Life insurance is a crucial way to protect your family's financial future, but it can be frustrating when your application is denied. There are several reasons why your life insurance application may be rejected, including medical conditions, age, lifestyle choices, financial history, and misleading or withholding information. Understanding these reasons can help you take control of the situation and explore alternative options to secure coverage for your loved ones.

| Characteristics | Values |

|---|---|

| Health History | Pre-existing conditions, cancer treatment, diabetes, high blood pressure, heart disease, smoking, drug use |

| Lifestyle Choices | Hazardous job, risky hobbies, alcohol or drug use |

| Age | Age limits, e.g. over 75 or 80 |

| Financial History | Unpaid debts, delinquent payments, bankruptcy, low income |

| Lying on Application | Misleading information, omitting critical information |

| Medical Exam Results | Poor results, positive drug test |

| Motor Vehicle Record | History of accidents, reckless driving, speeding tickets, DUI or DWI |

| Criminal Record | Convictions |

What You'll Learn

Lying or omitting information on your application

Lying or omitting information on your life insurance application can have serious consequences. If the insurance company discovers that you have lied or withheld critical information, they may deny your application or, worse, deny your beneficiary the insurance payout after your death.

Insurance companies conduct thorough investigations to assess the risk of insuring applicants. They consider various factors, including medical history, lifestyle, and financial stability. Lying about or omitting critical information, such as a family history of heart disease or a diagnosis of depression, can significantly impact their evaluation.

For example, if you lie about your smoking habits or fail to disclose a dangerous hobby like skydiving, the insurer may discover this during the contestability period, which is typically the first two years of the policy. If you pass away within this period, and the insurer finds that you misrepresented information, they may deny the claim, even if the cause of death was unrelated to the misrepresentation.

Insurance companies may also deny coverage if they believe you cannot afford the premiums. This could be due to a history of bankruptcy, significant debt, or low income. It is essential to provide honest and accurate information on your application to avoid issues with your coverage.

If you are unsure about what information to disclose, it is best to consult with an independent insurance broker or agent. They can guide you through the process and ensure you provide all the necessary details. Remember, honesty is crucial when applying for life insurance to protect your loved ones' future financial security.

The Intricacies of Life Insurance Product Creation

You may want to see also

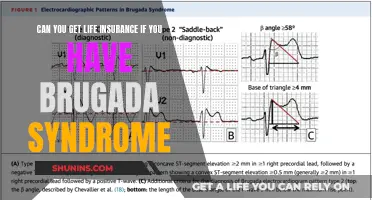

Medical conditions

Life insurance companies take your physical health into account when assessing your application. Most life insurance companies require you to undergo a medical exam and blood tests before issuing a policy. They are, after all, betting that you'll live longer than your life insurance policy term.

If you have a serious medical condition, your insurer may be inclined to deny you coverage as your current health could pose too much of a risk. Some insurers may approve coverage if consistent treatment methods are proven, but your existing health conditions may increase the price of the policy.

- Chronic illnesses

- Diabetes

- Heart disease

- High blood pressure

- Obesity

- High cholesterol

- Cancer

- HIV

- Cerebral palsy

- Epilepsy

If you've had cancer, most insurers require you to complete five years of remission before you can qualify for life insurance coverage.

Additionally, any history of chronic disease, cancer, diabetes, or suicide in your family (typically parents and/or siblings) may make it more difficult for the applicant to be approved for coverage.

If you are denied life insurance coverage due to a medical condition, you can take steps to improve your chances of being approved. If you can prove that a physician is treating your health condition, your odds of approval may increase. Depending on the company, you can ask the physician to write a statement explaining your health battle and confirming that you are actively pursuing treatment.

If you are faced with a chronic health issue, you may be able to qualify for life insurance without a medical exam by improving your physical health. This could include eating healthier, quitting smoking, or exercising more.

Whole Life Insurance: When Does It Pay Up?

You may want to see also

Lifestyle choices

One such lifestyle choice is participation in risky hobbies. Skydiving, racing, and base jumping are examples of activities that can increase your mortality risk, leading insurance companies to deny coverage or offer it at a higher rate. Similarly, having a high-risk occupation, such as being a police officer or serving in the military, can also impact your eligibility.

