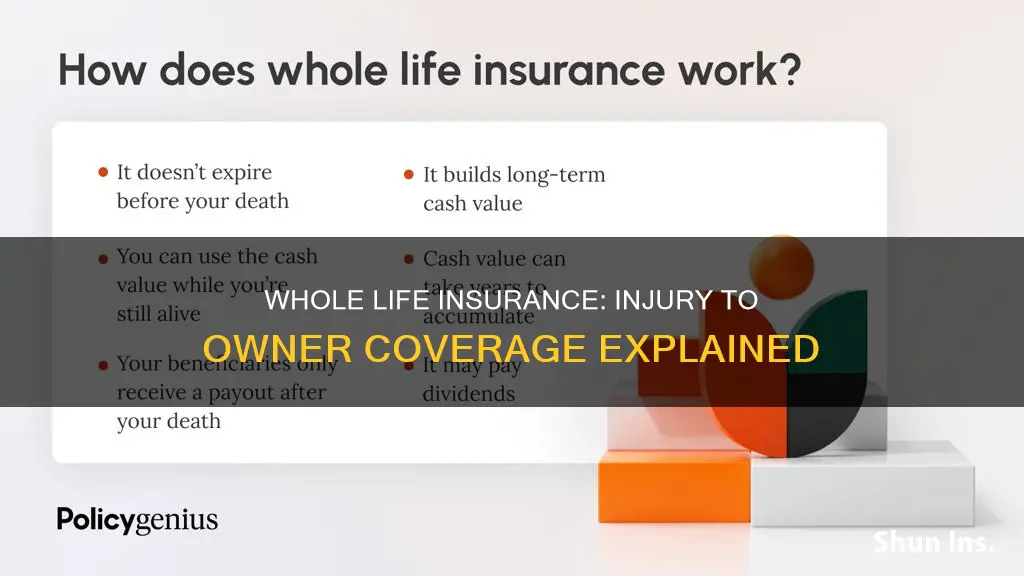

Whole life insurance is a type of permanent life insurance that covers the insured person for their entire life. It provides a death benefit to the policy's beneficiaries upon the insured person's death and also includes a savings component, known as the cash value, which functions similarly to a savings account. This cash value can be borrowed against or withdrawn by the policyholder during their lifetime. Whole life insurance policies also have level premiums, meaning the amount paid every month stays the same.

What You'll Learn

- Whole life insurance covers death due to natural causes, illness, and accidents

- Whole life insurance covers suicide, but only after a certain period

- Whole life insurance may not cover death resulting from risky activities

- Whole life insurance may not cover death caused by illegal activity

- Whole life insurance may not pay out if the policyholder lied on their application

Whole life insurance covers death due to natural causes, illness, and accidents

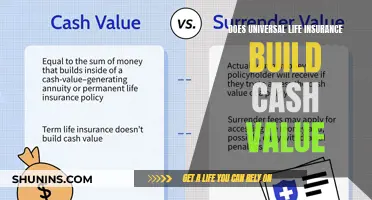

Whole life insurance is a type of permanent life insurance that covers death due to natural causes, illness, and accidents. It provides coverage for the entirety of the insured person's life and includes a savings component, known as the cash value, which functions similarly to a savings account. Interest accrues on a tax-deferred basis, and the policy owner can withdraw or borrow from the cash value.

Whole life insurance policies offer several guarantees, including a guaranteed minimum rate of return on the cash value, fixed premium payments, and a guaranteed death benefit amount. The death benefit is typically paid as a lump sum to the designated beneficiaries, who can then use the money as they see fit.

Whole life insurance is more expensive than term life insurance due to its lifelong coverage and cash value component. Term life insurance only provides coverage for a specific number of years and does not have a cash savings component.

Whole life insurance policies also offer the potential for annual dividends from the insurance company, which can be taken as cash, used to pay premiums, or invested back into the policy. The cash value in a whole life insurance policy can be accessed through policy loans, withdrawals, or by surrendering the policy. However, it's important to note that outstanding loans and withdrawals will reduce the death benefit paid out to beneficiaries.

