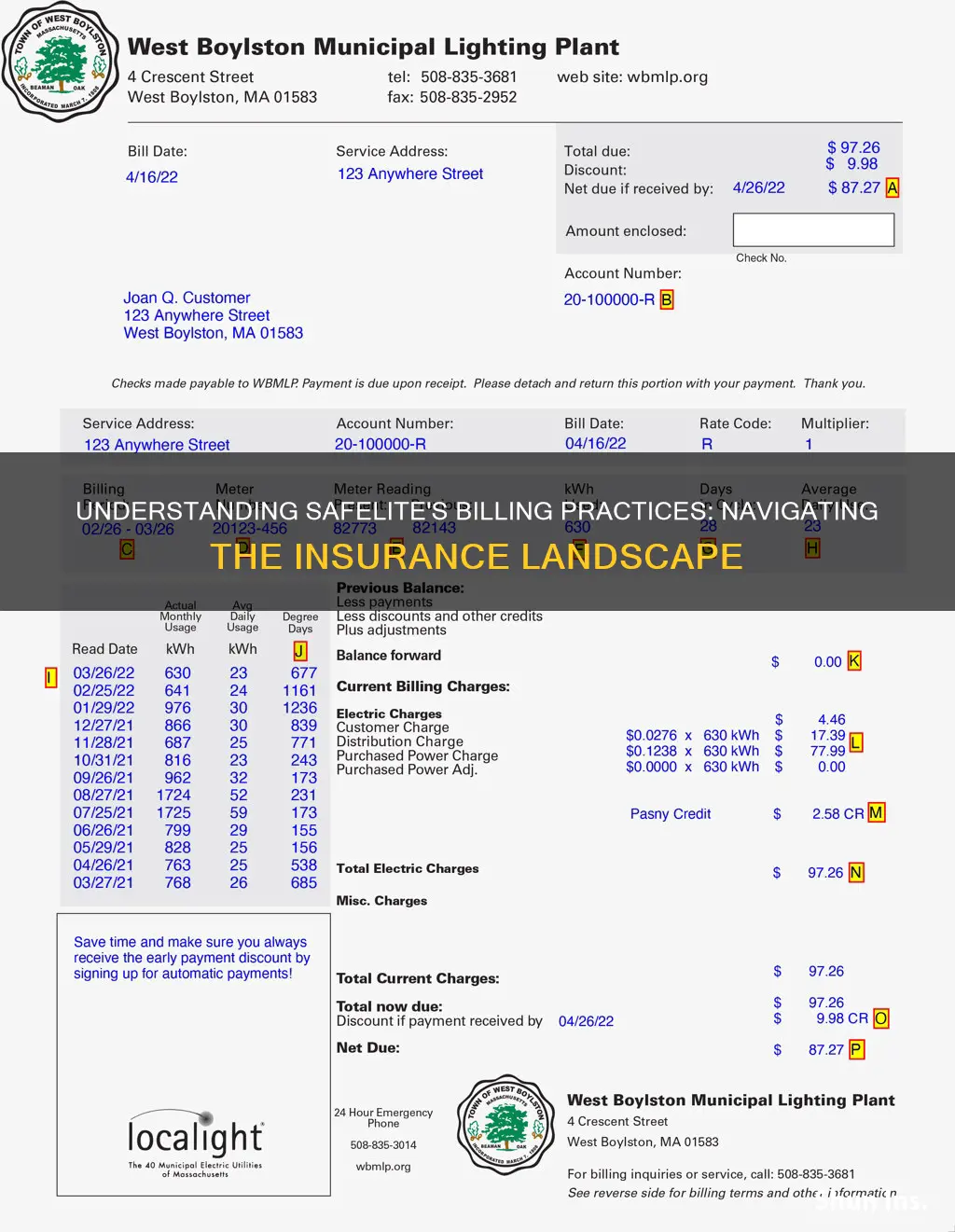

Safelite is a well-known auto glass repair and replacement service in the United States. The company works with over 150 insurance companies and is well-versed in the insurance claim process. They can verify your coverage, file a claim, and handle the paperwork, making the process seamless for you. However, whether or not Safelite is covered by insurance depends on various factors, including the type of insurance coverage you have and how the glass damage occurred. If you have comprehensive coverage, you will typically be covered for the cost of repairs or replacements, minus your deductible. On the other hand, if you only have minimum liability insurance, your insurance will not cover the cost unless another driver was at fault. In this case, you may be able to make a claim through the other driver's insurance. It's important to review your policy details and consult with your insurance provider to understand your coverage.

