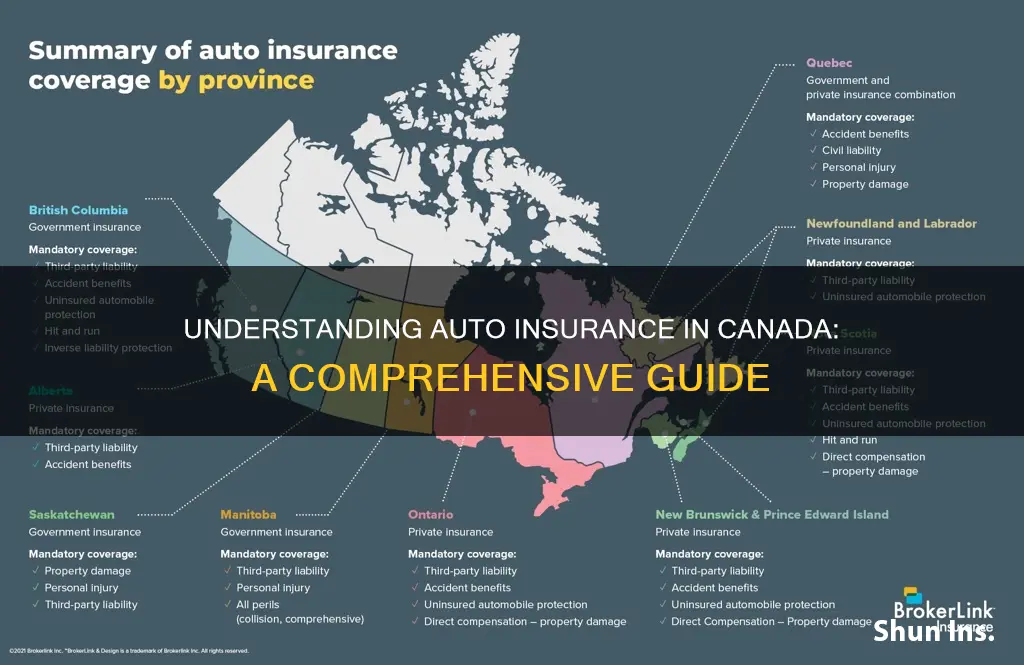

Auto insurance is a legal requirement for vehicle owners in Canada. It protects you in the event of an accident, covering the cost of repairs to your car or other vehicles, as well as liability claims if you're responsible for the accident. The law is clear on this: if you're caught driving without insurance, you could face a hefty fine, a suspended license, or even have your vehicle confiscated.

There are several types of auto insurance available in Canada, including third-party liability coverage, collision coverage, and comprehensive coverage. The cost of your insurance will depend on various factors, such as your vehicle, driving history, age, and gender.

What You'll Learn

Third-party liability coverage

Third-party liability insurance covers repair costs to damaged vehicles and property, medical costs for injured parties, legal fees, and damages awarded from a lawsuit. It is important to note that this type of insurance does not cover injuries or damage to the insured person or their property. Instead, it is meant to protect against financial repercussions and legal struggles if found responsible for damages or injuries to a third party.

The minimum amount of third-party liability insurance in Canada is $200,000, except in Quebec, where it is $50,000, and in Nova Scotia, where it is $500,000. However, insurance companies recommend buying additional coverage as one accident can easily exceed these minimums. Most Canadians purchase between $1 million and $5 million in coverage for broader protection.

When determining how much third-party liability coverage to get, it is important to consider factors such as how often you drive, where you drive, and whether you use your vehicle for work. Discussing your specific needs with an insurance provider can help ensure you have adequate coverage.

Auto Insurance Gaps: California's Take

You may want to see also

Collision coverage

If you lease or finance a car, your lender will likely require you to have collision coverage. If you own your car, collision coverage is optional. However, you should consider your financial situation and whether you could afford to replace your car if you're in an accident.

With collision coverage, your insurance company will pay to repair or replace your vehicle if you are at fault, minus your deductible. You set your deductible amount, which is the portion of money you have to pay before your insurance provider will pay the rest. A higher deductible can help you save on car insurance, but it also means you'll pay more out of pocket before receiving any payment from your insurer. Typically, deductibles range from $500 to $1,000, but they can go as high as $5,000.

The cost of collision coverage varies based on several factors, including your insurance provider, driving history, the current value of your car, type of vehicle, and your deductible amount.

It's important to note that collision coverage only applies to accidents and does not cover weather-related damage, theft, fire, vandalism, or collisions with animals. For protection against these types of incidents, you would need to purchase comprehensive insurance in addition to collision coverage.

Auto Insurance Impact: Reducing Road Risks and Saving Lives

You may want to see also

Comprehensive coverage

Comprehensive insurance is an optional form of insurance that you can add to your policy. It is not part of the mandatory auto insurance in Canada. Comprehensive insurance provides additional protection not included in basic automobile policies. It covers the cost of repairing damage caused by vandalism, theft, fire, natural disasters, and other hazards, even when your car is parked and unattended. It also covers damage to your windshield.

