How to Apply Insurance to a New Vehicle

If you're buying a new car, you'll need to think about insurance. In most cases, you'll need to purchase an insurance plan before buying a new car to ensure you have enough coverage. You should get insurance for a new car as soon as possible since most dealerships require proof of insurance before you drive off with a new vehicle.

When to Buy Insurance for a New Car

If you already have car insurance for another vehicle, your existing auto insurance policy will likely automatically cover the new vehicle for a grace period of around seven to 30 days, giving you time to contact your insurer. However, it's best to let your insurer know about your new vehicle right away.

How to Buy Insurance for a New Car

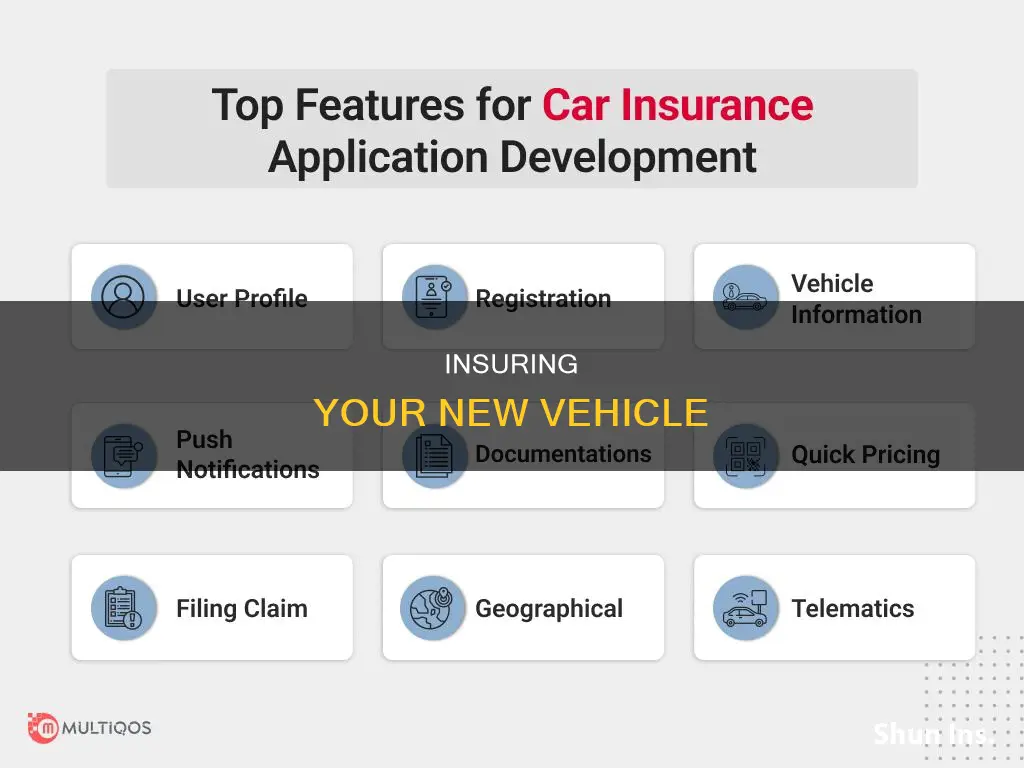

To buy insurance for a new car, you'll need to provide the make, model, and year of the vehicle, as well as the vehicle identification number (VIN) and approximate annual mileage. You can then compare quotes from multiple insurers and apply for a policy.

Cost of Insurance for a New Car

The cost of insurance for a new car will depend on various factors, including the vehicle's make and model, your location, your age, and your driving history. Insurance for a new car costs an average of $1,424 to $2,150 per year for a good driver with full coverage.

| Characteristics | Values |

|---|---|

| When to buy new car insurance | When you move to a new state, buy a new vehicle, your renewal rates increase, or your auto insurance policy is being non-renewed or cancelled. |

| New car insurance grace period | The length of the grace period varies by car insurance company, if offered at all. A 30-day grace period is typical but can be as short as seven days. |

| How long does a new car grace period last? | 7-30 days |

| What car insurance coverage is given during the grace period? | A replacement vehicle generally receives the same coverage as the car it replaces. |

| How to buy insurance for a new car | Get multiple quotes for the vehicle, apply for a policy when you know the car you want, cancel your old car insurance policy. |

| How much does new car insurance cost? | Insurance for a new car costs an average of $1,424-$2,150 a year for a good driver with full coverage car insurance. |

| State minimum new car coverage requirements | State minimum car insurance requirements are the same whether your car is new or used. |

| Standard types of required new car insurance | Bodily injury liability insurance, property damage liability insurance, uninsured motorist bodily injury coverage, underinsured motorist bodily injury coverage, personal injury protection, medical payments. |

| New car insurance requirements | Collision coverage, comprehensive coverage, gap insurance, loan or lease payoff. |

| New car insurance additional coverage options | Roadside assistance, rental reimbursement, mechanical breakdown insurance, rideshare insurance, travel expenses. |

What You'll Learn

Know the make, model, and year of your new car

Knowing the make, model, and year of your new car is essential when applying for insurance. The make of a car is the brand or manufacturer, such as Ford, Toyota, or Honda. The model is the specific product line within that brand, like a Toyota Corolla. The year of the car is typically indicated by a four-digit number, such as 2023.

