Nevada auto insurance is mandatory for all drivers in the state and provides financial protection for cars, trucks, motorcycles, and other road vehicles in the event of loss, physical damage, or bodily injury resulting from a traffic collision, theft, or other losses. The minimum coverage requirements in Nevada include $25,000 in bodily injury per person and $50,000 per accident, as well as $20,000 in property damage coverage. While these are the minimum requirements, drivers can choose to purchase additional coverage for added protection and peace of mind. It is important to note that out-of-state insurance is not accepted in Nevada, and policies must be written specifically for the state.

| Characteristics | Values |

|---|---|

| Minimum auto insurance requirements in Nevada | $25,000 in bodily injury per person and $50,000 per accident; $20,000 in property damage per accident |

| Required types of coverage | Property damage and bodily injury |

| Optional types of coverage | Comprehensive, collision, uninsured/underinsured motorist, medical payments |

| Proof of insurance | Must be carried in the vehicle or on a mobile device |

| Registration | Vehicle cannot be registered without proof of insurance |

| Out-of-state insurance | Not accepted |

| Grace period | None |

What You'll Learn

Nevada auto insurance minimums

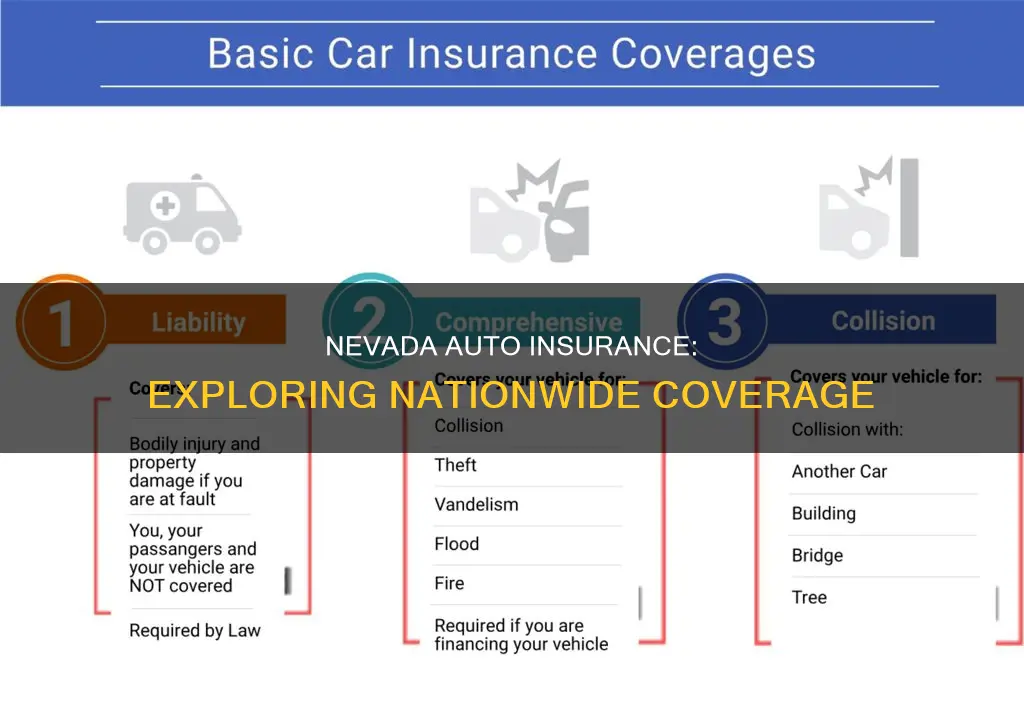

The minimum coverage requirements in Nevada include two types of liability coverage: property damage and bodily injury. Property damage coverage protects your assets if you are legally responsible for a covered accident, reimbursing you for certain types of damage you may cause to another person's property or vehicle. Bodily injury coverage, on the other hand, safeguards your assets if you are found legally responsible for a covered accident, covering certain expenses associated with bodily harm sustained by the other parties.

While these are the minimum requirements, drivers can choose to purchase additional coverage to protect themselves and their vehicles. Collision coverage, for example, can be added to cover damage to your vehicle resulting from a collision, regardless of who is at fault. Comprehensive coverage insures against theft or damage caused by incidents other than collisions, such as wind, falling objects, fire, flood, or vandalism. Uninsured or underinsured motorist coverage can also be added to protect you in the event that an at-fault driver does not have sufficient insurance to cover your medical expenses.

It is important to note that liability coverage will not pay for your own injuries or damage to your property. To ensure adequate protection, it is recommended to increase liability limits and consider additional coverage options beyond the minimum requirements.

