Life insurance agents are not taxed on the proceeds of a policy, but there are some exceptions. For example, if the policyholder delays the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated. If the policyholder names their estate as the beneficiary, the person inheriting the estate may have to pay estate taxes. If the insured and the policy owner are different, taxes may also be involved.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | In most cases, life insurance proceeds are not considered taxable income.) |

| Are there exceptions? | Yes, there are some exceptions. |

| What are the exceptions? | 1. If the policy accrued interest, taxes are due on the interest. 2. If the policyholder names the estate as a beneficiary, taxes may apply depending on the estate's value. 3. If the insured and the policy owner are different individuals, there may be taxes involved. 4. If the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period. 5. If the policy is a modified endowment contract (MEC), taxes are different. With MEC, withdrawals are treated as taxable income until they equal all interest earnings in the contract. |

| How to avoid paying taxes on a life insurance payout? | 1. Use an ownership transfer. 2. Create an irrevocable life insurance trust (ILIT). 3. Get a life insurance quote. |

What You'll Learn

Interest on life insurance proceeds

In most cases, life insurance proceeds are not taxable. However, if the beneficiary chooses to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments is taxed as regular income. This is because income earned in the form of interest is almost always taxable.

For example, if the death benefit is $500,000, but it earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth. The beneficiary will need to report the interest as income on their taxes.

To avoid this, beneficiaries can choose to receive the death benefit as a lump sum. This keeps the death benefit income tax-free.

It is important to note that the death benefit itself is typically not taxed. Only the interest that accumulates on installment payments is subject to taxation.

Additionally, if the policyholder named their estate as the beneficiary instead of a specific person, the person or people inheriting the estate might have to pay estate taxes. This could further reduce the amount received by the beneficiary.

To avoid paying taxes on life insurance proceeds, the policy's ownership can be transferred to another person or entity. This must be done at least three years before the death of the policyholder to be effective.

Exploring Life Insurance: Uncertainty About My Father's Policy

You may want to see also

Naming an estate as beneficiary

Naming an estate as the beneficiary of a life insurance policy is an option, but it is not always advisable. While it ensures that your assets will be distributed according to your will, there are some disadvantages to this approach.

One key disadvantage is that it may result in higher taxes for your heirs. When you name your estate as the beneficiary, you increase the value of your estate, which could lead to higher estate taxes for those who inherit it. In addition, if you have any outstanding debts at the time of your death, creditors may be able to make claims against the life insurance proceeds, reducing the amount that your beneficiaries ultimately receive.

Another disadvantage of naming your estate as the beneficiary is the time and complexity involved in settling the estate. Life insurance proceeds paid to your estate become part of the probate process, which can take months to complete. This delays the distribution of assets to your beneficiaries and incurs additional costs, including administrative expenses, attorney fees, and executor fees.

Furthermore, naming your estate as the beneficiary may limit the tax advantages typically associated with life insurance proceeds. In many states, life insurance proceeds are exempt from the claims of creditors when there is a named beneficiary. However, this exemption does not apply when the estate is the named beneficiary, making the proceeds more vulnerable to creditor claims.

To avoid these potential issues, it is often recommended to name a trust as the beneficiary of your life insurance policy. This helps protect the proceeds from creditor claims and shields them from the probate process, resulting in a faster and more efficient distribution of assets to your beneficiaries.

It is important to carefully consider your options and seek professional advice when designating beneficiaries for your life insurance policy to ensure that your wishes are carried out in the most efficient and beneficial way possible.

Global Life: Health Insurance Provider?

You may want to see also

Policy owner and insured are different

In most cases, the policy owner and the insured are the same person. However, there are situations where the policy owner and the insured are different. For instance, a business might purchase key person insurance for a crucial employee, such as a CEO. In this case, the business is the policy owner, while the employee is the insured. Another example is when an insured person sells their policy to a third party for cash in a life settlement. Here, the third party becomes the policy owner, while the insured remains the same.

When the policy owner and the insured are different, it's essential to understand the roles and responsibilities of each party. The policy owner is responsible for making timely payments, known as premiums, to the insurer. They have the right to manage several aspects of the policy, including naming or changing beneficiaries, deciding on the amount and length of coverage, transferring ownership, and updating payment frequency. On the other hand, the insured is the person whose life is insured under the policy. When the insured person passes away, the insurer will assess the claim made by the beneficiary and, if approved, pay out the tax-free death benefit to the beneficiary.

