Comparing auto insurance companies is a great way to find the best value for your needs. It doesn't need to be complicated, but it's important to gather quotes from multiple insurers with similar coverage levels and deductibles that meet your requirements. Key factors to consider include price, coverage options, customer reviews, and the insurer's reputation. Additionally, it's recommended to compare at least three auto insurance quotes to ensure you're getting a competitive rate. By taking the time to compare, you can save hundreds of dollars and find the policy that's right for you.

| Characteristics | Values |

|---|---|

| Compare quotes from multiple companies | Get quotes from at least three companies |

| Compare similar types and levels of coverage | Liability coverage, collision coverage, comprehensive coverage, etc. |

| Consider age and gender | Seniors pay the least, on average, while teenagers pay the most |

| Consider vehicle information | Make, model, vehicle identification number (VIN), mileage, etc. |

| Consider driving history | Accidents, violations, tickets, completed driving courses, etc. |

| Consider insurance history | Continuously covered for a long period vs uninsured |

| Compare discounts | Safe driver, bundling, good grades, anti-theft device, paperless, multiple vehicles, military, alternative fuel vehicle, automatic payments, etc. |

What You'll Learn

Compare quotes from multiple insurers

Comparing quotes from multiple insurers is a great way to find the best deal on car insurance. Here are some tips to help you get started:

Decide on the coverage you need

First, you'll need to determine what type of coverage you need. Most states require drivers to carry a minimum amount of liability coverage, and a minimum-coverage policy is usually the cheapest option. However, if you have a newer car or a leased vehicle, you may be required to have additional coverage, such as comprehensive and collision insurance. As your vehicle ages, you may also want to adjust your coverage and coverage amounts.

Research different insurers

When comparing quotes, be sure to research the reputation and offerings of each insurer. Consider their customer service, claims handling process, and overall reputation. Also, don't forget to check for discounts! Some common discounts include those for safe driving, paying your annual premium in full, and insuring multiple vehicles.

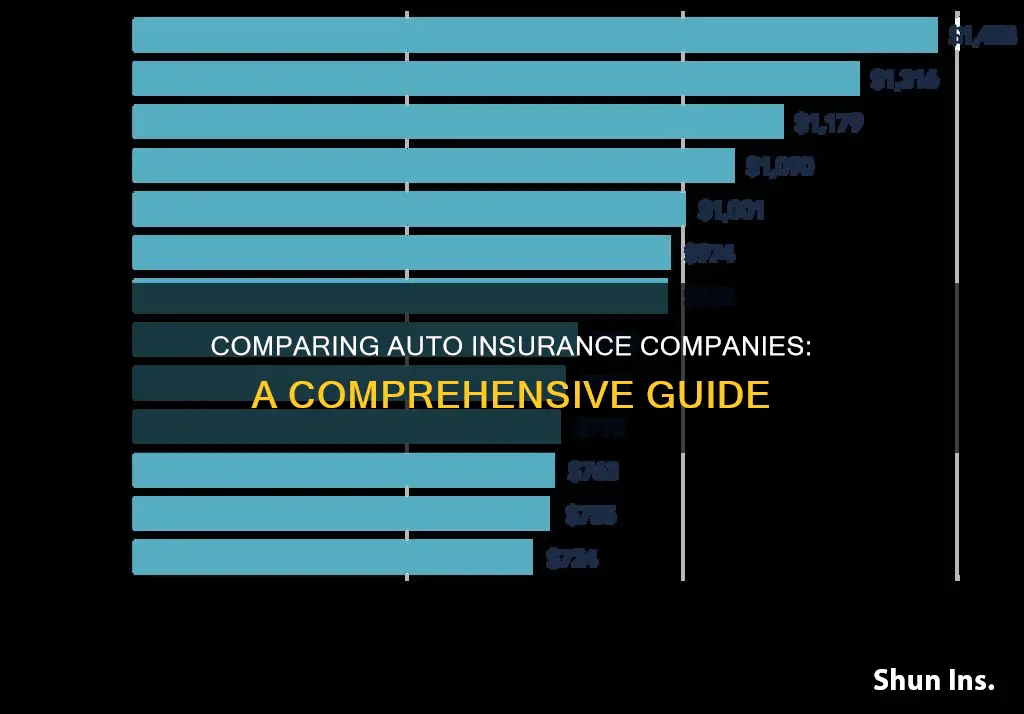

View rate comparisons

Take a look at rate comparisons to get an idea of which insurers offer the lowest rates overall and for specific driver groups. Keep in mind that rates can vary depending on factors such as your driving record, age, and location. USAA, for example, often has the cheapest rates, but their policies are only available to military members and their families.

