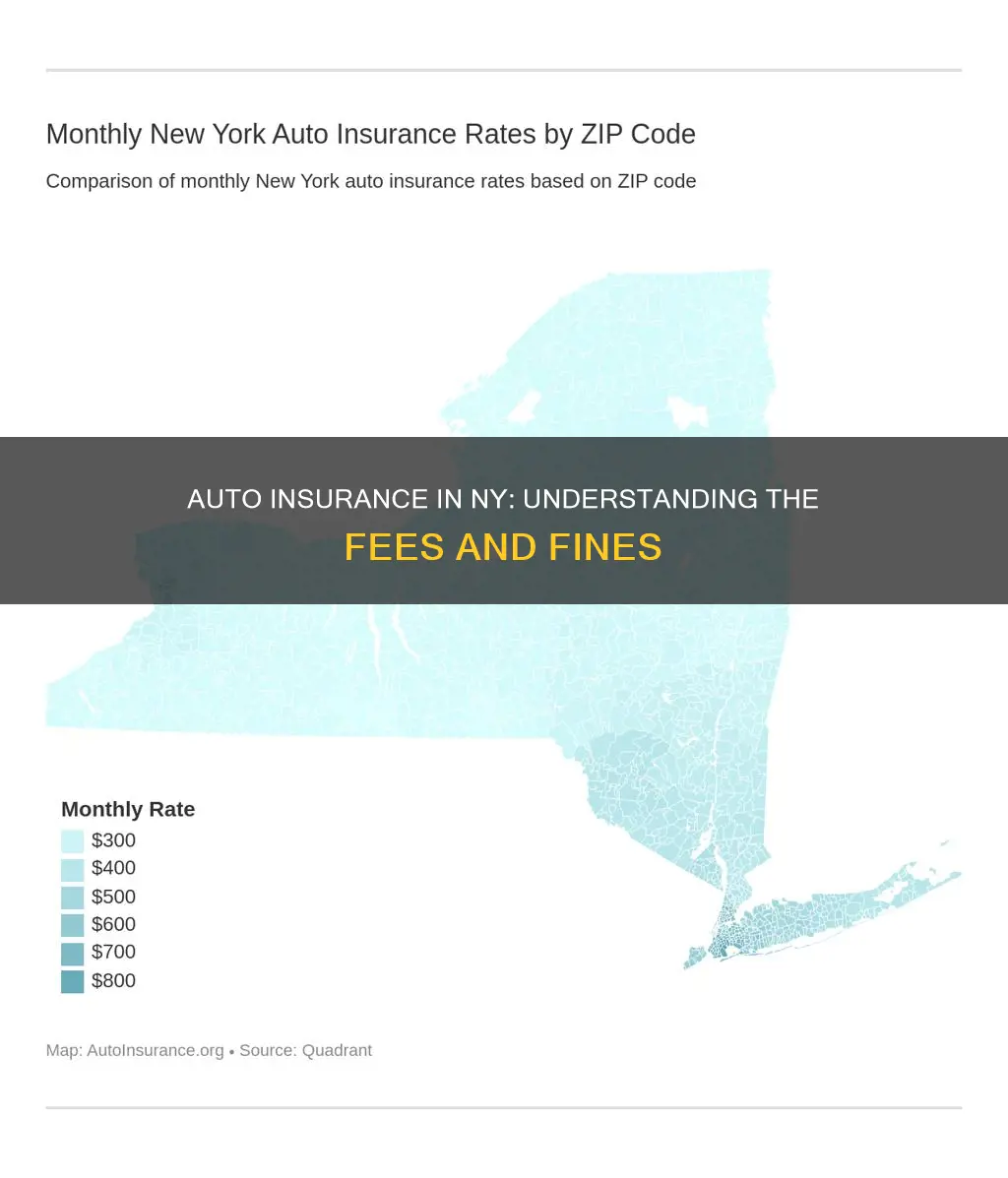

New York is the most expensive state in the US to insure a vehicle, with insurance rates that are 42% higher than the national average. The average cost of car insurance in New York is $3,697 per year for full coverage and $1,544 per year for minimum coverage. The Motor Vehicle Law Enforcement Fee is an additional $10 per insured vehicle per year.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance in New York | $1,511 |