| Characteristics | Values |

|---|---|

| Does Safelite bill insurance? | Yes, Safelite works with insurance companies and can verify your coverage, file the claim, and handle all the paperwork. |

| What type of insurance coverage is required for Safelite to bill insurance? | Comprehensive coverage or minimum liability insurance where another driver was at fault for the damage. |

| Does Safelite waive the deductible? | In some cases, depending on your insurance coverage and your state of residence. |

| What states waive the deductible for windshield repairs? | Arizona, Connecticut, Massachusetts, Minnesota, New York, Florida, Kentucky, and South Carolina. |

| What states waive the deductible for windshield replacements? | Florida, Kentucky, and South Carolina. |

What You'll Learn

Comprehensive coverage

If you have comprehensive coverage, you will be responsible for paying your comprehensive coverage deductible, which is typically around $250 per claim. Your insurance will then cover the remaining costs of repairing or replacing your glass. Some insurers waive deductibles for auto glass claims. For example, if you live in Arizona, Connecticut, Massachusetts, Minnesota, or New York, insurance companies are required by law to waive the deductible for windshield repairs.

If you are unsure whether your insurance policy includes comprehensive coverage, you should refer to your insurance policy or contact your insurance provider for more information.

Term Insurance: Unraveling the Myth of Solely Death Benefits

You may want to see also

Minimum liability insurance

If you only have minimum liability insurance, your insurance will not cover the cost of repairing or replacing your vehicle's glass unless another driver was at fault for the damage. In that case, you may be able to make a claim through the other driver's insurance company.

Liability insurance is the main mandated coverage in most states. It covers damage and injuries you cause to others in an accident. There are three components to car insurance liability coverage: bodily injury coverage per person, bodily injury coverage per accident, and property damage coverage per accident. These limits are usually expressed as a series of numbers, such as 15/30/10. For example, with those hypothetical limits, your liability coverage would pay up to $15,000 per person for bodily injuries caused to people in the van but no more than $30,000 in total bodily injury costs for the incident. You'd also be covered for up to $10,000 in property damage.

The minimum liability insurance that you must carry is based on your state's laws. Failing to carry the minimum liability insurance required by your state can lead to expensive fines, and you could be personally liable if you cause an accident. Minimum liability insurance requirements vary by state. For example, in Alabama, the bodily injury liability limit is $25,000 per person, $50,000 per accident, and $25,000 in property damages. In Alaska, the bodily injury liability limit is $50,000 per person, $100,000 per accident, and $25,000 in property damages.

The Mystery of PCN in Insurance: Unraveling the Acronym's Meaning

You may want to see also

Full glass coverage

In some states, such as Florida, Kentucky, and South Carolina, insurers are required to offer zero-deductible glass coverage, meaning that repairs or replacements of windshields and other auto glass may be covered without any deductible. Additionally, some insurance companies may waive the deductible for windshield repairs in certain states, including Arizona, Connecticut, Massachusetts, Minnesota, and New York.

It is worth noting that comprehensive coverage, which is optional in all states, typically covers auto glass repairs and replacements, but you will need to pay a deductible, which is usually around $250 per claim. Comprehensive coverage also protects your vehicle from damage unrelated to car accidents or collisions, such as fire, theft, and natural events.

When it comes to auto glass repair and replacement, Safelite is a well-known company that works with insurance companies to handle claims. They can verify your coverage, file the claim, and handle the necessary paperwork. However, it is always a good idea to check your insurance policy and consult with your provider to understand your specific coverage.

