Life insurance is a valuable financial product that provides peace of mind and financial security for individuals and their loved ones. While the benefits of life insurance are well-known, there is often confusion about the tax implications, especially when it comes to insurance proceeds. In the state of New York, understanding the taxation of life insurance proceeds is crucial for beneficiaries to maximize their benefits and ensure compliance with legal requirements. This is particularly important given the high cost of living in New York and the potential for large insurance payouts. This paragraph aims to introduce the topic of life insurance taxation in New York State and explore the complexities involved in ensuring beneficiaries receive their full entitlements.

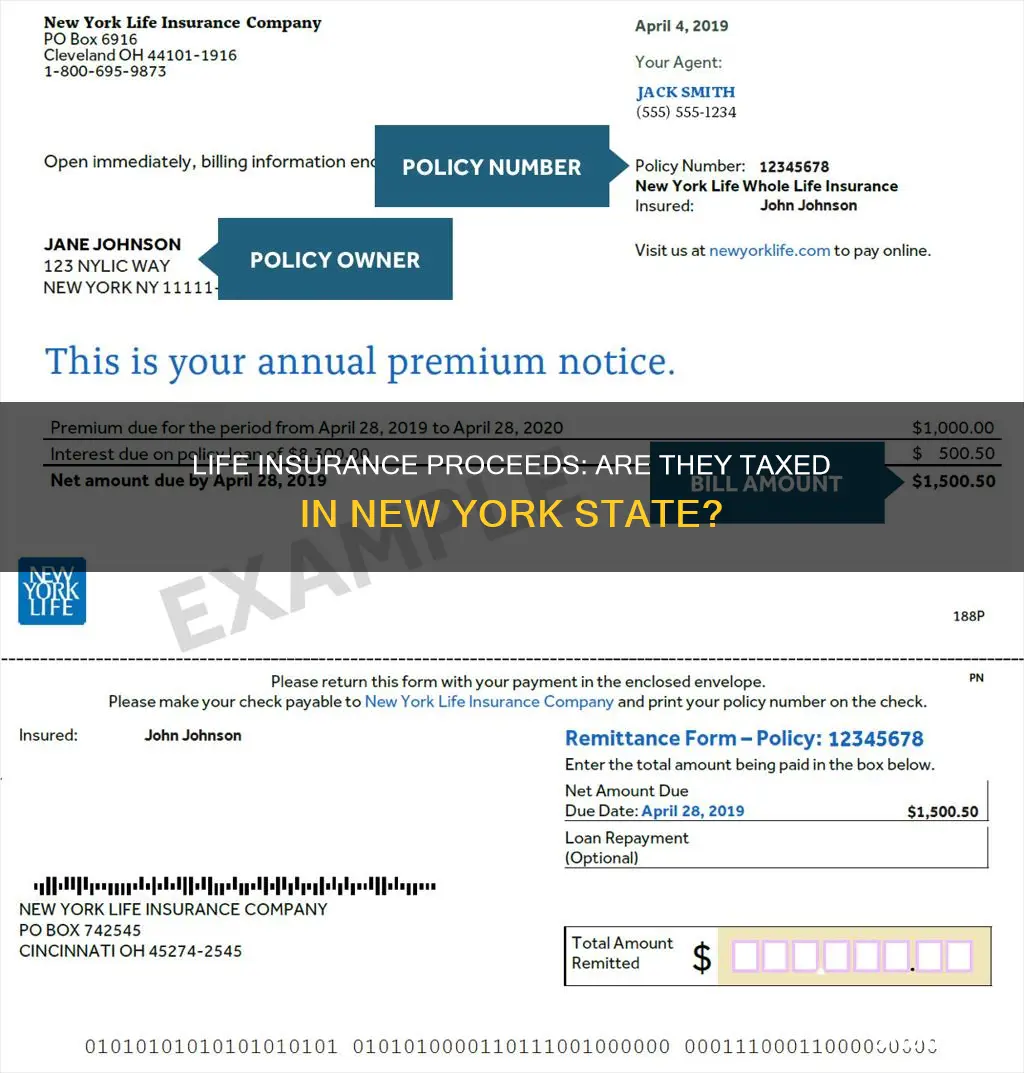

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable in NYS? | No, life insurance proceeds are not taxable as income. However, they may be subject to federal estate taxation. |

