Understanding your insurability limit is crucial for making informed decisions about your insurance coverage. This limit represents the maximum amount of insurance you can obtain based on various factors such as your health, age, and lifestyle. Knowing your insurability limit can help you choose the right insurance policies, ensuring you have adequate protection without overpaying. It's essential to assess your specific circumstances and consult with insurance professionals to determine the most suitable coverage options.

What You'll Learn

- Understanding Insurance Policies: Review policy details to know your coverage limits

- Assessing Risk Factors: Evaluate health, age, and lifestyle to determine insurability

- Medical History Impact: Past health issues can affect insurance eligibility and limits

- Financial Assessment: Income and assets influence the insurability and coverage amount

- Consulting Insurance Brokers: Experts can guide you on insurability and suitable coverage options

Understanding Insurance Policies: Review policy details to know your coverage limits

When it comes to insurance, understanding your policy is crucial, especially when it comes to knowing your coverage limits. These limits define the maximum amount an insurance company will pay out in the event of a claim, and they can vary widely depending on the type of insurance and the specific policy you have. Here's a guide on how to review your policy to determine these important limits:

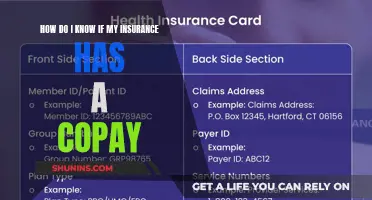

Read the Policy Document: The first step is to thoroughly read and understand your insurance policy. This document, often provided by your insurance provider, contains all the essential details about your coverage. Look for sections that specifically mention coverage limits, such as 'Policy Limits' or 'Coverage Amounts'. These sections will outline the maximum financial protection you have for different types of losses or events. For instance, in health insurance, you might find a limit on the annual reimbursement for medical expenses, while in home insurance, there could be a limit on the amount covered for property damage.

Identify Key Coverage Limits: Different insurance policies have various coverage limits, and it's essential to identify the most relevant ones for your situation. For example, in auto insurance, you might have a limit for bodily injury liability, which covers the costs if you cause an accident and someone is injured. Similarly, in life insurance, there are death benefit limits that determine the payout amount upon the insured's passing. Understanding these specific limits will help you assess the extent of your coverage.

Check for Exclusions and Limitations: Insurance policies often have exclusions, which are specific events or circumstances that are not covered. These exclusions can significantly impact your coverage limits. For instance, natural disasters like earthquakes or floods might be excluded in certain policies, meaning you won't have coverage for related damages. Additionally, look for any limitations or restrictions on coverage, such as maximum payout amounts for specific incidents or timeframes.

Review Policy Updates and Changes: Insurance policies can change over time, and it's important to stay informed about any updates or modifications. Insurance providers may adjust coverage limits, introduce new exclusions, or make other changes. Regularly reviewing your policy ensures that you are aware of any alterations that might affect your insurability and the limits of your coverage. This proactive approach allows you to make necessary adjustments to your insurance plan.

By carefully reviewing your insurance policy and paying close attention to the details, you can gain a clear understanding of your coverage limits. This knowledge is essential for making informed decisions about your insurance needs and ensuring that you have adequate protection in place. Remember, being proactive in reviewing your policy can help you avoid surprises and potential financial gaps when it's time to make a claim.

Adjusting Your Insurance Coverage: Navigating Enrollment Date Changes

You may want to see also

Assessing Risk Factors: Evaluate health, age, and lifestyle to determine insurability

When it comes to determining your insurability, understanding the risk factors that insurance companies consider is crucial. These factors play a significant role in assessing your eligibility and the terms of your insurance coverage. Here's a detailed breakdown of how to evaluate these critical aspects:

Health Assessment:

- Medical History: Insurance providers scrutinize your medical records, including any pre-existing conditions, chronic illnesses, or past surgeries. Conditions like diabetes, heart disease, or cancer can impact your insurability and premium rates. Be transparent about your health history to ensure accurate assessments.

- Current Health Status: Recent medical examinations, lab results, and health reports are essential. These provide a snapshot of your overall health. For instance, a healthy blood pressure reading might indicate a lower risk for life insurance, while high cholesterol could lead to higher premiums.

- Lifestyle Choices: Smoking, excessive alcohol consumption, and drug use are closely monitored. These habits can significantly increase the risk of various health issues, making you a higher-risk candidate for insurance. Quitting smoking, for example, can lead to improved insurability over time.