Gather your information

To get accurate quotes, you'll need to provide some basic information, such as your age, gender, marital status, vehicle information, current insurance status, and driving history. This information will help insurers tailor the quote to your specific needs and situation.

Now it's time to start comparing! Get quotes from at least two or three companies, including both regional and national insurers. Make sure you're comparing the same types and levels of coverage across all quotes to ensure an accurate comparison. Remember, each insurer has its own approach to pricing and discounts, so it's important to shop around.

By following these steps, you'll be well on your way to finding the best car insurance policy for your needs and budget.

Weed and Wheels: The Impact of Marijuana Legalization on Auto Insurance Rates

You may want to see also

Understand state minimum coverage requirements

Understanding state minimum coverage requirements is an important part of comparing auto insurance companies. Nearly all states in the US require drivers to have a minimum amount of car insurance, also known as auto insurance, to drive legally. The only two states that don't require car insurance are New Hampshire and Virginia. However, even in these states, residents are still liable for any bodily injury or property damage they cause in an accident.

State minimum coverage requirements vary, but they always include liability coverage, which covers bodily injury (BI) and property damage (PD) to someone else. In other words, liability insurance helps pay for any damage you cause to another driver, their passengers, or their property. There are three components to car insurance liability coverage:

- Bodily injury coverage per person

- Bodily injury coverage per accident

- Property damage coverage per accident

These limits are usually expressed as a series of numbers, such as 15/30/10. For example, with these hypothetical limits, your liability coverage would pay up to $15,000 per person for bodily injuries and no more than $30,000 in total bodily injury costs for the incident. You would also be covered for up to $10,000 in property damage.

It's important to note that state minimum coverage limits might not cover all the costs of an incident. Therefore, it's recommended to purchase more than the minimum required amount of liability insurance and consider additional coverage types for greater financial protection.

In addition to liability insurance, some states require other types of coverage, such as:

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage helps pay for injuries to you or your passengers if you're in an accident with a driver who doesn't have insurance or doesn't have enough insurance. UM/UIM is required in almost half of the states but can be optional in others.

- Personal Injury Protection (PIP): PIP covers medical expenses for you or your passengers if you're in an accident, regardless of who is at fault. It may also cover lost wages or other benefits that health insurance doesn't. PIP is often required in "no-fault" states, where each party is responsible for their own damages in an accident.

- Medical Payments Coverage (MedPay): MedPay is similar to PIP but only covers medical expenses and doesn't include additional benefits like lost wages. It is typically considered optional but is required in some states.

Does Auto Insurance Protect Against Flash Floods?

You may want to see also

Research insurers' customer service, claims handling, and reputation

When comparing auto insurance companies, it is important to research insurers' customer service, claims handling, and reputation. This can help you understand how well a company treats its customers and how satisfied customers are with the company's service. Here are some factors to consider:

- Customer Service Quality: Evaluate the quality of customer service by looking at how easily you can reach customer support, the availability of multiple communication channels (such as phone, email, live chat), the responsiveness and professionalism of the support staff, and their ability to provide helpful solutions. You can also check online reviews and ratings from current and former customers to gauge their overall satisfaction with the company's customer service.

- Claims Handling Process: Understand the claims handling process by reviewing the steps involved, the ease of filing a claim, the average time taken to approve and process claims, and the overall satisfaction of customers who have gone through the claims process. Look for companies with a smooth, transparent, and efficient claims process.

- Reputation and Brand Image: Consider the reputation and brand image of the insurance company. This includes assessing their financial stability, years in business, and how well they treat their customers. Check ratings from independent organizations, such as AM Best, for financial strength and claims-paying ability. Additionally, look for companies with a positive reputation for ethical business practices, social responsibility, and environmental sustainability.

- Customer Feedback and Reviews: Pay attention to customer feedback and reviews on independent websites and forums. Look for patterns in the reviews, both positive and negative. Take note of common complaints or praises to understand the strengths and weaknesses of the insurance company.

- Awards and Recognitions: Look for insurance companies that have received awards or recognitions for their customer service, claims handling, or overall business practices. These awards can be an indication of their commitment to providing a positive customer experience.

By researching these factors, you can gain valuable insights into the quality of customer service, claims handling, and reputation of different auto insurance companies. This information will help you make a more informed decision when choosing an insurance provider.

GEICO Commercial Auto Insurance: Does It Exist?

