Renewable term life insurance is a policy that allows you to extend your original term coverage for an additional period without undergoing new health underwriting. The premiums for renewable term life insurance are typically cheaper than those for whole life insurance policies, but they increase with each renewal based on your age, sex, health, and other factors. This can make the coverage less affordable over time. Renewable term life insurance is, therefore, considered a short- to medium-term solution.

| Characteristics | Values |

|---|---|

| Renewal frequency | Yearly |

| Renewal conditions | No new health underwriting |

| Renewal costs | Higher premium based on age at renewal |

| Coverage | No cash value, only death benefit |

| Age limits | Common maximum renewal age is 70 or 80 |

| Length of coverage | 1-40 years |

What You'll Learn

- Renewable term life insurance is more expensive long-term than level term life insurance

- Renewable term life insurance is ideal for short-term scenarios

- Renewable term life insurance does not build cash value

- Renewable term life insurance is low-commitment

- Renewable term life insurance is best for people who need short-term coverage

Renewable term life insurance is more expensive long-term than level term life insurance

The main advantage of renewable term life insurance is its flexibility, especially for those who are unsure about their long-term needs. It is ideal for those who require short-term coverage or are between jobs. Additionally, renewable term life insurance does not require additional medical exams for renewal, making it a convenient option.

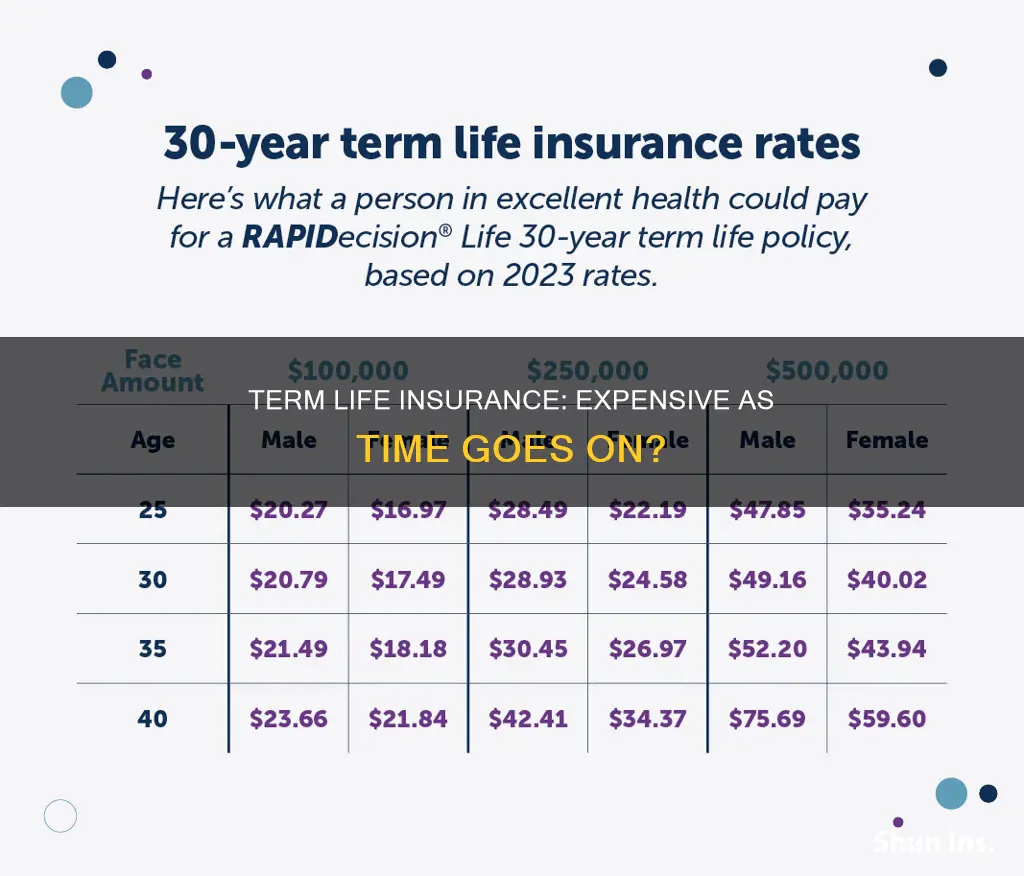

However, the premiums for renewable term life insurance can change with each renewal, and they will likely increase as the policyholder ages. This can make the coverage less affordable over time. In contrast, level term life insurance offers the security of fixed premiums, which can be locked in at a lower rate when the policy is purchased at a younger age.

For most people who need life insurance for longer periods, such as until their children are adults or their mortgage is paid off, level term life insurance is a more cost-effective option. While renewable term life insurance might seem more flexible due to its low-commitment nature, it may end up being more expensive overall. Level term life insurance provides long-term financial protection at a predictable cost, making it a better choice for those seeking coverage over an extended period.

