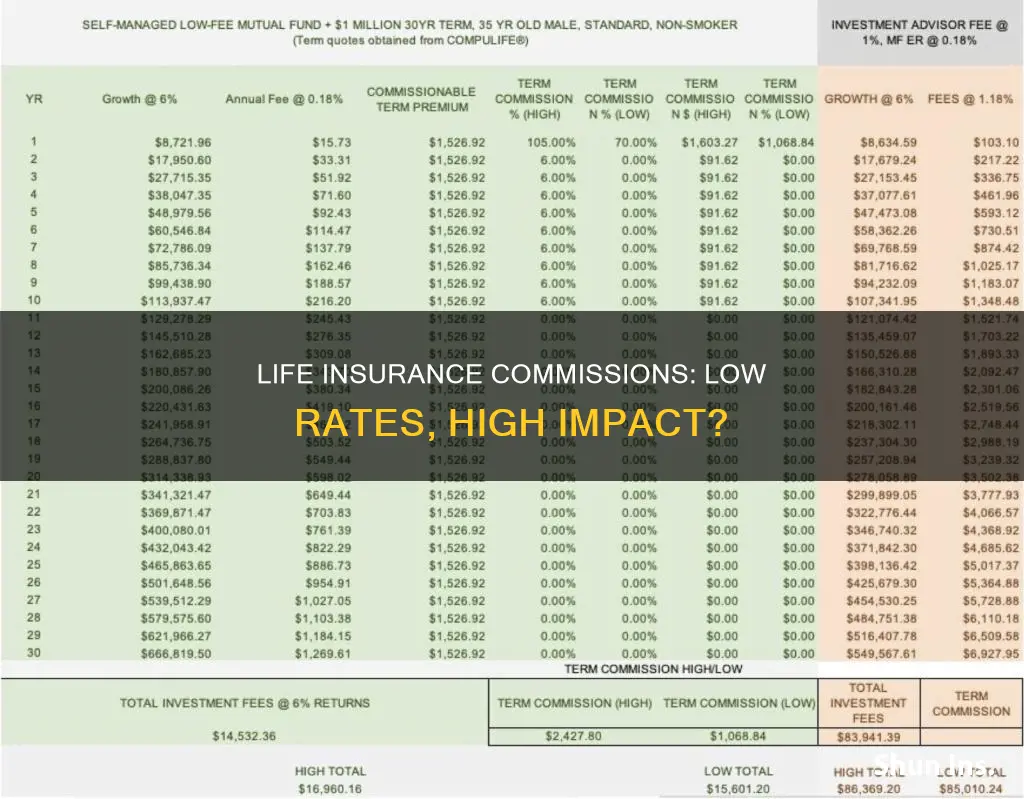

Life insurance agents are compensated through commissions, which are typically a percentage of the policy premiums paid in the first year and each year thereafter. Commissions vary depending on the type of insurance, with life insurance brokers earning between 7% and 15% on average. Term life insurance policies, which offer a guaranteed life benefit for a specified term, usually have lower premiums and thus result in lower commissions for agents. As a result, some agents may be hesitant to sell term life insurance plans, instead favouring permanent life insurance policies with higher premiums and commissions. Understanding the commission structure can help consumers make informed decisions and ensure they receive suitable recommendations from agents.

| Characteristics | Values |

|---|---|

| Commission in the first year | 60% to 80% of the premiums |

| Commission in subsequent years | 3% to 10% of the premiums |

| Commission for captive agents | Lower than independent agents |

| Commission for brokers | Up to 50% higher than captive agents |

| Commission for term life insurance | Several times lower than whole life insurance |

| Commission for whole life insurance | More than 100% of the first-year premium |

| Commission for cash-value riders | A fraction of the commissions on the base policy |

| Commission for term insurance riders | Relatively low |

| Commission for annuities | 5% of the invested amount |

What You'll Learn

- Life insurance agents are motivated to sell bigger policies to earn higher commissions

- Commissions are paid upfront and annually

- Independent agents earn higher commissions than captive agents

- Life insurance agents must constantly search for new customers

- Agents may suggest a convertible life insurance policy as a cheaper alternative to whole life insurance

Life insurance agents are motivated to sell bigger policies to earn higher commissions

Life insurance agents are typically paid via a combination of salary and commission, with the commission being a percentage of the policy premium. As such, agents are incentivised to sell bigger policies as this will result in higher commissions.

The commission structure varies depending on the type of policy being sold. Whole-life premiums, for example, generally have the highest commissions, with agents receiving over 100% of the first-year premium. Term life insurance plans, on the other hand, pay the lowest commissions, ranging from 30% to 80% of the annual premium.

In addition to the type of policy, the agent's commission may also depend on the age of the policyholder, the amount of the premium, and the agent's overall sales for the year. For instance, an agent's commission percentage may increase if they sell a certain dollar amount of premiums within a year.

While life insurance agents do have an incentive to sell bigger policies, it's important to note that regulations require agents to offer life insurance policies that meet certain suitability standards. If a customer feels that the policy they purchased was inappropriate for their financial situation, they can file a complaint.

When purchasing life insurance, it's recommended that individuals consult a financial advisor to determine the type and amount of coverage that best suits their needs. Individuals can also ask agents about the commissions they will receive and consider purchasing from "low-load" insurers, who have salaried consultants rather than commissioned agents.

Life Insurance and Suicide in Australia: What's Covered?

You may want to see also

Commissions are paid upfront and annually

Commissions are a significant motivating factor for insurance agents. The larger the policy, the more money they will make. Commissions are typically paid upfront and annually.

Life insurance agents who sell policies from a single company, known as "captive" insurance agents, may receive lower commission rates because they may receive other benefits, such as retirement accounts and health insurance. On the other hand, "brokers," who are independent, can receive up to 50% higher commissions than captive agents.

