Brugada syndrome is a rare heart condition that affects the heart's rhythm and can lead to cardiac arrest and even death. It is usually inherited, although not always, and often starts in adulthood. While there is currently no cure, there are treatments available to lower the risk of serious problems, such as an implanted cardioverter defibrillator (ICD). As it is a pre-existing medical condition, people with Brugada syndrome may wonder if they can get life insurance. The good news is that there are insurance companies that specialise in providing cover for people with heart conditions, and it is worth reaching out to them to discuss individual circumstances.

| Characteristics | Values |

|---|---|

| Can you get life insurance if you have Brugada syndrome? | Yes |

| Is it easy to get life insurance if you have Brugada syndrome? | No |

| What is Brugada syndrome? | A rare heart condition that can cause a dangerous irregular heartbeat. |

| What causes Brugada syndrome? | Genetic defect, unknown cause, or certain medications and substances. |

| How common is Brugada syndrome? | About 3 to 5 people in 10,000 have the condition. |

| What are the symptoms of Brugada syndrome? | Fainting, cardiac arrest, difficulty breathing, heart palpitations. |

| What are the treatment options for Brugada syndrome? | Implantable cardioverter defibrillator (ICD), ablation, medications. |

| How does Brugada syndrome impact life insurance premiums? | It will likely increase premiums due to the higher risk associated with the condition. |

What You'll Learn

- Life insurance for people with heart conditions

- Brugada syndrome as a cause of cardiac arrest

- The impact of medication on life insurance for people with Brugada syndrome

- The impact of age and gender on life insurance for people with Brugada syndrome

- The chances of getting life insurance with Brugada syndrome

Life insurance for people with heart conditions

If you have a heart condition, you can still get life insurance, but your rates and policy options will depend on several factors, including your diagnosis, treatments, family health history, and current overall health, as well as your age and gender.

Heart Conditions and Life Insurance

The specific details of your heart condition and your treatment will determine your options. Here are some common heart issues and how they may play a part in your life insurance journey:

- After a heart attack: It's possible to get life insurance after a heart attack, but most insurance companies will want you to be at least six months out from the event before they'll consider your application. Many will also decline your application if you had a heart attack before the age of 40, as they'll consider you a higher insurance risk. If your application is approved, expect to pay higher-than-average rates.

- Coronary artery disease (CAD): CAD is a common type of heart disease that affects blood flow in the heart and can cause a heart attack. If you have CAD, insurers will consider existing and treating blockages, clotting history, and any related diagnoses, like high blood pressure or diabetes. You may be approved for life insurance, but you'll likely have to pay average or higher-than-average rates, depending on your condition and overall health.

- Heart bypass surgery: If you've had heart bypass surgery, you may be able to get life insurance. Insurers will usually want you to be at least three months, or even six to 12 months, post-surgery before you apply.

- Arrhythmia (irregular heartbeat): If you have arrhythmia, your life insurance options will depend on factors such as whether you've also been diagnosed with heart disease. If you have bradycardia (a slow heart rate), you may qualify for better rates than people with tachycardia (a fast heart rate). If you have atrial fibrillation (AFib), you may qualify for average or lower-than-average rates, depending on your overall health profile. If you have AFib and a pacemaker, you can expect to pay higher-than-average rates.

- Congenital heart defects: Some people with congenital heart defects can get life insurance depending on their diagnosis and condition. For example, people with a bicuspid aortic valve birth defect may be able to qualify for average or higher-than-average rates as long as they don't have other related conditions.

- Other heart conditions: People with other heart issues or who have had a heart transplant may not be eligible for traditional life insurance or may have to pay higher-than-average rates. These conditions include congestive heart failure, aortic stenosis, mitral stenosis, and pericarditis.

Applying for Life Insurance with a Heart Condition

When applying for life insurance with a heart condition, you'll need to disclose your complete medical history. Lying or omitting information on your life insurance application can be considered fraud and may put your loved ones at risk of losing the financial protection you wanted to provide for them.

You'll also need to undergo a medical exam, which is similar to an annual physical and is usually conducted by an examiner at your home or office. The insurer will also likely request an attending physician statement (APS) from your doctor to learn more about your diagnoses and health.

