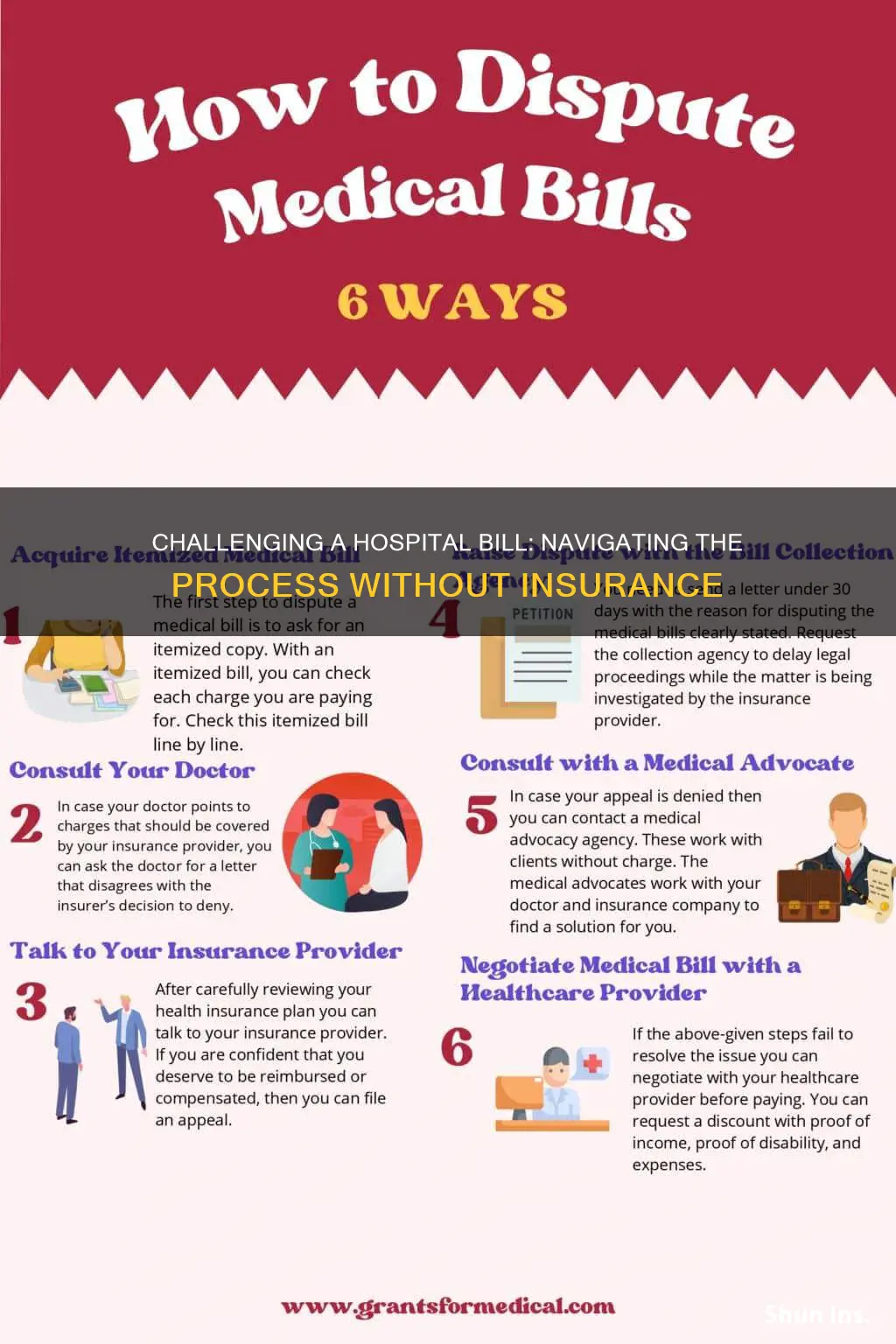

If you're facing a large hospital bill and you don't have insurance, you may be able to dispute the charges. The first step is to carefully review your bill for any errors or unexpected charges. Request an itemized bill from the hospital and compare it to your health insurance plan to check for any discrepancies. You can also research the fair price of each procedure to identify if the hospital's prices are higher than those charged by other hospitals. If you find any issues, contact the hospital and explain the situation. You may be able to negotiate a lower bill or set up a payment plan. It's important to keep detailed records of all your communications and be mindful of the timeline for payment to avoid any negative impact on your credit score.

| Characteristics | Values |

|---|---|

| When to dispute a hospital bill | If the bill is $400 or more above the "good faith" estimate |

| Who to contact | The medical provider's billing department |

| What to ask for | A detailed, itemized bill |

| What to look for | Double charges, coding mistakes, incorrect calculations, charges for medication brought from home, full-day rate charges for patients discharged in the morning, charges for supplies like sheets, gowns, or gloves |

| Who to talk to next | Your insurance company |

| What to do if the bill goes to a collection agency | File a notice with the collection agency within 30 days, stating that you're disputing the bill |

| What to do if your appeal is denied | Try a medical advocacy agency that works with clients for free |

| What to do if you can't pay the bill | Negotiate with the medical provider, ask for a discount, and offer to send proof of income or expenses |

| What to do if you need financial assistance | Ask the hospital about financial assistance programs |

What You'll Learn

Check your bill for errors

Hospital bills can be complex and confusing, but it's important to review your bill for accuracy. Here are some steps you can take to check your bill for errors:

- Ask for an itemized bill: Request a detailed bill from your provider's billing department, listing the costs for each medical item or service you're being billed for.