| Average annual cost of car insurance in the US | $1,061 |

| Average monthly cost of car insurance in New York | $126 |

| Average monthly cost of car insurance in New York (2020 data) | $120 |

| Average cost of full coverage car insurance in New York | $2,075 per year |

| Average cost of full coverage car insurance in New York (Bankrate) | $3,697 per year |

| Average cost of minimum coverage car insurance in New York | $804 per year |

| Average cost of minimum coverage car insurance in New York (Bankrate) | $1,544 per year |

| Cheapest car insurance in New York (NerdWallet) | NYCM |

| Cheapest car insurance in New York (AutoInsurance.com) | Kemper |

What You'll Learn

How much is a monthly car insurance payment in New York?

The cost of car insurance in New York varies depending on factors such as age, gender, driving record, and location. The average cost of car insurance in New York is $3,697 per year for full coverage and $1,544 per year for minimum coverage. On a monthly basis, full coverage costs an average of $308, while minimum coverage costs an average of $129 per month.

The cost of car insurance in New York is higher than the national average. This is due to a variety of factors, including the state's high population density and elevated risk of accidents, theft, and vandalism. Additionally, New York is a no-fault state, which means that drivers must carry personal injury protection (PIP) insurance, adding to the cost of minimum coverage.

When looking at the average cost of car insurance in New York, it's important to note that rates can vary depending on the city. For example, the average annual cost of full coverage car insurance in New York City is $3,868, while in Rochester, it is $1,257.

To find the cheapest car insurance in New York, it is recommended to compare quotes from multiple insurance providers. Progressive, American Family, and USAA are some of the cheapest car insurance providers in the state, but rates can vary depending on individual factors.

Gap Insurance: Partial Payment Explained

You may want to see also

Why is car insurance so high in New York?

Car insurance in New York is notoriously expensive, with rates more than double the national average. The average cost of car insurance in the state is $3,443 per year, or $286 per month. However, in New York City, that figure skyrockets to an average of $7,488 per year.

There are several factors contributing to the high cost of car insurance in New York:

- New York is a no-fault state, meaning drivers must file a claim with their insurance provider after an accident, regardless of who is at fault. No-fault states typically have additional insurance requirements, such as personal injury protection (PIP) insurance, which increases the overall cost of insurance.

- New York has high healthcare costs, which result in higher insurance payouts and, consequently, higher policy premiums.

- New York has more insurance requirements than other states, including wrongful death coverage, personal injury protection, and uninsured motorist coverage. These additional coverages drive up the cost of insurance for drivers in the state.

- The state is at high risk of severe weather conditions such as hurricanes and winter storms, which can result in costly accidents and total losses for insurance companies.

- New York has a high population density, particularly in New York City, the most populous city in the country. This density increases the risk of accidents, vandalism, and theft, leading to higher insurance rates.

- The risk of theft or vandalism is also a factor in the high cost of car insurance in New York. In 2022, the state had the ninth-highest rate of car thefts in the country, and theft rates are on the rise.

- New York's dense traffic patterns and high accident rates contribute to the high cost of insurance in the state.

- Garaging fraud and "ghost cars" with forged or altered license plates are also factors in the high cost of insurance in New York. Garaging fraud occurs when New Yorkers illegally register their vehicles in other states to avoid high local insurance premiums. "Ghost cars" are used to avoid insurance requirements, tolls, tickets, and even crimes, creating a safety risk and contributing to higher insurance costs.

Chiropractic Auto Insurance Billing: Maximizing Your Reimbursement

You may want to see also

Which company typically has the cheapest car insurance in New York?

The cost of car insurance in New York varies depending on factors such as age, location, driving record, vehicle type, and credit history.

According to a 2024 analysis by NerdWallet, NYCM offers the cheapest full coverage in New York, with an average rate of $947 per year. The average cost of full coverage in New York is $2,075 per year, or $173 per month.

For minimum coverage, the average cost in New York is $804 per year, but NYCM offers rates as low as $309 per year for a 35-year-old driver with a clean driving record.