Lyft and Your Auto Insurance: What You Need to Know

You may want to see also

Bodily injury liability

In Nevada, auto insurance is mandatory for all drivers and vehicle owners. The state's minimum insurance requirements include bodily injury liability coverage, which offers financial protection in the event of physical injuries caused to others in a car accident where you are at fault. This type of insurance does not cover the policyholder's injuries or those of their passengers, regardless of who is at fault.

In Nevada, this type of insurance also protects at-fault drivers from claims brought by passengers in other vehicles, their own vehicle, and pedestrians. It is essential to understand that bodily injury liability coverage only applies when the insured driver is at fault for the accident.

Auto Insurance: Understanding Wear and Tear Coverage

You may want to see also

Property damage liability

In the state of Nevada, the minimum amount of property damage liability coverage is $20,000. This means that if you are found legally responsible for a covered accident, your insurance will cover up to $20,000 worth of damage to another person's property.

When choosing how much property damage liability coverage you need, ask yourself the following questions:

- Do you own a home or other expensive items?

- Do you normally travel in high-traffic areas?

- Are there a lot of expensive vehicles driven in your area?

If you answered "yes" to any of these questions, you may want to consider raising your coverage amount.

In addition to property damage liability coverage, the state of Nevada also requires residents to carry bodily injury liability coverage as part of their auto insurance policy. The minimum amount of bodily injury liability coverage in Nevada is $25,000 per person and $50,000 per accident.

Auto Collision Insurance: Understanding the Coverage and its Cost

You may want to see also

Uninsured/underinsured motorist coverage

Uninsured motorist coverage comes into effect when you are hit by a driver who does not have auto insurance. Underinsured motorist coverage, which often accompanies uninsured motorist coverage, applies when the other driver doesn't have sufficient insurance to cover the damages or injuries caused.

In the state of Nevada, if you or your passengers are injured in an accident caused by another driver, and that driver is either uninsured or underinsured, uninsured/underinsured motorist coverage will pay for the medical costs of you and your passengers. This is particularly important as liability insurance, which is mandatory in Nevada, only covers injuries to others or damage to their property if you are at fault, and does not cover you, your passengers, or your property.

- Uninsured motorist bodily injury (UMBI): Covers medical bills for you and your passengers if you are hit by an uninsured driver.

- Uninsured motorist property damage (UMPD): Covers damage to your vehicle caused by an uninsured driver.

- Underinsured motorist bodily injury (UIMBI): Covers medical bills for you and your passengers if you are hit by an underinsured driver.

- Underinsured motorist property damage (UIMPD): Covers damage to your vehicle caused by an underinsured driver.

It is worth noting that while UMBI and UIMBI generally do not include a deductible, some states may require a deductible for UMPD/UIMPD. Additionally, in some states, uninsured motorist coverage for property damage (UMPD) does not cover hit-and-run incidents, and you would need collision coverage for your insurance to cover such damage.

The amount of uninsured/underinsured motorist coverage you need depends on your specific circumstances. For bodily injury coverage, it is recommended to match the amount with your liability coverage limits. For property damage coverage, you can select a limit that aligns with the value of your vehicle, especially if you do not have collision coverage.

Auto Insurance Binder: Temporary Proof of Coverage

You may want to see also

Medical payments coverage

The premium for MedPay coverage is relatively cheap, and it is offered at different limits by insurance companies, typically ranging from $1,000 to $100,000. It is important to note that MedPay does not have a right of subrogation, which means that if the insured individual's auto insurance coverage pays for their medical bills and they receive compensation from the at-fault driver's bodily injury liability coverage, they are not required to reimburse their insurance company for the medical expenses paid under MedPay.

When deciding on the amount of MedPay coverage to purchase, it is essential to consider factors such as the need for coverage, income, and tolerance for risk. While MedPay is not mandatory, it can provide valuable financial protection in the event of an accident, ensuring that medical treatment costs are covered without regard to fault.

In summary, Medical Payments Coverage is an affordable and essential option for Nevada residents, offering peace of mind and financial security in case of unexpected accidents and injuries.

Freeze Auto Insurance: Yes or No?

You may want to see also

Frequently asked questions

The minimum amount of auto insurance coverage in Nevada is $25,000 per person for bodily injury, with a total maximum of $50,000 per incident, and $20,000 for damage to another person's property.

In addition to the minimum liability coverage, you can also purchase collision coverage and comprehensive coverage. Collision coverage repairs damage to your vehicle resulting from a collision, regardless of who is at fault. Comprehensive coverage insures your vehicle against theft or damage from causes other than collision, such as wind, fire, or vandalism.

Driving without auto insurance in Nevada is against the law and can result in penalties such as fines, license suspension, vehicle impoundment, and increased insurance premiums.