In summary, while renewable term life insurance offers the advantage of flexibility, it comes at a cost. The premiums increase with each renewal, making it more expensive long-term than level term life insurance. For those seeking long-term coverage, level term life insurance with its fixed premiums is a more financially prudent option.

Exercise and Life Insurance: Is There a Catch?

You may want to see also

Renewable term life insurance is ideal for short-term scenarios

Renewable term life insurance offers extended coverage without new health underwriting, ensuring continued protection even if health issues arise. It is also a good option if you are worried about possibly developing health issues in the future because of pre-existing conditions or family history. With renewable life insurance, you can extend without being denied for health reasons.

The main drawback of renewable term life insurance is that your premiums can change every time you renew. Going year-to-year provides added flexibility, but when you renew your term, you will be older and potentially in worse health, which is why your premiums increase.

If you are looking for long-term coverage, a level term life insurance policy might be a better option. Level term life insurance policies have fixed premiums that do not change over the term of the policy. This can be more cost-effective than renewable term life insurance in the long run.

Life Insurance: Job-Hopper's Guide to Coverage

You may want to see also

Renewable term life insurance does not build cash value

Term life insurance is a form of insurance that provides a death benefit for a specified period of time, which is paid to the policyholder's beneficiaries if the insured person dies during the term. Term life insurance is usually the least costly form of life insurance available because it offers a death benefit for a restricted time and doesn't have a cash value component like permanent insurance.

Cash value is a feature that is typically offered within permanent life insurance policies, such as whole life and universal life insurance. The cash value component of permanent life insurance policies can be used as an investment-like savings account and can be withdrawn from or borrowed against.

While renewable term life insurance does not build cash value, it does offer other benefits. Renewable term life insurance is a policy that allows you to extend your original term life coverage for an additional period of time without undergoing new health underwriting, by paying a higher premium based on your attained age at renewal. This ensures continued protection even if health issues arise.

Civil Service Life Insurance: Cash Value and Benefits Explained

You may want to see also

Renewable term life insurance is low-commitment

The low-commitment nature of renewable term life insurance also means that it is generally more affordable upfront. Initial premiums are typically cheaper than those for whole life insurance policies, making it a good option for those on a tight budget or with other financial commitments. However, it's important to keep in mind that renewable term premiums will increase with each renewal, based on factors such as age, health, and gender. Over time, renewable term life insurance may become more expensive than a permanent policy, especially if you renew multiple times.

While renewable term life insurance offers the advantage of low initial commitment and cost, it may not be the best option for those seeking long-term coverage. If you are certain that you will need life insurance for several decades or your entire life, locking in a long-term rate with an extended term policy or a form of permanent coverage may be more cost-effective in the long run.

In summary, renewable term life insurance is low-commitment due to its flexible term lengths, no-strings-attached nature, and typically lower upfront costs. However, the trade-off is that premiums can change with each renewal, and long-term coverage may be more expensive compared to other options.

Erie Life Insurance: What You Need to Know

You may want to see also

Renewable term life insurance is best for people who need short-term coverage

Renewable term life insurance policies typically have shorter terms, sometimes as little as one year, and offer the option to renew without reapplying or undergoing additional medical exams. This can be advantageous for individuals whose health may change over time, as the insurer will not be able to check their health status upon renewal. However, it's important to note that the premiums for renewable term life insurance will increase with each renewal, and there may be limits on how long you can keep renewing, such as a maximum renewal age.

Compared to traditional term life insurance policies with level premiums, renewable term life insurance can be more expensive in the long run. Traditional term life insurance policies have fixed premiums for the duration of the term, which is usually 10, 20, or 30 years. On the other hand, renewable term life insurance premiums increase annually, making them more suitable for short-term needs.

In summary, renewable term life insurance is best suited for individuals who require short-term coverage, have uncertain long-term needs, or are looking for temporary insurance until they can obtain group life insurance. It offers flexibility and the ability to extend coverage without medical exams, but it comes with increasing premiums and potential renewal limitations.

Pacific Life: Diabetic Life Insurance Options

You may want to see also

Frequently asked questions

Renewable term life insurance is a policy that allows you to extend your original term life coverage for an additional period of time, without undergoing new health underwriting, by paying a higher premium based on your attained age at renewal.

Renewable term life insurance is typically cheaper than permanent life insurance initially, but the premiums increase each time you renew. The insurer bases the new premium on your age at the time of renewal, and the policy only becomes more expensive over time.

Renewable term life insurance offers low-cost initial premiums and the flexibility to continue your coverage. It also does not require a future health check, so you can extend your coverage without being denied for health reasons.

The biggest drawback of renewable term life insurance is that the premiums increase every time you renew. There are also limits on how long you can renew the policy for, and it does not build cash value.