Types of Life Insurance for People with Heart Conditions

The best type of life insurance coverage for you will offer the most coverage for the lowest rates. Here are some options:

- Term life insurance: This is the most popular and affordable type of life insurance. It provides coverage for a set term, usually between 10 and 30 years, and then expires. Many people with heart conditions will qualify for term life coverage, though some with more serious conditions or who were diagnosed before the age of 40 may not.

- Permanent life insurance: Permanent life insurance policies last your entire life and usually include a cash value component that grows over time, which you can borrow against while you're alive. However, these policies are significantly more expensive than term life insurance and are generally not recommended for people with a history of heart issues.

- Simplified issue life insurance: This type of final expense insurance doesn't require a medical exam but relies on a medical questionnaire. It offers lower coverage amounts and higher premiums and is designed for people who don't qualify for traditional life insurance policies. However, people with congestive heart failure, new diagnoses of heart disease, or those who have had heart surgery or a heart transplant will likely not qualify.

- Guaranteed issue life insurance: This type of insurance is aimed at covering end-of-life costs for people over 45 who don't qualify for simplified issue life insurance. While it offers small coverage amounts and costly premiums, it doesn't have any medical requirements, so approval is almost certain regardless of your health profile.

Best Life Insurance Companies for People with Heart Conditions

Some life insurance companies are more lenient than others when it comes to heart disease, and a few insurers specialize in specific heart issues like atrial fibrillation. Here are some of the best life insurance companies for people with heart disease:

- Corebridge Financial: Best overall and cheapest option for people with heart conditions, especially those with complex heart disease or who have had a heart bypass.

- Lincoln Financial: A good option for people who have had a heart attack, as they consider applications within three months of the event. They also offer affordable rates for people with pre-existing conditions.

- Prudential: A good option for young people who have had a heart attack before the age of 40.

- Protective: A solid choice for people with arrhythmia, offering lower-than-average rates for many people with irregular heartbeats.

Brugada Syndrome and Life Insurance

Brugada syndrome is a rare, genetic heart condition that can affect your heart rhythm and can be life-threatening. It's usually inherited and is more common in people of Southeast Asian origin, affecting about 5 in every 10,000 people worldwide.

While I couldn't find specific information about life insurance for people with Brugada syndrome, the general advice for people with heart conditions should apply. You can still get life insurance, but your rates and options will depend on your specific circumstances. It's important to be transparent about your medical history when applying for life insurance to ensure you get the best coverage for your needs.

Oxford Life's Medicare Supplement Insurance in North Carolina

You may want to see also

Brugada syndrome as a cause of cardiac arrest

Brugada syndrome is a rare, genetic heart condition that affects the heart's rhythm and can be life-threatening. It is usually inherited, passed down from just one parent, and is caused by a defect in the SCN genes, which handle sodium. This results in malfunctioning sodium channels in the heart muscle cells, which can lead to abnormal heart rhythms.

The syndrome can remain dormant and cause no problems, but certain factors can trigger dangerous heart rhythms, including certain medications and illegal drugs, conditions that cause fever, and electrolyte problems.

The most common symptom of Brugada syndrome is a fast and irregular heartbeat, which can lead to cardiac arrest and sudden death, often during sleep. This is because the irregular heartbeat prevents blood from circulating correctly in the body, causing a person to faint or lose consciousness and stop breathing.

The average age of diagnosis is around 40, and the condition affects around 5 in every 10,000 people worldwide. It is more common in people of Asian descent and occurs more frequently in men than in women.

