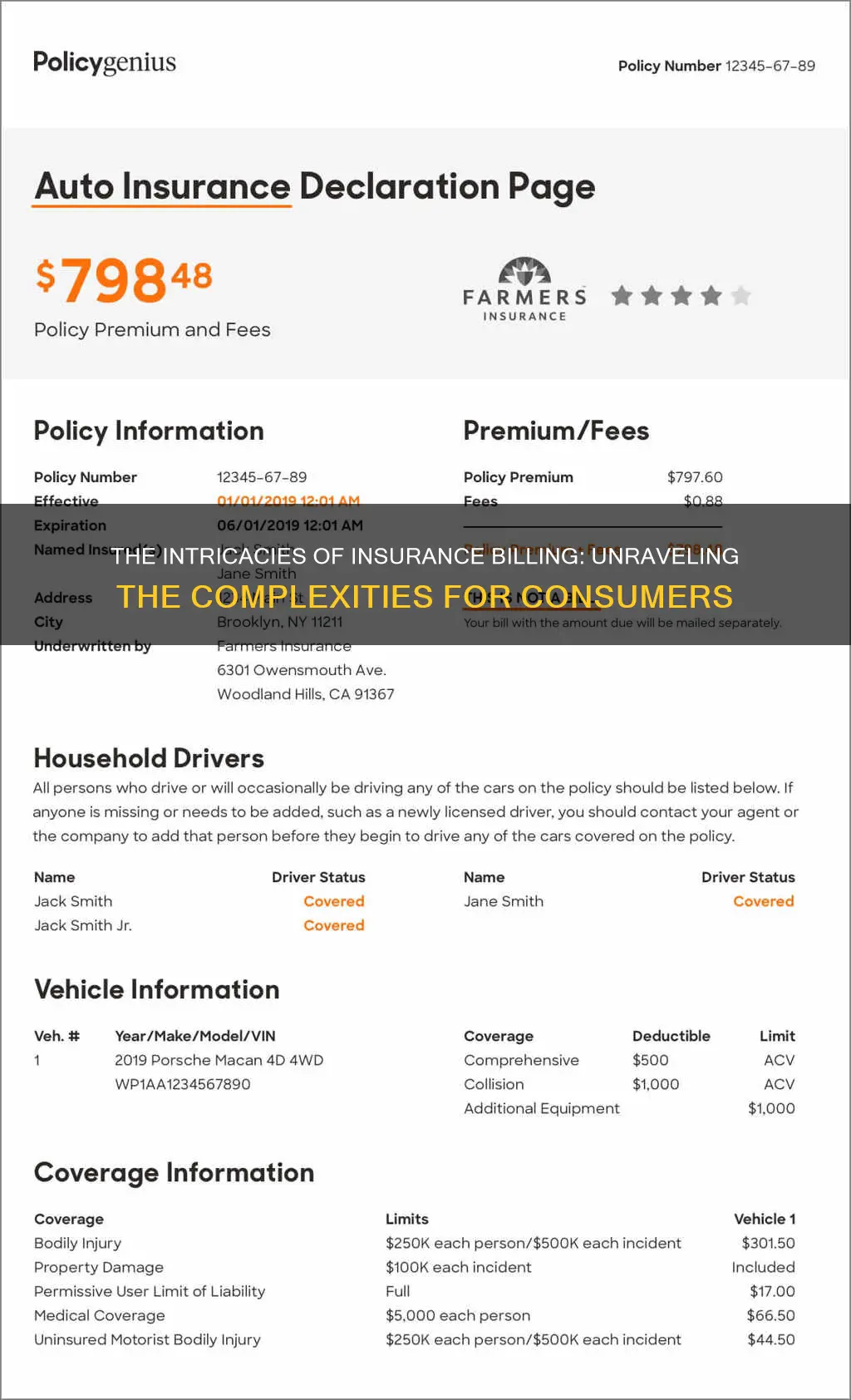

Insurance bills can be confusing, with a 2016 survey reporting that 72% of American consumers are confused by their medical bills. However, understanding insurance bills is important to ensure that you are not being overcharged. After a doctor's appointment, the doctor's office will submit a bill to your insurance company, listing the services provided. The insurance company will then send an Explanation of Benefits (EOB) to the patient, explaining what the insurance company is and is not paying for, and why. The patient will then receive a bill from the doctor's office for any remaining balance. This bill will include the name and address of the patient, the statement date, the name and address of the provider, the account number, the date(s) of service, a description of services, the costs of services, and how to pay.

| Characteristics | Values |

|---|---|

| Name and address | The name and address of the patient and the provider(s) or facility |

| Statement date | The date the provider's or facility's billing office printed the bill |

| Account number | A unique number assigned by the provider or facility to the patient |

| Date(s) of service | The date(s) the patient received services |

| Description of services or supplies | A description of the services or supplies received by the patient |

| Total charges | The full price for the service(s) and/or item(s) |

| Allowed amount | The maximum amount a plan will pay for a covered health care service |

| Adjustments | An amount subtracted from the total charges because the provider has agreed to discount or charge a lower amount for that service |

| Insurance payment | The amount the insurance has paid or is expected to pay, up to the allowed amount, after the patient pays their share of the cost |

| Patient payment | Any amount the patient has already paid to the provider or facility when they got the service or supply, like a copayment |

| Balance due/patient responsibility | The amount the patient still owes the provider or facility based on that bill, like a deductible or coinsurance |

| How to pay the bill | The different ways to pay the bill and who to pay |

What You'll Learn

What is an Explanation of Benefits (EOB)

An Explanation of Benefits (EOB) is a statement from your health insurance provider that details the costs of medical care or products you've received. It is generated when your healthcare provider submits a claim for the services you received. The EOB is not a bill, but it will explain any charges that you still owe or may have already paid.

