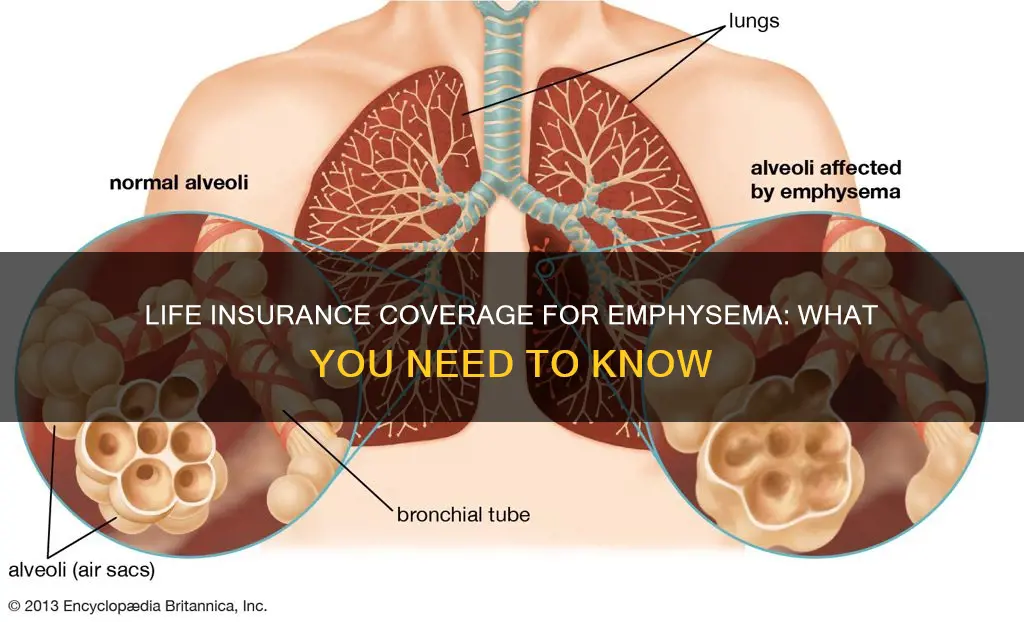

Emphysema is a lung disease that causes breathlessness and affects over 3 million people in the United States. It is a progressive disease, which means it gets worse over time, and there is currently no cure. The condition is usually caused by cigarette smoking, but it can also be caused by exposure to air pollution, chemical fumes, or other airborne toxins. As a result of the damage it causes to the lungs, emphysema makes it difficult for the body to absorb oxygen and release carbon dioxide, causing shortness of breath. So, does life insurance cover emphysema?

| Characteristics | Values |

|---|---|

| Can you get life insurance coverage with emphysema? | Yes, but it may depend on the severity of your condition and other factors such as your age, overall health, and lifestyle habits. |

| How do insurance companies view emphysema? | Emphysema is considered a long-term progressive disease, and most (if not all) of the best life insurance companies will consider anyone who has been “officially” diagnosed with emphysema as a “high-risk” applicant. |

| What information will insurance companies ask for? | Insurance companies will typically ask for a range of information about your emphysema and overall health when you apply for life insurance. This includes the date of your emphysema diagnosis, the type and severity of your emphysema, and any related health issues or complications. |

| What rate or price can you qualify for? | The rate you can qualify for after being diagnosed with emphysema will depend on several factors, including the severity of your condition, any related health issues or complications, and your overall health status. If you have mild emphysema and have not experienced significant health issues related to your condition, you may still be able to qualify for a standard or preferred rate. However, if your emphysema is more severe, and you have experienced related health issues, you may be considered a higher risk and could be offered a substandard or rated policy. |

What You'll Learn

- Does life insurance cover emphysema if it's caused by smoking?

- Does life insurance cover emphysema if it's caused by air pollution?

- Does life insurance cover emphysema if it's caused by chemical fumes?

- Does life insurance cover emphysema if it's caused by respiratory infections?

- Does life insurance cover emphysema if it's caused by genetics?

Does life insurance cover emphysema if it's caused by smoking?

Life insurance policies provide your beneficiaries with a specific amount of money outlined in the policy should you die. Smokers pay higher life insurance rates than non-smokers because insurance companies are protecting themselves from the higher risk that smokers pose. Tobacco users are committing fraud if they fail to disclose their smoking habits when applying for a life insurance policy.

Emphysema is a form of chronic (long-term) lung disease that causes shortness of breath. It is caused by the destruction of air sacs in the lungs, mainly from exposure to cigarette smoke. It is one of the two main conditions that make up chronic obstructive pulmonary disease (COPD), the other being chronic bronchitis. There is no cure for emphysema, but treatments can help reduce symptoms and improve quality of life.

The main cause of emphysema is smoking, but other causes include air pollution, chemical fumes, and genetic factors. Symptoms include shortness of breath, coughing, fatigue, wheezing, and tightness in the chest. Emphysema usually develops after many years of smoking. The longer and more frequently a person smokes, the higher their chances of developing emphysema.

