ES Insurance Services is a leading provider of comprehensive insurance solutions, offering a wide range of coverage options to meet the diverse needs of individuals and businesses. With a strong commitment to customer satisfaction and a deep understanding of the insurance market, ES Insurance Services specializes in personal and commercial insurance, including health, auto, home, and business insurance. Their team of experienced professionals is dedicated to delivering tailored solutions, ensuring that clients receive the best protection and support. Whether it's finding the right policy, managing claims, or providing expert advice, ES Insurance Services is committed to building long-lasting relationships with its clients, offering peace of mind and financial security.

What You'll Learn

- Life Insurance: Protects individuals and families against financial loss due to death

- Health Insurance: Covers medical expenses, promoting access to healthcare and financial security

- Auto Insurance: Provides coverage for vehicle damage and liability, ensuring financial protection on the road

- Homeowners Insurance: Safeguards homes and belongings from damage or loss, offering peace of mind

- Business Insurance: Tailored solutions for businesses, mitigating risks and ensuring continuity

Life Insurance: Protects individuals and families against financial loss due to death

Life insurance is a crucial financial tool that provides a safety net for individuals and their loved ones, offering protection against the unforeseen event of death. It is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. This financial security is particularly important as it ensures that the family's financial obligations and long-term goals are met, even when the primary breadwinner is no longer present.

The primary purpose of life insurance is to provide financial stability and peace of mind. When an individual purchases a life insurance policy, they are essentially making a promise to their family that their basic needs and future plans will be taken care of, regardless of the circumstances. This is especially vital for families with financial commitments such as mortgage payments, children's education, or other long-term financial goals. In the event of the insured's passing, the life insurance policy becomes a vital source of income replacement, ensuring that the family can maintain their standard of living and cover essential expenses.

There are various types of life insurance policies available, each designed to suit different needs and preferences. Term life insurance is a popular choice, offering coverage for a specified period, such as 10, 20, or 30 years. This type of policy provides a fixed death benefit if the insured dies during the term, and it is generally more affordable than permanent life insurance. Permanent life insurance, on the other hand, provides lifelong coverage and includes a savings component, allowing the policyholder to accumulate cash value over time. This type of policy can be tailored to meet specific financial goals and can be an excellent tool for long-term wealth building.

When considering life insurance, it is essential to evaluate your unique circumstances and goals. Factors such as age, health, lifestyle, and financial obligations will influence the type and amount of coverage needed. Consulting with an insurance professional can help individuals navigate the various options and choose a policy that best suits their requirements. They can provide personalized advice, ensuring that the chosen plan aligns with the policyholder's vision for their family's financial security.

In summary, life insurance is a powerful tool for protecting individuals and families from the financial impact of death. It provides a safety net, ensuring that loved ones are cared for and financial goals are achieved, even in the face of adversity. With various policy types available, individuals can select the coverage that best fits their needs, offering both protection and potential long-term financial benefits.

Billing Insurance for Associate Dentists: Navigating the Reimbursement Journey

You may want to see also

Health Insurance: Covers medical expenses, promoting access to healthcare and financial security

Health insurance is a vital component of any comprehensive financial strategy, offering individuals and families a safety net for medical expenses and promoting access to quality healthcare. It provides financial security and peace of mind, knowing that unexpected illnesses or injuries won't lead to overwhelming costs. This type of insurance is designed to cover a wide range of medical services, from routine check-ups and preventive care to major surgeries and long-term treatments.

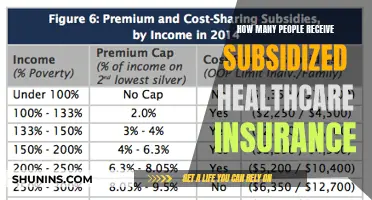

The primary benefit of health insurance is its ability to cover medical expenses, ensuring that policyholders can access necessary healthcare without incurring substantial out-of-pocket costs. When an individual has health insurance, they are more likely to seek regular medical attention, which can lead to early detection of potential health issues and more effective treatment. This proactive approach to healthcare can significantly improve overall health outcomes and reduce the risk of developing chronic conditions.