Other companies that offer competitive rates in New York include:

- Utica National

- GEICO

- Progressive

- Kemper

- Allstate

- American Family

- USAA (for military families)

Auto Insurance Basics for Teen Drivers

You may want to see also

What are the minimum auto insurance requirements in New York?

The minimum auto insurance requirements in New York are as follows:

- $25,000 bodily injury liability per person.

- $50,000 bodily injury liability per accident.

- $50,000 liability for death per person.

- $100,000 liability for death per accident.

- $10,000 property damage liability per accident.

- $25,000 uninsured motorist coverage per person.

- $50,000 uninsured motorist coverage per accident.

- $50,000 personal injury protection (PIP).

In addition to the above, New York also requires drivers to have personal injury protection (PIP), which covers medical/health expenses, lost wages, and other reasonable expenses after an accident, regardless of who is at fault.

The minimum coverage limits in New York are relatively high compared to other states, which is one of the reasons why New York is the most expensive state to insure a vehicle in the US. The average annual cost of auto insurance in New York is $1,511, which is 42% higher than the national average.

It's important to note that while minimum coverage may help you comply with legal requirements, it may not provide sufficient financial protection in the event of a serious accident. To ensure adequate protection, consider purchasing higher coverage limits and additional types of coverage, such as collision and comprehensive insurance.

Transferring Auto Insurance: Is It Possible?

You may want to see also

What are the penalties for driving without insurance in New York?

Driving without insurance in New York is considered a criminal offense. The state has strict penalties for those who choose to get behind the wheel without proper insurance coverage. Here are the consequences for driving without insurance in New York:

Fines and Fees

If you are caught driving without insurance in New York, you will face steep fines. The fine for driving without insurance can be anywhere from $150 to $1,500. If your license is revoked, you will also have to pay a civil penalty fee of $750 to get it reinstated. This means that the total financial penalty for driving without insurance in New York can be as high as $2,250.

License and Registration Suspension

In addition to fines, your driver's license and vehicle registration will be suspended if you are caught driving without insurance. The suspension period will last for at least one year and may be longer depending on the circumstances. This means that you will not be able to legally drive during this time.

Jail Time

Driving without insurance in New York can also result in jail time. You could be sentenced to up to 15 days in jail if you are caught driving without insurance. This is true for both first-time and repeat offenders.

Vehicle Impoundment

If you are caught driving without insurance, your vehicle may be impounded. This means that your car will be towed and held in a lot until you can pay to get it back. Impound fees can be very expensive, adding to the overall cost of driving without insurance.

Increased Insurance Premiums

If you are caught driving without insurance, you can expect your insurance premiums to increase. Insurance companies view driving without insurance as a high-risk behavior, and they will adjust your rates accordingly. This means that your insurance will likely become more expensive after an uninsured driving incident.

Difficulty Obtaining Future Coverage

Not only will your insurance become more expensive, but you may also have trouble finding an insurance company willing to cover you at all. Many insurance companies will not accept drivers with a history of driving without insurance. This means that you may have to turn to high-risk insurance providers, which can be even more costly.

Accident Costs

If you are in an accident while driving without insurance, you will be responsible for all the associated costs. This includes damage to your vehicle, the other driver's vehicle, and any medical expenses for injuries sustained in the accident. These costs can quickly escalate, potentially leaving you with overwhelming debt.

In conclusion, driving without insurance in New York can result in a range of penalties, including fines, license and registration suspension, jail time, vehicle impoundment, and increased insurance costs. It is always best to ensure you have proper insurance coverage before getting behind the wheel to avoid these costly consequences.

Casualty and Auto Insurance: What's the Difference?

You may want to see also

Frequently asked questions

The average cost of car insurance in New York varies depending on the level of coverage. The average annual cost of car insurance in the state is $1,511, while the average cost of full coverage is $3,697 and the average cost of minimum coverage is $1,544.

The cost of car insurance in New York can be influenced by various factors, including age, gender, marital status, credit score, driving record, and location. Urban areas, such as New York City, tend to have higher insurance rates due to higher traffic density and a higher risk of accidents.

Driving without insurance in New York can result in legal penalties, including fines ranging from $150 to $1,500, a civil penalty of $750, and imprisonment of up to 15 days. Additionally, your license and registration may be suspended for up to 90 days if you are uninsured for more than 90 days.