Comprehensive auto insurance is an optional coverage that protects your vehicle from damage caused by unexpected events that are not collisions. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. It is often required by lenders if you lease or finance your vehicle, but if you own your vehicle outright, you can decide whether to purchase it. Comprehensive coverage is typically added to an existing policy and is not a separate type of insurance. The cost of comprehensive insurance depends on factors such as the value, make, and model of your car, as well as your driving history and chosen deductible.

| Characteristics | Values |

|---|---|

| What does it cover? | Damage to your vehicle caused by non-collision events outside of your control. |

| Theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. | |

| Civil unrest or riots, falling or projective objects (e.g. ice, trees, branches). | |

| What doesn't it cover? | Damages to another vehicle, medical expenses, legal expenses, personal property stolen from your vehicle. |

| Cost | The average cost of comprehensive insurance is about $134 per year, but this varies depending on your car's value, make and model, driving history, and deductible. |

| When to get it | If you have a new vehicle, if you lease or finance your vehicle (as lenders often require it), or if you don't think you could cover the cost of unexpected repairs. |

| When to skip it | If you drive an old vehicle or feel you can cover unexpected repairs, or if the premiums and deductibles will likely exceed the cost of repairs or the actual cash value of your car. |

What You'll Learn

Comprehensive insurance covers non-collision damage

Comprehensive insurance is often confused with collision insurance, but they are two different types of coverage. Collision insurance covers damage to your vehicle caused by a collision with another vehicle or object, such as a telephone pole, guard rail, or mailbox. Collision coverage reimburses you for the cost of repairing your car, minus the deductible. On the other hand, comprehensive insurance covers damage caused by incidents other than collisions. These are typically unexpected incidents outside of your control, such as natural disasters or theft.

Comprehensive insurance is optional and not required by state law in the US. However, it is usually required by lenders if you are leasing or financing your vehicle. If you own your vehicle outright, you can decide whether to purchase comprehensive insurance. It is a good idea to consider the value of your car, your financial circumstances, and your personal preferences when deciding whether to opt for comprehensive insurance.

Comprehensive insurance covers a range of non-collision incidents, including:

- Weather events: This includes damage caused by hail, wind, floods, hurricanes, lightning, and storms.

- Natural disasters: Comprehensive insurance covers damage caused by earthquakes, floods, hurricanes, tornadoes, and volcanic eruptions.

- Theft: This includes the theft of the entire car or parts of the car, such as the airbag.

- Vandalism: Comprehensive insurance covers damage caused by vandalism and civil unrest.

- Fallen objects: This includes damage caused by fallen trees, branches, ice, or other projectiles.

- Accidents with animals: Comprehensive insurance covers damage caused by contact with animals, such as hitting a deer.

Comprehensive insurance provides valuable protection against unexpected non-collision incidents. It gives you peace of mind, knowing that you are covered no matter what unexpected events come your way.

Amica Auto Insurance: Mechanical Breakdown Protection

You may want to see also

It's optional, but often required by lenders

Comprehensive auto insurance is optional coverage that protects your vehicle from damage caused by events other than collisions. This can include theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. While comprehensive auto insurance is not required by law in any state, it is often required by lenders if you are leasing or financing your vehicle. This is because lenders want to protect their investment in the vehicle until the loan is paid in full.

If you are unsure whether you have comprehensive auto insurance, you can review your insurance policy or contact your insurance provider. Your insurance policy will outline the specific coverages included in your plan. Additionally, your insurance provider can confirm the details of your coverage and answer any questions you may have. It is important to understand the terms of your insurance policy to ensure you have the protection you need.

Comprehensive auto insurance provides valuable protection for your vehicle. By covering non-collision events, it offers peace of mind and financial security in the event of unexpected damage. This type of insurance is particularly relevant if you live in an area prone to weather-related disasters, high car theft rates, or other factors that increase the risk of non-collision damage. Ultimately, the decision to opt for comprehensive coverage depends on your personal circumstances and your tolerance for risk.

When considering comprehensive auto insurance, it is essential to weigh the costs and benefits. The average cost of comprehensive insurance is approximately $134 per year, but this can vary depending on factors such as your car's value, make, and model. Additionally, your driving history and the deductible you choose will impact your rates. It is worth shopping around and comparing rates and coverage options from different insurers to find the best fit for your needs.

In conclusion, while comprehensive auto insurance is optional in most cases, it is often required by lenders for leased or financed vehicles. This type of insurance provides valuable protection against non-collision events and can offer financial peace of mind. By reviewing your insurance policy and consulting with your provider, you can ensure that you have the coverage you need to protect your vehicle.

