Knowing the exact date your insurance coverage began is crucial for managing your policies effectively. Whether it's health, auto, or home insurance, understanding the start date is essential for ensuring you're adequately covered and can make claims when needed. This information is also vital for billing purposes and maintaining accurate records. In this guide, we'll explore various methods to determine when your insurance coverage officially commenced, helping you stay informed and prepared.

What You'll Learn

- Policy Initiation Date: Understand the exact date your insurance policy was activated

- Contract Signing: Identify the date when the insurance contract was signed

- Premium Payment: Recognize when the first premium was paid

- Coverage Activation: Learn when the insurance coverage officially began

- Policy Renewal: Note the date of the first policy renewal

Policy Initiation Date: Understand the exact date your insurance policy was activated

The 'Policy Initiation Date' is a crucial piece of information for any insurance holder, as it marks the beginning of your coverage and is essential for understanding the timeline of your insurance benefits. This date is often referred to as the 'effective date' or 'start date' of your policy. Knowing this specific date is vital for several reasons. Firstly, it helps you determine the exact period during which your insurance is active and provides coverage. This is especially important when you need to file a claim, as it ensures that you are aware of the time frame during which your policy is valid. For instance, if you experience a covered event, such as a car accident or a medical emergency, understanding the policy initiation date will help you navigate the claims process efficiently.

To find this date, you can typically refer to your insurance policy documents. These documents, which include your insurance certificate or policy summary, will clearly state the 'Effective Date' or 'Policy Initiation Date.' It is usually presented in a specific format, such as 'MM/DD/YYYY,' indicating the month, day, and year the policy came into effect. If you have lost these documents, you can contact your insurance provider's customer service team, who will be able to provide you with the necessary information. They might also be able to assist in retrieving any missing policy documents.

In some cases, the policy initiation date might be different from the date you purchased the insurance. For instance, if you bought a policy online or over the phone, there could be a delay between the purchase date and the activation of the policy. This is often due to the time required for the insurance company to process and activate the policy. Understanding this timeline can help you manage your expectations and ensure that you have coverage when you need it.

Additionally, if you have multiple insurance policies, it is essential to keep track of the initiation dates for each. This is particularly relevant for comprehensive insurance coverage, such as health or life insurance, where different policies might have varying start and end dates. Managing these dates can help you ensure continuous coverage and take advantage of any promotional periods or benefits associated with specific policy periods.

In summary, knowing the exact 'Policy Initiation Date' is a fundamental aspect of managing your insurance effectively. It empowers you to understand the duration of your coverage, navigate claims processes efficiently, and maintain comprehensive insurance protection. By locating this date in your policy documents or through your insurance provider, you can stay informed and make the most of your insurance benefits.

Insurance in the Bahamas: Who's Covered?

You may want to see also

Contract Signing: Identify the date when the insurance contract was signed

When it comes to understanding the start date of your insurance coverage, the contract signing process is a crucial step. This is where the insurance company and the policyholder officially agree on the terms and conditions of the insurance policy. Here's how you can identify the date when your insurance contract was signed:

Review the Policy Documents: The first step is to locate the original insurance policy documents. These documents are typically provided to you after the contract is signed. Within these documents, you will find a section that outlines the policy's effective date or the date when the coverage begins. Look for any references to "effective date," "start date," or "coverage commencement." This date is usually clearly stated and may be highlighted for easy identification.

Check the Signature Page: The signature page of the insurance contract is a critical part of the document. It will include the names of the policyholder and the insurance company's representative, along with their respective signatures. The date of signing is often mentioned on this page, sometimes near the signatures or in a separate section. This date signifies when both parties agreed to the terms, and it is a strong indicator of when your insurance coverage officially started.

Contact the Insurance Company: If you are unable to find the information in the policy documents, reach out to your insurance provider. Their customer service team can assist you in locating the contract signing date. Provide them with your policy details or any available information, and they should be able to retrieve the necessary records. This direct approach ensures you receive accurate and up-to-date information regarding your insurance coverage.

