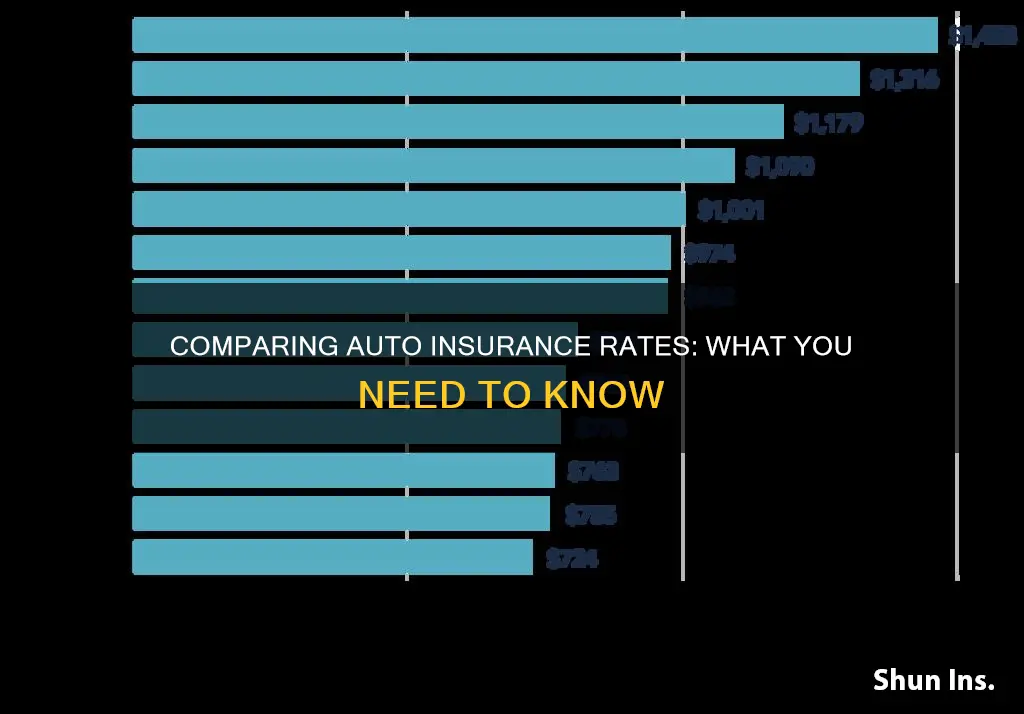

Comparing auto insurance rates can help you find the best price. Each company has its own secret sauce when it comes to setting rates, and their recipes change with time. That's why comparing rates from two car insurance companies may reveal wildly different results for the same driver.

To compare auto insurance rates, you'll need to decide on the coverage you need, view rate comparisons, and learn more about individual insurers. You'll need to provide some basic information about yourself, such as age, gender, and marital status, and also information about your vehicle. You'll also be asked about your current insurance status, if applicable, and will need to provide some information related to your driving history.

Most insurers offer the option of obtaining free quotes through their websites. There are also comparison sites that allow you to obtain and compare quotes from multiple insurers at once.

| Characteristics | Values |

|---|---|

| Personal information | Date of birth, gender, marital status, address, occupation, driver's license number |

| Vehicle information | Vehicle Identification Number (VIN), mileage, make, model, year |

| Driving history | Claims, violations, tickets |

| Insurance history | Current or previous insurer's name |

| Payment | Down payment, monthly or quarterly payment plan |

What You'll Learn

How to compare car insurance rates online

Comparing car insurance rates online is a great way to find the best deal for you. Here's a step-by-step guide on how to do it:

Decide on the coverage you need:

Firstly, you should consider what type of car insurance coverage you require. Most states require a minimum amount of liability coverage, and a minimum-coverage policy is usually the cheapest option. However, there are other factors to keep in mind. For example, if you have a newer car or a leased vehicle, you may need comprehensive and collision coverage.

View rate comparisons:

Look at different insurers' rates to see which offers the best deal for your needs. Keep in mind that rates can vary depending on factors such as your driving record, age, gender, location, and credit score. Some companies may also offer discounts for things like being a good driver or having safety features in your car.

Learn more about individual insurers:

Research individual insurance companies to find the best fit for you. Check out their customer reviews, claim handling processes, and satisfaction rates. Also, make sure to compare quotes for the same types and levels of coverage to ensure an accurate comparison.

Gather your information:

To get an accurate quote, you'll need to provide some personal information. This includes your age, gender, marital status, driving history, vehicle information (make, model, VIN), and current insurance status.