- Understand the terminology: Medical bills often contain codes and abbreviations that can be difficult to decipher. Use online resources or a third-party website like www.online-medical-dictionary.org to help you understand the billing codes and terminology.

- Compare to your records: Keep a diary or log of your hospital stay, including dates, treatments received, medications, tests, and any other relevant information. Compare this to your bill to ensure you are only being charged for services and items you actually received.

- Look out for common errors: Some common errors to watch for include duplicate billing, coding errors, charges for cancelled or unreceived treatments, incorrect patient information, and upcoding (when a provider inflates the cost of a procedure or diagnosis).

- Verify dates and charges: Check that the dates on the bill match your hospital stay, including admission and discharge dates. Also, verify that the number of days and individual charges are correct and that you are not being charged for any extra days or services.

- Question miscellaneous charges: If there are charges listed under "miscellaneous" or "supplies", ask for a detailed breakdown of these charges.

- Review medication charges: Ensure you are not being charged for medications you brought from home or for brand-name drugs when a generic version was prescribed.

- Check for double-billing: Make sure you are not being billed twice for the same service, medication, or supply. This can be common if you received care from multiple providers.

- Contact the billing department: If you find any discrepancies or have any questions about your bill, don't hesitate to contact your provider's billing department for clarification or correction.

The Slippery Slope of Insurance: Understanding the "Sliding" Concept

You may want to see also

Compare with insurance coverage

If you have insurance coverage, you are protected from surprise or unexpected medical bills in certain situations. For example, if you have insurance coverage subject to New York Law, you are protected from surprise medical bills or bills for emergency services when treated by an out-of-network provider at an in-network hospital.

If you receive a surprise bill, you can submit a dispute through the Independent Dispute Resolution (IDR) process. You must sign a Surprise Bill Certification Form if your in-network doctor referred you to an out-of-network provider or if an out-of-network provider treated you at an in-network hospital or facility before January 1, 2022.

If you receive a bill for emergency services, contact your health plan as you are only responsible for your in-network copayment, coinsurance, or deductible.

If you have employer or union self-funded coverage, the date you received services and the type of payment dispute will determine whether you are eligible to file an IDR through your state or whether you are eligible for protections under the Federal No Surprises Act.

If you are insured but you don't plan to file a claim with your health plan, health care providers must give you a good faith estimate of what their expected charges will be before you receive health care services. If you are billed for an amount that is at least $400 more than the good faith estimate, you may dispute the charges in the Federal patient-provider dispute resolution process.

If you receive a bill that you think is incorrect or unfair, you can take the following steps:

- Get an itemized copy of your bill and review it for any errors or unexpected charges.

- Contact your medical provider and ask them to review the charges and fix any mistakes.

- Contact your insurance company and file an appeal if you believe they should be covering the bill or reimbursing you.

- If the bill goes to a collection agency, file a notice with the agency and ask them not to send the matter to court while it's being investigated.

- Work with a medical advocate who can help you find a solution with your insurance company or doctor.

- Negotiate with your medical provider to see if they can offer a discount or a flexible repayment plan.

Northwestern Mutual's Level Term Insurance Option: A Comprehensive Overview

You may want to see also

Contact the hospital

Contacting the hospital is the first step in disputing a hospital bill. Here are some detailed instructions on how to do this effectively:

Collect All Your Bills

Get organised and gather every bill you have received from the hospital, as well as bills from medical centres, labs, and doctors' offices. It is not uncommon to receive multiple bills for one procedure or visit, and bills may arrive up to eight months after treatment. Keep all your bills in a folder and scan them to have a digital copy.

Request an Itemised Bill

If you have only received a bill that shows a lump sum, call the hospital and request a detailed, itemised bill. This will list each charge, making it easier to spot any errors. Hospitals are required to provide this upon request.

Review Your Bills

Go through your itemised bill line by line, looking for any errors or double charges. Check that you have not been charged for medications you brought from home, or for supplies like sheets, gowns, or gloves, which should be included in the cost of the room. Also, make sure you have not been charged a full-day rate for the room if you were discharged in the morning.

Research Fair Prices

To challenge a bill, you will need evidence that the hospital's prices are higher than those of other hospitals. You can find this information online by visiting websites such as Healthcare Blue Book and FAIR Health. This research will provide valuable evidence to support your case when disputing the bill.

Call the Hospital

You can initiate the dispute process by calling the hospital. Explain that you are unhappy with the charges and why. Keep careful notes of your conversations, including the names of the people you speak to, dates, and times. You are likely to speak to multiple people, so keeping a record is important.