In summary, whole life insurance provides coverage for death due to natural causes, illness, and accidents, along with additional benefits such as lifelong coverage, guaranteed death benefit, and the ability to build cash value over time.

Life Insurance and VA Loans: What You Need to Know

You may want to see also

Whole life insurance covers suicide, but only after a certain period

Whole life insurance is one type of permanent life insurance that provides coverage throughout the life of the insured person. It is designed to last for an insured's lifetime, as opposed to term life insurance, which is for a specific amount of years. Whole life insurance has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value of a whole life policy typically earns a fixed rate of interest.

Whole life insurance policies typically feature level premiums, meaning the amount you pay every month won’t change. However, whole life insurance is generally more expensive than term life insurance. On average, whole life insurance policies are significantly pricier, with monthly premiums ranging from $247 for a 30-year-old female to $887 for a 60-year-old male for a $500,000 policy. In contrast, term life insurance premiums for the same coverage amount range from $25 for a 30-year-old female to $241 for a 55-year-old male.

Whole life insurance policies often include a "suicide clause," which states that if the policyholder dies by suicide within a certain period, usually the first two years, the insurer may deny the death benefit or only return the premiums paid. This clause is meant to prevent people from taking out a policy with the intention of ending their lives soon after. After this exclusion period, whole life insurance policies do cover suicide, and beneficiaries can receive the full death benefit.

It's important to note that changing a policy, such as adding coverage or converting a term policy into a whole life policy, can reset the clock on the suicide exclusion period. Therefore, it's crucial to carefully review the terms and conditions of your specific whole life insurance policy to understand how suicide is covered.

Universal Life Insurance: Does It Expire or Endure?

You may want to see also

Whole life insurance may not cover death resulting from risky activities

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured person's life. It guarantees a death benefit to the policy's beneficiaries and contains a savings component, known as the "cash value", which functions similarly to a savings account. The cash value can be borrowed against or withdrawn by the policyholder.

Whole life insurance policies typically feature level premiums, meaning the amount paid every month remains the same. However, the policyholder can also choose to pay a single premium upfront or pay regular premiums over an extended period.

While whole life insurance provides coverage for the duration of the insured person's life, it may not cover death resulting from risky activities. Risky activities are generally defined as pursuits or occupations with an increased potential for injury or death. This includes recreational activities such as rock climbing and mountain climbing, as well as certain jobs like logging, aircraft piloting, and construction work.

If the insured person engages in risky activities, their insurer may add an exclusion to the policy that prohibits payments if death occurs during these activities. It is important for policyholders to disclose any participation in risky activities during the application process, as failure to do so could result in the insurer cancelling the policy or refusing to pay the death benefit.

Additionally, whole life insurance policies may not cover death resulting from certain other circumstances, such as lying on the application, failing to pay premiums, or committing a crime or engaging in illegal activity. It is important to carefully review the terms and conditions of a whole life insurance policy to understand what is covered and what may void the policy.

Life Insurance: Epidemic Coverage and Your Policy

You may want to see also

Whole life insurance may not cover death caused by illegal activity

If you die while committing a crime or engaging in an illegal activity, the insurance company will usually deny the claim, and your beneficiaries will not be paid.

However, the exact circumstances of the death will determine whether the insurance company will pay out. For example, if you are a victim of a crime, such as a robbery or assault, and die as a result, your beneficiaries will receive the death benefit.

If you die while committing a crime, the insurance company will usually deny the claim.

If you die as a result of a crime, your beneficiaries will receive the death benefit.

Document: 6

Url: https://www.investopedia.com/articles/personal-finance/082015/life-insurance-cover-death-abroad.asp

Timestamp: 2024-10-24T07:49:04

Snippet: Please fill out this field.