The commission structure for term life policies is a percentage of the premium paid each year. These commissions are likely to be several times lower than those earned from whole-life or universal policies. A typical life insurance agent receives a commission ranging from 30% to 90% of the policy year premiums paid in the first year. In later years, the agent may receive between 3% and 10% of each year's renewals.

The upfront commission can be a substantial percentage of the first year's policy cost. For example, the New York State Department of Financial Services caps first-year commissions at 99% of the premium. Life insurance agents must constantly search for new customers and be prepared for rejection.

Commissions are built into the policy premium, so the same policy from the same company will have the same commission, regardless of whether it is purchased from an agent or a broker.

While term life insurance is considered the best and most important form of insurance by experts, it offers low commissions to insurance agents. Term insurance policies have the lowest premiums compared to other life insurance policies because they are pure protection policies that provide only death benefits. As a result, term plans offer life cover at a nominal cost, which translates to a lower commission for agents.

Pacific Life: Diabetic Life Insurance Options

You may want to see also

Independent agents earn higher commissions than captive agents

Independent insurance agents, also known as insurance producers, sell different types of insurance products for multiple companies. They are not employees of the insurance companies, so they work on commission percentages. Their commission schedule depends on their contract with the insurance company, and the percentage varies depending on variables such as the type of insurance or policy.

Independent agents have higher lifetime earnings than captive agents. For example, the average independent agent's salary is $117,895, while the average captive agent salary in January 2023 was $93,821. Independent agents' commissions can be as much as 50% higher than those of captive agents.

However, independent agents have to pay all the bills, taxes, payroll, and so on to keep their business open, which is often considered their biggest disadvantage. They are also responsible for covering their own business expenses, such as rent or office space, office supplies, advertising, and marketing.

Captive agents, on the other hand, work for a single insurance company and are usually paid with a combination of salary and commission, plus benefits. They may receive lower commission rates because they may also receive other benefits, such as retirement accounts and health insurance. They are provided with administrative support, a marketing/advertising department or budget, and a starting book of business. However, they are required to do extensive paperwork and contracts and are limited to selling specific products that may not always be the best option for the customer.

Gun Ownership: Impact on Life Insurance Rates

You may want to see also

Life insurance agents must constantly search for new customers

Life insurance agents are typically paid via commission. This means that they have an incentive to promote policies with higher premiums, such as permanent life insurance. As a result, they must constantly be on the lookout for new customers to sell these policies to.

Commissions are a percentage of the premiums paid by the policyholder. Whole-life premiums, for example, generally have the highest commissions, with rates of over 100% of the first-year premium. In contrast, term life insurance policies have much lower premiums, resulting in lower commissions for agents. This means that, despite being considered the most important form of insurance by experts, term plans are often not sold by agents.

The commission structure for term life policies is a percentage of the premium paid each year. These commissions are several times lower than what an agent would earn from a whole-life or universal policy. For example, a term insurance rider adds coverage to a whole-life policy at a low cost and has a relatively low commission.

Additionally, life insurance agents often have to deal with a lot of rejection. Selling insurance is a challenging job, and it can be difficult to find qualified customers. This constant search for new customers can be exhausting, but it is necessary for agents to make a living.

To find new customers, life insurance agents can leverage client referrals, enhance their online presence, collaborate with other businesses, and improve their customer service. They can also offer a wide range of products to appeal to a broader range of potential customers.

Life Insurance and Missing Persons: What's Covered?

You may want to see also

Agents may suggest a convertible life insurance policy as a cheaper alternative to whole life insurance

Life insurance agents' commissions are a percentage of the policy premiums paid in the first year and each year after. Commissions can play a role in which life insurance policies agents promote and how much you pay. Agents may suggest a convertible life insurance policy as a cheaper alternative to whole life insurance.

Convertible insurance is a type of life insurance that allows the policy owner to change a term policy into a whole or universal policy without going through the health qualification process again. It is a temporary term life insurance that can be turned into permanent life insurance. You can switch coverage at a future date without having to undergo a new health screening process. This gives you the option to buy low-cost temporary coverage now while keeping your options open to buy lifelong coverage later.

The conversion can happen as long as the policy conditions have been maintained, including making payments on time. While permanent life insurance carries higher premiums than term, it also provides benefits such as lifelong coverage, level premiums, and tax-free cash value accumulation.

Term life insurance provides coverage for a given number of years before it expires. Convertible term allows you to exchange your term temporary coverage for a permanent policy at a later date. While term premiums are less expensive initially, you need to pay more each time the term expires for a renewal. The coverage also does not last your entire life.

Permanent insurance costs more than term but the coverage does not expire as long as you keep paying the premiums. Whole life policies also charge the same premium the entire time, so your future costs will not go up. Permanent policies can include a savings component that accumulates cash value tax-free, which you can access through loans or withdrawals.

A convertible life insurance policy allows you to obtain less expensive term coverage today with the option to convert it to a permanent policy at a later date with the same death benefit. This can be a valuable alternative if your insurance needs, financial resources, or medical situation change in the future.

Life Insurance: AD&D Coverage and Benefits

You may want to see also

Frequently asked questions

Term insurance plans have the lowest premium compared to other life insurance policies. The commission that agents receive is usually a percentage of the premium paid by the policyholder, so they receive a lesser commission than other plans.

Life insurance agents typically receive between 60% to 80% of the premiums paid in the first year as commission. In subsequent years, they collect smaller commissions, usually 5% to 10% of the premiums paid.

Commissions vary depending on the type of policy being sold. Whole life insurance policies generally have the highest commissions, often exceeding 100% of the first-year premium. Term life insurance policies have lower commissions, usually a percentage of the premium paid each year.