It's worth noting that the beneficiary, or the person named in the policy to receive the death benefit, should be made aware of the policy's existence by the policy owner. This ensures that the beneficiary can make a claim when the time comes, as it may be difficult for the insurer to locate them otherwise. While the death benefit is usually tax-free, there are situations where the beneficiary may be taxed on the proceeds. For example, if the policyholder delays the benefit payout and the money accrues interest, the beneficiary will have to pay taxes on that interest. Additionally, if the beneficiary is an estate rather than an individual, the heirs may have to pay estate taxes.

To summarise, while the policy owner and the insured are typically the same person, there are cases where they differ. Understanding the distinct roles of the policy owner, insured, and beneficiary is crucial when dealing with life insurance policies. By knowing the rights and responsibilities of each party, individuals can make informed decisions regarding their financial wealth and ensure a smooth process for claiming death benefits.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

Installments vs. lump sum

Life insurance death benefits are usually tax-free, but there are some situations in which taxes may be incurred. One such scenario is when beneficiaries opt for installment payments instead of a lump sum.

When a policyholder passes away, their beneficiaries can choose to receive the death benefit in a lump sum or in installments. While the default option for most policies is a lump sum, some beneficiaries may prefer to receive regular payments over the course of their lifetime. This option allows beneficiaries to guarantee an income stream for a pre-determined number of years.

However, it's important to note that any interest that accumulates on installment payments is considered taxable income. This means that beneficiaries may end up paying more in taxes if they choose installments instead of a lump sum, especially if the death benefit amount is substantial.

On the other hand, opting for a lump-sum payout keeps the death benefit income tax-free. By avoiding installment payments, beneficiaries can steer clear of taxable interest.

It's worth mentioning that beneficiaries should carefully consider their options and seek advice from a financial professional before making a decision. While a lump sum may be the best choice in some cases, there are situations where installments could be more advantageous, depending on the beneficiary's financial needs and goals.

Other Tax Implications

In addition to the potential tax on interest for installment payments, there are a few other instances where taxes may apply to life insurance proceeds:

- Policy loans: If you take out a loan against the cash value of your permanent life insurance policy and the policy lapses or terminates before you repay the loan, the outstanding loan balance exceeding your cost basis will be treated as taxable income.

- Withdrawals and surrenders: If you withdraw or surrender your policy and the amount you receive is greater than the total premiums you've paid, the excess amount may be subject to taxes.

- Estate taxes: Death benefits could be subject to estate taxes if the policyholder's estate is named as the beneficiary. To avoid this, you can name your spouse or another individual as the beneficiary or transfer ownership of the policy to the beneficiary at least three years before your death.

Is Your Life Term Insurance Convertible?

You may want to see also

Irrevocable life insurance trust

An Irrevocable Life Insurance Trust (ILIT) is a type of trust that holds one or more life insurance policies and provides certain advantages. It is created during the insured's lifetime and owns and controls a term or permanent life insurance policy or policies. The trust can also manage and distribute the proceeds that are paid out upon the insured's death, according to their wishes.

ILITs are irrevocable, meaning the insured cannot change or undo the trust after its creation. This allows the premiums from the life insurance policy to avoid estate taxes. If the policy were not created under an ILIT, any insurance benefits plus other assets of the insured above the applicable exclusion amount could trigger both state and federal estate taxes.

The benefits of an ILIT include the ability to avoid estate and gift taxes, protect government benefits, and more. For example, an ILIT can be used to protect an inheritance for a minor child, a loved one with special needs, or an adult child who lacks the maturity or financial savvy to handle a large sum of money. It can also be used to equalize inheritance among multiple beneficiaries or provide liquidity to pay taxes or make charitable bequests.

The primary downside of an ILIT is that no changes can be made once the trust is finalized. Whatever is put into the trust is no longer the grantor's, which could have severe implications down the road. For instance, if you put a significant amount of cash in a trust intending to give it to your heir, and then you unexpectedly need that money, there is nothing you can do.

Universal Life Insurance: Savings or Security?

You may want to see also

Frequently asked questions

In most cases, the money beneficiaries receive from a life insurance payout is not taxed as income. However, there are some exceptions. For example, if the policy accrued interest, the beneficiary will have to pay taxes on the interest.