This information is crucial because it helps determine the insurance rates and coverage options available to you. Insurance companies use the make, model, and year of a vehicle to assess the risk associated with insuring it. Factors such as the vehicle's safety features, repair costs, and replacement value are considered when setting insurance rates. Additionally, the make and model can impact the cost of repairs, with foreign and luxury vehicles generally having higher repair costs than domestic or lower-end cars.

When applying for insurance, you will need to provide detailed information about your vehicle, including the make, model, year, vehicle identification number (VIN), and mileage. This information helps insurance companies accurately assess the risk and provide you with an appropriate quote.

It is worth noting that insurance rates may vary depending on other factors, such as your age, driving record, and credit score. Therefore, it is recommended to shop around and compare quotes from multiple insurance providers to find the best coverage at a reasonable price.

Insuring Inactive Vehicles

You may want to see also

Get quotes from multiple insurance companies

Getting quotes from multiple insurance companies is a great way to find the best deal on car insurance. Here are some tips to help you get started:

- Shop around: Compare quotes from at least three different insurance companies to find the best price and coverage for your needs. You can use online tools like NerdWallet's car insurance comparison tool or Progressive's AutoQuote Explorer® to get quotes from multiple companies at once.

- Provide accurate information: When getting a quote, make sure to provide accurate information about your driving history, vehicle, and personal details. This will help ensure that the quote is accurate and reflects the final price you will pay.

- Compare the same coverage levels: When comparing quotes, make sure to select the same coverage levels, policy limits, and deductible amounts across all companies. This will allow you to make an accurate comparison and find the best price for the coverage you need.

- Consider the company's reputation: In addition to price, consider the insurance company's reputation, customer satisfaction ratings, and financial strength. You can check customer reviews and complaint records to get an idea of the quality of service you can expect.

- Look for discounts: Many insurance companies offer discounts for things like student status, being a federal employee, or having safety features in your car. Be sure to ask about any discounts you may be eligible for when getting a quote.

- Get a quote before buying a car: If you don't already own a car, it's a good idea to get an insurance quote before purchasing a vehicle. This will help you factor the cost of insurance into your budget and choose a car that is affordable to insure.

Usaa: Salvage Vehicle Insurance?

You may want to see also

Apply for a policy

Applying for a new car insurance policy is a relatively simple process. Here are the steps you need to follow:

Step 1: Gather Information

First, you will need to gather some basic information about the vehicle you plan to purchase, including the make, model, and year of the car. Additionally, having the vehicle identification number (VIN) and the approximate annual mileage you expect to drive will be helpful. It is also a good idea to have your driver's license and information about any recent traffic violations or previous insurance claims.

Step 2: Decide on Coverage Options

Next, you will need to decide on the level of coverage you want. This includes determining your desired third-party liability coverage limit, deductible limit, and whether you want collision and comprehensive coverage. You may also want to consider additional coverage options, such as gap insurance, new car replacement insurance, or roadside assistance.

Step 3: Compare Quotes

Once you know the type of coverage you need, it is essential to compare quotes from multiple insurance providers. Costs can vary significantly between companies, so shopping around can help you find the best rate. It is recommended to get quotes from at least three different insurers before making a decision.

Step 4: Submit an Application

After you have chosen an insurance company and coverage options, it is time to submit your application for the new car insurance policy. Depending on the insurer, you may be able to complete the application process online or through a phone call. Be prepared to provide detailed information about your vehicle and driving history.

Step 5: Finalize the Purchase

Once you have submitted your application and received approval from the insurance company, finalize the purchase of your new car insurance policy. Make sure to review the terms and conditions carefully before committing. Also, remember to cancel your old car insurance policy, if applicable, and request a pro-rated refund for any remaining coverage period.

Salvage Vehicles: Insurable?

You may want to see also

Cancel your old insurance policy

When getting a new car, you will need to cancel your old insurance policy. Here is a step-by-step guide on how to do this:

Step 1: Purchase a new insurance policy

Before cancelling your old insurance policy, it is important to secure a new one to avoid any lapse in coverage. This is because driving without insurance is illegal in most states and can result in fines and an increase in future insurance rates. Contact your new insurance provider and finalise the details of your new policy, including the start date.

