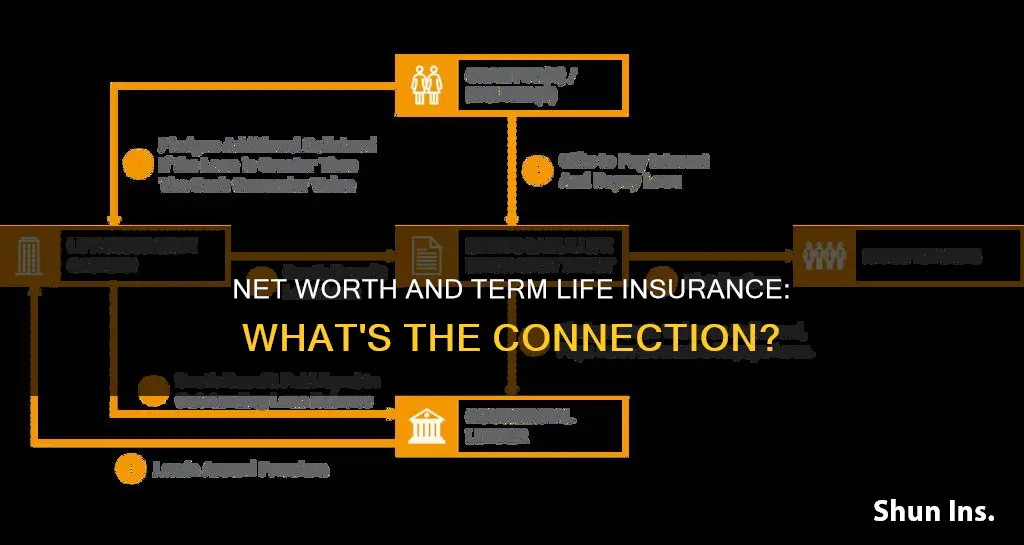

Net worth is a valuable metric for understanding your financial health. It is calculated by subtracting your liabilities (debts and financial obligations) from your assets (cash, investments, property, etc.). Life insurance policies can be included in this calculation, but it depends on the type of policy. Term life insurance, which is pure insurance without any cash value, is not considered an asset and therefore does not contribute to net worth. On the other hand, permanent life insurance policies like whole life, universal life, and variable life insurance can accumulate cash value and are thus considered assets, positively impacting an individual's net worth.

| Characteristics | Values |

|---|---|

| Term life insurance considered as net worth | No |

| Whole life insurance considered as net worth | Yes |

| Universal life insurance considered as net worth | Yes |

| Variable life insurance considered as net worth | Yes |

| Universal variable life insurance considered as net worth | Yes |

What You'll Learn

- Term life insurance is not counted as an asset during the policyholder's lifetime

- Term life insurance is the cheapest form of life insurance

- Permanent life insurance policies can be used as an investment tool

- Life insurance death benefits are income-tax-free for beneficiaries

- Life insurance can be used to protect business owners and their beneficiaries

Term life insurance is not counted as an asset during the policyholder's lifetime

Term life insurance is rarely considered an asset during the policyholder's lifetime. This is because term life insurance does not have any cash value. It is pure insurance that only has value if the insured person dies within the specified term. If the policyholder passes away, the death benefit goes to the beneficiary tax-free. However, if the policy expires before the policyholder's death, there is no payout.

Term life insurance is different from other types of insurance, such as car, homeowners, or health insurance, which reimburse the policyholder for an economic loss. On the other hand, life insurance compensates the policyholder's beneficiaries for an event that is certain to occur, i.e., the policyholder's death.

Term life insurance is also different from permanent life insurance, which lasts for the entire life of the insured person and has a cash value component. This cash value can be used by the policyholder for various purposes, such as taking out loans or paying policy premiums.

While term life insurance is not considered an asset during the policyholder's lifetime, it still provides valuable protection for beneficiaries in the event of the policyholder's death. It is also the cheapest form of life insurance, making it a good option for those on a tight budget.

Life Insurance: Unearned Income or Smart Investment?

You may want to see also

Term life insurance is the cheapest form of life insurance

Term life insurance is the most affordable type of life insurance policy. It provides coverage for a fixed period, typically ranging from 10 to 30 years. If the insured person passes away during the term, their beneficiaries will receive the death benefit, subject to the policy conditions. However, if the policyholder outlives the term, the policy expires without any payout.

Term life insurance is a popular choice for those seeking affordable protection for a specific period, such as when their children are young or until their business stabilizes. It is also suitable for individuals who want to protect against income loss due to the premature death of a key employee in their company. Additionally, term life insurance can facilitate the transition of business ownership upon the death of a partner, ensuring a smooth transition and preventing disputes.

Compared to permanent life insurance, term life insurance offers lower premiums, making it an attractive option for those on a tight budget. Permanent life insurance, on the other hand, provides coverage for an individual's entire lifetime, as long as they continue to pay the premiums. While permanent policies offer lifelong coverage and a cash value component, they come with significantly higher costs.

When choosing between term and permanent life insurance, individuals should consider their specific needs and financial goals. Term life insurance is ideal for those seeking affordable coverage for a defined period, while permanent life insurance may be more suitable for those seeking lifelong protection and willing to pay higher premiums for additional benefits.

Life Insurance: Epidemic Coverage and Your Policy

You may want to see also

Permanent life insurance policies can be used as an investment tool

Permanent life insurance policies, such as whole life insurance and universal life insurance, can be used as an investment tool. These policies allow the owner to build cash value over time and provide access to these funds. This cash value component makes permanent life insurance policies an investment vehicle that can be used to diversify one's portfolio and hedge against market risk.