Compare quotes:

Use online comparison tools or contact insurance companies directly to get quotes. Get quotes from at least three different insurers to ensure you're getting a good deal. Remember to compare the same types and levels of coverage across companies.

By following these steps, you'll be able to compare car insurance rates online effectively and find the best policy for your needs.

Insuring Your Vehicle at DMV

You may want to see also

How to compare car insurance rates by age

Age is one of the most significant factors that affect car insurance rates. In all states except Massachusetts and Hawaii, insurance providers use your age to determine your premium. Typically, younger drivers under 25 pay higher rates than adults, while drivers between the ages of 25 and 60 benefit from lower premiums. Seniors over the age of 60 may see their insurance costs increase again.

Teen Drivers

Teen drivers tend to have the highest insurance rates because they are inexperienced and more likely to be involved in accidents. The Centers for Disease Control and Prevention (CDC) reports that teens have a higher crash rate than any other age group. According to Bankrate, a 21-year-old driver pays an average of 69% more for a full-coverage policy than a 40-year-old.

Among the insurance companies analysed, Nationwide, Geico, and Farmers tend to offer lower rates for young drivers. USAA also offers competitive rates for young drivers with a military connection.

Drivers Aged 20-25

Drivers in their early 20s continue to face elevated car insurance prices, although the increase is usually less dramatic compared to teen drivers. Some young adults may find it more affordable to stay on their parent's policy instead of purchasing their own.

Adult Drivers

Adult drivers aged 25 and above generally benefit from lower insurance rates, as insurance companies reward them for having more driving experience and a clean record. Car insurance premiums tend to follow a downward trend from ages 25 to 50.

Senior Drivers

Senior drivers, typically defined as those aged 60 and above, may experience an increase in their insurance rates. This is because senior drivers are statistically at greater risk of being involved in accidents due to ageing-related health factors, such as decreased eyesight and slowed reaction time.

Based on the analysis, older adults may want to consider getting quotes from USAA, Nationwide, Geico, and Auto-Owners for low-cost coverage, as these carriers offer some of the best average insurance rates for senior drivers.

Vehicle De-Insure: What You Need to Know

You may want to see also

How to compare car insurance rates by driver history

When comparing car insurance rates by driver history, it's important to understand that insurance companies will scrutinize your driving record to determine your level of risk. Factors such as age, driving experience, accidents, violations, and claims history will all be taken into account when calculating your rates. Here are some tips on how to compare car insurance rates by driver history:

- Compare rates for different driver profiles: Look for average rates based on specific driver characteristics such as age, gender, driving record, and credit history. This will give you an idea of how your driver history can impact your insurance rates.

- Consider the impact of driving experience: Insurance companies often offer lower rates to drivers with more experience on the road. Compare rates for drivers in different age groups, such as teens, young adults, and seniors, to see how experience affects rates.

- Analyze rates after a DUI: A DUI can significantly increase your insurance rates for several years. Compare rates from different companies to find the most affordable option if you have a DUI on your record.

- Evaluate rates for drivers with poor credit: Your credit history can also influence your insurance rates. Compare rates from different companies to see how much of an impact poor credit may have.

- Assess rates after an accident: At-fault accidents will typically lead to higher insurance rates. Compare rates from multiple insurers to find the best option if you have an accident on your record.

- Utilize insurance comparison sites: Websites like NerdWallet, The Zebra, and Compare.com allow you to compare rates from multiple companies at once, making it easier to see how your driver history affects your rates.

Gap Insurance vs. Conditional Gap Waivers

You may want to see also

How to compare car insurance rates by state

Car insurance rates vary significantly from state to state. The national average cost of car insurance is $2,118 per year, according to Forbes Advisor's analysis of full-coverage car insurance rates. However, this figure can range from as low as $1,021 in Idaho to as high as $4,769 in New York.

Factors Affecting Car Insurance Rates by State

Several factors contribute to the variation in car insurance rates across different states. Here are some of the key factors:

- State regulations and requirements: Each state has its own set of laws and requirements for car insurance. Some states mandate additional coverages, such as uninsured motorist coverage, personal injury protection (PIP), or medical payments, which can drive up the cost of insurance.

- Population density and urban areas: States with higher population density and larger cities tend to have higher insurance rates due to increased accident risks and claims.

- No-fault insurance laws: In no-fault states, drivers are required to carry PIP insurance to cover their medical expenses, regardless of who is at fault in an accident. This requirement often leads to higher insurance rates in these states.

