Safe Auto is now a part of Direct Auto Insurance, specialising in selling minimum required car insurance to drivers who may have trouble getting coverage elsewhere. It offers instant insurance cards, which can be accessed through its mobile app or website. Safe Auto's policies are geared towards drivers considered high-risk due to issues like multiple moving violations, poor credit, or a DUI. The company provides insurance in 11 states, including Arizona, Illinois, Georgia, and Indiana.

| Characteristics | Values |

|---|---|

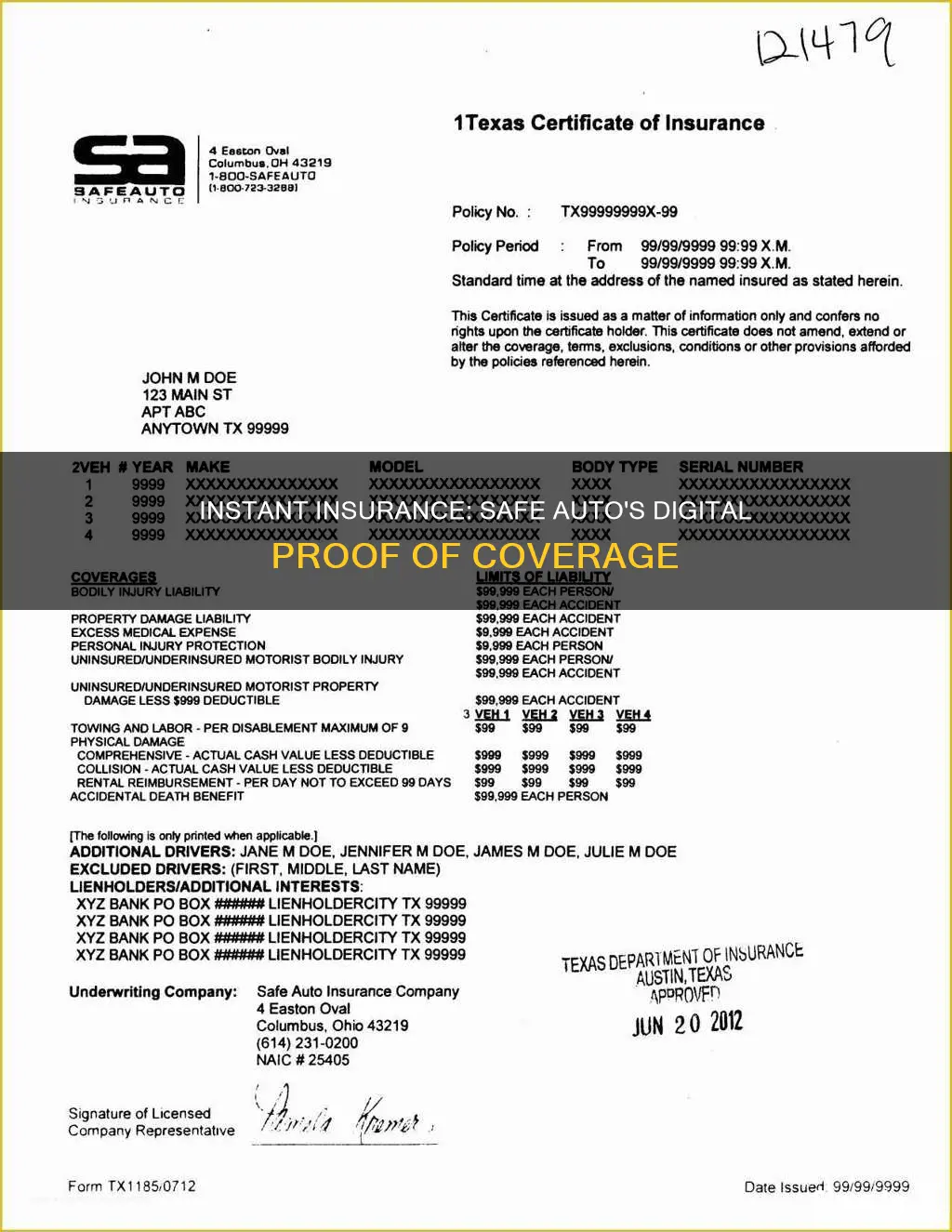

| Instant auto insurance proof | Safe Auto offers instant auto insurance proof. |