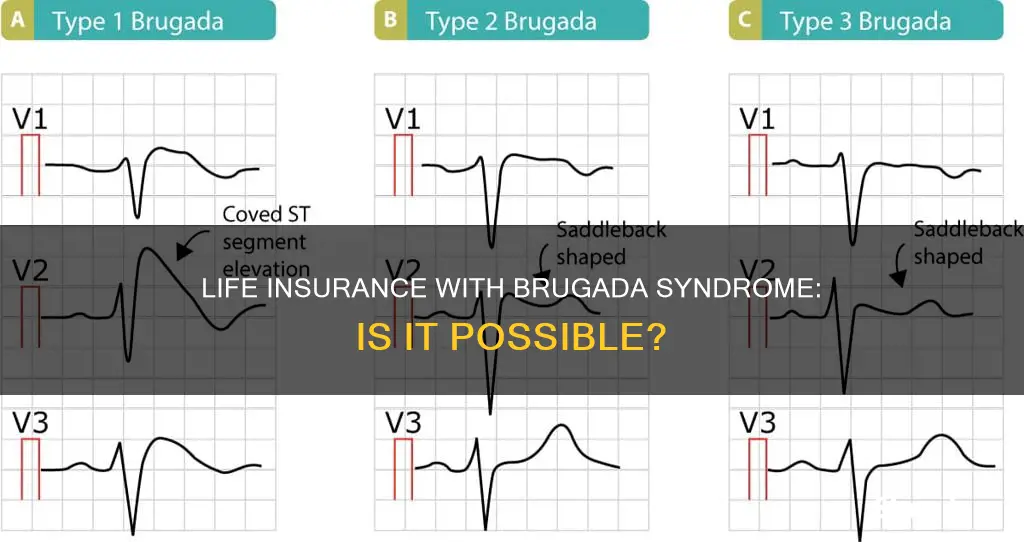

Diagnosis is made through an electrocardiogram (ECG) and genetic testing. Treatment options include an implanted cardioverter defibrillator (ICD), medication, and, in rare cases, cardiac ablation.

Life Insurance Payouts: Tax Implications and Exemptions

You may want to see also

The impact of medication on life insurance for people with Brugada syndrome

Brugada syndrome is a rare, genetic heart condition that can cause a dangerously irregular heartbeat, fainting, and even death, especially during sleep or rest. This condition affects about 5 in every 10,000 people worldwide and usually doesn't cause any symptoms. However, certain medications and drugs can trigger dangerous heart rhythms and should be avoided.

The specific medications and their impact on insurance outcomes for people with Brugada syndrome are as follows:

- Red List Drugs: These are drugs that should be avoided by Brugada syndrome patients as they have been associated with triggering dangerous heart rhythms. These drugs include certain antidepressants, antipsychotics, and illegal drugs like cocaine. The use of these drugs will likely result in higher insurance premiums or even a denial of coverage.

- Orange List Drugs: These are drugs that are preferably avoided by Brugada syndrome patients. While they have been linked to the appearance of the Brugada syndrome ECG pattern, there is no clear documentation of their impact. Some patients may benefit from these drugs for other reasons, but their use will still be considered a risk factor by insurance providers, potentially leading to higher premiums or coverage limitations.

- Green List Drugs: These drugs may have an antiarrhythmic effect on Brugada syndrome patients. They could potentially be used as treatment options, and their use may not negatively impact insurance outcomes.

- Blue List Drugs: These are diagnostic drugs used to induce the Brugada syndrome ECG pattern for testing purposes. Their use is necessary for diagnosis and will not negatively impact insurance outcomes.

It is worth noting that the impact of medication on life insurance for people with Brugada syndrome is not just limited to the lists above. Insurance providers will also consider other factors, such as age, overall health, and the presence of any implanted medical devices, such as an implantable cardioverter defibrillator (ICD). Additionally, the psychological impact of living with Brugada syndrome and the social and professional difficulties arising from ICD implantation can also influence insurance outcomes.

In summary, the impact of medication on life insurance for people with Brugada syndrome is substantial. Adhering to the recommended drug lists and seeking medical advice is crucial for managing the condition and optimising insurance outcomes. However, insurance providers will consider multiple factors, and each case will be assessed individually.

Life Coaches: Can They Bill Insurance?

You may want to see also

The impact of age and gender on life insurance for people with Brugada syndrome

Life insurance providers consider several factors when assessing an applicant's eligibility for coverage. For individuals with Brugada Syndrome, a rare heart condition that affects the heart's rhythm and can lead to cardiac arrest, age and gender can play a significant role in the underwriting process. Here's an overview of the impact of age and gender on life insurance for people with Brugada Syndrome:

Age:

Age is a critical factor in life insurance underwriting, and it can significantly influence the availability and cost of coverage for individuals with Brugada Syndrome. While symptoms of Brugada Syndrome typically appear during adulthood, the condition can manifest at any age, including infancy. The average age of death related to the disease is 40 years old. Therefore, age can be a crucial consideration for insurers when evaluating the risk associated with providing coverage for individuals with this syndrome.