Online Resources: In the digital age, many insurance companies offer online portals or customer-facing platforms. These platforms often provide access to policy information, including the contract signing date. Log in to your account (if available) and navigate to the relevant section to retrieve this specific detail. Online resources can be a convenient way to access your insurance information without the need for direct contact.

By following these steps, you can accurately determine the date when your insurance contract was signed, which is essential for understanding the start of your coverage. Remember, keeping track of these details is crucial for managing your insurance policy effectively.

The Mystery of EOR: Unraveling Insurance Billing Codes

You may want to see also

Premium Payment: Recognize when the first premium was paid

When it comes to understanding the start date of your insurance coverage, knowing when the first premium was paid is a crucial piece of information. This date marks the beginning of your insurance policy and is essential for several reasons. Firstly, it helps you determine the exact start of your coverage, ensuring you are aware of when you are protected against potential risks and liabilities. This knowledge is particularly important for claims and compensation processes, as it provides a clear timeline for when your insurance company's obligations begin.

The first premium payment is often a significant milestone in the insurance process. It signifies the completion of the initial steps, including the acceptance of your application and the evaluation of your eligibility. Once the premium is paid, the insurance company is legally bound to provide the coverage as per the terms and conditions of the policy. Therefore, it is essential to keep records of this payment, including the date, amount, and method of payment.

To identify when the first premium was paid, you can review your insurance documents. Your policy document or certificate should clearly state the 'Effective Date' or 'Policy Commencement Date,' which is the date when the insurance coverage officially starts. This date is typically the same as the date of the first premium payment. Additionally, your insurance company's records, such as invoices or payment receipts, can provide further evidence of the payment date.

If you have lost your policy documents or are unsure about the payment details, contact your insurance provider. They can assist in verifying the start date of your coverage and provide any necessary documentation. It is always a good idea to maintain open communication with your insurance company to ensure you have accurate and up-to-date information regarding your policy.

In summary, recognizing the date of the first premium payment is vital for understanding the commencement of your insurance coverage. By reviewing your policy documents and keeping records of the payment, you can easily determine when your insurance started. This knowledge empowers you to manage your insurance effectively and ensures you are aware of your coverage's beginning, allowing for better preparedness and utilization of your insurance benefits.

Managing Your 21st Century Insurance Autopay: A Step-by-Step Guide

You may want to see also

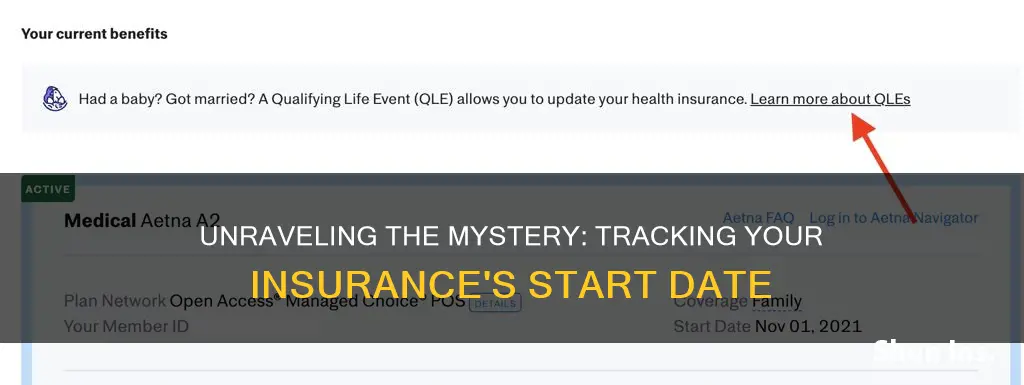

Coverage Activation: Learn when the insurance coverage officially began

To determine when your insurance coverage officially began, you need to carefully review your insurance policy documents. Here's a step-by-step guide to help you navigate this process:

- Policy Documents: Start by locating your insurance policy documents, which typically include a policy schedule or summary, a declaration page, and a policy contract. These documents contain crucial information about your coverage, including the effective date of the policy. Look for a section titled "Policy Period," "Coverage Dates," or "Effective Date." This section will clearly state the start and end dates of your insurance coverage.

