Primerica is a legitimate company offering term life insurance policies, but most people can find a better policy elsewhere. They have an A+ rating from A.M. Best and pay 94% of claims within 14 days. However, their rates are usually higher than the competition. Primerica uses a multi-level marketing strategy to recruit new agents who aren't always experts in the field. Their agents are encouraged to sell policies to friends and family and recruit them as new agents. This business model may not be in the best interests of the customers. It is always recommended to shop around and compare rates from multiple companies before purchasing a life insurance policy.

What You'll Learn

Primerica's multi-level marketing business model

Primerica is a financial services company that has been in business for over 40 years. It is publicly traded on the New York Stock Exchange under the stock symbol "PRI" and is rated A+ by the Better Business Bureau. The company offers term life insurance coverage and other financial products like mutual funds, annuities, auto and homeowner's insurance, and pre-paid legal and identity theft products. Primerica's term life insurance products are available in North America and Canada, with different underwriting companies in each region.

While Primerica is a legitimate company, its business model has been described as multi-level marketing (MLM) or network marketing. This is because the company encourages its representatives to recruit their friends and family as new agents, and then receive a portion of the commission from each sale made by these recruits. This is known as a \"warm market\" approach, where representatives sell to their personal connections. Representatives also earn commissions based on their personal sales.

The multi-level marketing aspect of Primerica's business model has been criticised by some, who argue that it leads to a focus on recruitment rather than skill development. There are also concerns about the low average income of representatives, who are independent contractors rather than employees. However, others defend the model, arguing that it provides a legitimate business opportunity and that people do make money through Primerica.

In summary, while Primerica's multi-level marketing business model has its critics, the company is a legitimate provider of financial services and insurance products.

Coronavirus: Life Insurance Impact and Your Coverage

You may want to see also

Primerica's expensive life insurance rates

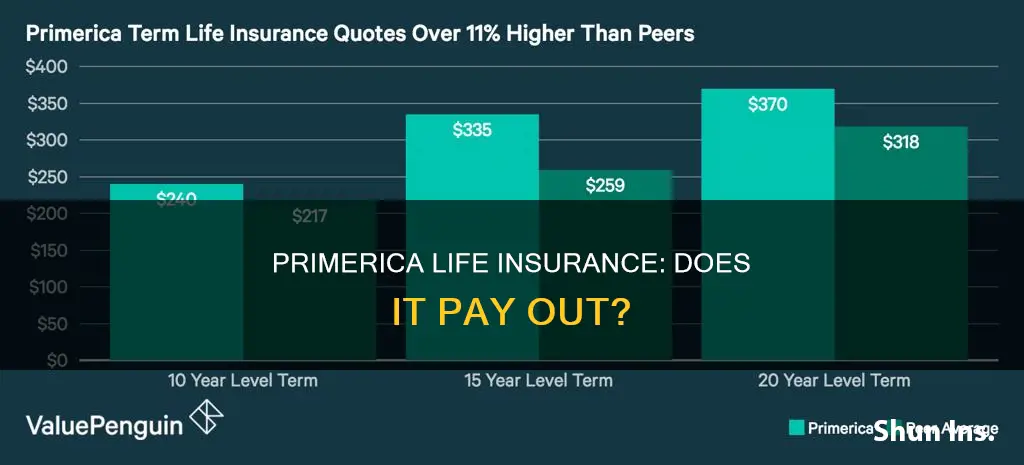

Primerica's life insurance rates are reportedly high, with some sources stating that its term life insurance costs roughly 11% to 29% more than equivalent policies from a group of 50 major competing companies. This finding was based on quotes for a 35-year-old non-smoking man seeking $500,000 in coverage.

Primerica's rates are not available online, and interested individuals must contact a representative to obtain a quote. The company's website provides a list of life insurance representatives by state and ZIP code, along with their contact information.

Primerica's expensive rates may be due to its multi-level marketing structure, where agents are encouraged to sell policies to friends and family and recruit them as new agents. The recruiting agent then receives a portion of the commission from each sale made by the recruits. This structure may result in higher costs for consumers, as the company needs to compensate multiple levels of agents.

Additionally, Primerica's term life insurance products have a lower death benefit availability than many other carriers, which may contribute to their higher prices. While Primerica offers a "guaranteed insurability" option, allowing policyholders to renew without a new health exam until age 95, the premium may increase due to age.

Furthermore, Primerica's longer-term policies, such as the 30-year and 35-year options, only guarantee level premiums for the first 20 years. After that period, premiums can potentially increase, and individuals may lose coverage if they cannot afford the extra cost.

Overall, while Primerica has a strong financial strength rating and pays claims quickly, its life insurance rates are considered expensive compared to other providers in the market.