| Availability | Safe Auto is now a part of Direct Auto Insurance and is available in 28 states. |

| Online purchase | Safe Auto allows customers to purchase policies online. |

| Digital proof | Safe Auto provides digital proof of insurance that can be accessed via phone or printed at home. |

| Coverage | Safe Auto offers state minimum coverage, as well as comprehensive and collision coverage. |

| Discounts | Safe Auto offers various discounts, including those for seniors, safe drivers, military members, multi-vehicle policies, and more. |

| Customer satisfaction | Safe Auto has a higher-than-average complaint index score and mixed reviews from customers. |

What You'll Learn

Safe Auto's website is available in English and Spanish

The Safe Auto website is not just informative but also functional. Customers can use it to view and manage their policy details, make payments, and report claims. The website is available in two languages, making it accessible to a wider audience. This is in line with Safe Auto's commitment to serving high-risk drivers, who may have been denied coverage by other insurance companies.

In addition to its website, Safe Auto also offers a mobile app for iOS and Android users. The app allows policyholders to view their insurance ID cards, make payments, and access other policy information. However, the app has received poor ratings on the App Store and Google Play, with customers citing issues with functionality.

Safe Auto's website and mobile app provide customers with convenient access to their insurance information and services. The availability of the website in English and Spanish makes it more accessible to a diverse range of customers. This, along with Safe Auto's focus on serving high-risk drivers, demonstrates the company's commitment to inclusivity and accessibility.

Drunk Driving: Auto Insurance Coverage?

You may want to see also

Safe Auto offers non-owner insurance policies

Safe Auto is now a part of Direct Auto Insurance. The company specializes in providing the minimum required car insurance to drivers who may have trouble getting coverage elsewhere. This includes drivers who are considered high-risk due to issues like multiple moving violations, poor credit, or a DUI.

Safe Auto offers non-owner car insurance policies, which are designed for individuals who don't own a vehicle but still need insurance coverage for the times they do drive. Non-owner insurance can be a good alternative to full coverage, as it provides basic liability protection in the event of an at-fault accident. This type of policy can save individuals money by avoiding the cost of medical bills and property damage associated with an accident.

Non-owner car insurance is typically recommended for those who don't own a vehicle but regularly borrow or rent cars. It can also be useful for those who need to file an SR-22 form, which some states require for reinstating a driver's license after a serious conviction.

Safe Auto's non-owner insurance policies are available in all states except Alaska, Hawaii, Montana, Vermont, and Wyoming. The cost of these policies can range from $200 to $500 per year and will depend on factors such as the desired amount of coverage, driving history, and frequency of driving.

To obtain a non-owner insurance policy from Safe Auto, individuals will need to provide their name, date of birth, phone number, address, occupation, and details about their previous insurance coverage.

In addition to non-owner insurance, Safe Auto also offers comprehensive and collision coverage, as well as rental reimbursement, roadside assistance, towing, and personal injury protection.

Safe Auto provides various ways to access proof of insurance instantly, including through their website, mobile app, or by contacting customer service.

Insurance Data: Vehicle Identification Accuracy

You may want to see also

Safe Auto offers SR-22 filing

The cost of filing an SR-22 is usually inexpensive, at around $25, but having an SR-22 will typically increase your auto insurance rates. This increase will depend on the issue that led to the SR-22 requirement. For example, a DUI conviction will significantly increase your car insurance costs.

Safe Auto specializes in providing the minimum required car insurance for drivers who may be considered high-risk and offers SR-22 filing for those who need it. Their policies are aimed at drivers with multiple moving violations, poor credit, or a DUI on record. Safe Auto operates in all states except Alaska, Hawaii, Montana, Vermont, and Wyoming.

