Life insurance is an important financial safety net for you and your loved ones, but your coverage needs may change over time. You might need to adjust your policy if your circumstances change, such as getting married, having children, or buying a bigger home. Changing life insurance companies or policies can be daunting, but it's possible to do so at any time. Before making any changes, it's crucial to review your current coverage and calculate if it's still sufficient for your needs. You can then compare different life insurance policies to find the best fit in terms of coverage and price.

If you want to stick with your current insurer, contact them to discuss your options, as not all policies can be modified. On the other hand, if you've found a new insurer you prefer, be sure to sign up for the new policy before ending your old one to avoid a gap in coverage. Switching life insurance providers may be the best option if the cost of changing policies with your current insurer is too high. When choosing a new insurer, focus on those with strong reputations and ensure they are registered with the appropriate financial authorities.

What You'll Learn

Changing your type of coverage

Changing the type of coverage you have is a common reason for switching life insurance policies. This could be because your current level of coverage is no longer suitable, or you've decided you want to incorporate a cash-value policy into your comprehensive financial plan.

- Your needs have changed: Perhaps your children have grown and no longer need support, you've gotten divorced, or your income or estate has grown in size.

- Your current level of coverage is no longer suitable: Maybe you want to switch from a term policy to whole life insurance to obtain permanent coverage, or vice versa.

- You're changing jobs: You may need to consider the group life insurance benefits at your new job and whether you need to supplement that coverage with a privately-owned policy.

- Your finances have changed: You may no longer be able to afford the premium payments and need to adjust your coverage or find cheaper coverage.

- Your health has improved: If you've made positive changes to your health, such as quitting smoking or losing weight, you may qualify for a better premium.

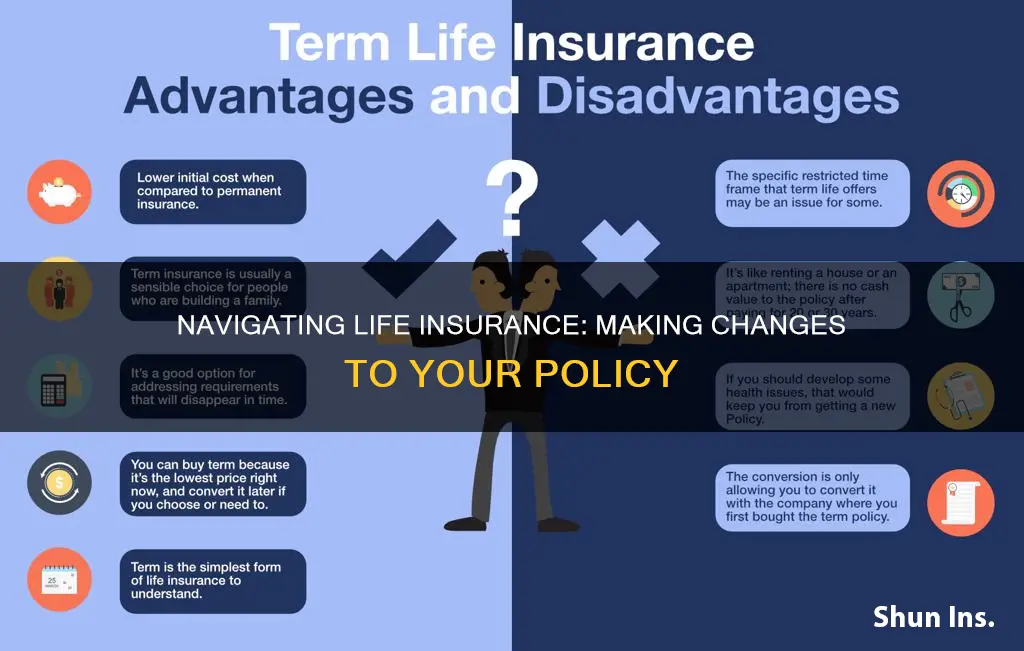

When changing your type of coverage, it's important to review the different types of policy options available, such as term, whole life, or other permanent life policies like universal life insurance. You should also be aware of any costs associated with changing your policy, such as surrender fees or tax consequences.

Before making any changes, it's recommended that you speak with a financial advisor or insurance agent to ensure you're making the best decision for your needs. They can help you evaluate your current coverage, determine your future needs, and explore alternative options, such as adjusting your current policy or purchasing a second policy to supplement your existing coverage.

