes by developing an emergency plan, gathering supplies, and staying safe. FPL provides guidance and resources to help customers before, during, and after storms, but it is not liable for damages caused by occurrences beyond its control.

| Characteristics | Values |

|---|---|

| Is Florida Power and Light Corporation responsible for storm damage? | No, FPL is not responsible for food loss, power outages, voltage fluctuations, or property damage caused by hurricanes, weather-related conditions, or other acts of nature. |

| What is the customer's responsibility regarding a claim? | Customers should retain copies of all receipts for a full and accurate assessment of any loss or damage suffered, minimize damages, and ensure losses or expenses are reasonable in relation to the loss. |

| What is FPL's responsibility regarding a claim? | FPL will respond to claims promptly and fairly, determine how the incident happened, evaluate if they caused it, assess the extent of the damages, and determine fair compensation. |

| What is included in the Florida Hurricane Windstorm Insurance policy? | Coverage for damage caused by wind during a hurricane, including ensuing damage to the interior of a building or property inside caused by rain, snow, sleet, hail, sand, or dust if the direct force of the windstorm first damages the building. |

| What is the Florida Hurricane Deductible? | A hurricane deductible is a percentage of the insurance coverage on the dwelling or a dollar deductible higher than those for other causes of loss. |

What You'll Learn

Florida Power and Light Corporation's (FPL) liability for storm damage

Florida Power & Light Company (FPL) is the largest power utility in Florida, serving around 5 million customers and 11 million people. As a rate-regulated electric utility, FPL generates, transmits, distributes, and sells electric energy.

FPL offers storm restoration services to its customers, responding to outages caused by severe weather, including heavy rain and wind gusts. The company provides updates on its website and mobile app, allowing customers to view power outages and restoration information for their area. FPL also provides tips for preparing for storms and taking appropriate safety measures, such as staying away from downed power lines.

In the aftermath of hurricanes, FPL focuses on restoring power to affected customers. They employ a large workforce, including assistance from other states, to address power outages and infrastructure damage. FPL also provides financial assistance through its FPL Care to Share® program for eligible customers who need repairs on damaged electrical equipment before their power can be restored.

Regarding liability for storm damage, FPL has faced legal disputes over its role in preventing power outages during hurricanes. In a class-action lawsuit related to Hurricane Irma in 2017, plaintiffs argued that FPL did not meet its obligations to help prevent outages, such as carrying out a storm "hardening" plan and adequately clearing vegetation near power lines. FPL disputed these claims, citing a new state law that protects utilities from liability for power outages during emergencies. The outcome of this legal battle is not yet clear, with ongoing arguments over the retroactive application of the new law.

FPL also offers surge protection programs for businesses to help safeguard their equipment from power surges that can occur during storms. These programs provide commercial-grade surge protectors installed directly at the electric meter to defend against unpredictable power surges.

While FPL actively works to restore power and assist customers in the aftermath of storms, the company also engages in proactive measures to enhance its energy grid's resilience. FPL has invested in building a stronger and smarter grid, including underground power lines that are less susceptible to wind-blown debris.

Contractors: Errors and Omissions Insurance

You may want to see also

FPL's storm preparation advice

Develop an Emergency Plan:

- Secure your home, car, and boat, and know who will help you.

- Decide on evacuation routes and where you will stay during the hurricane.

- Make arrangements for pets.

- If staying at home, prepare to be self-sufficient for up to 14 days without running water or electricity.

- Review your emergency plan with your family.

- Photograph or videotape your home for insurance purposes.

Address Special Needs:

- Contact your local emergency management office if you or anyone in your area has special needs in the event of evacuation.

- Make backup power arrangements or relocate if someone relies on electric-powered, life-sustaining medical equipment.

Communication Considerations:

- Update your contact information on your FPL account.

- Consider getting a non-cordless, non-mobile telephone for your home in case of power and mobile service outages.

Tree Trimming and Debris Clearance:

- Have trees properly trimmed by professionals to minimize their impact on your home and power lines.

- Clear debris before a hurricane warning announcement when trash pickup is suspended.

Supplies and Provisions:

- Purchase bottled water—at least one gallon per person per day.

- Gather non-perishable food, a non-electric can opener, disposable dinnerware and utensils, matches or a lighter, medications, personal hygiene supplies, baby supplies, pet food, trash bags, paper products, soaps and detergents, rubber gloves, sunscreen, insect repellent, tarps, clothing, blankets, pillows, and items for entertainment.

- Check your radio, flashlights, and batteries.

- Obtain cash or traveler's checks.

- Fill up your car with gas and propane tanks for cooking.

- Charge your cell phone and obtain a car charger.

Food and Water Conservation:

- Turn refrigerators and freezers to their coldest settings to keep food fresh for longer.

- Make blocks of ice and store them in coolers.