In general, younger individuals tend to have lower premiums for life insurance because they are perceived to have a longer life expectancy. However, when it comes to Brugada Syndrome, the impact of age on insurance rates may be more nuanced. Insurers will likely consider the age of onset of symptoms and the overall health and medical history of the applicant. The presence of symptoms and the severity of the condition can influence the underwriting decision, regardless of age.

Gender:

Gender also plays a role in the life insurance underwriting process for individuals with Brugada Syndrome. Research has consistently shown that male gender is a significant risk factor for arrhythmic events in patients with this syndrome. It occurs 8 to 10 times more often in men than in women, and the male hormone testosterone is believed to contribute to this difference. As a result, men with Brugada Syndrome may face higher premiums or additional underwriting requirements compared to women.

However, it is important to note that while the prevalence is lower in women, they are not immune to the condition. Some studies have found that asymptomatic women may still be at risk, and the risk of arrhythmic events should not be underestimated in this population. Therefore, while gender plays a role in the underwriting process, other factors, such as individual health history and symptoms, will also be considered.

In conclusion, age and gender are important factors that life insurance providers will consider when assessing an individual with Brugada Syndrome for coverage. However, it is essential to understand that these are not the only considerations, and each case will be evaluated based on its unique circumstances. The availability and cost of life insurance for individuals with Brugada Syndrome will depend on a comprehensive assessment of their health, medical history, and other relevant factors.

Life Flight Insurance: Worth the Cost?

You may want to see also

The chances of getting life insurance with Brugada syndrome

- Symptoms and Severity: The presence and severity of symptoms associated with Brugada syndrome can impact your life insurance options. Insurers will consider factors such as cardiac arrest, fainting spells, heart palpitations, and breathing difficulties. The more severe and frequent these symptoms are, the higher the risk is perceived by insurers.

- Treatment and Management: If you have Brugada syndrome, the type of treatment you've received or are currently undergoing can affect your life insurance options. For example, if you have an implantable cardioverter defibrillator (ICD) or are taking medications to manage your condition, insurers will take this into account when assessing your application.

- Family History: Brugada syndrome often has a genetic component, so insurers will consider your family history of the condition. If you have first-degree relatives with Brugada syndrome or a history of sudden cardiac death, this may impact your chances of obtaining life insurance.

- Age and Gender: Brugada syndrome is more prevalent in certain demographics, particularly males and those of Asian descent. Your age and gender can also influence your life insurance premiums and options.

- Overall Health and Lifestyle: Insurers will consider your overall health and lifestyle choices when assessing your application. This includes factors such as your diet, exercise habits, alcohol consumption, and whether you smoke. Improving your overall health and making positive lifestyle changes can work in your favour when applying for life insurance.

- Choice of Insurer: Different life insurance companies have varying criteria and positions on pre-existing medical conditions. Shopping around and comparing quotes from multiple insurers can increase your chances of finding suitable coverage. Working with a specialist broker or advisor who has experience in securing life insurance for individuals with heart conditions can significantly improve your chances.

While Brugada syndrome is a serious and rare heart condition, many people with this diagnosis are able to obtain life insurance. The key is to be thorough in disclosing your medical history and to work with insurers or brokers who understand your condition and can find the most suitable coverage options for your circumstances.

Life Insurance Interest: Myth or Reality?

You may want to see also

Frequently asked questions

Yes, it is possible to get life insurance if you have a heart condition, including Brugada syndrome. However, it is considered a pre-existing medical condition, and you may need to pay higher premiums or accept certain exclusions. It is important to disclose this information when applying for life insurance to ensure that your policy remains valid.

Brugada syndrome is a rare heart condition that can cause a dangerous irregular heartbeat, leading to fainting, cardiac arrest, and even sudden death, especially during sleep. It is often inherited and affects about 3 to 5 out of every 10,000 people worldwide.

Symptoms of Brugada syndrome include sudden death, cardiac arrest, ventricular arrhythmia, difficulty breathing, heart palpitations, and dizziness. However, more than 70% of people with Brugada syndrome do not experience any symptoms.

There is currently no cure for Brugada syndrome, but treatments such as an implanted cardioverter defibrillator (ICD) and cardiac ablation can help lower the risk of sudden cardiac death and manage symptoms.