Life Insurance and Lung Cancer: What Coverage is Offered?

You may want to see also

Cancelling your current policy

First, you need to decide what type of policy you want to replace it with. You should research the differences between term and permanent life insurance and decide which is best for your needs. Term insurance lasts for a set amount of time, whereas permanent life insurance covers you for your whole life as long as you continue to pay the premium. Permanent policies also often have additional benefits, such as a cash value component. However, they typically cost more than term insurance.

Second, you should determine how much coverage you need. Consider what you want the death benefit payout to cover and how your beneficiary would use it. For example, you may want to replace your income for your spouse, leave an inheritance for your children, or provide for burial expenses.

Third, you should check whether you can adjust your current policy instead of cancelling it. Contact your current insurer or agent to see if your policy includes terms that allow you to make changes. That way, you can avoid the hassle of switching policies and may be able to avoid a health questionnaire or medical exam.

If you decide to go ahead and cancel your current policy, make sure you have your new policy in place first. You don't want to be left with a gap in coverage. Also, be aware that there may be waiting periods with a new policy, so find this out in advance. For example, with a guaranteed issue life insurance policy, your beneficiaries may not receive a full payout if death occurs during the first two years.

Finally, be aware of the financial consequences of cancelling your current policy. If you have a permanent policy, you may lose the money you've already paid into it. There may also be surrender charges if you're cancelling a permanent life insurance policy.

Canceling Northwestern Mutual Life Insurance: A Step-by-Step Guide

You may want to see also

Buying a new policy

Buying a new life insurance policy is a straightforward process, but it's important to do your research and understand your options. Here are some detailed steps to guide you through the process of buying a new policy:

Figure out your coverage needs:

Consider your current life stage, financial situation, and future goals. Evaluate if you need more or less coverage than your previous policy. Think about what kind of policy you want—term or permanent life insurance. Your needs may have changed since you purchased your last policy. For example, your income might be different, or your family might have grown. It's essential to ensure that your new policy aligns with your current circumstances and adequately covers your needs.

Research and compare policies:

Explore the market by reaching out to multiple insurance companies and reviewing their offerings. Compare the benefits, premiums, and services provided by different insurers. Consider factors such as the financial strength and reputation of the insurance company. Read reviews from trusted sources like Yelp, the Better Business Bureau, or Trustpilot to help you make an informed decision.

Choose a reliable insurer:

Select an insurer with a strong reputation and excellent customer service. The right insurance company should offer helpful and friendly service, making the process seamless and stress-free. Look for an insurer that prioritises your needs and is committed to supporting you throughout the life of the policy.

Understand the costs and benefits:

Before finalising your new policy, be sure to review all the costs involved. Understand the premiums, any additional fees, and the benefits included in the policy. Compare these costs and benefits with your previous policy to ensure you're making a well-informed decision. Ask about any tax implications and loan options associated with the new policy.

Start the application process:

Once you've found the right insurer and policy, begin the application process. Provide accurate and detailed information about your health, lifestyle, and financial situation. Be prepared to undergo a medical exam or complete a health questionnaire, as this may be required by the insurer. Work closely with the insurance agent to ensure a smooth application process.

Finalise the new policy:

Before cancelling your existing policy, ensure that your new policy is in place and active. Confirm the start date of the new policy and understand any waiting periods or restrictions on claiming benefits. It's crucial to avoid any gaps in coverage, so carefully time the transition between policies.

Remember, when buying a new life insurance policy, it's essential to be proactive, ask questions, and ensure that the policy meets your unique needs. Don't hesitate to seek advice from financial advisors or insurance experts if needed.

Congress' Entitlement: Free Health Insurance for Life?

You may want to see also

Finding a reliable insurer

Do Your Research

Before settling on a new insurer, it is essential to conduct thorough research. Explore a variety of insurance companies and compare their offerings. Understand your coverage needs and evaluate how well each company can meet those needs. Consider factors such as the type of policy, premium costs, and the level of service provided.

Seek Reviews and Reputation

To assess an insurer's reliability, look for reviews and testimonials from other customers. Check platforms like Yelp, the Better Business Bureau, or Trustpilot to gain insights into their experiences. A company with a strong reputation and positive feedback from its customers can be a good indicator of reliability.