- Sanitize your bathtub and fill it with water.

Documentation and Valuables:

- Gather important documents and put them in a waterproof container.

- Make a list of important phone numbers, including your FPL account number.

- Store objects from your yard inside.

- Fasten doors and windows.

- Cover valuables and furniture with plastic and move them away from windows.

Safety Measures:

- If using a portable generator, follow the manufacturer's instructions and set it up outside. Do not wire it directly to your breaker or fuse box.

- Do not travel until it is safe.

- Report dangerous conditions and stay away from downed power lines and flooded areas.

- If your roof or windows leak, turn off circuit breakers and disconnect electrical appliances. Do not stand in water while operating switches or unplugging devices.

- Use battery-operated flashlights and lanterns instead of candles.

- Be cautious when using a grill, portable stove, or other emergency cooking devices.

- Make emergency repairs only when it is safe to do so, giving priority to repairs that prevent looting or further damage.

Carry Guard Insurance: Attorney Provision?

You may want to see also

FPL's storm safety advice

Storms can be dangerous, and Florida Power and Light Corporation (FPL) offers a range of safety advice to help keep you and your family secure. Here are some essential storm safety tips from FPL:

Prepare for the Storm:

- Develop an emergency plan: Identify evacuation routes, decide on a meeting place, and plan how to secure your home, car, and boat.

- Address special needs: Contact your local emergency management office if you or anyone in your household has special needs. Make backup power arrangements or plan to relocate if someone relies on electric-powered medical equipment.

- Update your contact information: Keep your phone number and email address on your FPL account up to date.

- Trim trees and vegetation: Engage professionals to trim trees and vegetation around power lines to minimize their impact on your home and neighbourhood.

- Gather supplies: Stock up on bottled water, non-perishable food, medications, personal hygiene items, baby supplies, pet food, and other essentials.

- Prepare for power and water loss: Charge your devices, turn refrigerators and freezers to their coldest settings, make blocks of ice, and fill your bathtub with water.

- Gather important documents: Put your essential paperwork in a waterproof container, along with a list of important phone numbers and your FPL account number.

- Secure your home: Bring objects inside, fasten doors and windows, cover valuables and furniture with plastic, and unplug non-essential electrical equipment.

During the Storm:

- Stay informed: Use the FPL Mobile App or visit FPL.com/storm for updates and to report outages.

- Stay safe: Do not travel until it is safe. Stay away from downed power lines and flooded areas. If your roof or windows leak, turn off circuit breakers and disconnect electrical appliances.

- Avoid open flames: Do not use candles; opt for battery-operated flashlights and lanterns instead.

- Be cautious with cooking: Exercise caution when using a grill, portable stove, or other emergency cooking devices.

- Make emergency repairs: Only when it is safe to do so, prioritize repairs that prevent looting or further damage.

After the Storm:

- Continue to conserve refrigeration: Check food for spoilage and throw out anything questionable.

- Report outages and check for updates: Utilize the FPL Mobile App or visit FPL.com/storm to stay informed and report power outages.

- Practice generator safety: If using a portable generator, follow the manufacturer's instructions and connect appliances directly to it. Do not wire the generator to your breaker box to avoid power backflow and potential injuries.

- Stay vigilant: Be cautious of hazardous conditions, such as downed power lines or damaged electrical equipment. Report any issues to FPL or the appropriate authorities.

Modular Manufacturing: Insurance Necessity?

You may want to see also

FPL's power restoration process after a storm

Florida Power & Light Company (FPL) has a clear process to restore power after a storm. The company's primary goal is to restore power to the largest number of customers as safely and quickly as possible. FPL follows a well-defined plan to get life back to normal, working tirelessly to repair power plants, transmission lines, and substations, which are all critical to providing electricity to its customers.

FPL's power restoration process is guided by a set of priorities. Firstly, they focus on restoring power to critical facilities, such as hospitals, police and fire stations, communication centres, water treatment plants, and transportation providers. This ensures that essential services remain operational during the aftermath of a storm.

Simultaneously, FPL works to restore power to major thoroughfares and areas with needed community services, such as supermarkets, pharmacies, and gas stations. This two-pronged approach ensures that critical infrastructure and community services are given priority while also restoring power to the largest number of customers in the shortest amount of time.

Once the larger repairs are completed, FPL shifts its focus to restoring power to smaller groups of customers. They work around the clock until every single customer has their power restored. FPL also provides estimated restoration times based on the damage inflicted on the electric system and the resources available. Within 24 hours of the storm, they provide initial estimates, followed by more detailed county-level and local-level estimates in the following days.

FPL also offers an online, interactive Power Tracker Map that allows customers to view real-time outage and restoration information for their specific area. This tool helps customers stay informed and plan accordingly during power outages.

FPL's power restoration process is a well-coordinated and efficient operation, with the entire workforce dedicated to getting life back to normal for their customers as quickly and safely as possible.