FAFSA and Life Insurance: What You Need to Know

You may want to see also

Primerica's lack of permanent life insurance products

Primerica's life insurance products are limited to term life insurance, with no permanent life insurance options available. This means that the company does not offer whole life insurance or universal life insurance policies, which could provide lifelong coverage for its customers.

Primerica's term life insurance products are designed to provide coverage for a specific period, usually ranging from 10 to 35 years. While these policies offer a lower initial cost compared to other types of life insurance, they do not build cash value over time and are not intended to be permanent solutions. This lack of permanent options may be a significant drawback for individuals seeking long-term financial security and peace of mind.

Additionally, Primerica's term life policies do not include a term life conversion feature, which is commonly offered by other life insurance companies. This feature allows policyholders to convert their term life policies into permanent life insurance policies, providing them with more flexibility and the option to extend their coverage if their circumstances change.

Primerica's sole focus on term life insurance may limit their customer's ability to find a policy that aligns with their long-term financial goals and needs. Permanent life insurance products are designed to provide lifelong coverage and often include additional benefits such as cash value accumulation, which can be borrowed against or used to supplement retirement income. By not offering these products, Primerica may not be able to meet the diverse and changing needs of its customers.

In conclusion, while Primerica's term life insurance products may be suitable for some individuals, the lack of permanent life insurance options could be a significant disadvantage for those seeking comprehensive and long-term financial protection. It is important for customers to understand the limitations of Primerica's offerings and consider their financial goals when making decisions about their life insurance coverage.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

Primerica's poor consumer reviews

Primerica has received mixed reviews from its customers. While some customers have praised the company for its financial services and insurance coverage, others have criticized its sales tactics, recruitment practices, and customer service.

One common complaint is that Primerica operates as a multi-level marketing company, with agents encouraged to sell policies to friends and family and recruit them as new agents. This has led to concerns about the lack of experience of some agents, with many receiving poor ratings. Primerica's sales tactics have also been described as high-pressure, with agents not allowing potential customers to make financial decisions without pressure.

In terms of customer service, there have been reports of long wait times for refunds, difficulty cancelling policies, and issues with policy changes. Some customers have also reported problems with unexpected charges and increases in premiums.

However, it is important to note that Primerica has also received positive reviews, with some customers highlighting the company's wide range of financial products, knowledgeable agents, and quick claims processing. There are also positive reviews from customers who have had their claims paid out quickly and efficiently, especially during difficult times.

Overall, while Primerica has received some poor consumer reviews, it is important to consider a variety of sources and perspectives before drawing conclusions about the company's products and services.

Life Insurance and Divorce: What's the Verdict?

You may want to see also

Primerica's limited term life insurance offerings

Primerica offers term life insurance products with a maximum death benefit of $300,000. The company provides term life insurance policies in increments of 10, 15, 20, 25, 30, and 35 years, but the specific options available to you depend on your age. For example, the 35-year term policy is only available to buyers between the ages of 18 and 45.

Primerica offers two types of term life insurance: Custom Advantage and TermNow. Custom Advantage is a term life insurance policy that requires a medical exam and has a minimum coverage amount of $150,000. On the other hand, TermNow policies do not require a medical exam and can be issued quickly, but the coverage is limited to $300,000. Since TermNow is a no-exam life insurance policy, the rates tend to be higher than those of Custom Advantage.

Primerica's policies offer a “guaranteed insurability” option, which means that you can renew your policy without a new health exam or application until the age of 95. The premium may increase due to age, but this feature is valuable as it ensures that you can renew your policy even if you develop health issues.

Primerica also offers several riders that allow you to customize your term policy. Each rider typically increases your premiums by a small amount. Here are some of the riders offered by Primerica:

- Increasing Benefit Rider: This rider lets you increase your coverage amount by up to 10% per year over 10 years, up until the policyholder turns 55.

- Child Rider: This rider covers all eligible children under the policy as well.

- Terminal Illness Rider: This rider gives you access to some or all of your death benefit if you are diagnosed with a qualifying terminal illness.

- Waiver of Premium Rider: With this rider, Primerica will waive part of your premiums if you become disabled and unable to work.

Primerica's term life insurance products are generally considered more expensive than those of competing companies, and the company has received criticism for its sales tactics and sales process, which has been described as a multilevel marketing operation. However, Primerica has a strong Financial Strength Rating and pays claims quickly.

High Blood Pressure: Life Insurance Rates Impacted?

You may want to see also

Frequently asked questions

No, Primerica only offers term life insurance.

Yes, Primerica pays 94% of claims within 14 days.

Cancelling life insurance from Primerica works the same as with any other provider. Contact the company by calling (800) 257-4725 or emailing [email protected].

Yes, Primerica is a legitimate company offering term life insurance policies.