The amount of auto insurance coverage you need depends on your financial situation and the requirements of your state. While the minimum amount of car insurance you'll typically need is state-required liability coverage, it's recommended that you purchase as much coverage as you can comfortably afford to ensure you and your vehicle are covered in most scenarios.

Liability coverage is required to drive in almost every state, but the amount you need may vary depending on where you live. Liability coverage doesn't pay you if you cause a crash; instead, it pays others for injuries, deaths, and property damage you cause, but only up to your policy's limits.

Full coverage insurance will cover damage to your own car, up to your vehicle's market value. It's a smart choice if you want peace of mind or if you drive an expensive vehicle that would be difficult to replace. However, if your car has a low cash value or you're willing to pay for a replacement, you may be better off without it.

In addition to liability and full coverage, there are several other types of optional coverage you may want to consider, such as uninsured motorist coverage, medical payments coverage, and roadside assistance. Ultimately, the right amount of auto insurance coverage for you will depend on your individual needs and budget.

What You'll Learn

Liability insurance

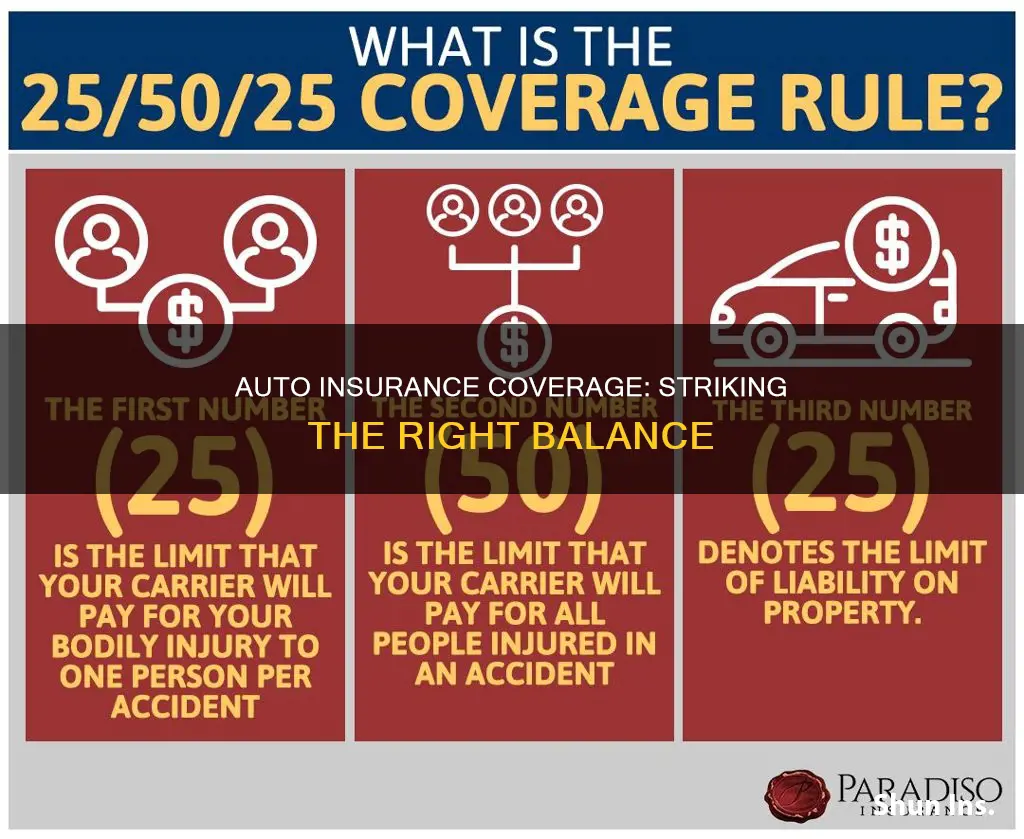

The minimum liability limits typically required by states are $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, these limits vary across states, and it is recommended to get higher coverage if you can afford it. Experts suggest that you should carry enough liability insurance to cover your net worth, which includes the value of your assets such as your home, cars, savings, and investments, minus your debt. This will protect your assets in case you are sued after an accident.

If you want insurance for your own car repairs, you will need to purchase collision and comprehensive insurance in addition to liability insurance. Collision insurance covers the cost of repairing or replacing your car if it is damaged in an accident, while comprehensive insurance covers damage to your car from events outside your control, such as theft, vandalism, or natural disasters.

Auto Insurance: New Plates?

You may want to see also

Collision insurance

If you own your vehicle outright and choose not to carry collision coverage, you will have to pay for repairs or a replacement vehicle out of pocket if you're involved in a single-vehicle accident or are found at fault in an accident. If the other driver is at fault, their liability coverage will typically pay for the damage.

When deciding whether to get collision coverage, consider the value of your vehicle. If your vehicle is brand new or still worth a considerable amount, collision coverage may be a good idea as it can help you pay for expensive repairs or a replacement if it's damaged. Another factor to consider is your ability to pay out of pocket. If you couldn't afford to pay for repairs or a replacement vehicle, collision coverage may be worth it for peace of mind.

If your vehicle won't be driven for a long period, such as a boat or RV in storage, you may not need collision coverage during that time.