Comprehensive insurance does not cover certain losses or damage to your car. For example, it does not cover damage to your car from a collision with another vehicle or object on the road. It also does not cover medical expenses, lost income, or legal fees for you or another person after an accident.

Comprehensive insurance is especially important if you are getting a loan to pay for your car. It is required by some lenders. If you lease or finance your vehicle, you will most likely need comprehensive coverage as part of your lease or finance agreement.

The cost of comprehensive insurance varies by province and provider, but a rough range is about $100-$300. You can increase your comprehensive insurance deductible to reduce your premium costs.

Insurance Write-Offs: What Happens When Your Car Is Totaled

You may want to see also

Specified perils and all perils

Specified Perils Coverage

Specified perils coverage is an optional coverage that you can buy at an extra cost and add to your base policy. It protects your vehicle from a list of specific perils or hazards that are outlined in your policy. This type of coverage usually includes protection against theft or attempted theft and damage that occurs to your vehicle while it is being transported on land or water. However, it does not cover vandalism or damage from falling or flying objects. Specified perils coverage also does not include collision-related incidents.

All Perils Coverage

All perils coverage, also known as "all-risk" insurance, is another form of optional coverage that combines collision and comprehensive coverage. It provides protection for all risks unless they are specifically excluded in your policy. This includes protection against theft, fire, water damage, earthquake, and weather damage such as hail, lightning, and wind. All perils coverage will also cover loss or damage resulting from a collision or hit-and-run. This type of coverage is ideal for those who require full coverage, including collision-related damages, and are comfortable with having a common deductible for collision and comprehensive claims.

Choosing Between Specified Perils and All Perils Coverage

When deciding between specified perils and all perils coverage, it's important to consider your personal circumstances and the level of coverage you need. Specified perils coverage is more limited in scope and does not include collision-related damages, vandalism, or certain types of glass breakage. On the other hand, all perils coverage is the broadest form of coverage, including everything on the list of specified perils, plus additional perils such as vandalism. All perils coverage also covers loss or damage resulting from a collision. If you require full coverage and are comfortable with a common deductible for collision and comprehensive claims, all perils coverage may be the better option. However, if you don't need collision coverage and are looking to save money on your premium, specified perils coverage may be a more suitable choice.

Auto Insurance and Tax Write-Offs

You may want to see also

Accident benefits

The Statutory Accident Benefits Schedule (SABS) is a document that outlines what is covered under your policy. It applies to all basic automobile policies and outlines the mandatory and optional limits for medical care, income replacement, death, funeral expenses and loss of income from disability.

Income Replacement Benefits

If you are unable to work, you may qualify for benefits of 70% of your gross income, capped at $400 per week. You can increase this up to $1,000 per week.

Caregiver Benefits

If you are unable to provide care to a dependent due to specific injuries, you can receive compensation to hire someone to help. You can add optional endorsements to include all injuries.

Non-Earner Benefits

If you don't qualify for income replacement, are a student, and cannot continue your daily life as before the incident, you may qualify to receive $185 per week.

Medical, Rehabilitation and Attendant Care Benefits

This covers the cost of healthcare and rehabilitation that are not covered by a private health plan or the government.

Mandatory coverage includes up to $65,000 for non-catastrophic injuries or up to $1 million for catastrophic injuries. You can increase the amount for non-catastrophic injuries to $130,000 and catastrophic injuries to $2 million.

Death and Funeral Benefits

In the event of death as a result of an accident, the following will be paid out:

- $25,000 to the spouse

- $10,000 to each dependent

- A maximum of $6,000 for funeral expenses

- $10,000 to former spouses if the person had financial obligations to them

You can increase these limits up to $50,000 for the spouse, $20,000 for dependents, and $8,000 for funeral expenses.

Additional Expenses

Other expenses that may be covered include:

- Lost educational expenses

- Expenses for visitors

- Housekeeping and home maintenance

- Damage to clothing, glasses, and other belongings

- Cost of examinations

Does Mercury Auto Insurance Cover U-Haul Rentals?

You may want to see also

Frequently asked questions

Auto insurance is a financial protection you must purchase if you own a car or other vehicle in Canada. It protects you in the case of an accident and is mandatory for all motorists in Canada.

The most basic type of auto insurance is third-party liability coverage, which is mandatory. It protects you against paying for damage you cause to someone else's property and covers the medical costs of anyone injured in an accident. Collision coverage is the second type of insurance, which covers you if you hit something other than a vehicle. The third type is comprehensive coverage, which is the broadest range of protection and usually covers medical and collision-related damages, as well as events unrelated to the operation of the vehicle, such as theft and floods.

You can buy auto insurance from a licensed insurance broker, who will research the market to find the best insurance for you. You can also use an insurance agent, who typically represents a single insurance company, or shop online.