The EOB breaks down the following information:

- The services provided

- What the doctor or hospital charged

- What your insurance covered and did not cover

- What your insurance agreed to pay

- The amount you must pay

The EOB is an important tool that shows you how your bill is divided between the medical service provider(s), your insurance, and you. It can help ensure you are receiving the full benefit or discount that you are entitled to under your insurance plan.

The EOB will also include general information about you and your health plan, including:

- Who provided your care and when

- A reference number, or claim number

- The person who gets reimbursed for any overpayments, or the payee

- Your health plan's phone number

Securing Short-Term Rental Insurance: Navigating the Path to Comprehensive Coverage

You may want to see also

How to read your medical bill

What to Expect

Most medical bills are filled with specialised terminology, confusing acronyms, and indecipherable numerical codes. In fact, 60.5% of respondents in one survey rated their medical bills as confusing or very confusing. So, if you feel overwhelmed by medical jargon when reading your bill, you're not alone.

What to Do

Get an itemized statement—If your bill does not include a detailed list of charges, call your doctor's or hospital's billing office and ask for an itemized invoice. This is the only way to be sure you're being charged only for the services you received. Remember, you may receive additional statements from physicians, surgeons, or specialists who are not employees of the hospital or facility where you were treated. Request itemized bills from these providers as well.

Check your personal information—Make sure your name, address, and other personal information on the bill are correct, and verify your health insurance information. If this information is incorrect, it can lead to a claim denial.

Understand the codes—Every medical procedure has a corresponding five-digit code. These numerical systems are called Current Procedural Terminology (CPT) for insurance and the Healthcare Common Procedure Coding System (HCPCS) for Medicare. These codes determine how much your provider will be paid. There are thousands of billing codes, and they can be very complicated. If a description is unclear or a charge seems excessive, you can type the code into a search engine to get an idea of what it means. Online cost-comparison tools can also give you an estimate of typical charges in your area for specific codes.

Compare with your Explanation of Benefits (EOB)—Every medical procedure or visit will be listed on an EOB from your insurance company. The EOB explains what medical treatments and services your insurance company agreed to pay for and what you are responsible for paying. The EOB is not a bill, although it may look similar and show a balance due. When the EOB indicates that money is still owed, you can expect a separate bill from the doctor or hospital. Make sure the dates and codes on the EOB match the bills you receive from medical providers.

Check for common errors—Common billing mistakes include incorrect quantities or duplicate charges, charges for treatments you didn't receive, inflated surgery and recovery times, and incorrect room fees. Be on the lookout for signs of fraud, such as upcoding (listing a code for a more expensive procedure than was performed) and unbundling (charging individually for related services typically billed under a single code). If you suspect billing fraud, contact your insurer's anti-fraud office.

What to Do if You Find a Mistake

If you find an error on your medical bill, call your doctor or the hospital and flag it. Be prepared to make multiple phone calls and ask for a direct phone number for a specific billing professional so you don't have to keep re-explaining your issue. If the prospect of disputing charges is too overwhelming, you could hire a professional medical billing advocate. For a fee, they will review your bill and work with your provider to correct errors or negotiate charges.

Understanding Non-Decreasing Term Insurance: A Guide to Its Benefits and Features

You may want to see also

How the billing cycle works

A billing cycle is the interval between the end of one billing statement date and the next. Billing cycles are usually set on a monthly basis but can vary in length depending on the product or service. They guide companies on when to charge customers and help them estimate revenue. Billing cycles also help customers regulate their payment expectations and budget their money accordingly.

The date a billing cycle begins depends on factors such as the type of service being offered and the customer's needs. For instance, an apartment complex may issue rent bills on the first day of each month, regardless of when individual tenants signed their leases. This simplifies accounting and makes it easier for tenants to remember the payment due date. Companies may also use a rolling billing cycle, such as a cable TV provider setting a customer's billing cycle to align with the date the customer first received a signal.

If charges are not paid in full by the due date, they are rolled over to the next billing cycle, which may trigger late fees and interest charges. The length of a billing cycle can be adjusted to help vendors better manage cash flows or accommodate changes in the creditworthiness of customers. For example, if a customer has a history of making late payments, a vendor might shorten the billing cycle to anticipate future delinquencies.

In the context of insurance, billing cycles are important in determining payment due dates. Most insurance companies offer six-month or year-long policies, and the policy period is the timeframe during which the policy is effective. Policy periods typically start on the day the policy is purchased and can be any day of the month. If paying monthly, payments are usually due on the same day of the month as the original policy start date.

