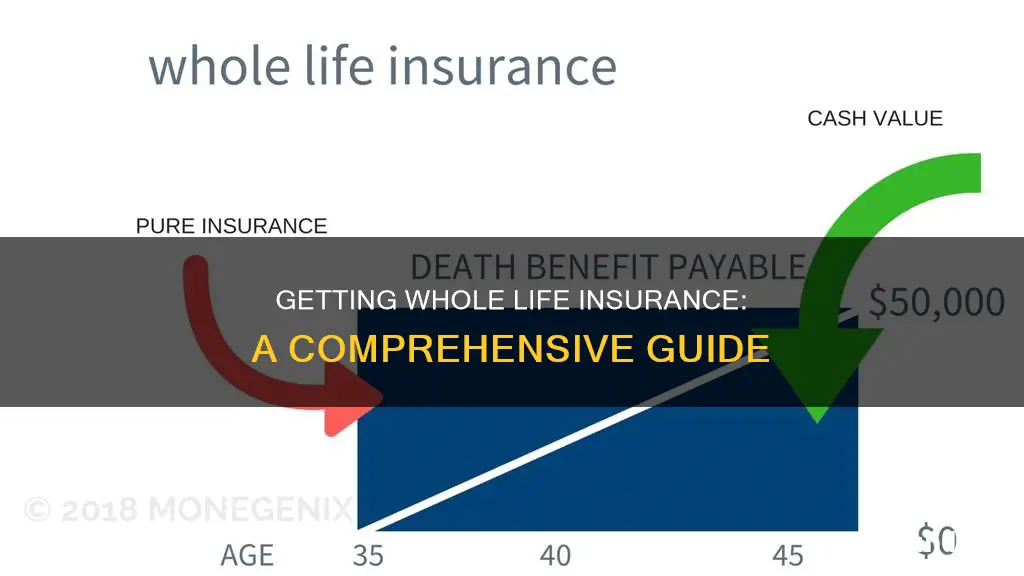

Whole life insurance is a type of permanent life insurance that offers coverage for your entire life, as opposed to term life insurance which is temporary and expires after a certain number of years. Whole life insurance typically offers the ability to build cash value over time, which can be borrowed against or used for other financial needs. The premiums for whole life insurance tend to be higher than those for term life insurance, but they are fixed and will not increase with age. When choosing a whole life insurance policy, it is important to compare quotes from different companies and consider factors such as the coverage amount, premium, and rate of growth for the policy's cash value.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Coverage | Lifelong |

| Premium | Fixed for life |

| Premium cost | Higher than term life insurance |

| Death benefit | Guaranteed |

| Cash value | Grows at a fixed rate over time |

| Cash value access | Yes, can borrow or withdraw |

| Cash value tax | Tax-deferred |

| Medical exam | Required |

| Beneficiaries | Can be split |

| Riders | Optional |

What You'll Learn

Whole life insurance vs. term life insurance

Overview

Whole life insurance and term life insurance are two types of life insurance policies with distinct features and benefits. While both types of policies offer financial protection for loved ones in the event of the policyholder's death, there are important differences to consider when deciding which type of insurance is more suitable for your needs.

Whole Life Insurance

Whole life insurance is a form of permanent life insurance that covers the policyholder for their entire life, rather than a fixed period. It combines a death benefit with a cash value component, offering both financial protection and a savings vehicle. Here are some key features of whole life insurance:

- Lifetime coverage: Whole life insurance provides coverage for the policyholder's entire life, as long as premiums are paid.

- Guaranteed premiums: Premiums remain fixed and do not increase over time.

- Cash value growth: Whole life insurance includes a cash value component that grows over time, tax-free, and can be borrowed against or withdrawn under certain conditions.

- Death benefit: Offers a guaranteed death benefit that is typically higher compared to term life insurance.

- Complexity: Whole life insurance policies can be more complex and difficult to evaluate due to their lifelong coverage and cash value component.

Term Life Insurance

Term life insurance, in contrast, offers coverage for a specific period, such as 10, 20, or 30 years. It is designed to provide financial protection for a limited time, often coinciding with significant financial obligations or life stages. Here are some key features of term life insurance:

- Temporary coverage: Coverage is provided for a set term, and the policy does not accumulate cash value.

- Lower cost: Term life insurance typically has lower premiums than whole life insurance, making it a more affordable option.

- Simplicity: Term life insurance is generally easier to understand and apply for, with straightforward coverage for a fixed period.