Does Life Insurance Cover Death Outside the U.S.?

Life Insurance Coverage Outside the U.S.

Life Insurance Coverage for U.S. Citizens Living Abroad

Life Insurance Coverage for Non-U.S. Citizens

Life Insurance Coverage for U.S. Citizens Traveling Abroad

Life Insurance Coverage for Non-U.S. Citizens Traveling to the U.S.

Life Insurance Coverage for U.S. Citizens Traveling to War Zones

Life Insurance Coverage for Non-U.S. Citizens Traveling to War Zones

Life Insurance Coverage for U.S. Citizens Moving Abroad

Life Insurance Coverage for Non-U.S. Citizens Moving Abroad

Life Insurance Coverage for U.S. Citizens Living in U.S. Territories

Life Insurance Coverage for Non-U.S. Citizens Living in U.S. Territories

Life Insurance Coverage for U.S. Citizens Traveling to U.S. Territories

Life Insurance Coverage for Non-U.S. Citizens Traveling to U.S. Territories

Life Insurance Coverage for U.S. Military Members Stationed Abroad

Life Insurance Coverage for Non-U.S. Citizens Traveling to War Zones

Life Insurance Coverage for Non-U.S. Citizens Living in U.S. Territories

Life Insurance Coverage for U.S. Citizens Traveling to Canada

Life Insurance Coverage for Non-U.S. Citizens Traveling to Canada

Life Insurance Coverage for U.S. Citizens Traveling to Mexico

Life Insurance Coverage for Non-U.S. Citizens Traveling to Mexico

Life Insurance Coverage for U.S. Citizens Traveling to the Caribbean

Life Insurance Coverage for Non-U.S. Citizens Traveling to the Caribbean

Life Insurance Coverage for U.S. Citizens Traveling to Central America

Life Insurance Coverage for Non-U.SUh citizens traveling to Central America

Life insurance coverage outside the U.S. depends on the type of policy you have.

If you have a term life insurance policy, you're generally covered anywhere in the world.

If you have a whole life insurance policy, you're covered in the U.S. and Canada.

If you have a permanent life insurance policy, you're covered in the U.

Life Insurance Coverage for U.S. Citizens

U.S. citizens are covered by life insurance anywhere in the world, regardless of the type of policy they have.

Life Insurance Coverage for Non-U.S. Citizens

Non-U.S. citizens are covered by life insurance anywhere in the world, except in their home country.

Life Insurance Coverage for U.S. Citizens Traveling to War Zones

If you're a U.S. citizen traveling to a war zone, your life insurance policy will still be valid.

Life Insurance Coverage for Non-U.S. Citizens Traveling to War Zones

If you're a non-U.S. citizen traveling to a war zone, your life insurance policy will not be valid.

Life Insurance Coverage for U.S. Citizens Moving Abroad

If you're a U.S. citizen who's moving abroad, your life insurance policy will still be valid.

Life Insurance Coverage for Non-U.S. Citizens Moving Abroad

If you're a non-U.S. citizen who's moving abroad, your life insurance policy won't be valid.

Life Insurance Coverage for U.S. Citizens in U.S. Territories

If you're a U.S. citizen living in a U.S. territory, your life insurance policy will still be valid.

Life Insurance Coverage for Non-U.S. Citizens in U.S. Territories

If you're a non-U.S. citizen living in a U.S. territory, your life insurance policy won't be valid.

Life Insurance Coverage for U.S. Citizens Traveling to Canada or Mexico

If you're a U.S. citizen traveling to Canada or Mexico, your life insurance policy will be valid.

Life Insurance Coverage for Non-U.S. Citizens Traveling to Canada or Mexico

If you're a non-U.S. citizen traveling to Canada or Mexico, your life insurance policy won't be valid.

Life Insurance Coverage for U.S. Citizens Traveling to the Caribbean or Central America

If you're a U.S. citizen traveling to the Caribbean or Central America, your life insurance policy will be valid.