Step 2: Contact your old insurance provider

Get in touch with your current insurance provider and inform them that you would like to cancel your policy. You can do this by calling them, using their mobile app or website, mailing a cancellation request, or speaking to an agent in person. Ask them about any specific requirements they may have for cancelling a policy.

Step 3: Ask about cancellation requirements

Some insurance providers may require you to pay a cancellation fee or give advance notice before cancelling. They may also require you to sign and submit a cancellation letter, which should include your policy number, name, and the date you want your policy to be cancelled. If you have paid for your policy upfront, you can also request a refund for the remaining coverage period.

Step 4: Request a policy cancellation notice

Once your cancellation request has been finalised, ask your insurance carrier for a written notice confirming that your policy has been officially cancelled. This will ensure that you have a record of the transaction.

Step 5: Notify your lender (if applicable)

If you have an auto loan or lease, be sure to inform your lender of the change in insurance coverage. They will need to be listed on your new policy as they have a financial interest in the vehicle.

Step 6: Update your DMV records

Depending on your state's requirements, you may need to notify your local Department of Motor Vehicles (DMV) of the cancellation. Check with your DMV to ensure you are complying with the applicable insurance laws.

Remember to review your new insurance policy carefully to ensure it meets your needs and provides the necessary coverage for your new vehicle.

AAA and Salvage Vehicle Insurance

You may want to see also

Understand state minimum insurance requirements

Understanding the minimum insurance requirements of your state is crucial when applying for insurance for your new vehicle. Here is a detailed and comprehensive overview of the minimum insurance requirements across different states to help you navigate this process effectively:

Liability Insurance:

Nearly all states mandate a minimum amount of liability insurance, which is essential for covering any injuries or damages caused by the insured in a car accident. This includes harm to other drivers, their passengers, and their property. Liability insurance typically consists of two components: bodily injury coverage and property damage coverage. The bodily injury coverage limit is set per person and per accident, while the property damage coverage limit is set per accident. For example, a policy with liability coverage limits of 15/30/10 would provide up to $15,000 per person for bodily injuries, with a total limit of $30,000 for all bodily injuries in the incident, and $10,000 for property damage.

Uninsured/Underinsured Motorist Coverage:

Also known as UM/UIM coverage, this type of insurance is required in about half of the states. It protects you and your passengers from injuries and property damage caused by a driver with insufficient or no insurance. In some states, UM/UIM coverage is mandatory only for bodily injury, while others require coverage for both bodily injury and property damage. The minimum limits for UM/UIM coverage are often similar to the state's liability insurance limits.

Personal Injury Protection (PIP):

Roughly 20% of states, including no-fault states like Florida, Hawaii, Michigan, Minnesota, and New Jersey, require Personal Injury Protection (PIP). PIP covers medical expenses for the insured driver and their passengers, regardless of who is at fault in the accident. It may also extend to lost wages and other benefits not covered by health insurance.

Medical Payments Coverage:

Medical Payments Coverage is mandated in a few states, including Maine, New Hampshire, and Pennsylvania. This coverage is similar to PIP but does not include additional benefits like lost wages. It assists with medical expenses for the insured, their family, or passengers injured in a car accident.

State-Specific Requirements:

It is important to note that insurance requirements can vary significantly from state to state. For example, while Virginia requires liability insurance, drivers have the option to pay an annual uninsured motorist fee of $500 instead of purchasing insurance. On the other hand, New Hampshire does not mandate car insurance but requires drivers to prove their ability to meet financial responsibility requirements in the event of an accident.

Recommended Coverage:

While understanding state minimums is crucial, it is generally recommended to carry more than the minimum liability insurance coverage. In the event of a severe accident, the minimum coverage may not be sufficient, and you could be held financially responsible for any damages exceeding your coverage limits. Experts suggest considering a "full coverage" policy with higher liability limits and exploring additional coverage options like collision and comprehensive insurance to ensure adequate protection.

Police Cars: Insured?

You may want to see also

Frequently asked questions

You can apply for insurance for a new vehicle by calling your insurance agent or using an online application. You will need to provide the make, model, and year of the vehicle, as well as the vehicle identification number (VIN). You may also need to provide your driver's license number, date of birth, and approximate annual mileage.

The cost of insurance for a new vehicle depends on various factors, including the make and model of the car, your age, driving history, and credit score. On average, insurance for a new car costs around $2,150 per year for a good driver with full coverage.

The insurance requirements for a new vehicle depend on your state's minimum insurance laws and whether you have a loan or lease. Most states require liability insurance, which covers property damage and injuries to others in an accident. If you have a loan or lease, your lender may also require you to have collision and comprehensive insurance, which cover repairs or replacement of your vehicle in various situations.