In addition to covering medical expenses, health insurance also promotes financial security. It provides a means to manage and predict healthcare costs, which can be unpredictable and financially devastating without insurance. With insurance coverage, individuals can budget for their healthcare needs, knowing that their insurance plan will help cover the costs of doctor visits, hospital stays, prescription medications, and more. This financial security encourages people to prioritize their health and make informed decisions about their medical care.

Furthermore, health insurance plans often include a network of healthcare providers, ensuring that policyholders have access to a wide range of medical services. This network can include primary care physicians, specialists, hospitals, and other healthcare facilities. By utilizing the network, individuals can benefit from coordinated care, reduced wait times, and potentially lower costs due to negotiated rates between the insurance company and healthcare providers.

In summary, health insurance is an essential tool for managing medical expenses and promoting access to healthcare. It provides financial security, encourages regular medical check-ups, and ensures that individuals can receive the necessary treatment without facing financial ruin. With the right health insurance plan, individuals can take control of their health and well-being, knowing that they are protected against unexpected medical costs.

Asthma: Pre-Existing Condition for Insurance?

You may want to see also

Auto Insurance: Provides coverage for vehicle damage and liability, ensuring financial protection on the road

Auto insurance is a vital component of responsible vehicle ownership, offering financial protection and peace of mind to drivers. This type of insurance is specifically designed to cover the costs associated with vehicle damage and liability, ensuring that you are prepared for various road-related scenarios. Whether you're a new driver or a seasoned motorist, understanding the importance of auto insurance is key to navigating the roads safely and confidently.

The primary purpose of auto insurance is to provide financial coverage in the event of an accident or other incidents that may damage your vehicle. This includes repairs or replacement costs for your car, truck, or any other vehicle you own. For instance, if you're involved in a collision with another vehicle, the insurance policy will cover the expenses to fix or replace your car, ensuring you're not left with a substantial financial burden. Additionally, auto insurance can also provide coverage for damage caused by natural disasters, theft, or vandalism, offering comprehensive protection beyond just accidents.

Liability coverage is another critical aspect of auto insurance. This part of the policy protects you financially if you are found responsible for causing an accident that results in injuries or property damage to others. In many jurisdictions, having liability insurance is mandatory, as it ensures that you can meet your legal obligations and protect yourself from potential lawsuits. For example, if you're at fault in a minor fender-bender, your liability insurance will cover the medical expenses and repairs for the other driver, preventing a minor incident from becoming a major financial crisis.

Furthermore, auto insurance policies often include various additional benefits and protections. These may include medical payments coverage for injuries sustained in an accident, regardless of fault, and coverage for damage to your vehicle caused by natural disasters or other non-collision incidents. Some policies also offer rental car reimbursement, roadside assistance, and even accident forgiveness, which can provide further peace of mind and financial security.

In summary, auto insurance is an essential service that safeguards your financial well-being and provides a safety net for various road-related situations. It ensures that you can drive with confidence, knowing that you have the necessary coverage for vehicle damage and liability. By understanding the different aspects of auto insurance, you can make informed decisions and choose a policy that best suits your needs, offering comprehensive protection for your vehicle and yourself.

Unlocking the Mystery: Does Insurance Free Up Your Phone's Value?

You may want to see also

Homeowners Insurance: Safeguards homes and belongings from damage or loss, offering peace of mind

Homeowners insurance is a crucial safeguard for any property owner, offering comprehensive protection against various risks and unforeseen events. This type of insurance is specifically designed to protect your home and its contents, providing financial security and peace of mind. Whether it's a cozy cottage, a spacious family home, or an investment property, homeowners insurance ensures that your asset is protected from potential threats.

The primary purpose of homeowners insurance is to cover damages or losses to your property. This includes structural damage caused by natural disasters such as hurricanes, floods, earthquakes, or fires. For instance, if a severe storm damages your roof, the insurance policy will cover the repair or replacement costs, ensuring your home is restored to its original condition. Additionally, it provides coverage for personal belongings within the home, such as furniture, appliances, clothing, and valuables, in the event of theft, damage, or loss.

This insurance policy also extends its protection beyond the physical structure and contents. It typically includes liability coverage, which safeguards you against legal claims or lawsuits arising from accidents or injuries that occur on your property. For example, if a visitor slips and falls on your porch, causing injury, the insurance will cover the associated medical expenses and legal fees. Furthermore, homeowners insurance often offers additional living expenses coverage, which helps with temporary accommodation costs if your home becomes uninhabitable due to a covered loss.