- Number of uninsured drivers: States with a high percentage of uninsured drivers tend to have higher insurance rates, as insured drivers bear the cost of accidents involving uninsured motorists.

- Weather conditions and natural disasters: States prone to severe weather events, such as hurricanes, floods, or hail storms, typically experience higher insurance rates due to the increased frequency of claims.

- Crime rates and vandalism: States with higher crime rates, particularly car theft and vandalism, can impact insurance rates as insurers consider these areas higher risk.

- Cost of repairs and medical care: The cost of car repairs and medical treatments varies across states, and states with higher costs tend to have higher insurance rates.

- Frequency of lawsuits: States with a higher rate of lawsuits related to car accidents can lead to increased insurance rates as insurers anticipate larger settlements.

Cheapest and Most Expensive States for Car Insurance

As of 2024, the cheapest states for car insurance include Idaho, Vermont, Ohio, Maine, and Iowa. On the other hand, the most expensive states for car insurance are New York, Florida, Louisiana, Pennsylvania, and Maryland.

Comparing Car Insurance Rates by State

When comparing car insurance rates by state, it is essential to consider your specific circumstances, such as your age, driving record, and the type of vehicle you own. Additionally, remember that rates can vary within a state, depending on your ZIP code and other local factors. Therefore, it is always a good idea to shop around and get quotes from multiple insurance providers to find the best rates and coverage for your needs.

Umbrella Insurance: Auto-Optional

You may want to see also

How to compare car insurance rates by credit score

Comparing car insurance rates by credit score is an important aspect of managing your financial health effectively. Here's a step-by-step guide on how to do it:

Understand the Impact of Credit Scores on Insurance Premiums:

Credit scores significantly influence car insurance rates, with individuals with excellent credit often paying lower annual rates than those with poor credit histories. Maintaining a good credit score can help secure more favourable insurance costs.

Compare Rates by Credit Tier:

Compare insurance rates by considering different credit tiers, such as excellent, good, fair, and poor credit. For example, individuals with excellent credit may pay around $2,200 annually for full coverage, while those with poor credit could face rates as high as $4,801.

Evaluate Insurance Companies:

Different insurance companies may weigh credit scores differently when determining rates. Compare rates from multiple insurers, such as Liberty Mutual, GEICO, Nationwide, and State Farm, to find the most favourable option for your credit score.

Improve Your Credit Score:

Enhancing your credit score can lead to reduced insurance premiums. Strategies to improve your credit score include paying your bills on time, minimising hard credit inquiries, regularly monitoring your score, maintaining old lines of credit, and managing your credit utilisation ratio effectively.

Consider State Regulations:

Note that some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit or limit the use of credit scores when determining insurance rates. Be sure to review the regulations in your state to understand how credit scores impact insurance premiums in your specific location.

Compare Quotes:

Gather quotes from multiple insurance companies by providing them with your personal information, vehicle details, driving history, and current insurance information. Compare quotes with the same coverage levels and driver profiles to ensure an accurate comparison.

Choose the Right Coverage:

Determine the appropriate liability coverage levels based on your net worth. Select full coverage if you want to include collision and comprehensive insurance, which covers damage to your car in various scenarios.

By following these steps, you can effectively compare car insurance rates by credit score and make an informed decision to secure the best coverage at a favourable rate.

Broad Form Auto Insurance: What's Covered?

You may want to see also

Frequently asked questions

Comparing auto insurance rates involves gathering quotes from multiple companies and seeing how they stack up against each other. This is because each company has its own unique method for setting rates, and these recipes change over time. You will need to provide some personal information, such as your age, gender, driving history, and vehicle details, to get a quote. It is also important to compare the same types and amounts of coverage across companies to ensure an accurate comparison.

To get an auto insurance quote, you will typically need to provide your personal information, such as your age, gender, driving history, and vehicle details. This includes your vehicle's make, model, year, and mileage. You may also be asked about your current insurance status and the number of miles you drive annually.

Auto insurance rates are influenced by various factors, including your age, driving record, vehicle type, location, and credit score. Rates tend to be higher for younger and less experienced drivers, those with a poor driving record, and individuals with a low credit score. Additionally, the level of coverage you choose and the deductible amount will impact your premium.

It is recommended to obtain quotes from at least three different insurance companies to find the most competitive rate. Comparing multiple quotes allows you to see how each company weighs the various factors and helps you identify the best coverage for your needs at the lowest price.