Substance use is another critical area of consideration. A history of heavy drug, nicotine, or alcohol abuse can significantly affect your chances of obtaining life insurance. Even the use of marijuana, whether legal or for medical purposes, may be a factor, depending on the insurer.

Other lifestyle choices that can impact your application include international travel, particularly to high-risk areas, and poor driving records, specifically multiple speeding or reckless driving charges.

It is important to note that making positive lifestyle changes can improve your chances of obtaining life insurance. Quitting smoking, improving your health, and addressing any high-risk behaviours can all contribute to a more favourable outcome when applying for coverage.

Life Insurance and Pregnancy: What Coverage is Offered?

You may want to see also

Financial history

In addition, insurers may deny coverage if the amount of coverage applied for does not align with the applicant's financial situation. For instance, if an applicant with a low net worth and annual income suddenly applies for $2 million in coverage, this discrepancy will raise red flags for the insurer, who will likely reject the application.

Furthermore, insurers may reject applications if there is reason to believe the applicant cannot afford the premiums. This may occur if the applicant has a history of bankruptcy, substantial debt, or low income.

In summary, a less-than-ideal financial history can increase the likelihood of life insurance coverage denial. Insurers consider the applicant's ability to pay premiums and assess whether the amount of coverage applied for is justified by their financial situation.

Pera's Life Insurance Offering: What You Need to Know

You may want to see also

Age

The older an individual is, the more expensive it becomes to obtain life insurance. While there are life insurance options for seniors, the available policies may not adequately meet their coverage needs or may be prohibitively expensive. Life insurance options start to become limited once an individual reaches the age of 80, but there are still some insurers that offer coverage up to the age of 85 or even 90.

For individuals who are older and have been denied life insurance due to age, there are alternative options available. Whole life insurance, for example, is often available to people as old as 85 or 90, although it is significantly more expensive than term life insurance. Final expense insurance is another option for individuals concerned about funeral expenses, and it can be obtained by people up to 85 years old or older, depending on the provider.

Additionally, individuals who are older and have sufficient savings may not need life insurance as their investments can generate enough growth to replace their income. This is known as self-insuring.

It is important to note that age is not the only factor considered by life insurance companies. Other factors, such as physical health, lifestyle choices, financial situation, and occupation, also play a role in determining eligibility for life insurance coverage. However, age can be a significant factor, and it is recommended to consider obtaining life insurance at a younger age when the chances of approval are higher, and premiums are typically lower.

Borrowing Against Life Insurance: Is It Worth the Risk?

You may want to see also

Frequently asked questions

Life insurance companies have to balance the risk they take on. If an insured person dies, they pay out a lot of money. Here are some reasons why life insurance companies deny coverage:

- Medical conditions: Life-threatening illnesses such as diabetes, high blood pressure, or heart disease may disqualify you from coverage.

- Lifestyle choices: Risky hobbies, hazardous jobs, or a history of substance abuse may lead to denial.

- Age: Most life insurance products have age limits, and your age can also affect the coverage amount.

- Financial history: A history of unpaid debts, delinquent payments, or bankruptcy may suggest an inability to pay premiums.

- Lying on the application: Intentionally misleading the insurance company can lead to rejection.

Here are some steps you can take:

- Review the reason for denial: Contact the insurance company to understand why your application was denied.

- Appeal the decision: If the denial was based on inaccurate information, ask the insurance company about the appeals process.

- Try a different insurance provider: Each company has its own underwriting standards, so consider applying to multiple carriers or working with an independent insurance broker.

- Explore alternative coverage options: Consider no-exam life insurance, group term life insurance, whole life insurance, or final expense insurance.

- Wait and reapply later: Make lifestyle changes to reduce your risk, such as giving up risky hobbies or improving your financial health.

Even if you have a life insurance policy, there are certain circumstances under which the insurance company may deny a claim made by your beneficiaries. Here are some common reasons for denial of a life insurance claim:

- Contestability period: If the insured person dies within the contestability period (usually the first two years of the policy), the insurer can investigate the accuracy of the information provided on the application and may deny the claim if misrepresentations are found.

- Type of death not covered: Deaths resulting from illegal or criminal activities, suicide (within the specified period from the start of the policy), or homicide may not be covered.

- Failure to disclose relevant information: Not providing information needed to accurately assess the risk of a policy payout can lead to denial of a claim.

- Non-payment of premiums: If the policy premiums are not up to date, the insurer may deny the claim.