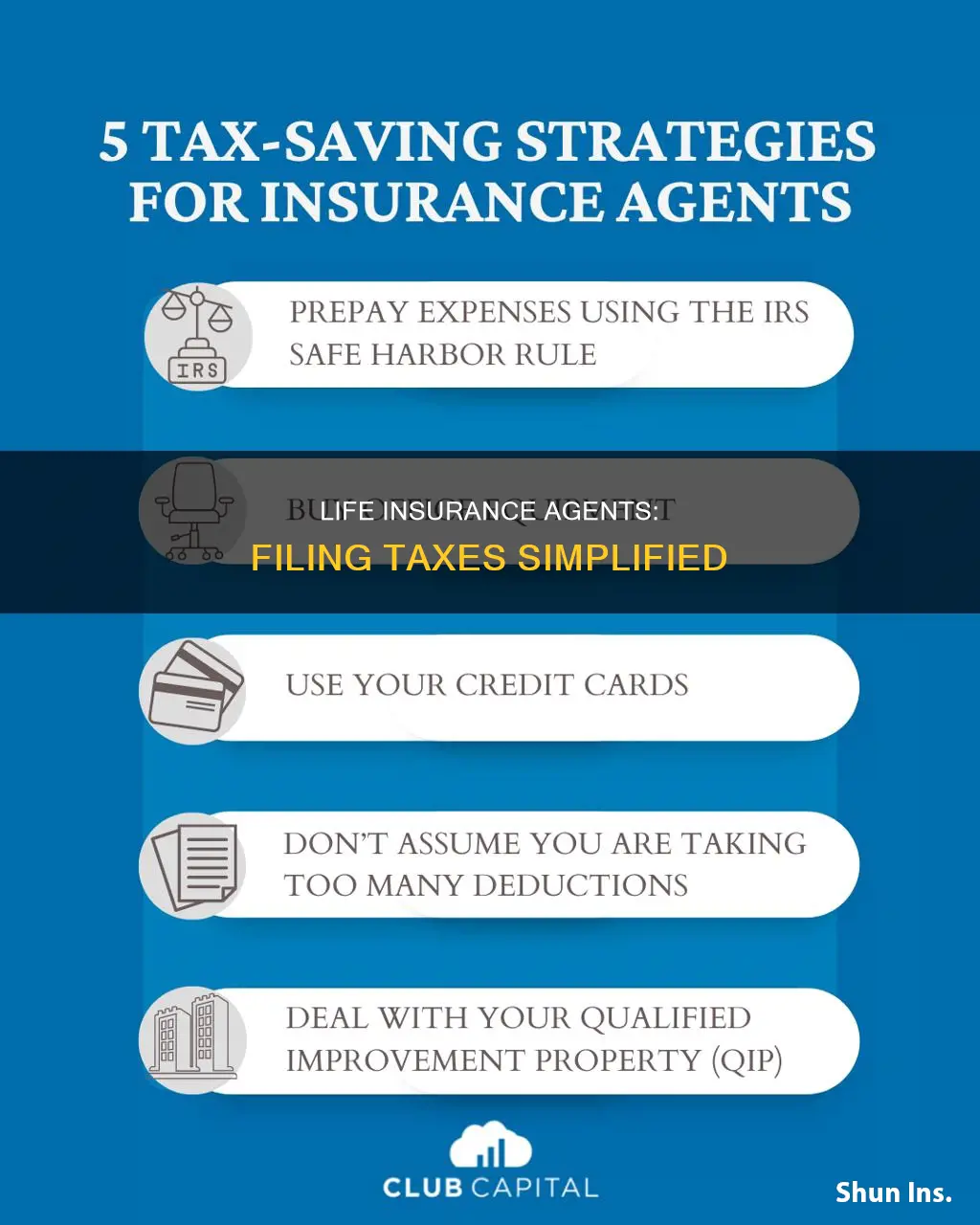

There are a few strategies that can be used to avoid paying taxes on a life insurance payout. One way is to use an ownership transfer, where you transfer ownership of your policy to another person or entity. Another way is to create an irrevocable life insurance trust (ILIT), which owns the life insurance policy instead of you, so the proceeds are not included in your estate.

Life insurance premiums are typically not tax-deductible for personal policies. However, there are a few exceptions. If you gift a life insurance policy to a charity and continue to pay the premiums, those payments are generally considered charitable donations and may be tax-deductible.