Life Insurance Coverage for Non-U.S. Citizens Traveling to the Caribbean or Central America

If you're a non-U.S. citizen traveling to the Caribbean or Central America, your life insurance policy won't be valid.

Life Insurance Coverage for U.S. Military Members Stationed Abroad

If you're a U.S. military member stationed abroad, your life insurance policy will be valid.

Life Insurance and Death Outside the U.S.

If you're a U.S. citizen, your life insurance policy will be valid anywhere in the world. If you're a non-U.S. citizen, your life insurance policy will be valid anywhere in the world except in your home country.

Life insurance is a contract between an insurance company and a policy owner. In exchange for regular premium payments, the insurance company agrees to pay a sum of money to the policy's beneficiaries when the insured person dies.

Life insurance policies are designed to provide financial protection to your loved ones after your death. But there are some situations in which your beneficiaries may not receive the death benefit.

If you die while committing a crime or engaging in an illegal activity, the insurance company will usually deny the claim.

However, if you are the victim of a crime and die as a result, your beneficiaries will receive the death benefit.

Life insurance policies are contracts between an insurance company and a policy owner. In exchange for regular premium payments, the insurance company agrees to pay a sum of money to the policy's beneficiaries when the insured person dies.

Life insurance policies are designed to provide financial protection for your loved ones after your death. But there are some situations in which your beneficiaries may not receive the death benefit.

If you die while committing a crime or engaging in an illegal activity, the insurance company will usually deny the claim.

However, if you are the victim of a crime and die as a result, your beneficiaries will receive the death benefit.

Life insurance policies are also valid if you die while traveling to certain places, such as war zones, or living in certain places, such as U.S. territories.

If you're a U.S. citizen, your life insurance policy will be valid anywhere in the world. If you're a non-U.S. citizen, your life insurance policy will be valid anywhere in the world except in your home country.

If you're a U.S. citizen traveling to a war zone, your life insurance policy will still be valid. If you're a non-U.S. citizen traveling to a war zone, your life insurance policy will not be valid.

If you're a U.S. citizen who's moving abroad, your life insurance policy will still be valid. If you're a non-U.S. citizen who's moving abroad, your life insurance policy won't be valid.

If you're a U.S. citizen living in a U.S. territory, your life insurance policy will still be valid. If you're a non-U.S. citizen living in a U.S. territory, your life insurance policy won't be valid.

If you're a U.S. citizen traveling to Canada or Mexico, your life insurance policy will be valid. If you're a non-U.S. citizen traveling to Canada or Mexico, your life insurance policy won't be valid.

If you're a U.S. citizen traveling to the Caribbean or Central America, your life insurance policy will be valid. If you're a non-U.S. citizen traveling to the Caribbean or Central America, your life insurance policy won't be valid.

If you're a U.S. military member stationed abroad, your life insurance policy will be valid.

Life insurance coverage outside the U.S. depends on the type of policy you have.

If you have a term life insurance policy, you're generally covered anywhere in the world.

If you have a whole life insurance policy, you're covered in the U.S. and Canada.

If you have a permanent life insurance policy, you're covered in the U.S.

Document: 7

Url: https://www.investopedia.com/articles/personal-finance/042315/life-insurance-cover-death-abroad.asp

Timestamp: 2024-10-24T07:48:58

Snippet: Please fill out this field.