In the case of medical billing, the billing process involves several steps, including registration, establishing financial responsibility, patient check-in and check-out, checking for coding and billing compliance, preparing and transmitting claims, monitoring payer adjudication, generating patient statements, and arranging collections. Medical billing can be complex, as insurance coverage varies significantly between companies, individuals, and plans. Billers must determine which services are covered by the patient's insurance plan and ensure compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA).

Maximizing Insurance Reimbursement for Massage Therapy: A Guide to Efficient Billing

You may want to see also

Dealing with billing errors

Billing errors are common, and it's important to monitor your bills and EOB forms to identify and dispute any errors. Here are some steps to help you deal with billing errors:

- Know your health plan: Understand what your health plan covers, including deductibles, coverage limits, and in-network and out-of-network providers. This information is usually available on your insurer's or employer's website.

- Estimate costs in advance: Before receiving medical care, contact your doctor's office to obtain the billing codes for the services you will receive. Then, contact your insurer to find out how much they will cover and what your expected out-of-pocket costs will be.

- Review paperwork: After receiving medical care, you will get paperwork from both your healthcare provider and your insurer. This will include a bill from your provider and an Explanation of Benefits (EOB) from your insurer. Review these documents carefully and compare them to the estimates you received beforehand.

- Act quickly: If you identify any errors or discrepancies, contact your healthcare provider and/or insurer right away. Addressing billing errors promptly will help prevent issues such as your account being sent to collections.

- Get help: If you are unable to resolve the issue on your own, seek assistance from your employer's benefits department, a medical billing advocate, or your state's Consumer Assistance Program.

- Negotiate: If you cannot dispute a charge, consider negotiating with your healthcare provider. You may be able to get a reduced fee or set up a payment plan.

- Duplicate charges: Review your bill carefully to ensure you have not been charged twice for the same service or procedure.

- Incorrect patient information: Errors in patient information, such as name spelling or policy number, can lead to claim denials or incorrect charges.

- Upcoding: This is when a provider uses a code that represents a more serious or expensive procedure than the one you actually received. This is illegal and should be corrected immediately.

- Unbundling of charges: This is when charges that should be billed under the same procedure code are separated. This can be tricky to identify without knowledge of medical billing codes.

- Balance billing: This is when a healthcare provider bills you for charges other than co-payments or co-insurance amounts assigned by your insurance company. This is prohibited by the No Surprises Act but may still occur.

Remember to keep detailed records of all communications and payments related to your medical bills, as this will help you identify and resolve any errors or disputes.

The Benefits of Short-Term Insurance for Individuals: Protecting Your World

You may want to see also

How to pay the bill

There are several ways to pay your insurance bill. Firstly, you can pay online. To do this, you will need to log in to your account or create an account if you don't already have one. You can then schedule a payment, review billing history, update payment methods, and more. You will need your phone number, policy number, payment plan number, account number, or key code to get started. You can also set up AutoPay to make payments automatically.

Another option is to pay by phone. You can call the insurance company's customer service line and provide your billing information, including your credit or debit card details, or bank account information, as well as your phone number and date of birth. You can also use the key code from your current bill.

If you prefer, you can also pay by mail. You can send a check or money order using the return envelope included in your bill, or use your own envelope addressed to the insurance company's payment processing centre. Be sure to include your account information and any necessary identifying information, such as your name and address.

Additionally, some insurance companies may offer the option to pay in person by visiting one of their local offices or agents. You can typically pay by cash, check, credit or debit card, or money order.

It's important to note that payment methods may vary depending on your insurance provider, so be sure to review their specific instructions and options for making payments.

The Role of an Insurance Broker: Navigating the Complex World of Insurance

You may want to see also

Frequently asked questions

An EOB is a document sent by your insurance provider after a claim has been submitted by your healthcare provider. It explains what medical treatments and services your insurance company agreed to pay for, and what you are responsible for paying. It is not a bill, but it will show a balance due if money is still owed to the healthcare provider.

Review your EOB and check it for mistakes. When you get a bill from your healthcare provider, compare it with the EOB to make sure you were billed for the correct services and supplies. Also, compare the amount on your medical bill to the amount the EOB says you owe to make sure the amount is correct.

There could be a few reasons for this. A prior balance could have been carried over for unpaid medical expenses, or your bill might include charges for more than one date of service. A payment may have been made at the time of service or another point between when the EOB and bill were sent. If this is the case, wait until your insurance company processes the claim, and then you may be reissued an updated bill.

If you are a member of a health plan and your doctor’s office has your insurance information, they will usually submit the insurance claim for you. But if they don’t have that capability or you go to an out-of-network provider, you may have to submit the claim yourself. In that case, you may get a bill from your doctor or health care provider before you get an EOB.

If you don’t have health insurance, you will usually need to pay the full amount shown on the bill. Your provider or facility must give you a “good faith estimate” of expected charges before you get an item or service if you ask for one, or after you’ve scheduled a service at least 3 business days in advance.