Age and Demographic Factors:

- Age is a critical determinant of insurability. Younger individuals often face lower insurance premiums due to a longer life expectancy and reduced risk of certain health issues. As you age, premiums tend to increase, especially after a certain age threshold.

- Gender also plays a role, with some insurance types offering different rates for men and women. This is often due to statistical differences in life expectancy and health risks.

- Marital Status: Being married can sometimes result in lower insurance rates, as it may indicate a more stable lifestyle and reduced risk of certain accidents or health issues.

Lifestyle and Behavior Evaluation:

- Insurance companies assess your lifestyle choices and habits to gauge your potential risks. For instance, a sedentary lifestyle may increase the likelihood of obesity-related health issues, impacting insurability.

- Occupational Hazards: Certain professions expose individuals to higher risks, such as construction workers facing injury risks or pilots with specific health requirements. These factors are considered when determining insurability.

- Financial and Credit History: While not directly related to health, financial stability and creditworthiness are essential. A poor credit score might indicate financial risks, which could indirectly affect insurability, especially for life insurance.

By thoroughly evaluating these risk factors, individuals can gain a better understanding of their insurability and potentially negotiate more favorable terms with insurance providers. It empowers individuals to make informed decisions about their health and lifestyle choices, ultimately leading to better insurance coverage. Remember, transparency and a proactive approach to health management are key to a successful insurability assessment.

Insurance Bills: The Mystery of the Decreasing Costs

You may want to see also

Medical History Impact: Past health issues can affect insurance eligibility and limits

Understanding your insurability limit is crucial when considering insurance coverage, especially health insurance. This limit represents the maximum amount an insurance company is willing to cover for your medical expenses, and it can significantly impact your financial security. One of the primary factors that determine this limit is your medical history, particularly any past health issues or conditions.

Past medical problems can influence insurance eligibility and coverage limits in several ways. Firstly, pre-existing conditions may lead to higher premiums or even denial of coverage. Insurance companies often assess the severity and management of these conditions to gauge the potential risk. For instance, if you have a history of chronic illnesses like diabetes or heart disease, insurers might require additional medical information or may offer limited coverage with higher premiums.

The impact of medical history becomes more apparent when applying for comprehensive health insurance plans. These plans often have specific exclusions and limitations for pre-existing conditions, which can vary widely among insurance providers. Some companies may impose waiting periods before covering pre-existing conditions, while others might offer limited coverage or require additional premiums. It is essential to disclose all past medical issues accurately to ensure proper assessment and avoid surprises during the claims process.

Furthermore, the severity and timing of past health issues play a role in determining insurability. Minor ailments or accidents that have been resolved with treatment might not significantly affect your insurance limits. However, more serious conditions, especially those with ongoing management or frequent medical interventions, can lead to higher insurance premiums or reduced coverage. Insurance companies often review medical records to assess the likelihood of future claims and adjust their offerings accordingly.

In summary, your medical history is a critical factor in determining your insurability limit. Past health issues can influence eligibility, coverage, and premiums. Being transparent about your medical background is essential to finding suitable insurance coverage. It is advisable to consult with insurance professionals who can guide you through the process, ensuring you understand your options and make informed decisions regarding your health insurance.

Senior Discounts: Auto Insurance Savings

You may want to see also

Financial Assessment: Income and assets influence the insurability and coverage amount

When assessing your insurability and determining the appropriate coverage amount, understanding the relationship between your financial situation and insurance is crucial. Your income and assets play a significant role in this evaluation, as they provide a clear picture of your financial health and stability. Here's how these factors influence your insurability and coverage:

Income: Your income is a primary indicator of your ability to afford insurance premiums and manage potential financial obligations. Insurance companies consider your income to assess your capacity to pay for various coverage options. Higher income often translates to a better insurability position, as it demonstrates a stronger financial foundation. For instance, if you have a substantial income, you are more likely to be offered higher coverage limits and more comprehensive insurance policies. This is because a higher income suggests a greater ability to handle potential financial losses and the associated costs of insurance claims.

Assets: The value of your assets is another critical aspect of financial assessment. Assets include property, investments, savings, and other valuable possessions. Insurance companies evaluate your assets to gauge your financial resources and potential liabilities. A diverse and substantial asset portfolio can enhance your insurability. For example, owning a home or valuable possessions can increase your coverage limits, as these assets can be used to settle claims or provide financial security in case of loss. Additionally, having a significant amount of savings or investments can improve your insurability, as it demonstrates financial stability and the ability to cover potential expenses.