Collision coverage doesn't apply to collisions with animals or damage to your vehicle caused by events outside of your control, such as a tree falling on it. These situations would be covered under comprehensive coverage. Additionally, collision coverage doesn't cover injuries or damage you cause to another driver and their vehicle; your liability coverage applies in these cases.

Texas Auto Insurance in Louisiana: What You Need to Know

You may want to see also

Comprehensive insurance

- Vandalism, fire, and explosions

- Windshield and glass damage

- Falling trees/limbs and other objects

- Rocks/objects kicked up by or falling off cars

- Storms, hail, wind, floods, lightning, and earthquakes

- Accidents with animals (e.g. hitting a deer)

The amount of comprehensive coverage you need depends on your financial situation. If you don't have enough savings to cover the costs of repairing or replacing your vehicle in the event of an accident, then you may want to consider getting more comprehensive coverage.

The Power Play: Auto Insurers, Body Shops and the Fine Line Between Them

You may want to see also

Uninsured motorist insurance

Uninsured motorist coverage typically includes two components: uninsured motorist bodily injury (UMBI) and uninsured motorist property damage (UMPD). UMBI will pay for medical bills for both you and your passengers if you are in an accident with an uninsured driver. UMPD, on the other hand, will cover damage to your vehicle caused by an uninsured driver. In some states, a deductible may be required for UMPD.

In addition to uninsured motorist coverage, it is also a good idea to consider underinsured motorist coverage. This type of coverage will protect you if you are in an accident with a driver who does not have enough insurance to cover the damages. Underinsured motorist coverage typically includes underinsured motorist bodily injury (UIMBI) and underinsured motorist property damage (UIMPD). UIMBI will pay for medical bills for you and your passengers, while UIMPD will cover damage to your vehicle.

When deciding how much uninsured motorist coverage to purchase, it is generally recommended to choose limits that match your liability coverage. For example, if your liability coverage limits are $50,000 per person and $100,000 per accident, you should consider choosing the same limits for your uninsured motorist coverage. This will ensure that you have sufficient coverage in the event of an accident with an uninsured driver.

In summary, uninsured motorist insurance is a crucial component of auto insurance, providing financial protection in the event of an accident with an uninsured or underinsured driver. By understanding the different types of coverage available and selecting appropriate limits, you can ensure that you have the necessary protection in place.

Anti-Theft System: Cheaper Auto Insurance?

You may want to see also

Personal injury protection

PIP coverage can help pay for medical expenses for you and your injured passengers. It can also help cover your health insurance deductible. If you are injured in an accident and are unable to work, your PIP coverage can help replace lost wages. This benefit can also apply if you are self-employed and need to hire temporary workers to perform tasks.

PIP coverage can also help pay for funeral, burial, or cremation expenses after a car accident. If you pass away in an auto accident, your PIP insurance can help replace your lost income for your surviving dependents. Additionally, your PIP insurance can help pay for services that you would normally perform if you weren't injured, such as childcare and house cleaning.

PIP insurance does have its limitations. It won't cover the other driver's injuries in a collision, nor will it cover any injuries from an accident that occurred while you were committing a crime, such as fleeing the police, or while you were receiving payment for driving.

The amount of PIP coverage you need will depend on the requirements of your state. In some states, PIP is mandatory, while in others, it is optional. It's important to review your state's requirements and consider your own financial situation when determining how much PIP coverage you need.

In terms of how much PIP coverage to purchase, it is generally recommended to get enough coverage to protect your financial security. Consider your net worth, which includes the value of your assets (such as your car, savings, home, business, or retirement and investment funds) and subtract any debt you owe. Make sure your PIP coverage is sufficient to protect your assets in the event of an accident.

Some states have minimum requirements for PIP coverage. For example, in Texas, insurance companies are required to offer every driver at least $2,500 of PIP insurance, and you can typically increase your coverage up to $5,000 or $10,000.

When deciding on the amount of PIP coverage, it's important to weigh the cost of the insurance against the potential benefits. PIP coverage can provide valuable financial protection in the event of an accident, but it is an additional expense that will increase your insurance premiums. Compare quotes from multiple insurance providers to find the best rate for the level of coverage you need.

Auto Insurance Coverage for Stalled Vehicles: Am I Protected?

You may want to see also

Frequently asked questions

The minimum amount of auto insurance coverage you need is your state's required liability coverage. This allows you to pay for some, if not all, injuries and damages you're liable for in an accident. The most commonly required liability limits are $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage per accident. However, individual state requirements vary widely.

To be fully protected, you should try to purchase the maximum amount of auto insurance coverage you can comfortably afford. A good rule of thumb is to buy enough liability insurance to cover what you could lose in a lawsuit against you if you cause a car accident. You should also consider adding optional coverage types, such as uninsured motorist coverage, medical payments coverage, and personal injury protection.

If you lease or finance your car, your lender will typically require you to carry liability coverage above your state's minimum limits, as well as comprehensive and collision coverage. Comprehensive coverage protects your vehicle from things outside your control, such as theft, vandalism, and natural disasters. Collision coverage pays to repair or replace your car if it's damaged in an accident with another vehicle or object.