Life Insurance Coverage for U.S. Citizens

Life Insurance Coverage for Non-U.S. Citizens

Life Insurance Coverage for U.S. Citizens Traveling to War Zones

Life Insurance Coverage for Non-U.S. Citizens Traveling to War Zones

Life Insurance Coverage for U.S. Citizens Moving Abroad

Life Insurance Coverage for Non-U.S. Citizens Moving Abroad

Life Insurance Coverage for U.S. Citizens Living in U.S. Territories

Life Insurance Coverage for Non-U.S. Citizens Living in U.S. Territories

Life Insurance Coverage for U.S. Citizens Traveling to Canada

Life Insurance Coverage for Non-U.S. Citizens Traveling to Canada

Life Insurance Coverage for U.S. Citizens Traveling to Mexico

Life Insurance Coverage for Non-U.S. Citizens Traveling to Mexico

Life Insurance Coverage for U.S. Citizens Traveling to the Caribbean

Life Insurance Coverage for Non-U.S. Citizens Traveling to the Caribbean

Life Insurance Coverage for U.S. Citizens Traveling to Central America

Life Insurance Coverage for Non-U.S. Citizens Traveling to Central America

Life insurance coverage outside the U.S. depends on the type of policy you have.

If you have a term life insurance policy, you're generally covered anywhere in the world.

If you have a whole life insurance policy, you're covered in the U.S. and Canada.

If you have a permanent life insurance policy, you're covered in the U.S.

Life insurance coverage outside the U.S. depends on the type of policy you have.

If you have a term life insurance policy, you're generally covered anywhere in the world.

If you have a whole life insurance policy, you're covered in the U.S. and Canada.

If you have a permanent life insurance policy, you'sre covered in the U.S.

If you're a U.S. citizen, your life insurance policy will be valid anywhere in the world. If you're a non-U.S. citizen, your life insurance policy will be valid anywhere in the world except in your home country.

If you're a U.S. citizen traveling to a war zone, your life insurance policy will still be valid. If you're a non-U.S. citizen traveling to a war zone, your life insurance policy will not be valid.

If you're a U.S. citizen who's moving abroad, your life insurance policy will still be valid. If you're a non-U.S. citizen who's moving abroad, your life insurance policy won't be valid.

If you're a U.S. citizen living in a U.S. territory, your life insurance policy will still be valid. If you're a non-U.S. citizen living in a U.S. territory, your life insurance policy won't be valid.

If you're a U.S. citizen traveling to Canada or Mexico, your life insurance policy will be valid. If you're a non-U.S. citizen traveling to Canada or Mexico, your life insurance policy won't be valid.

If you're a U.S. citizen traveling to the Caribbean or Central America, your life insurance policy will be valid. If you're a non-U.S. citizen traveling to the Caribbean or Central America, your life insurance policy won't be valid.

If you're a U.S. military member stationed abroad, your life insurance policy will be valid.

Life insurance is a contract between an insurance company and a policy owner. In exchange for regular premium payments, the insurance company agrees to pay a sum of money to the policy's beneficiaries when the insured person dies.

Life insurance policies are designed to provide financial protection to your loved ones after your death. But there are some situations in which your beneficiaries may not receive the death benefit.

If you die while committing a crime or engaging in an illegal activity, the insurance company will usually deny the claim.

However, if you are the victim of a crime and die as a result, your beneficiaries will receive the death benefit.

Life insurance policies are contracts between an insurance company and a policy owner. In exchange for regular premium payments, the insurance company agrees to pay a sum of money to the policy's beneficiaries when the insured person dies.

Life insurance policies are designed to provide financial protection for your loved ones after your death. But there are some situations in which your beneficiaries may not receive the death benefit.

If you die while committing a crime or engaging in an illness, the insurance company will usually deny the claim.

However, if you are the victim of a crime and die as a result, your beneficiaries will receive the death benefit.

Life insurance policies are also valid if you die while traveling to certain places, such as war zones, or living in certain places, suchs as U.S. territories.

If you're a U.S. citizen, your life insurance policy will be valid anywhere in the world. If you're a non-U.S. citizen, your life insurance policy will be valid anywhere in the world except in your home country.

If you're a U.S. citizen traveling to a war zone, your life insurance policy will still be valid. If you're a non-U.S. citizen traveling to a war zone, your life insurance policy will not be valid.

If you're a U.S. citizen who's moving abroad, your life insurance policy will still be valid. If you're a non-U.S. citizen who's moving abroad, your life insurance policy won't be valid.