You can obtain instant proof of insurance through Safe Auto's website or mobile app, where you can log in to view policy information, make payments, or report a claim.

Insuring Yourself to Drive Hospital Vehicles

You may want to see also

Safe Auto's customer service line is 1-800-723-3288

The Safe Auto website redirects customers to the Direct Auto website, as Safe Auto has become a part of Direct Auto Insurance. On the website, you can view policy information, pay premiums, or report a claim. Safe Auto also has a mobile app that allows policyholders to view their insurance ID cards, make payments, and see policy details.

Safe Auto specializes in providing the minimum required car insurance to drivers who may have trouble getting coverage elsewhere. Their policies are geared towards drivers considered high-risk due to issues like multiple moving violations, poor credit, or a DUI. In addition to auto insurance, Safe Auto also offers motorcycle insurance, commercial auto insurance, individual term life insurance, accident medical expense coverage, and supplemental Medicare insurance.

Safe Auto operates in 28 states with offices in Alabama, Arkansas, Delaware, Florida, Georgia, Louisiana, Michigan, Mississippi, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, and Washington. Their customer service line is available Monday through Friday, from 9 a.m. to 9 p.m. ET, and from 11 a.m. to 5 p.m. ET on Saturday.

Insuring Your Vehicle: When is it Mandatory?

You may want to see also

Safe Auto offers a range of insurance discounts

Safe Auto Insurance offers a range of insurance discounts to its customers. The availability of these discounts may vary by state, and not all drivers may be eligible. Here are some of the discounts offered:

- Military Discount: Active-duty service members who can provide a copy of their current orders may be eligible for up to a 25% discount on their car insurance premiums.

- Senior Discount: Drivers aged 55 and above who have completed a qualified accident prevention course may be eligible for a 5% discount.

- Homeowners Discount: If the insured vehicle is kept at the policyholder's home address, they may qualify for a 15% discount.

- Qualified Driving Course Discount: Completing a state-approved driver education or accident prevention course may reduce your premium costs by up to 10%.

- Multi-Vehicle Discount: Customers insuring more than one vehicle with Safe Auto could save up to 25% on their premiums.

- Multi-Policy Discount: Customers participating in other Safe Auto Insurance products, such as bundling their auto insurance with home or life insurance, may be eligible for a 5% discount.

- Dynamic Drive Program: Through the Dynamic Drive Program, drivers who use Safe Auto's Routely mobile app to track their driving may receive a 10% discount.

- Safe Driving Record Discount: If you have maintained an accident-free driving record for at least 36 months, you may be eligible for a discount of up to 10%.

- Safety Equipment Discount: If the insured vehicle is equipped with passive safety features, including anti-theft devices and airbags, the policyholder may be eligible for a 10% discount.

- AutoPay Discount: Customers who set up automatic payments, pay their full premium upfront, or enroll in paperless statements may receive a discount of up to 9%.

- Prior Coverage Discount: Policyholders who have maintained at least six months of continuous auto insurance coverage with a different carrier and have less than 90 days of lapsed coverage may save up to 25% with Safe Auto.

Golf Cart Conundrum: Navigating Insurance Coverage for Your Ride

You may want to see also

Frequently asked questions

You can get instant proof of insurance by purchasing an auto insurance policy, providing the necessary information, making the required payments, and receiving the proof of insurance from your insurer via email, online portal, or in person. You can also print your insurance card at home or keep a digital copy on your phone.

When buying auto insurance online, you will typically need to provide personal information such as your name, address, date of birth, contact details, vehicle information (make, model, year, vehicle identification number), driving history, previous insurance coverage, and details about other drivers to be included in the policy.

The time frame for obtaining instant proof of insurance can vary depending on the insurance company and delivery method. In most cases, you can receive the proof within minutes or a few hours after completing the necessary steps and providing the required information.

Yes, many insurance companies offer the option to buy auto insurance online and provide instant proof of insurance electronically, such as through a digital insurance card or policy document. You can usually access this through the insurer's website or mobile app.