Write a Dispute Letter

After calling, follow up with a letter. Summarise your conversations and repeat the reasons for challenging the bill. Include your account information, the specific charges you are disputing, the reasons for disputing them, and any supporting documents, such as evidence of competitor pricing.

Consider Hiring an Advocate

If the hospital is still unwilling to lower the bill, consider hiring a patient or medical-billing advocate. These professionals often work on a contingency basis, taking a percentage of the savings they help you achieve as their fee. They can negotiate with the hospital on your behalf and help you reach a fair outcome.

Unlocking Flexibility: Converting Term Insurance to an IUL Policy

You may want to see also

Negotiate with the hospital

If you've received a hospital bill that you think is too high, you can try to negotiate with the hospital to lower the amount. Here are some steps you can take:

- Get an itemized bill: Ask the hospital for an itemized bill, which breaks down all the charges and allows you to see exactly what you are being billed for. This will help you identify any errors or discrepancies.

- Review your bill for errors: Common medical billing errors include duplicate charges, incorrect patient information, incorrect codes, and unbundling of charges. Make sure you are not being billed for anything you didn't receive, and verify that the codes on your bill match the procedures you received.

- Research fair prices: Look up the average cost of the procedures and services you received to determine if the hospital is charging you a fair price. You can use websites like Healthcare Bluebook or FAIR Health Consumer to find this information.

- Contact the billing department: Call or write to the hospital's billing department to dispute any errors or request a reduction in the bill. Be polite and courteous, and provide documentation to support your case.

- Offer to pay upfront: If you can afford to pay a portion of the bill upfront, the hospital may be more likely to offer a discount. Many hospitals will also negotiate a lower cost if you agree to pay the discounted amount immediately.

- Set up a payment plan: If you can't afford to pay the bill in full, ask the hospital about setting up a payment plan. Hospitals often allow patients to pay off their bills in monthly installments without interest, which can make the debt more manageable.

- Apply for financial assistance: If you have a low income or are facing financial hardship, ask the hospital about financial assistance programs. Non-profit hospitals are required by law to offer financial assistance, and many other hospitals also have programs to help patients in need.

- Hire a patient advocate: If you need help negotiating with the hospital, you can hire a patient advocate or medical billing advocate. These professionals can work on your behalf to get the bill reduced and will typically take a percentage of the savings as their fee.

The Intricacies of Insurance: Unraveling the Concept of Contribution

You may want to see also

Hire an advocate

If you're facing a large hospital bill and are unsure of how to dispute it, you may want to consider hiring a patient or medical-billing advocate. These advocates are experts on medical bills and the medical billing system, and can help you lower your bills. They can review medical bills for correctness, appeal insurance claim denials, help you apply for financial aid, and negotiate prices.

Advantages of hiring a medical billing advocate include:

- They generally charge lower fees than attorneys.

- They deal with medical billing issues for a living and have experience in navigating the complex bureaucracy of hospital and insurance billing systems.

- They know the language used in the insurance industry and can quickly negotiate substantial reductions and facilitate appeals.

- They can help you save hundreds, if not thousands, of dollars.

When deciding whether to hire a medical billing advocate, consider the following:

- Whether you're dealing with a legal issue. If so, you may be better off hiring an attorney. If there may be a way to settle without going to court, an advocate may be more suitable.

- The type of advocate you need. Some advocates specialise in one area, while others have experience in multiple areas.

- Their pricing structure. Some advocates charge a percentage of the savings they make you (typically 20-30%), while others charge an hourly rate (usually between $50 and $175 an hour).

You can find a patient advocate online or in your phone book. They may be listed under different names, such as "claims assistance professionals" or "health-care claims advocates". Alternatively, you can contact a non-profit organisation, such as California Medical Billing Advocates, which provides free expert assistance.

Jiffy Lube's Insurance Coverage for Rock Chip Repairs: Understanding the Process

You may want to see also

Frequently asked questions

What should I do if I receive a bill or get sent to collections during the dispute process?

FAQ 2

You will need to pay a $25 non-refundable administrative fee to file a dispute. If the dispute is decided in your favor, the $25 will be deducted from the amount you owe your provider. You can pay this fee online via credit card, PayPal, or Venmo, or by mail via money order or cashier’s check.

FAQ 3

You and your health care provider or facility can settle the payment amount before the dispute process ends. They may offer to reduce your bill, or you may agree to pay the billed amount in full. If you both agree on a payment amount, the provider must reduce your bill by at least $12.50 (half of the $25 administrative fee) and notify the independent third-party reviewer that you've reached a settlement.

FAQ 4

If you didn’t use health insurance, review the financial assistance guide for ways to reduce your bill. You can also submit a complaint if your provider didn’t give you a good faith estimate. If you used health insurance, you don't qualify to dispute a bill, but you should still submit a complaint if you received care on or after January 1, 2022, and received an out-of-network bill, already paid more than in-network rates, or your provider didn’t follow the rules around notice and consent.