| Are there situations where life insurance proceeds are taxable? | Yes, if the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. |

| Are there other taxes that may apply to life insurance proceeds? | Yes, there are three primary types of taxes that can apply to life insurance: estate taxes, inheritance taxes, and gift taxes. |

| What is the exemption limit for estate taxes? | For an individual, the exemption limit is set at $13.61 million for 2024. |

| Which states impose inheritance taxes? | Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. |

| When might gift taxes apply to life insurance proceeds? | If there are more than two parties involved (the insured, policy owner, and beneficiary) and the proceeds exceed certain limits. |

| Are there other situations that can trigger taxes on life insurance proceeds? | Yes, if the beneficiary is the estate, if the policy owner surrenders the policy, or if the policy is sold to a third party. |

| How can I avoid taxes on life insurance proceeds? | By establishing an irrevocable life insurance trust (ILIT) to hold and manage the life insurance policy outside of the insured's estate. |

What You'll Learn

Life insurance benefits are not subject to federal income taxes

Life insurance benefits are typically not subject to federal income tax, and beneficiaries usually receive the full amount. This is true of all forms of life policies, and it helps ensure that the financial support reaches the beneficiaries as the policy owner intended.

However, there are some situations in which taxes may be charged, both while the policy owner is alive and after the insured person’s death. For example, if the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period. In this case, the beneficiary must pay taxes on the interest, not the entire benefit.

Additionally, if the policy's owner dies within three years of transferring ownership, the full amount of the proceeds is included in their estate as though they still owned the policy. This can result in higher estate taxes if the value of the estate surpasses the exemption limit.

It is important to consult a tax professional to understand the specific tax implications for your situation.

Life Insurance and the IRS: Do They Ask for Payouts?

You may want to see also

Taxes may be charged while the policy owner is alive

While the life insurance benefit, or death benefit, is typically not subject to federal income tax, there are some situations in which taxes may be charged while the policy owner is alive.

One such scenario is when there are more than two parties involved in the policy. Usually, the policy owner and the insured are the same person, but sometimes the policy owner is also the beneficiary, as is often the case when a policy owner insures a spouse or child. In other cases, all three roles (insured, policy owner, and beneficiary) may be different people. If this is the case, a gift tax may apply to the proceeds if they exceed certain limits.

Another situation in which taxes may be charged while the policy owner is alive is if the policy owner withdraws funds from the cash value of a policy. Some policies, like whole life and universal life, can accumulate cash value over time, which can be withdrawn or borrowed against tax-free. However, if too much money is put into the policy during its first seven years, or during the seven-year period after a "material change" to the policy, certain tax advantages may no longer apply.

Additionally, if the policy owner names their estate as the beneficiary, there are a couple of ways in which the proceeds can be reduced. First, the estate may be subject to the probate process, and any debts will need to be paid off before the money can be dispersed to heirs, reducing the amount they ultimately receive. Second, if the value of the estate is above the exemption limit for estate taxes, including the value of the life insurance proceeds, this could lead to higher estate taxes.

Furthermore, if the policy owner surrenders their policy, they may receive a cash payment from the insurance company based on the accumulated cash value within the policy. This can lead to taxes and penalties on the accumulated cash value if it exceeds the premiums paid. Similarly, if the policy owner sells their policy to a third party, any profit made after accounting for cumulative premium payments could be taxable as income.

Life Insurance and Experimental Drug Deaths: What's Covered?

You may want to see also

Taxes may be charged after the insured person's death

While life insurance benefits are generally not subject to federal income taxes, there are some situations in which taxes may be charged after the insured person's death. These taxes depend on the structure of the life insurance policy and the overall value of the estate.