- Tax-deferred savings: The cash value in a permanent life insurance policy grows tax-deferred. This means that any interest earned on the cash value is not taxed as long as the funds remain in the policy. This provides a tax-advantaged way to grow your savings over time.

- Withdrawals and loans: Depending on the policy, you may be able to withdraw funds from the cash value or take out a loan against the policy. Withdrawals up to the policy basis (the total amount of premiums paid) are typically tax-free, while withdrawals above this amount may be subject to income tax. Loans taken against the policy are not taxed as income but accrue interest over time.

- Collateral for loans: In some cases, you can use your permanent life insurance policy as collateral when taking out a loan. This can make it easier to get approved for a loan or obtain a better interest rate.

- Supplemental retirement income: If you buy a permanent policy when you're young, the cash value can grow significantly by the time you retire. You can then withdraw funds from the policy to supplement your retirement income.

- Estate planning: The cash value in a permanent life insurance policy can be used to pay estate taxes, ensuring that your beneficiaries receive the full value of their inheritance.

- Peace of mind: Permanent life insurance provides lifelong coverage, giving you peace of mind that your loved ones will be financially protected, especially if you have lifelong dependents, such as children with disabilities.

Living Benefits: Mortgage Protection and Life Insurance

You may want to see also

Life insurance death benefits are income-tax-free for beneficiaries

Life insurance is an important financial tool, even for those with significant assets. It plays a crucial role in estate planning and provides a financial safety net for loved ones. While term life insurance is an affordable option for those on a tight budget, it does not count towards your net worth during your lifetime. This is because term life insurance is pure insurance without any cash value. On the other hand, some life insurance policies, such as whole life, universal life, variable life, and universal variable life insurance, do count as assets for net worth because they have a cash value component.

Life insurance death benefits are typically not subject to income tax, and beneficiaries do not need to report the payout on their taxes. This means that the death benefit payout is tax-exempt and can provide financial support to your loved ones without reducing the amount through taxation. However, there are a few exceptions to this rule. If the death benefit payout earns interest, such as in the case of a specific income payout, retained asset account, or lifetime or fixed-period annuity, then the interest accrued will be subject to taxation. Additionally, if the death benefit is paid to the insured's estate instead of directly to a beneficiary, it may be subject to federal or state estate tax if the estate exceeds the exemption limit.

It is important to note that while the death benefit itself is not taxable, any interest received by the beneficiary is considered taxable income and should be reported as such. This includes situations where the death benefit is paid out in installments, and the remaining portion earns interest. In such cases, the interest would be taxable, while the principal amount of the death benefit remains tax-free.

To ensure a smooth process for your beneficiaries, it is essential to designate primary and secondary beneficiaries and keep them informed about the policy. This will enable them to claim the death benefit promptly by providing the necessary documentation, such as a death certificate and proof of the deceased's coverage.

Life Term Insurance: Gaining Cash Value?

You may want to see also

Life insurance can be used to protect business owners and their beneficiaries

Life insurance is an essential tool for business owners to protect their interests, their families, and their companies. While it may be overlooked, it is a critical component of financial planning, especially for high-net-worth individuals. Here are some ways life insurance can be used to protect business owners and their beneficiaries:

Protecting Your Family

Life insurance is crucial for business owners who support a family. In the unfortunate event of the owner's death, a suitable life insurance policy can cover expenses and outstanding business debts, as well as make up for the sudden loss of income. This ensures that the owner's family is not left with substantial debts and financial difficulties.

Keeping Your Business Running

Business owner life insurance can help keep the company afloat during challenging times. It can be used to pay off business debts, supplement cash flow, and cover expenses related to finding a replacement for the deceased owner. Additionally, if the life insurance policy has a cash value component, those funds can be utilised to fuel tax-free business growth while the owner is still alive.

Equalising an Estate

Life insurance can help "equalise an estate," which means ensuring that each heir receives an equal amount of money or asset value. This is particularly relevant for business owners with multiple heirs, some of whom may inherit ownership of the business while others do not. The non-inheriting heirs can receive a life insurance payout, ensuring that everyone receives a fair share.

Funding Partnership Agreements

Life insurance can be used to fund partnership agreements or buyout clauses. In the event of a business owner's death, the surviving partners can use the insurance payout to buy out the deceased owner's share of the business, as stipulated in the agreement. This helps maintain the stability and continuity of the business.

Protecting Business Assets

Key person life insurance policies are designed to protect business assets rather than personal assets. These policies are crucial for larger businesses, as they provide financial stability in the event of the death or disability of a key employee. The policy can help cover lost revenue, recruitment costs, and debt repayment, ensuring the company stays afloat during a challenging transition.

In conclusion, life insurance is a vital tool for business owners to safeguard their businesses, protect their families, and ensure a smooth transition in the event of their death. It provides financial stability, helps honour partnership agreements, and can even facilitate business growth. By choosing the right type of life insurance policy and consulting financial professionals, business owners can rest assured that their legacy and their loved ones are protected.

Coronavirus: Life Insurance Impact and Your Coverage

You may want to see also

Frequently asked questions

No, term life insurance is not included in net worth calculations. Term life insurance is designed to provide coverage for a set period, usually 10-20 years, and does not accumulate cash value. It is considered a liability.

Net worth is the value of your assets minus your loans and financial obligations (liabilities). Assets include cash, investments, retirement accounts, savings accounts, life insurance policies, and real estate. Liabilities include mortgages, loans, and credit card debt.

Term life insurance provides coverage for a specific period, often 10 to 20 years. It is designed to offer temporary protection and does not build cash value over time. Term life insurance tends to be more affordable than permanent life insurance.