The assessment of income and assets is a comprehensive process. Insurance providers may consider various factors, such as the stability of your income sources, the type of assets you own, and their liquidity. They might also review your credit history and financial records to make a well-informed decision. By analyzing these aspects, insurance companies can determine the appropriate coverage limits and types of insurance that align with your financial capabilities.

It's important to note that insurance companies often use these financial assessments to set premiums and coverage terms. A favorable financial assessment can lead to lower premiums and more competitive insurance rates. Conversely, a limited income and asset base might result in higher premiums or more restrictive coverage options. Therefore, understanding and managing your financial situation is essential to optimizing your insurability and obtaining the desired level of coverage.

In summary, your income and assets are key determinants of your insurability and the extent of coverage you can obtain. By evaluating these financial aspects, insurance companies can provide tailored policies that suit your needs while ensuring a mutually beneficial relationship. Being aware of your financial strengths and limitations allows you to make informed decisions when selecting insurance coverage.

Challenging the Charges: Navigating the Process of Contesting an Insurance Bill

You may want to see also

Consulting Insurance Brokers: Experts can guide you on insurability and suitable coverage options

When it comes to understanding your insurability and finding the right coverage, consulting an insurance broker can be an invaluable step. These professionals are experts in the field and can provide tailored guidance to meet your specific needs. Here's how they can assist:

Insurance brokers have extensive knowledge of the insurance market and its various products. They stay updated on industry trends and regulations, ensuring they can offer the most relevant and suitable coverage options. When you consult them, they will assess your unique circumstances, including your health status, age, lifestyle, and financial situation. This personalized approach allows them to determine your insurability and recommend appropriate policies. For instance, they can explain the concept of insurability limits, which refer to the maximum amount an insurance company is willing to cover based on your individual profile. By understanding these limits, you can make informed decisions about the extent of coverage you require.

The role of an insurance broker is to act in your best interest. They will carefully analyze your requirements and suggest policies that provide comprehensive protection without unnecessary expenses. These experts can negotiate with insurance providers on your behalf, ensuring you receive competitive rates and favorable terms. They have access to a wide range of insurers and can compare policies to find the best fit for your budget and coverage needs. Moreover, they can explain the different types of insurance, such as life, health, property, and liability coverage, and how they apply to your specific situation.

Consulting an insurance broker also provides an opportunity to review and update your existing policies. They can identify any gaps in your current coverage and propose adjustments to ensure you are adequately protected. For example, if you have recently undergone a significant life event like a marriage, the birth of a child, or a career change, an insurance broker can help you reassess your insurability and make necessary modifications to your policies. They can also assist in understanding the claims process and guide you through any potential challenges you may face when making a claim.

In summary, insurance brokers are skilled professionals who can simplify the complex world of insurance. They offer personalized advice, ensuring you have the right coverage at the right price. By consulting them, you gain a deeper understanding of your insurability and can make confident decisions about your insurance needs. Remember, their expertise is invaluable in navigating the insurance market and securing the protection you deserve.

Protect Your Phone: eBay's Insurance Options Explained

You may want to see also

Frequently asked questions

Your insurability limit is the maximum amount of insurance coverage you can obtain based on various factors assessed by the insurance company. It is determined by considering your age, health, lifestyle, and other risk factors. Insurance companies use complex algorithms and medical data to evaluate your insurability, and the higher your insurability score, the more coverage you may be eligible for.

Several factors can impact your insurability, including your age, gender, medical history, family medical history, lifestyle choices (such as smoking or excessive alcohol consumption), occupation, and hobbies. Insurance companies may also consider your financial situation, credit score, and the type of insurance you are applying for.

Yes, there are several ways to improve your insurability and potentially qualify for higher coverage limits. Maintaining a healthy lifestyle by exercising regularly, eating a balanced diet, and avoiding harmful habits can positively impact your insurability. Managing pre-existing health conditions, keeping regular medical check-ups, and having a good credit score can also contribute to a better insurability profile.

You can often get a preliminary estimate of your insurability limit by requesting a quote from multiple insurance providers. These quotes will provide an idea of the coverage options available to you and their respective premiums. Additionally, some insurance companies offer online assessment tools or calculators that can give you a general idea of your insurability and the potential coverage amounts.