You may want to see also

Consider your age, gender, and driving history

When comparing auto insurance companies, it's important to consider your age, gender, and driving history, as these factors can significantly impact your insurance rates. Let's take a closer look at each of these factors and how they might affect your insurance premiums.

Age

Age is a crucial factor in determining auto insurance rates, as it correlates with driving experience and the risk of getting into accidents. Younger drivers, especially teens, tend to pay higher insurance rates due to their lack of experience and higher statistical risk of accidents. This risk decreases as drivers mature and gain more experience, leading to lower premiums in their mid-to-late twenties. However, insurance rates may start to creep back up around age 65 as aging-related factors, such as changes in vision, hearing, and reaction time, can increase the likelihood of accidents.

Gender

In most states, gender also plays a role in insurance rates. Women often pay less for car insurance than men, as they are generally involved in fewer accidents and tend to take fewer risks behind the wheel. Men are more likely to engage in risky driving behaviors, such as speeding and not wearing seat belts, which makes them riskier to insure. However, as drivers age and gain more experience, the gender gap in insurance rates narrows, and in some age groups, women may even pay slightly more. It's worth noting that some states, such as California, Hawaii, and Massachusetts, prohibit the use of gender as a factor in determining insurance rates.

Driving History

Your driving history is another critical factor that insurance companies consider when setting rates. Drivers with a clean record and no accidents or violations will typically pay less for insurance. On the other hand, those with a history of accidents, speeding tickets, or other traffic violations will likely pay higher rates. At-fault accidents can significantly impact your insurance premiums, and insurance companies may view you as a high-risk driver if you have multiple violations. Additionally, your driving history may also affect your eligibility for certain insurance companies or policies.

When comparing auto insurance companies, it's essential to consider how they weigh these factors when determining your insurance rates. By understanding how your age, gender, and driving history can influence your premiums, you can make more informed decisions and find the best policy for your needs. Remember to shop around, compare quotes, and ask about available discounts to ensure you're getting the most suitable coverage at a competitive rate.

Who Pays First in a Car Accident: Driver or Owner's Insurance?

You may want to see also

Decide on your liability coverage

When deciding on your liability coverage, it's important to understand the two types of liability insurance: bodily injury liability coverage and property damage liability coverage.

Bodily Injury Liability Coverage

This type of coverage helps pay for bodily injuries for which you are legally liable. This means that if you are found responsible for causing injury to another person, your insurance will help cover the costs of their medical expenses, rehabilitation, and legal costs. The coverage limit for bodily injury liability is typically set per person and per accident, and it's important to choose a limit that is sufficient to protect your financial well-being in the event of a significant accident.

Property Damage Liability Coverage

Property damage liability coverage, on the other hand, helps pay for damage caused to another person's property during a covered accident or event. This includes repairs to the other driver's vehicle, rental vehicle expenses while their car is being repaired, damage to buildings, fences, or other structures, and damage to personal property inside the vehicle. Similar to bodily injury coverage, property damage coverage also has limits that you need to set.

When deciding on your liability coverage limits, it's recommended to choose a limit that is at least as much as your net worth. This will ensure that your assets, such as your savings and home, are protected in the event of a serious accident. You can use a net worth calculator to help you determine your net worth if you don't know it off the top of your head.

Additionally, it's important to review your state's minimum car insurance requirements, as the required limits may vary depending on where you live. You may also need to consider additional coverages, such as personal injury protection or medical payments coverage, depending on your state's requirements. Keep in mind that liability coverage only pays for damages and injuries to others and does not cover damages to your property or your own injuries. To protect yourself in these cases, you may want to consider adding comprehensive and collision coverage to your policy.

Claiming on Another's Auto Insurance

You may want to see also

Frequently asked questions

You can get car insurance quotes online from multiple insurers' websites or from comparison sites that allow you to obtain and compare quotes from multiple insurers at once. You can also contact agents with specific companies, independent agents, or insurance brokers.

You will need to provide some basic information about yourself, such as your age, gender, and marital status, as well as information about your vehicle, such as its make, model, and vehicle identification number (VIN). You will also need to provide information about your current insurance status and your driving history.

When comparing car insurance quotes, ensure that you are comparing the same types and levels of coverage. Consider factors such as price, coverage options, customer reviews, and the insurer's reputation. It is also important to select the same set of coverages and deductibles for each quote.

Car insurance rates are influenced by various factors, including age, location, driving record, credit score, and the type of vehicle. Rates can vary significantly between different insurers, so it is important to shop around and compare quotes to find the best deal.