Ameriprise Auto Insurance: Extended Coverage Options Examined

You may want to see also

It covers theft, vandalism, fire, and animal accidents

Comprehensive auto insurance is an optional coverage that protects your vehicle from damage caused by incidents outside of your control, such as theft, vandalism, fire, and animal accidents. It is important to note that comprehensive insurance does not cover any personal items within the car if they are stolen during a vandalism incident. Coverage for personal belongings would typically fall under renters or homeowners insurance.

Theft: Comprehensive auto insurance covers the cost of repairs or replacement of your vehicle if it is stolen. It also covers the cost of repairs for stolen or damaged car parts.

Vandalism: Comprehensive insurance covers acts of vandalism, such as slashed tires, broken windows, defaced vehicles, and damage to the vehicle's interior. It is important to note that you must first pay your deductible before the insurance company starts paying for repairs.

Fire: Comprehensive auto insurance covers damage caused by fire, including explosions and fire-related accidents.

Animal Accidents: Comprehensive insurance covers accidents involving animals, such as hitting a deer or other animals on the road. It also covers damage caused by animals to your vehicle's interior, such as rodents breaking into the car.

To know if you have comprehensive auto insurance, review your policy documents or contact your insurance provider. It is also important to understand the limitations and exclusions of your comprehensive coverage, as well as the claims process, to ensure you are adequately protected in the event of any of these incidents.

Auto Insurance Injury Claims: Understanding the Check-Cutting Process

You may want to see also

It doesn't cover damage to other vehicles

Comprehensive auto insurance is an optional coverage that protects your vehicle from damage caused by non-collision events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. It is important to note that comprehensive insurance does not cover damage to other vehicles.

Comprehensive auto insurance is often required by lenders if you are leasing or financing your vehicle. It is designed to protect your vehicle from unexpected events and provide peace of mind. While it covers a wide range of incidents, it is crucial to understand that it does not include damage to other vehicles.

If you are involved in an accident with another vehicle, the repairs to your car will not be covered by comprehensive insurance. In such cases, collision coverage comes into play. Collision coverage protects your car from damage caused by colliding with another vehicle or object, regardless of who is at fault. It covers situations like swerving to avoid an animal and hitting a tree or another car.

Comprehensive insurance is specifically intended to cover non-collision incidents, such as vandalism, fire, theft, or weather-related damage. It is essential to distinguish between comprehensive and collision coverage when understanding what is included and excluded from your policy.

When considering comprehensive auto insurance, it is important to review your policy carefully. Discuss your insurance needs with your agent, broker, or insurance company, and always get multiple quotes to make an informed decision. Remember, comprehensive insurance provides valuable protection for your vehicle, but it does not cover damage to other vehicles involved in an accident.

Auto Insurance Abroad: Unraveling the Mystery of International Rental Coverage

You may want to see also

It's based on the actual cash value of your car

Comprehensive auto insurance is an optional coverage that protects your vehicle from damage caused by incidents that are outside of your control, such as theft, vandalism, fire, accidents with animals, weather, or other acts of nature. It is important to note that comprehensive coverage does not include damage caused by colliding with another vehicle or object; this is covered by collision coverage.