If you're a U.S. citizen living in a U.S. territory, your life insurance policy will still be valid. If you're a non-U.S. citizen living in a U.S. territory, your life insurance policy won't be valid.

If you're a U.S. citizen traveling to Canada or Mexico, your life insurance policy will be valid. If you're a non-U.S. citizen traveling to Canada or Mexico, your life insurance policy won't be valid.

If you're a U.S. citizen traveling to the Caribbean or Central America, your life insurance policy will be valid. If you're a non-U.S. citizen traveling to the Caribbean or Central America, your life insurance policy won't be valid.

If you're a U.S. military member stationed abroad, your life insurance policy will be valid.

Life insurance coverage outside the U.S. depends on the type of policy you have.

If you have a term life insurance policy, you're generally covered anywhere in the world.

If you have a whole life insurance policy, you're covered in the U.S. and Canada.

If you have a permanent life insurance policy, you're covered in the U.S.

Document: 8

Url: https://www.investopedia.com/articles/personal-finance/091415/life-insurance-cover-death-war-terrorism.asp

Timestamp: 2024-10-24T07:49:02

Snippet: Please fill out this field.

Life Insurance Coverage for U.S. Citizens

Life Insurance Coverage for Non-U.S. Citizens

Life Insurance Coverage for U.S. Citizens Traveling to War Zones

Life Insurance Coverage for Non-U.S. Citizens Traveling to War Zones

Life Insurance Coverage for U.S. Citizens Moving Abroad

Life Insurance Coverage for Non-U.S. Citizens Moving Abroad

Life Insurance Coverage for U.S. Citizens Living in U.S. Territories

Life Insurance Coverage for Non-U.S. Citizens Living in U

Life Insurance Surrender Charges: Do They Expire?

You may want to see also

Whole life insurance may not pay out if the policyholder lied on their application

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder's life. It is distinguished by its level premiums, tax-deferred savings component, and death benefit. However, it is important to note that whole life insurance may not pay out if the policyholder lied on their application.

Lying on a life insurance application is considered insurance fraud and can lead to serious consequences. While minor mistakes or unintentional lies may not significantly impact the policy, intentional lies or omissions can result in the insurance company declining coverage, increasing premiums, reducing the payout, or even cancelling the policy.

During the underwriting process, insurers verify the information provided in the application by reviewing medical records, conducting interviews, and utilizing databases like the Medical Information Bureau (MIB). Any discrepancies or false statements discovered during this process may result in adverse consequences.

The potential consequences of lying on a life insurance application include being asked to revise the application, having the application rejected, facing higher insurance premiums, experiencing a reduction in the payout, or having the policy cancelled. Additionally, if false information is discovered within the first two years of the policy, known as the contestability period, the claim may be denied.

To avoid these issues, it is crucial to be truthful and accurate when completing a life insurance application. Providing honest and comprehensive information about your health, lifestyle, and personal history ensures that your beneficiaries receive the intended benefits in the event of your death.

Tricare for Life: Insurance Card Essentials for Enrollees

You may want to see also

Frequently asked questions

Whole life insurance provides coverage throughout the life of the insured person. It pays a tax-free death benefit to the policy owner when the insured person dies. It also contains a savings component, which functions like a cash value account. This means that the policy owner can draw on or borrow from the policy.

Whole life insurance lasts for the entirety of the insured's life, while term life insurance is only in effect for a specific number of years. Whole life insurance also has a cash savings component, which term life insurance does not.

Whole life insurance provides lifelong coverage and financial security to the insured's family in the event of their death. It can also be used as an investment, as the cash value can be withdrawn or borrowed from to pay for large purchases or supplement income in retirement.

Whole life insurance tends to be more expensive than term life insurance. It also offers less flexibility, as the premium payments and death benefit cannot be adjusted. Additionally, the cash value may grow more slowly compared to other policies.