- Flexibility: It offers flexibility in choosing the term length to match specific financial obligations, such as the length of a mortgage or until children become financially independent.

- Limited coverage: If the policyholder outlives the term, the coverage ends, and no benefits are paid.

Choosing Between Whole and Term Life Insurance

When deciding between whole life insurance and term life insurance, it is essential to consider your unique circumstances, including your budget, time frame, and financial goals. Here are some factors to help guide your decision:

- Cost: Whole life insurance typically has higher premiums due to its lifelong coverage and cash value component, while term life insurance is generally more affordable.

- Coverage needs: If you require coverage for a specific period, such as until your children become financially independent or until your mortgage is paid off, term life insurance may be more suitable. If you seek lifetime coverage and want to build cash value, whole life insurance may be preferable.

- Savings component: Whole life insurance offers a cash value component that can be used for savings or investment purposes, while term life insurance does not have this feature.

- Simplicity vs. complexity: Term life insurance is generally simpler and easier to understand, while whole life insurance can be more complex due to its additional features and lifelong coverage.

- Long-term goals: Consider your long-term financial goals and whether you aim to maximize your financial potential. Whole life insurance may be more suitable if you want to build cash value over time, while term life insurance may be sufficient if you have other investment strategies in place.

In summary, the choice between whole life insurance and term life insurance depends on your individual needs, budget, and financial circumstances. Both types of policies have their advantages and disadvantages, and it is essential to carefully evaluate your situation before making a decision.

Term Life Insurance: Expensive as Time Goes On?

You may want to see also

How much life insurance do you need?

When considering how much life insurance you need, it's important to assess your financial situation and future goals. Here are some factors to guide you in determining the appropriate amount of coverage:

Financial Obligations and Goals

Calculate your long-term financial obligations, such as mortgage payments, college fees for your children, and future income requirements. Consider how many years of income you want to replace, especially if you have dependents who rely on your earnings. You can use the DIME formula, which takes into account debt, income, mortgage, and education, to get a comprehensive view of your financial needs.

Number of Dependents

The number of people who depend on your income will influence the amount of coverage you need. If you have a larger family or multiple children, you may require higher coverage to ensure their financial security.

Age and Life Stage

Your age and life stage play a crucial role in determining your insurance needs. For example, if you're a young family with a new home and children, your needs will differ significantly from someone who is retired, with grown children, and a paid-off mortgage.

Income and Savings

Your current income and savings are essential factors. A higher income may warrant higher coverage to replace that income in the event of your passing. Additionally, consider any savings or investments you have that could be used to cover expenses or support your dependents.

Final Expenses and Burial Costs

Don't forget to include end-of-life expenses and burial costs in your calculations. These can be significant, and you'll want to ensure your loved ones aren't burdened with these financial obligations.

Existing Life Insurance and Workplace Coverage

If you already have some form of life insurance, whether through your workplace or a personal policy, take that into account. However, remember that workplace insurance may not be portable if you change jobs, so it's not advisable to rely solely on it.

Future Income Growth and Expenses

When calculating your coverage needs, consider the possibility of your income increasing over time and plan for future expenses, such as college tuition for your children. It's better to have a cushion than to be underinsured.

While it's challenging to pinpoint the exact amount of coverage you need, using online calculators, consulting experts, and considering your unique circumstances will help you make an informed decision about the appropriate level of life insurance coverage.

Mondelez Life Insurance: Contact and Policy Details

You may want to see also

How to compare whole life quotes

To compare quotes and find the best whole life insurance policy for your needs, there are several steps you can take.

Firstly, determine how much life insurance you need. This will depend on your financial situation, including your income, the needs of your dependents, and your financial goals. You may want to buy at least six to ten years of your salary, or you could multiply how many years you have left until retirement by your salary.

Next, select the companies you want to compare. There are hundreds of life insurance companies to choose from, but you can narrow it down by considering their AM Best financial strength rating, J.D. Power customer satisfaction ranking, and NAIC consumer complaint index.

Then, prepare the necessary information and get quotes. For whole life insurance, you'll usually need to contact an agent directly. They will ask for details such as your height, weight, medical history, and family history. You will also need to decide on the amount of coverage you want. Remember that the quote is just an estimate and not a guarantee of the final price.

You can also request illustrations, which provide more detailed information about the policy than a quote, including features, limitations, riders, and performance over time. This will help you understand the cash value and death benefit at different policy years, as well as any surrender charges.