While it is difficult to determine an exact cause, most experts agree that smoking contributes to emphysema. The physical damage sustained by the lungs as a result of exposure to tobacco smoke or the toxins released in tobacco products encourages emphysema to develop. The chemicals and particles released in the smoke lead to irritation, which progresses into inflammation, and the thin walls of the alveoli in the lungs are eventually destroyed with sustained exposure.

In conclusion, life insurance covers emphysema even if it is caused by smoking. However, smokers will pay higher insurance rates and may have to disclose their smoking habits when applying for a policy. Emphysema is a serious condition that can develop as a result of smoking, and there is currently no cure.

Cholesterol and Life Insurance: What's the Connection?

You may want to see also

Does life insurance cover emphysema if it's caused by air pollution?

Life insurance companies consider emphysema a factor because it is a chronic and progressive disease that can have significant consequences for one's health. Emphysema is a pre-existing medical condition that falls under the diagnosis of Chronic Obstructive Pulmonary Disease (COPD). It is a lung disease that damages the alveoli (air sacs) within the lungs, usually caused by smoking or exposure to air pollution, dust, or chemical fumes for a prolonged period.

Yes, it is possible to qualify for life insurance if you have been diagnosed with emphysema. However, it may depend on the severity of your condition and other factors such as your age, overall health, and lifestyle habits. Most, if not all, of the best life insurance companies will consider anyone who has been "officially" diagnosed with emphysema as a "high-risk" applicant because emphysema is considered a long-term progressive disease.

The rate or price you can qualify for after being diagnosed with emphysema will depend on several factors, including the severity of your condition, any related health issues or complications, and your overall health status. If you have mild emphysema and have not experienced any significant health issues related to your condition, you may still be able to qualify for a standard or preferred rate. However, if your emphysema is more severe, and you have experienced related health issues such as lung infections or heart disease, you may be considered a higher risk and could be offered a substandard or rated policy.

In general, the premiums for life insurance policies are based on the level of risk posed by the insured individual. The higher the risk, the higher the premiums. Insurers may also take into account your age, gender, and lifestyle factors, such as smoking or alcohol use, which can also impact the cost of your policy.

If you have severe emphysema, it is important to note that breathing is extremely difficult, and you may require regular medical help. There is currently no cure for emphysema, and even if you quit smoking, your lungs will not be able to heal the existing damage. However, treatments can help reduce your symptoms and improve your quality of life.

While I cannot provide a definitive answer regarding whether life insurance covers emphysema caused specifically by air pollution, it is clear that a diagnosis of emphysema will impact your life insurance options, regardless of the cause. The best course of action is to work with an experienced agent who can help you navigate the underwriting process and find the best policy for your unique situation.

Chest Pain: Can It Impact Your Life Insurance Eligibility?

You may want to see also

Does life insurance cover emphysema if it's caused by chemical fumes?

Life insurance companies consider emphysema a significant factor in their decision-making because it is a chronic and progressive disease that can have severe consequences for one's health. Emphysema is a pre-existing medical condition that falls under the umbrella diagnosis of Chronic Obstructive Pulmonary Disease (COPD). It causes damage to the alveoli (air sacs) within the lungs and is usually caused by smoking or prolonged exposure to air pollution, dust, or chemical fumes.

If you have been diagnosed with emphysema, it is possible to qualify for life insurance. However, you will likely be considered a "high-risk" applicant by most insurance companies. The rate or price you can qualify for will depend on several factors, including the severity of your condition, any related health issues, and your overall health status. If your emphysema is mild and you have not had any significant health issues related to your condition, you may still be able to qualify for a standard or preferred rate. However, if your emphysema is more severe and you have experienced related health issues, you may be considered a higher risk and offered a more expensive substandard or rated policy.

Insurance companies will typically ask for a range of information about your emphysema and overall health when you apply for life insurance. They may request information such as the date of your diagnosis, the type and severity of your emphysema, any related health issues or complications, your treatment plan, and medications prescribed. They may also require pulmonary function tests (PFTs) and other medical tests or exams to assess the severity of your condition. Additionally, they may ask about your lifestyle, including your smoking history, alcohol consumption, and physical activity levels.

To ensure that you get the best life insurance policy for your needs, it is recommended to work with an experienced agent who understands the underwriting process for emphysema. It is crucial to provide accurate and detailed information about your health when applying for life insurance. Maintaining good health habits, such as quitting smoking, maintaining a healthy diet, and engaging in regular exercise, can also help improve your overall health status and reduce the risk of complications.

In summary, while it is possible to qualify for life insurance with emphysema caused by chemical fumes, you may face higher rates and be considered a high-risk applicant. The specific rate or price you qualify for will depend on the severity of your condition and other factors. Working with an experienced agent and providing accurate information can help you navigate the application process and find the best policy for your unique situation.

Group Life Insurance: Physical Exam Needed?

