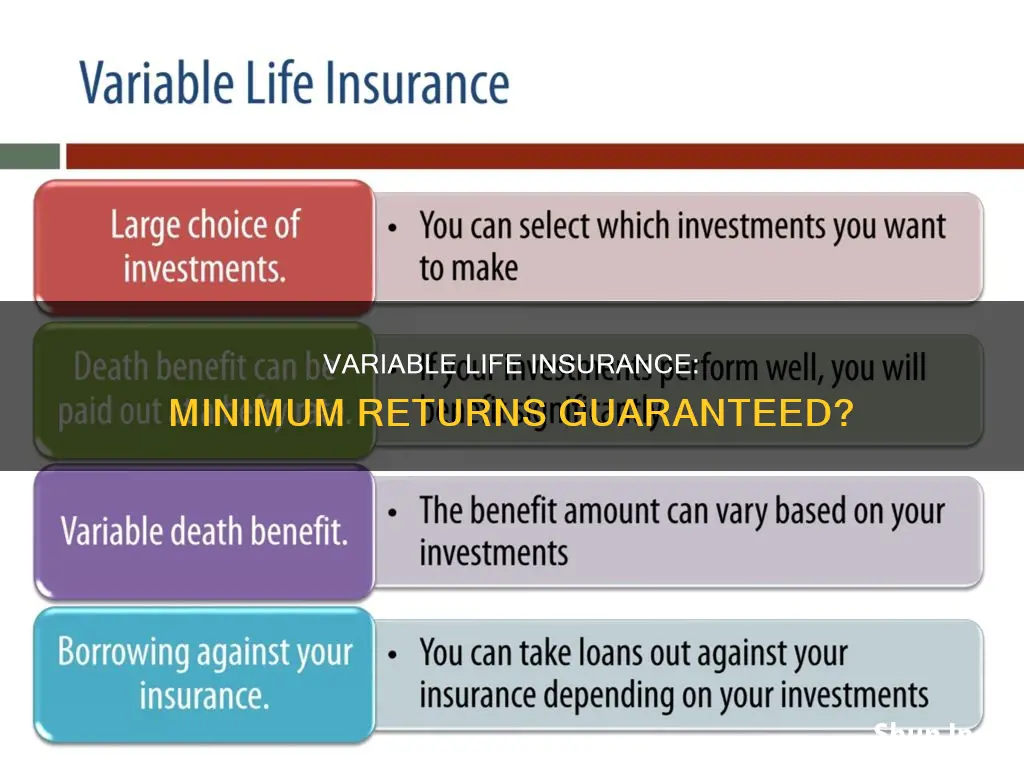

Variable life insurance is a type of permanent life insurance that includes a death benefit and a cash value component. The cash value is invested in various funds, usually mutual funds, and its performance depends on the market. While variable life insurance offers the potential for higher returns than traditional policies, it also carries more risk. The cash value can fluctuate based on market conditions, and there is no guaranteed minimum return. This means that policyholders could lose money if their investments perform poorly. Therefore, variable life insurance is generally recommended for individuals who are comfortable with investment risk and have a high net worth.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance |

| Payout | Death benefit |

| Investment | Yes |

| Risk | High |

| Cash value | Yes |

| Investment options | Mutual funds, index funds, equities, bonds, money market funds |

| Guaranteed minimum death benefit | Yes |

| Guaranteed minimum cash value | No |

| Premium | High |

| Premium flexibility | Yes |

| Tax on cash withdrawal | Yes |

What You'll Learn

Variable life insurance is a permanent life insurance policy

Variable life insurance policies are considered more volatile than standard life insurance policies. This is because the cash value component is invested in assets, and so the value of the policy may rise or fall. This means that these policies carry more risk than other life insurance policies. However, you can often allocate a portion of your premium to a fixed account, which guarantees a rate of return to reduce the overall risk.

Variable life insurance policies are also more complex and require more hands-on attention than other policies. They typically have higher premiums and fees than other cash value life insurance policies. The fees include sales fees, surrender charges, mortality and expense risk fees, cost of insurance, administration fees, loan interest, and underlying fund expenses.

Despite the added risk, variable life insurance policies offer a death benefit, and the potential for the cash value to be converted into a higher death benefit amount. This means that beneficiaries will receive a larger payout from the policy. Policyholders can also choose from several funds when deciding where to invest their money, and the premiums are adjustable if there are sufficient funds in the cash value account.