When comparing quotes and illustrations, consider factors beyond just the cost. Look at the cash value accumulation and whether the company pays dividends to policyholders. Check if there is a surrender period and any associated penalties. Also, look at the living benefits offered, such as accelerated death benefits.

Finally, don't forget to compare the same policy details, such as the type, term length, coverage amount, and riders, to get the most accurate comparison.

Term Life Insurance: Does GEICO Offer This?

You may want to see also

How to choose the right company

When choosing a company for whole life insurance, there are several factors to consider. Here are some guidelines to help you select the right provider:

Research and Compare Multiple Companies:

- Compare quotes and policies from several insurers to find the best fit for your needs.

- Look at the AM Best financial strength rating, which indicates the company's ability to pay its insurance claims.

- Consider the J.D. Power customer satisfaction ranking, which evaluates customer experiences with major life insurers.

- Refer to the NAIC consumer complaint index to understand the number of complaints each insurer has received relative to their size.

Understand Your Coverage Needs:

- Determine the amount of life insurance coverage you require by considering your financial situation, dependents, and future goals.

- Decide if you want a mutual life insurance company, which makes you a shareholder and eligible for dividends based on the company's financial performance.

- Evaluate the different types of whole life policies, such as participating vs. non-participating policies, and typical, limited, single, or modified premium payment options.

Evaluate Policy Features and Flexibility:

- Consider the flexibility offered by the company in terms of payment schedules, coverage amounts, and policy term lengths.

- Review the available riders or add-ons that can enhance your coverage, such as accelerated death benefit, waiver of premium, or child term rider.

- Assess the company's requirements for purchasing a policy, as some may necessitate a medical exam while others offer simplified underwriting.

Assess Financial Strength and Reputation:

- Choose a company with strong financial ratings, such as an A+ or higher rating from AM Best, indicating their ability to pay claims in the long term.

- Look for companies with a low number of complaints relative to their size, suggesting smoother customer experiences.

- Consider the company's reputation for customer satisfaction, as you want an insurer known for treating its policyholders fairly and respectfully.

Understand Cost and Value:

- Evaluate the cost of coverage, as whole life insurance tends to have higher premiums than term life insurance.

- Weigh the benefits offered by the company, such as dividend payments, tax advantages, and the potential for cash value growth.

- Remember that cost should not be the sole deciding factor; instead, focus on finding a reputable company with competitive pricing.

Remember to carefully review the terms, conditions, exclusions, and coverage amounts before committing to any policy. By following these guidelines, you can make an informed decision when choosing the right company for your whole life insurance needs.

Life Insurance Industry: Low Interest Rates Forever?

You may want to see also

How to complete the application

To complete the application for whole life insurance, you will typically need to go through medical underwriting. This involves the insurer pulling your medical records, requesting a thorough health and family history, and potentially asking you to submit blood and urine samples for testing, and/or meet with a nurse for a physical examination.

The healthier you are, the more likely you are to qualify for life insurance at a lower premium. Insurers have started using accelerated underwriting processes (no-medical-exam life insurance) that allow those in excellent health to skip the medical exam. Your health information is collected from other sources, so there is no need for an examination.

Some life insurance companies offer final expense or burial insurance policies that don't require a medical exam or medical underwriting. These policies are designed for applicants in poor health and have a small death benefit. They are not generally recommended if you are in average health or better.

Once underwriting is complete, the insurer will inform you of whether they are willing to extend coverage and at what rate. Most companies allow you to pay your premium when you first submit the application, providing conditional coverage while your records are reviewed. If you die during this period, your heirs will receive the death benefit.

After you sign up, insurance companies are required to give you a free-look period. This is a period of up to 30 days, depending on where you live, during which you can thoroughly review your life insurance contract. If you change your mind, you can request a full refund of your premium with no questions asked.

Whole Life Insurance: Injury Payouts Explained

You may want to see also

Frequently asked questions

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, unlike term insurance, which expires after a certain number of years. It combines an investment account called "cash value" with a guaranteed death benefit for your beneficiaries. The cash value component grows at a fixed rate over time, and you can borrow against it or withdraw it.

The cost of whole life insurance depends on various factors, including age, health, gender, occupation, policy features, and the insurance company. Generally, younger and healthier individuals pay lower premiums. It is recommended to compare quotes from multiple companies to find the best rate.

When choosing a whole life insurance policy, consider factors such as the financial strength and customer satisfaction ratings of the insurance company, the policy's cash value accumulation, dividends, surrender period, and living benefits offered. Compare quotes and illustrations from different companies to find a policy that fits your needs and budget.