Insurance Paper: Must-Have or No?

You may want to see also

Homeowner's insurance and hurricane windstorm coverage in Florida

Homeowners Insurance and Hurricane Windstorm Coverage in Florida

Florida is prone to hurricanes and tropical storms, and wind damage is a significant concern for homeowners in the state. While homeowners insurance policies typically cover wind damage, there are some important nuances to be aware of when it comes to hurricane windstorm coverage in Florida. Here's what you need to know:

Yes, windstorm damage is typically covered under a standard homeowners, condo, or renters insurance policy in Florida. However, it's important to understand the specifics of your policy, as there may be separate deductibles and conditions for windstorm damage caused by named storms, such as hurricanes or tropical storms.

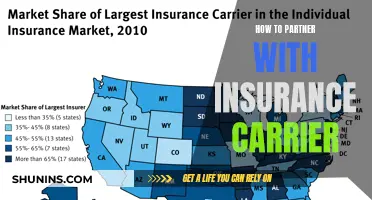

A named storm deductible is a separate deductible that applies specifically to damage caused by a "named storm," such as a hurricane or tropical storm. In Florida, insurance companies are required to offer named storm deductibles of $500, 2%, 5%, and 10% of your dwelling coverage amount. This means that if your home is insured for $250,000 and you have a 2% deductible, you would pay up to $5,000 out-of-pocket for windstorm damage caused by a named storm.

Florida Statutes on Windstorm Insurance:

The 2023 Florida Statutes outline the following key points regarding windstorm coverage:

- Windstorm coverage is mandatory in homeowners insurance policies in Florida.

- Homeowners have the option to exclude windstorm coverage by providing a written statement to their insurance company, accepting responsibility for any windstorm damage.

- Lender's approval is required if the homeowner has a mortgage or lien on the property.

- Personal belongings can also be excluded from windstorm coverage, but this must be communicated in writing to the insurance provider.

- Once a homeowner decides on their windstorm coverage, that decision remains in effect for the duration of the insurance policy. Changes are typically made during policy renewal.

How to Get Windstorm Insurance in Florida:

Under Florida law, insurers that provide property coverage must include windstorm damage coverage in their standard policies. However, homeowners in high-risk areas, such as coastal communities, may have difficulty obtaining coverage through standard carriers and may need to obtain a policy through the state-backed Citizens Property Insurance Corporation or the Florida Market Assistance Program (FMAP).

Ways to Save on Windstorm Insurance in Florida:

Living in a high-risk area can increase insurance costs. Here are some ways to potentially save on windstorm insurance in Florida:

- Florida offers the Hurricane Loss Mitigation Program, which provides grants for mitigation efforts such as retrofits, inspections, and modifications to make homes more wind-resistant.

- Florida law entitles homeowners with wind-resistant features to wind mitigation credits, resulting in discounted insurance rates.

- Implementing protective measures, such as storm shutters, proper sealing of windows and doors, roof reinforcements, and wind-rated garage doors, can help reduce insurance premiums.

Frequently Asked Questions:

While Florida law does not mandate homeowners insurance, most mortgage lenders will require it. Even if your lender doesn't require it, having windstorm coverage can provide financial protection against catastrophic storm losses.

No, flood coverage is not included in standard homeowners insurance policies and must be purchased separately. Flood insurance is available through FEMA's National Flood Insurance Program or private insurers in Florida.

Hurricane windstorm damage is covered by standard property insurance policies but with a separate deductible for named storms. Windstorm insurance specifically covers repair costs for windstorm events, while flood insurance is needed for water damage caused by hurricanes.

Country Insurance: Concealed Carry Coverage

You may want to see also

Frequently asked questions

No, Florida Power and Light Corporation (FPL) does not carry storm damage insurance. FPL is not responsible for food loss, power outages, voltage fluctuations, or property damage caused by hurricanes, weather-related conditions, or other acts of nature.

Storm damage insurance typically covers losses or damages caused by hurricanes, windstorms, flooding, lightning strikes, and other weather-related events. It provides financial protection for repairs, replacements, and temporary accommodations if your home is damaged or destroyed by a covered peril.

To file a claim for storm damage, follow these steps:

Contact your insurance provider: Inform them of the damage and ask about the specific requirements and procedures for filing a claim.

Submit the claim: Provide all the required information and documentation to your insurance company.

What are some ways to prepare for a storm and minimize potential damage?

- Develop an emergency plan: This includes knowing evacuation routes, having a meeting place, and securing important documents and valuables.

- Gather supplies: Stock up on non-perishable food, water, flashlights, batteries, and other essential items.

- Protect your home: Cover windows, bring outdoor items inside, and trim trees and vegetation to minimize potential hazards.

- Stay informed: Listen to local news and weather updates, and follow instructions from local authorities.