You may want to see also

Does life insurance cover emphysema if it's caused by respiratory infections?

Life insurance companies consider emphysema a significant factor because it is a chronic and progressive disease that can have serious consequences for one's health. Emphysema is a pre-existing medical condition that falls under the umbrella diagnosis of Chronic Obstructive Pulmonary Disease (COPD). It is a lung disease that causes the alveoli (air sacs) within the lungs to become damaged, leading to difficulty breathing. The main cause of emphysema is smoking, but it can also be caused by air pollution, chemical fumes, and respiratory infections.

If you have been diagnosed with emphysema, you may still be able to qualify for life insurance. However, it will depend on the severity of your condition and other factors such as your age, overall health, and lifestyle habits. Most life insurance companies will consider anyone with emphysema as a ""high-risk" applicant because emphysema is a long-term progressive disease. The insurance company will want to know the date of your diagnosis, the type and severity of your emphysema, and any related health issues or complications. They will also be interested in your treatment plan and medications prescribed.

The rate or price you can qualify for will depend on several factors, including the severity of your condition, any related health issues, and your overall health status. If you have mild emphysema and have not experienced any significant health issues related to your condition, you may be able to qualify for a standard or preferred rate. However, if your emphysema is more severe and you have experienced related health issues, you may be considered a higher risk and could be offered a more expensive substandard or rated policy.

In summary, while it is possible to obtain life insurance coverage if you have emphysema caused by respiratory infections, you may face higher rates and be subject to more stringent requirements due to the condition's progressive nature and potential impact on your overall health. Working with an experienced agent and providing accurate and detailed information about your health can help you navigate the application process and find the best policy for your unique situation.

Liberty Mutual's Life Insurance: Drug Testing and Policy Details

You may want to see also

Does life insurance cover emphysema if it's caused by genetics?

Life insurance companies consider a range of factors when determining coverage and rates, including age, gender, health, prescription drugs, and lifestyle. While it is possible to qualify for life insurance if you have emphysema, insurance companies will view anyone with the disease as a “high-risk” applicant because emphysema is a long-term progressive disease. The rate or price you can qualify for will depend on several factors, including the severity of your condition, any related health issues or complications, and your overall health status.

If you have mild emphysema and have not experienced any significant health issues related to your condition, you may still be able to qualify for a standard or preferred rate. However, if your emphysema is more severe, and you have experienced related health issues such as lung infections or heart disease, you may be considered a higher risk and could be offered a substandard or rated policy.

Insurance companies will typically ask for a range of information about your emphysema and overall health when you apply for life insurance. This is because emphysema is a chronic respiratory disease that can have a significant impact on your overall health and life expectancy. The more severe your condition, the higher the risk you may pose to the insurer and the more you may need to pay for your policy.

Some of the specific information that insurance companies may request includes the date of your emphysema diagnosis, the type and severity of your emphysema, and any related health issues or complications. For instance, if you have a history of lung infections or heart disease related to your emphysema, the insurer will likely want to know more about these conditions.

Insurance companies will also be interested in your treatment plan and medications prescribed for your emphysema. This information can give the insurer a better idea of how well-managed your condition is and whether you are taking steps to control it. If you are taking medications, the insurer may ask for more information about the dosages and frequency of use.

The insurance company may also require pulmonary function tests (PFTs). These tests help to measure how well your lungs are working and can provide insight into the severity of your emphysema. Other medical tests or exams may be required depending on the severity of your condition and overall health status.

It is important to note that the Genetic Information Nondiscrimination Act (GINA) of 2008 prohibits health insurance companies from using genetic information to make coverage or rate decisions. However, GINA protections do not extend to life insurance, disability insurance, or long-term care insurance. Therefore, life insurance companies can request and use genetic information when making coverage and rate decisions.

In summary, while it is possible to qualify for life insurance if you have emphysema caused by genetics, you may be considered a "high-risk" applicant, and the rate or price you can qualify for will depend on the severity of your condition and other factors. It is crucial to provide accurate and detailed information about your health when applying for life insurance to ensure that you receive the most accurate quote and coverage that meets your needs.

Life Insurance Beneficiaries and Tax: What's the Verdict?

You may want to see also

Frequently asked questions

Yes, it is possible to qualify for life insurance if you have emphysema. However, it may depend on the severity of your condition and other factors such as your age, overall health, and lifestyle habits. Most insurance companies will consider anyone with emphysema as a "high-risk" applicant.

Insurance companies will typically ask for a range of information about your emphysema and overall health when you apply for life insurance. This includes the date of your diagnosis, the type and severity of your emphysema, and any related health issues or complications. They will also be interested in your treatment plan and medications prescribed.

The rate you can qualify for will depend on several factors, including the severity of your condition, any related health issues, and your overall health status. If you have mild emphysema and have not experienced significant health issues related to your condition, you may still be able to qualify for a standard or preferred rate. However, if your emphysema is more severe, you may be considered high risk and offered a substandard or rated policy.