Unraveling the MIB Mystery: Understanding Insurance Industry Acronyms

You may want to see also

State regulations

For instance, Kentucky, South Carolina, and Florida have regulations that require insurers to repair and replace windshield glass without charging a deductible if you have comprehensive coverage. In these states, windshield repair or replacement is free for drivers with comprehensive coverage.

On the other hand, in Arizona, Connecticut, Massachusetts, Minnesota, and New York, insurance companies are mandated by law to waive the deductible for windshield repairs only. This means that if you require a full windshield replacement in these states, you may still be responsible for paying a deductible.

Additionally, some insurance companies offer an optional "full glass coverage" add-on to their policies. If you have this coverage, you may be able to get your Safelite glass repair or replacement without paying any deductible, regardless of the state regulations.

It's important to note that the decision to repair or replace a windshield also depends on the extent of the damage. If you have minor chips or cracks, Safelite may be able to repair your windshield at no cost to you, as long as you have comprehensive coverage. However, if you have extensive damage, large cracks, or other significant issues, you may need a full windshield replacement, which typically requires you to pay a deductible.

To summarize, while Safelite services may be covered by insurance, the specific state regulations, the type of coverage you have, and the extent of the damage will determine the final cost and billing process. Always check your policy details and consult with your insurance provider to understand your coverage and any applicable state regulations.

The Intricacies of Self-Insurance: Exploring the Viable Alternative to Traditional Insurance

You may want to see also

Deductibles

A deductible is the amount of money that the insured person must pay before their insurance policy starts paying for covered expenses. For example, if you have a health insurance policy with a $1,000 deductible and you receive a medical bill for $2,000, you will be responsible for paying the first $1,000 and your insurance will cover the remaining $1,000. Deductibles can vary depending on the type of insurance policy, the level of coverage, and other factors. Some insurance policies, such as liability insurance, may not have a deductible at all. Others, such as homeowners or auto insurance, may have a higher deductible in exchange for lower premiums.

When it comes to auto glass repair and replacement, Safelite is one of the most well-known companies in the United States. However, whether or not Safelite is covered by insurance depends on various factors, including the type of insurance coverage and how the glass damage occurred. If you have comprehensive coverage, you will typically be able to make a claim for Safelite glass repair or replacement services. You will need to pay your comprehensive coverage deductible, which is usually around $250 per claim, and your insurance will cover the remaining costs. On the other hand, if you only have minimum liability insurance, your insurance will not cover the cost of repairing or replacing your vehicle's glass unless another driver was at fault for the damage. In that case, you may be able to make a Safelite claim through the other driver's insurance company.

It is worth noting that some insurance companies offer an additional "full glass coverage" option. If you have chosen this option, you may be able to get your Safelite glass repair or replacement without paying a deductible. Additionally, certain states have special regulations when it comes to auto glass repair and replacement. For example, Kentucky, South Carolina, and Florida require insurers to repair and replace windshield glass without charging a deductible if you have comprehensive coverage.

Before making an insurance claim for Safelite services, it is important to consider the cost of the deductible. In some cases, it may be more economical to pay out of pocket if the cost of repairing your windshield is less than the deductible. For instance, if it costs $200 to repair a windshield crack and your comprehensive coverage deductible is $250, you are better off paying for the repair yourself.

Short-Term Insurance: A Safety Net or a Compromised Solution?

You may want to see also

Frequently asked questions

Safelite can verify your coverage, file the claim, and handle all the paperwork, making the process seamless for you. Safelite collaborates with more than 150 insurance companies and is well-versed in the insurance claim process.

Because liability insurance only provides coverage for damages to another vehicle, auto glass services are not covered under your liability policy. If another driver was at fault for the damage, you may be able to make a Safelite claim through the other driver’s insurance company.

In many cases, insurance companies will not count auto glass damage as a claim on your policy. To be certain, refer to your policy or contact your agent and/or insurance provider to confirm your specific auto glass coverage.