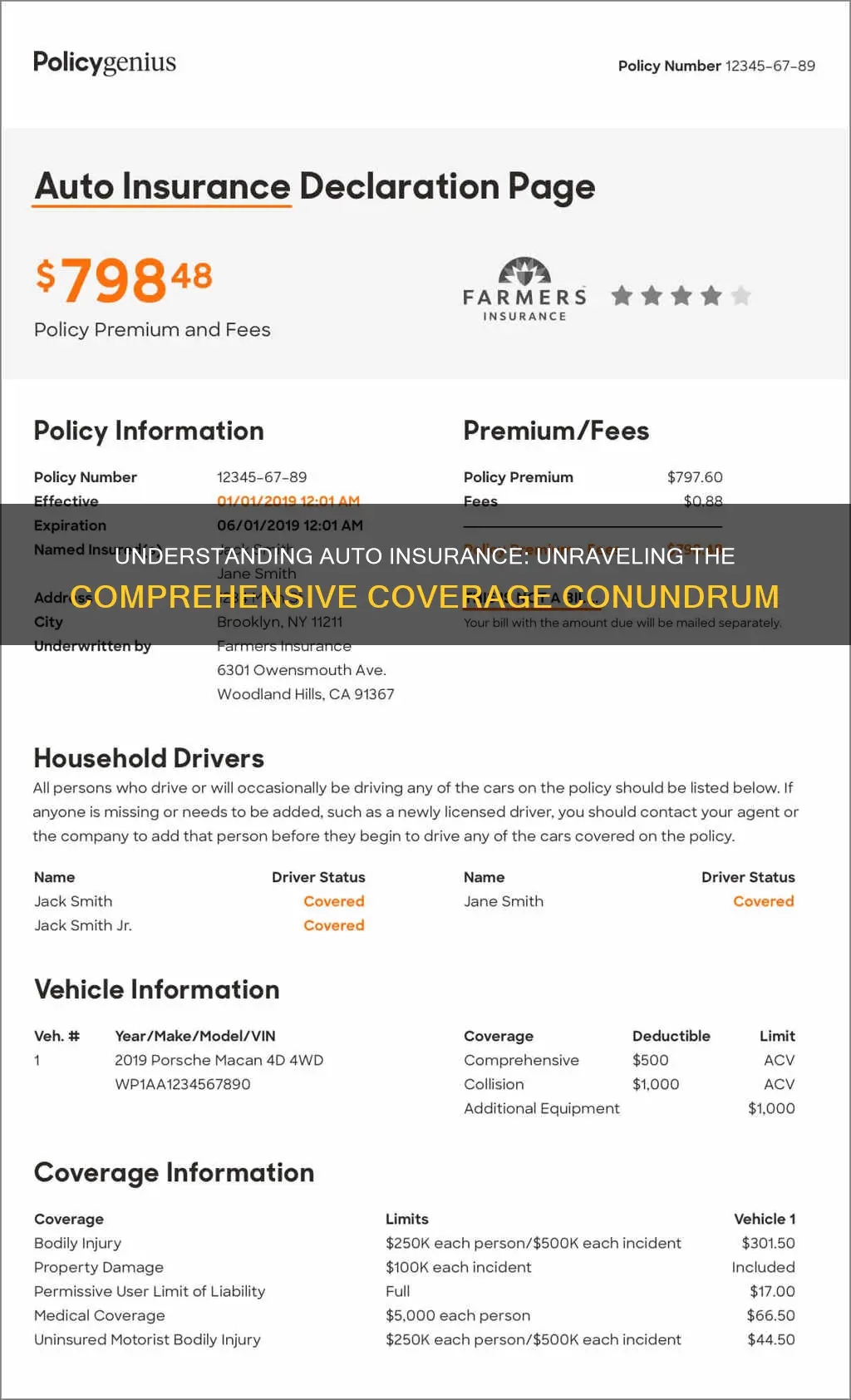

The maximum payout for comprehensive coverage is based on the actual cash value (ACV) of your car. The ACV is the amount your car is worth in its current condition, including depreciation. It is the amount you could reasonably expect to get for your car if you sold it today. When determining the ACV, factors such as the vehicle's year, make, model, mileage, wear and tear, accident history, and location are considered.

If your vehicle is damaged beyond repair, your insurance company will reimburse you for the car's ACV, minus your deductible. The threshold for declaring a vehicle a total loss varies by state and insurer. You may be able to negotiate a higher payout if you disagree with the insurer's valuation, but you will need to provide evidence to support your claim.

When deciding whether to purchase comprehensive coverage, it is essential to consider the value of your car, your financial circumstances, and your personal preferences. If your car has a high cash value or you cannot afford to repair or replace it out of pocket, comprehensive coverage may be a worthwhile investment.

Vehicle Totaled: What to Tell Your Insurer

You may want to see also

Frequently asked questions

Comprehensive auto insurance covers damage to your car that is not a result of a collision, such as natural disasters, theft, vandalism, and damage caused by animals.

Comprehensive auto insurance covers a range of unfortunate events, including theft, vandalism, hail, hitting an animal, fire, explosions, and weather conditions such as wind damage, hurricanes, floods, and falling objects.

Check your insurance policy documents or contact your insurance provider to confirm if you have comprehensive coverage.

No, comprehensive insurance is not the same as full coverage. Comprehensive insurance covers non-collision-related damage to your vehicle, while full coverage typically includes both comprehensive and collision coverage, as well as any other coverage mandated by your state.

The value of comprehensive auto insurance depends on your circumstances. If you have a new or expensive vehicle, comprehensive insurance can provide financial protection in the event of unexpected repairs or replacement. However, if you have an older vehicle and can cover the costs of potential repairs, comprehensive insurance may not be necessary.