- Policy Summary: The policy summary is a concise overview of the main terms and conditions. It often includes a table or chart that outlines the coverage start and end dates. If you have a digital copy, search for the term "effective date" to find the relevant information.

- Declaration Page: This page provides specific details about your insurance coverage, including the policy number, insured parties, and coverage amounts. It is a critical document to review for coverage activation details. Look for a section that mentions the "coverage effective date" or "start date."

- Policy Contract: The policy contract is the legal agreement between you and the insurance company. It contains the most detailed information about your coverage. Search for terms like "commencement of coverage" or "effective date of insurance." This section will provide the exact date when your insurance coverage officially began.

- Contact Your Insurance Provider: If you still can't find the information, reach out to your insurance company. Their customer service team can assist you in locating the coverage activation date. Provide them with your policy details or any available information to expedite the process.

Remember, knowing the exact start date of your insurance coverage is essential for making claims, understanding your policy's terms, and ensuring you receive the benefits you're entitled to.

The Intricacies of ILS: Unraveling the World of Insurance-Linked Securities

You may want to see also

Policy Renewal: Note the date of the first policy renewal

When it comes to insurance, understanding the renewal process is crucial to ensure you're adequately covered. One essential aspect of this process is knowing the date of your first policy renewal. This date is significant because it marks the point at which your insurance coverage will need to be reviewed and potentially adjusted to meet your current needs. Here's a step-by-step guide on how to identify this important date:

Review Your Policy Documents: The first step is to locate your insurance policy documents. These documents typically include a summary of your coverage, terms and conditions, and important dates. Look for a section titled "Policy Period" or "Coverage Dates." This section will usually outline the start and end dates of your initial coverage period. Make a note of the start date, as this is when your insurance coverage begins.

Check the Policy Schedule: Insurance policies often include a detailed schedule or table that provides a comprehensive overview of your coverage. This schedule will list each policy period, including the start and end dates. Identify the first entry in this schedule, as it will indicate the beginning of your insurance coverage.

Contact Your Insurance Provider: If you're unable to find the renewal date in your policy documents, reach out to your insurance company. Their customer service team can provide you with the necessary information. Be prepared to provide your policy number or other identifying details to ensure they can access your account accurately.

Understand the Renewal Cycle: Insurance policies typically have a renewal cycle, which is the frequency at which they are reviewed and adjusted. Common renewal cycles include annual, semi-annual, or monthly renewals. Knowing this cycle will help you anticipate future renewal dates. For example, if your policy renews annually, you can expect the first renewal to occur one year after the start date.

Mark the Renewal Date: Once you've identified the first policy renewal date, mark it on your calendar or in your insurance policy tracker. This will serve as a reminder to review your coverage and make any necessary adjustments before the renewal period begins. Staying proactive in this regard ensures that your insurance remains relevant and suitable for your evolving needs.

Marriage: Insurance Status Update?

You may want to see also

Frequently asked questions

To find the start date of your insurance policy, you can refer to your insurance documents. These documents typically include a policy schedule or a summary page that outlines the coverage period, including the start and end dates. If you don't have access to the original documents, contact your insurance provider, and they can provide you with the necessary information based on your policy details.

Yes, many insurance companies offer online resources to access policy information. You can log in to your account on their website or mobile app, where you might find a section dedicated to policy details. Look for a 'Policy Details' or 'Coverage Information' tab, which may display the start and end dates of your insurance coverage. If you encounter any issues or cannot locate the information, their customer support team can assist you further.

In cases where you've misplaced your documents, you can reach out to your insurance company's customer service. They can help verify your policy details, including the start date, using your personal information such as your name, date of birth, and policy number (if available). They might also ask for additional documentation to confirm your identity.

Absolutely! Requesting a copy of your insurance policy is a straightforward way to obtain the necessary information. Contact your insurance provider and ask for a copy of your policy documents. They will likely send you a digital copy or provide you with instructions on how to access it online. Reviewing the policy will give you all the details, including the start and end dates of your coverage.