If the life insurance policy is not structured correctly, the proceeds can be included in the estate's value. This can lead to significant taxes if the estate surpasses the exemption limit in the year of the insured person's death, particularly for policies with large death benefits. For individuals, the exemption limit for 2024 is set at $13.61 million.

In addition to federal estate taxes, state inheritance taxes and federal gift taxes may also apply to life insurance proceeds under specific circumstances. For example, if there are more than two parties involved in the policy, with different people serving as the insured, policy owner, and beneficiary, a gift tax may apply to the proceeds if they exceed certain limits.

Furthermore, if the insured person names their estate as the beneficiary of the life insurance policy, the proceeds may be reduced due to the probate process and the need to pay off any debts before dispersing the money to heirs. This can result in a lower amount being collected by the heirs. Additionally, if the value of the estate, including the life insurance proceeds, exceeds the exemption limit for estate taxes, it will lead to higher estate taxes.

It is important to consult a tax professional to understand the specific tax implications for your unique situation and to ensure that your life insurance policy is structured correctly to minimize potential tax burdens.

Clinical Trials: Are You Covered by Life Insurance?

You may want to see also

Life insurance proceeds can be included in an estate's value

One such situation is when the life insurance policy is not structured correctly. If the policy owner names their estate as the beneficiary, the proceeds can be reduced by any debts or taxes owed by the estate. This could result in a lower payout to the heirs. Additionally, if the value of the estate, including the life insurance proceeds, exceeds the exemption limit for estate taxes, it will lead to higher estate taxes. For 2024, the exemption limit for an individual is set at $13.61 million.

To avoid these tax implications, policy owners can establish an irrevocable life insurance trust (ILIT). An ILIT is a legal arrangement that holds and manages life insurance policies outside of the insured individual's estate. By removing the life insurance policy from the grantor's estate, the value of the policy is excluded from the calculation of estate taxes. This can be particularly beneficial for families with significant wealth.

It is important to note that life insurance proceeds may also be subject to state inheritance taxes and federal gift taxes under specific circumstances. Therefore, it is always advisable to consult a tax professional to understand the tax consequences of life insurance proceeds and how to structure your policy accordingly.

Lemonade Life Insurance: What You Need to Know

You may want to see also

Naming your estate as your beneficiary can reduce proceeds

Naming your estate as your beneficiary can have several negative consequences, including:

Higher Taxes

The shorter distribution timeline for estates means that more money must be withdrawn each year, leading to higher potential taxes. This can also result in higher Medicare charges and increased taxes on Social Security payments.

Creditor Invasion

Assets left to a named beneficiary are generally protected from creditor claims, but assets in an estate are not, meaning beneficiaries could receive a smaller inheritance.

Higher Administration Costs

Probate fees, legal fees, and other administrative costs are likely to increase when the estate is named as the beneficiary. These fees can add up to an additional 5% or more, depending on the complexity of the estate.

Increased Potential for Challenges

Wills could be more likely to be successfully challenged if the estate is named as the beneficiary, rather than a specific individual.

Delayed Payment to Beneficiaries

The probate process can take months or even years, especially if the will is contested. During this time, investments may be frozen and exposed to market risks. Naming a specific beneficiary ensures that the death benefit proceeds are usually paid within two weeks of receiving the proper documentation.

Federal Employee Life Insurance: Age Limit and Benefits

You may want to see also

Frequently asked questions

Life insurance proceeds are generally not taxable as income, but they may be subject to federal estate taxation.

Yes, life insurance proceeds may be taxable if the policy was transferred for cash or other valuable consideration. In this case, the exclusion for proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts.

There are three primary types of taxes that can apply to life insurance proceeds: federal income taxes, estate taxes, and gift taxes.

Yes, the New York State Public Employees Group Life Insurance Plan provides group term life insurance of up to $50,000, which is exempt from federal income tax.