Focus on Customer Service

Choose an insurer that prioritizes customer service. The right insurance company should offer helpful, friendly service that simplifies the process for you. Look for an insurer that is responsive, communicative, and willing to work with you to meet your specific needs. This level of service should be consistent throughout your interactions with them, from your initial meetings to the point when your beneficiaries may need to claim benefits.

Understand the Process

When switching insurers, it is beneficial to understand the steps involved. First, figure out your coverage needs, considering any changes in your income, family situation, or other relevant factors. Next, purchase your new policy, ensuring it is active before cancelling your old one to avoid a gap in coverage. Then, proceed to cancel your existing policy, being mindful of any accrued cash value if you're moving between whole life policies.

Consult Professionals

Consider consulting insurance agents or financial planners who can guide you through the process. They can help you navigate the complexities of different policies, coverage options, and potential pitfalls to avoid. These professionals can provide valuable insights and ensure you make well-informed decisions.

Be Wary of Questionable Agents

Unfortunately, there are agents who may engage in unethical practices, such as "churning," where they repeatedly change clients' policies to generate commissions. Be cautious if an agent discourages you from informing your current insurer or relatives about your plans to switch policies. Also, be wary of agents who pressure you to sign incomplete or unclear forms or make overly critical remarks about their competitors. If you encounter any warning signs, don't hesitate to contact your state insurance commissioner's office for guidance and protection.

Remember, finding a reliable insurer is about ensuring your peace of mind and the financial protection of your loved ones. Take the time to research, compare, and seek guidance as needed to make an informed decision that aligns with your unique circumstances and goals.

FBI Life Insurance: What's the Deal?

You may want to see also

Reviewing your cover

Understand your current coverage:

Firstly, review your existing life insurance policy. Understand the type of policy you have, the amount of cover, and the terms and conditions. Ask yourself if the current cover is sufficient for your needs. Consider any life changes that may have occurred, such as a new mortgage, marriage, divorce, or children, as these may impact the required level of cover.

Calculate your required cover:

Think about how much life insurance cover you need. Consider your financial situation, including income, debts, mortgage, and anticipated expenses such as childcare or medical costs. Evaluate how much cover you would need to ensure your dependents can maintain their standard of living if something happens to you.

Compare alternative policies:

Research and compare life insurance policies from different providers. Look at the different types of policies available, such as term life insurance or whole-of-life insurance, and weigh the benefits of each. Compare the premiums, coverage amounts, and additional benefits offered.

Contact your current insurer:

Get in touch with your current insurer and inquire about the possibility of making changes to your existing policy. They may be able to adjust your coverage or offer alternative options that better suit your needs. Ask about any fees or changes to your premiums that may result from making adjustments.

Consider the timing:

When switching policies or insurers, ensure there is no gap in your coverage. Start your new policy on the same day you end the old one to avoid being left uninsured. Make sure your new policy is agreed upon and set up before cancelling your old policy to prevent any lapses in coverage.

Be aware of potential fees:

Understand any fees associated with changing your policy, such as 'surrender charges', which may apply if you want to access your life insurance money early. Also, be aware that life insurance generally becomes more expensive as you get older, so your premiums may increase with any new policy.

By carefully reviewing your cover and following these steps, you can make informed decisions about changing your life insurance to ensure it remains aligned with your life circumstances and financial goals.

Annuities vs Life Insurance: What's the Real Difference?

You may want to see also

Frequently asked questions

Changing your life insurance policy is a straightforward process. First, review your cover and calculate if it meets your needs. Then, compare life insurance policies to check if another insurer provides a better deal. If you want to switch insurers, sign up for the new policy and contact your old provider to end your previous policy.

Ensure your new policy starts on the same day your old policy ends to avoid a period without cover. Check that your new policy is set up before you cancel your old one. Know the price of your new premium and be aware of any waiting periods before you can claim. Research your new insurer and confirm they are registered with the Financial Conduct Authority (FCA).

If you want more protection but don't want to change insurers, you can buy a second insurance policy. This is known as a 'top-up' policy and will cover any amount missing from your first policy. You can also change the type of life insurance policy you have, for example, switching from mortgage life insurance to term life insurance.

To change the beneficiary, simply speak to your insurer. The process depends on the type of policy you have and how it was set up.

There are several life milestones that may prompt a change in your life insurance policy. For example, if you have children, get married, or divorced. You may also want to change your policy to cover a new mortgage or if your family circumstances change.