When considering homeowners insurance, it's essential to understand the various coverage options and policy details. Policies may vary, and it's advisable to review and compare different providers to ensure you have the right level of protection. Some policies offer customizable coverage, allowing you to tailor the protection to your specific needs. This might include adding riders for valuable items, such as jewelry or art collections, or increasing coverage limits for high-value possessions.

In summary, homeowners insurance is a vital investment for any property owner, offering comprehensive protection against potential risks. It safeguards your home and belongings, provides financial security, and offers peace of mind, knowing that you are prepared for unexpected events. With the right insurance policy, you can focus on enjoying your home and its surroundings without constantly worrying about potential threats.

The Flexibility of Short-Term Insurance: Why It's Worth Considering for Your Yearly Plans

You may want to see also

Business Insurance: Tailored solutions for businesses, mitigating risks and ensuring continuity

In today's complex business landscape, having a robust insurance strategy is essential for any enterprise aiming to thrive and endure. Business insurance is a critical component of risk management, offering tailored solutions to address the unique challenges faced by different organizations. It provides a safety net, ensuring that businesses can navigate unforeseen circumstances and continue their operations with minimal disruption. This is particularly crucial for small and medium-sized enterprises (SMEs) that often have limited resources to manage risks independently.

The primary objective of business insurance is to identify and mitigate potential risks that could impact a company's operations, finances, and reputation. These risks can be diverse, ranging from property damage due to natural disasters to legal liabilities arising from business activities. For instance, a manufacturing company might face risks associated with machinery breakdowns, product recalls, or workplace injuries. On the other hand, a service-based business could be concerned with data breaches, professional negligence, or employment-related issues. By understanding these risks, insurance providers can offer customized policies to suit the specific needs of each business.

Tailored business insurance solutions often involve a comprehensive assessment of the company's operations, industry, and potential risks. This process includes analyzing the business model, understanding its unique challenges, and identifying areas where insurance can provide the most significant benefit. For example, a tech startup might require insurance coverage for data breach response, cyber liability, and business interruption, while a retail business might focus on inventory protection, customer injury claims, and property insurance. The key is to design a policy that provides adequate protection without unnecessary costs.

Effective business insurance strategies also involve regular reviews and adjustments to ensure that the coverage remains relevant and adequate as the business evolves. This is crucial because risks can change over time due to market shifts, technological advancements, or legal developments. For instance, a company might need to update its insurance policy after a significant expansion, a change in its supply chain, or the introduction of new products or services. Regular reviews help businesses stay resilient and prepared for any eventuality.

In conclusion, business insurance is a vital tool for risk management, offering tailored solutions that are essential for the continuity and growth of enterprises. By understanding and addressing specific risks, businesses can ensure they are adequately protected, enabling them to focus on their core activities and long-term success. It is a strategic investment that empowers companies to navigate the complexities of the business world with confidence and resilience.

Insurance: An Investment or a Safety Net?

You may want to see also

Frequently asked questions

ES Insurance Services is a leading insurance brokerage firm specializing in providing comprehensive insurance solutions to businesses and individuals. They offer a wide range of insurance products, including property, liability, professional indemnity, cyber insurance, and more. ES Insurance Services is known for its personalized approach, tailored coverage options, and expert guidance to help clients manage risks effectively.

Obtaining a quote is straightforward. You can visit the ES Insurance Services website and use their online quote calculator. Simply input the necessary details, such as the type of coverage, business or personal information, and any specific requirements. Alternatively, you can contact their customer service team, who will be happy to assist you with a personalized quote based on your unique needs.

ES Insurance Services stands out for its client-centric approach and industry expertise. Their team of experienced brokers takes the time to understand each client's unique risks and objectives. They offer tailored solutions, ensuring that the insurance policies provided are comprehensive and cost-effective. Additionally, ES Insurance provides 24/7 support, quick response times, and regular policy reviews to ensure clients' needs are always met.

Absolutely! ES Insurance Services offers comprehensive support throughout the entire insurance journey. In the event of a claim, their dedicated claims team will guide you through the process, ensuring a smooth and efficient experience. They provide regular policy updates, assist with policy renewals, and offer valuable resources to help clients manage their insurance effectively. The company's goal is to build long-term relationships and provide ongoing support to their clients.