Federal Employee Life Insurance: Age Limit and Benefits

You may want to see also

It has a higher earning potential than traditional policies

Variable life insurance has a higher earning potential than traditional policies. This is because it allows you to decide how to invest the cash value. The more money you pay in premiums, the lower some of your policy’s fees and expenses may be.

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds. The cash value can be invested in several ways, but the most common way is to invest in mutual funds. You may also be able to invest in index funds, equities, bonds or money market funds.

You can choose how your cash value is invested within your insurer’s provided funds. You have total control over your investments, and you can also allocate money to different funds, based on your risk tolerance and financial goals. If your investments perform well, your cash value could grow significantly, and you won’t pay taxes until you withdraw the funds.

Variable life insurance policies are permanent life insurance policies that have a higher potential for earning cash compared to traditional policies. That's because with variable life insurance, you get to decide how to invest the cash value. Plus, if you choose variable universal life insurance, you'll also get some flexibility in how much of a premium you'll need to pay.

The cash value of variable life insurance policies can grow at a much faster rate and even be used to pay premiums in certain cases. Whole life insurance policies don't offer the flexible premiums that variable universal life insurance policies do.

Life Worth Living Cincinnati: Exploring Insurance Options

You may want to see also

It has a higher risk than other life insurance policies

Variable life insurance policies are considered to carry more risk compared to other life insurance policies. This is because the cash value component of variable life insurance is invested in assets like mutual funds, meaning it may rise or fall in value. The insurance company does not guarantee a rate of return, so there is a risk of losing money.

Variable life insurance policies are also more complex and require more hands-on attention. They typically have higher premiums than other cash value life insurance policies, and the fees tend to be the highest of any life insurance policy. These fees include mortality and expense risk charges, sales and administrative fees, investment management fees, policy loan interest, and surrender charges.

There is also a risk of policy lapse if there is not enough cash value to cover policy fees and expenses. This means the policy would terminate without value and the beneficiary would not receive any death benefit.

Variable life insurance policies also have limited investment options, and there is a cap on the rate of return, so the earning potential is limited compared to a regular investment.

Overall, variable life insurance has a higher risk profile than other life insurance policies due to the potential volatility of the cash value component, the higher fees and premiums, the risk of policy lapse, and the limited investment options and earning potential.

Term Life Insurance: Living Benefits and Their Impact

You may want to see also

It has a guaranteed minimum death benefit

Variable life insurance is a type of permanent life insurance policy that guarantees a minimum death benefit. This means that, as long as premiums are paid and the terms of the policy are met, beneficiaries will receive a payout when the policyholder dies. The death benefit is the amount of money paid out to beneficiaries and is usually based on the "'face amount' selected when the policy is purchased.

The death benefit amount can be structured in different ways. The two most common structures are a level death benefit, where the benefit is equal to the face value of the policy, and a face amount plus cash value benefit, where the benefit includes the cash value in addition to the face value of the policy.

While the death benefit is guaranteed, the actual amount paid out may fluctuate over time, depending on the performance of the policy's investments. The death benefit amount and terms of the payout will be outlined in the policy's prospectus, which is provided by the insurance company.

It's important to note that variable life insurance policies carry more risk than other types of life insurance policies because the cash value component is invested in assets that can rise or fall in value. As a result, there is no guaranteed rate of return on the investments, and the policyholder bears the risk of investment losses.

To reduce the overall risk, policyholders can allocate a portion of their premium to a fixed account, which offers a guaranteed rate of return, typically with a minimum of 3%. This option provides more stability but may have lower potential rewards compared to other investment choices.

FCCU: Life Insurance Options and Availability

You may want to see also

It has a cash value component

Variable life insurance is a type of permanent life insurance that offers both death benefit protection and a cash value component that can be invested in a variety of different investment options, similar to mutual funds. The cash value component of variable life insurance is what

Understanding PA's Tax on Life Insurance Proceeds

You may want to see also

Frequently asked questions

Variable life insurance does not guarantee a minimum return. The cash value of a variable life insurance policy is influenced by the performance of the market and can therefore depreciate or appreciate.

Variable life insurance is a type of permanent life insurance policy that combines a death benefit with a cash value account that can be invested in various funds, usually mutual funds.

Variable life insurance offers a higher potential for earning cash compared to traditional policies. It also provides financial protection for your family and flexibility with regard to premiums and investments.

Variable life insurance policies are complex, high-risk, and typically have higher premiums and fees than other types of life insurance. There is also a risk of losing coverage if your cash value is insufficient to cover the minimum amount.